In the six months to December 2021, ARC Investments’ intrinsic investment value in the ARC Fund grew by 16.8% to nearly R13.5 billion. The net asset value (NAV) per share reported under IFRS rules increased by 16.5% to R10.31, so yesterday’s closing price of R6.16 is a discount to NAV of around 40%. This is higher than the discount seen in some other investment holding companies on the JSE.

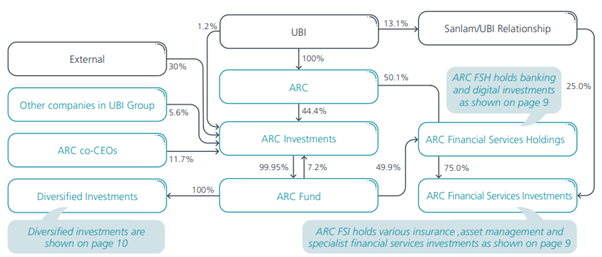

ARC Investments holds a 99.95% stake in ARC Fund. The ARC Fund holds 49.9% in ARC Financial Services Holdings, which in turn holds 75% in ARC Financial Services Investments. ARC Fund also holds 100% in a portfolio of diversified investments. To make this diagram even more complicated, ARC Fund also holds 7.2% in ARC Investments.

This is so tricky to understand that I’ve included a screenshot from the interim results below:

ARC investments (the third block in the middle) is the listed company that we are talking about here.

The annualised growth in the portfolio value of 36.2% is way above the modest performance participation hurdle of just 10%. For that reason, a provisional amount of R311 million has been recognised for the issue of performance participation shares to UBI. These types of “management fees” (in whatever form they take) are why these structures trade at a discount to the underlying portfolio value.

The plan is to relook at the fee structure by the time of the next annual general meeting. In the meantime, UBI is laughing all the way to the bank with a performance structure that has had no shortage of critics in the market.

The group refers to “early-stage businesses” that comprise 53% of the ARC Fund’s intrinsic portfolio value. These aren’t exactly small startups run by your friendly local hipster, as this category includes the likes of Rain, TymeBank, TymeGlobal and Kropz. More on those to come. Examples of established businesses in the portfolio would include Alexander Forbes and Afrimat.

Notable portfolio moves included R496 million raised through the disposal of shares in Afrimat (ARC Fund still has a 10% stake in Afrimat) and another R115 million through the sell-down of property business Majik. Much of this cash landed in the bank and stayed there, as the cash in ARC Fund increased from R339 million at 30 June 2021 to R538 million at 31 December 2021.

Cash that did leave the building included R182 million invested in Kropz Group, R64 million in ARCH Emerging Markets Funds and R56 million in Rain.

In the Financial Services portfolio, ARC Financial Services Holdings acquired 37.33% of Crossfin for R415 million and invested a further R257 million into TymeBank and TymeGlobal. The ARC Fund has an effective look-through interest of 25% in TymeBank.

The largest individual exposure is Rain, contributing 24.1% of fund value. The company broke even in the last 12 months and has accelerated quickly from there, with an expectation of R1 billion EBITDA for the year ended February 2022. The company is participating in the spectrum auction, with the result outstanding at the time ARC Investments finalised its report. During the opt-in round of the auction, Rain bid R1.15 billion.

The second largest exposure is Kropz Plc (15.2% of fund value), a phosphate developer with an advanced development-stage phosphate mine in South Africa and exploration assets in the Republic of Congo. Having finally made significant progress at Elandsfontein, ARC Fund recognised a R860 million fair value gain on this asset.

The third asset I’ll highlight is TymeBank, which contributes 10.1% of fund value. The bank has 4.2 million customers with 1.2 million active accounts. TymeBank recently attracted investment from Tencent and the CDC, which allowed ARC Investments to recognise a valuation uplift. The strategy includes the roll-out of similar banking operations in other emerging and frontier markets, with the technology white-labelled by TymeGlobal. Philippines is the first market outside of South Africa where the TymeBank technology will be launched in mid-2022.

There are many more companies in the portfolio. If you are interested in this group, you should refer to the full result and read carefully through the list of portfolio investments. It’s not easy finding the right website of the listed company, so here’s the link.

The share price is still well below its original listing price, having lost 26.7% of its value since 2017. Over the past year, the price has jumped 62.5%.