TreasuryONE’s Andre Botha gives us more context to this week’s market moves

With a largely bare data cupboard last week, we expected the rand to trade within tight bands. Although that was mostly the case, we saw the rand trading wildly within the R18.00/50 range. With the Fed and US data quiet last week, it was up to new sources for some market direction. One of the sources of market movement was the political situation in the UK.

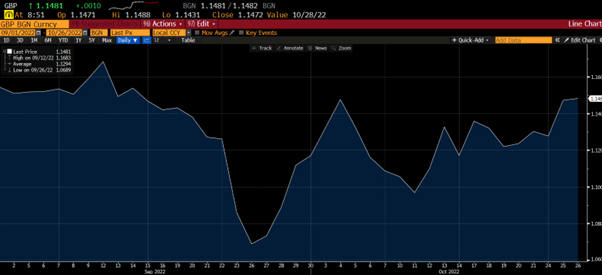

In a sensational scene, Liz Truss resigned from her post as Prime Minister, just 44 days after she took office. Looking back at her term, it certainly looked like her position became untenable with several economic faux pas happening in such a short space of time. The pound has been trading wildly in the lead-up to the announcement and staged a strong fightback at the start of the week after the new Prime Minster, Rishi Sunak was appointed on Tuesday.

Pound moves during Truss’ term:

Another event that caused the market some strain was the Prime Minister election in China. The Chinese Communist Party elected Xi Jinping as its general secretary for a precedent-breaking third term. Even though the move was not unexpected, the fact that Prime Minister Jinping surrounded himself with supporters in his Politburo Standing Committee triggered a small reaction from the market, because the Committee is full of supporters of China’s Zero Covid policy, which could impede the country’s economic growth if the restrictions are maintained.

Taking a look at this week, we have another few days of minmal market-moving data or events out of the US, which could mean another week for the rand trading within the R18.00/50 range. We have heard murmurs in the market that the Fed could start looking at pivoting in the early part of next year. This has caused the US dollar to trade close to parity against the Euro and improve the market sentiment. This has caused the rand to move back into the R18.10s, firmly within the current range.

Rand remains range-bound:

On the Eurozone front, we have the European Central Bank interest rate decision coming out on Thursday. We expect the ECB to hike interest rates by 75 basis points, which could see the euro gain some traction while also helping the rand. The key, however, is the speech by ECB President Christine Lagarde and the way forward for the ECB. Based on the tone of her speech and press conference, we could see some volatility in the market.

The Medium-Term Budget Policy Statement on Wednesday had little effect on the markets. It’s likely that the rand will see more action based on the ECB decision.