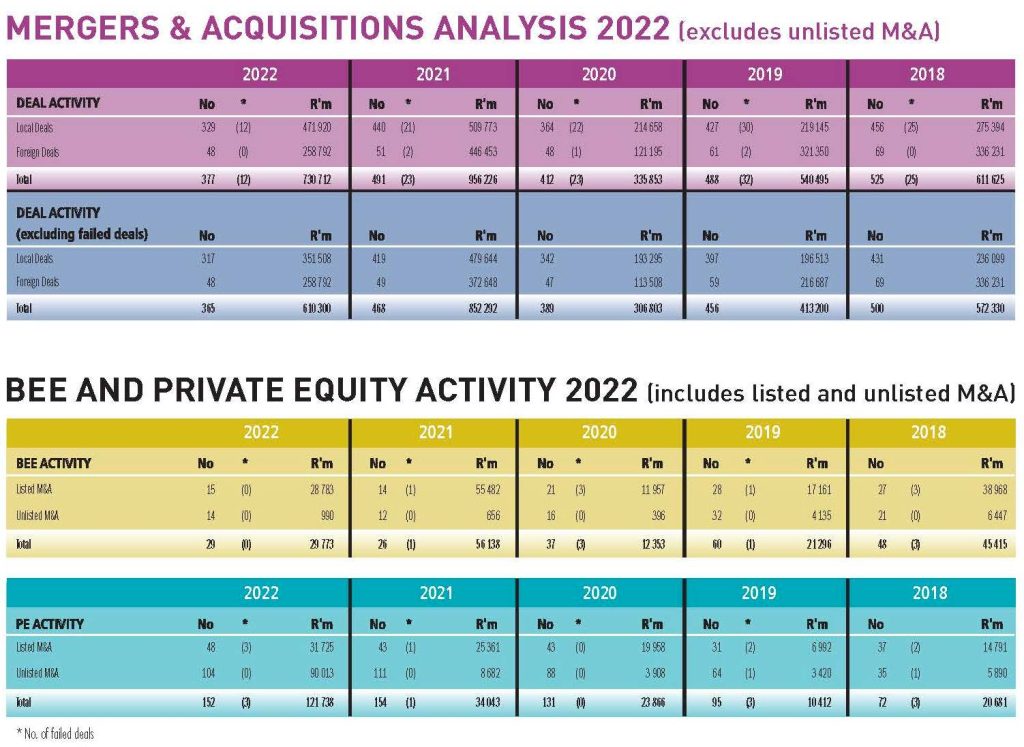

Facts are facts, and while they can be dressed up or down, they reflect the naked truth – dealmaking in South Africa is in steady decline. All but for a slight correction in 2021, due to the release of deals delayed by pandemic lockdowns, the effect of the political and energy related woes faced by ‘SA Inc’ on investor confidence is clearly seen in the number of local M&A deals captured for 2022 – down 7% on the numbers recorded in 2020 and that at the height of the COVID-19 pandemic! The start of 2023 offers insight as to what is to be expected – only four deals were announced during January, this compared with the 26 announced in January the previous year.

The take private of Mediclinic International, shortlisted for the Brunswick DealMakers Deal of the Year 2022, was the largest deal by value for 2022 at £2,05bn (R41,8bn). Gold Fields’ unsuccessful acquisition of Canadian Yamana Gold would have taken top spot at R103bn. The fact that, of the top 10 deals by value for 2022, only three were by SA companies, speaks to the decline in dealmaking in the listed space.

50% of deals used for league table purposes in 2022 fell into three categories. Deals in the Real Estate sector dominated representing 21% of the deals recorded valued at R93,6bn followed by Resources & Energy at 15% (this sector was the highest by value at R203,5bn). Tech deals represented 14% of transactions recorded valued at R39bn.

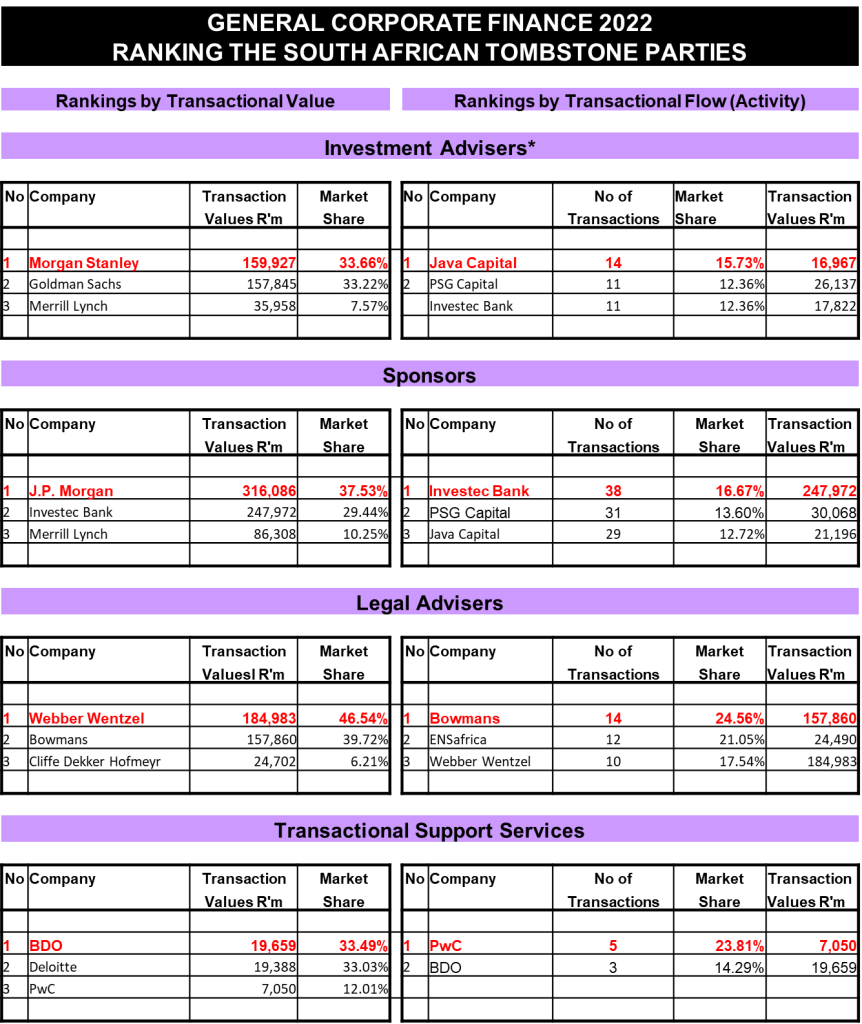

Behind the scenes – in what DealMakers categorises as general corporate finance activity, companies focused on value creation for shareholders by undertaking share repurchase programmes (R265,9bn versus R115,3bn in 2021) and the distribution of special dividends and unbundlings (R464,2bn versus R63bn in 2021) – most notable being the unbundling by Rand Merchant Investment of its stakes in Momentum, Metropolitan and Discovery, and PSG Group’s distribution of its stakes in its listed portfolio (also shortlisted for Deal of the Year 2022). For the most part, the uptick in the number of listings recorded reflects the growing number (19) of secondary listings undertaken by JSE-listed companies on A2X. But part of the picture is also the increased opportunities now available for domestic investors in the form of new disrupters and innovators.

Private equity continues to be an important driver in the dealmaking space across the continent. In South Africa, two sizeable transactions were recorded: Digital Realty’s acquisition of a majority interest in Teraco Data Environments (R56bn), and the exit by Actis and Mainstream from Lekela Power (R25bn) – the 2022 winner of the DealMakers Private Equity Award.

Given that more than 50% of adults in sub-Saharan Africa remain unbanked, the scope for investment in the fintech space is compelling, and as this number decreases, so the number of opportunities will grow.

Also on the radar of institutional investors are the venture capital alternative investment asset class – although the tough macroeconomic environment and associated rising interest rates will likely curb fundraising outcomes.

The winners of the platinum medal subjective awards are as follows:

Ince Individual DealMaker of the Year

(L-R) Arie Maree (Ansarada), Marylou Greig (DealMakers), Johan Holtzhausen (PSG Capital) and Andile Khumalo (Ince).

Brunswick Deal of the Year – Sanlam Allianz joint Venture

L-R Arie Maree (Ansarada), Iris Sibanda (Brunswick) and the local advisory teams to the deal – Standard Bank, J.P. Morgan, Webber Wentzel, Bowmans and PwC.

Exxaro BEE Deal of the Year – Shoprite Checkers’ evergreen B-BBEE transaction

Arie Marie (Ansarada), Sacha Allie (RMB), Mzila Mthenjane (Exxaro) and Warran Dukas (Shoprite).

Catalyst Private Equity Deal of the Year – Actis exit of Lekela Power

Marylou Greig (DealMakers), Arie Maree (Ansarada), David Cooke (Actis) and Michael Avery (Catalyst).

Business Rescue Transaction of the Year – CIG and CONCO

Marylou Greig (DealMakers), Arie Maree (Ansarada), Martin Liebenberg (Metis), Dean McHendrie (Birkett Stewart McHendrie), Josh Cunliffe (Metis) and Gerhard Albertyn (Metis).

2022 M&A award winners (listed companies)

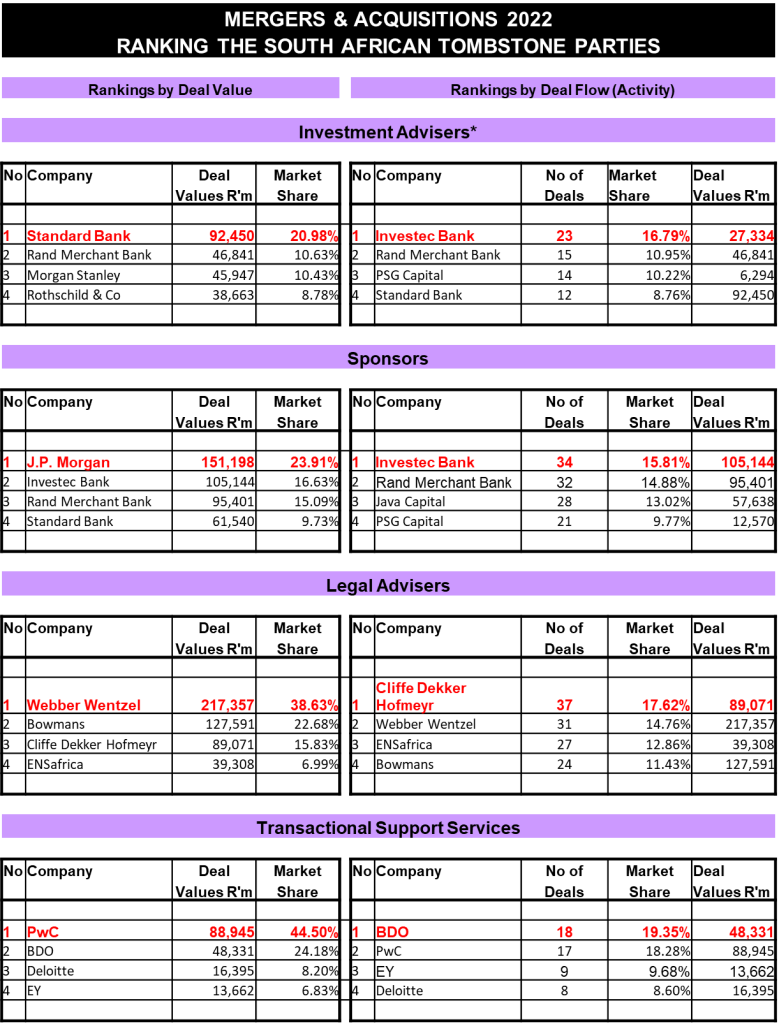

The category of Investment Adviser (by deal value) was won by Standard Bank. (L-R) Arie Marie (Ansarada), Marylou Greig (DealMakers) and Khutso Manthata (Standard Bank).

The category of Investment Adviser (by deal flow) was won by Investec Bank. (L-R) Arie Marie (Ansarada), Marylou Greig (DealMakers) and Marc Ackermann (Investec Bank).

J.P. Morgan was the winner of the Sponsor category (by deal value). Olwethu Matoti, Otsile Matheba (A2X), Thembeka Mgoduso, Athi Ayabulela Noah and Thusani Tshivhase (J.P.Morgan).

The Investec team received the award for top Sponsor (by deal flow). L-R: Rob Smith, Buhle Sithole, Otsile Matheba (A2X), Masetshaba Mabaso and Monica Griessel.

Top Legal Adviser (by deal value) was won by Webber Wentzel.

Roxanna Valayathum received the award on behalf of Cliffe Dekker Hofmeyr for Top Legal Adviser (deal flow) from Marylou Greig.

The award for Transactional Support Services Adviser (by deal value) was presented to PwC. Anneke du Plessis received the award from Hoosain Karjieker (Mail & Guardian).

Nicky Theori received the award for the top Transactional Support Services Adviser (by deal flow) on behalf of BDO from Hoosain Karjieker (Mail & Guardian).

Top Legal Advisers in unlisted M&A

This is the first time awards for unlisted M&A have been awarded.

Top Legal Adviser (by deal value) in unlisted M&A went to Bowmans. Ryan Wessels accepted the award.

Top Legal Adviser (by deal flow) went to Bowmans. Lerato Thahane accepted the award.

Top BEE Advisers in 2022

DealMakers recorded 29 BEE deals during 2022 in the exchange-listed and unlisted M&A space. The top two BEE deals by value were the disposal of 40m Shoprite Checkers shares (a 5.7% stake) to the Shoprite Employee Trust and Anglo American Platinum’s replacement ESOP representing a 2% stake in Amplats to B-BBEE employees.

Irshaad Paruk accepted the award on behalf of RMB for the top BEE Adviser (by deal value) from Marylou Greig.

RMB was awarded top BEE Adviser (by deal flow). Krishna Nagar accepted the award.

Sally Hutton received the award on behalf of Webber Wentzel for top BEE Legal Adviser (by deal value).

Webber Wentzel was awarded the top BEE Legal Adviser of the Year (by deal flow). Ziyanda Ntshona accepted the award.

2022 M&A League Tables: SA advisory firms (in relation to exchange-listed companies)

*Investment Advisers include Financial Advisers and all others claiming this category.

2022 General Corporate Finance League Tables: SA advisory firms (in relation to exchange-listed companies)

*Investment Advisers include Financial Advisers and all others claiming this category.