Embarking on a transformative journey, Baidu (NASDAQ: BIDU), the Chinese multinational technology titan, looks to stand at the forefront of technological revolution, poised to disrupt the industry and forge a new path towards long-term, sustainable growth.

Amidst the backdrop of impressive revenue growth and improved operating margins, Baidu has recognised the paradigm-shifting power of generative AI, having already launched its large language model, the ERNIE Bot.

Following Baidu’s earnings for the first quarter of its 2023 fiscal year, investors would have been pleased to see a 25.86% beat on its earnings projections, while first-quarter revenue also surprised to the upside.

In an era where artificial intelligence reigns supreme, Baidu aims “to invest unwaveringly in this area”, which will keep market players hungry with anticipation over how China’s largest search engine plans to disrupt an industry booming with excitement and undeniable potential.

Fundamentals

- Over the first quarter of its 2023 fiscal year, Baidu posted stronger-than-anticipated financial results as China’s economy steadily emerged from a prolonged lockdown period. Total revenues increased by 10% year-over-year, reaching RMB31.14 billion for the first quarter. In comparison, operating income surged by a staggering 91% to RMB4.98 billion in the same period, up from RMB2.60 billion in the first quarter of last year. Revenues from online marketing services increased by 6% year-over-year to RMB17.97 billion in the first quarter as companies increased their advertising spending to benefit from rising consumer demand. The Chinese search engine behemoth posted a basic earnings figure of RMB16.17 per American Depository Share (ADS), up from a loss of RMB2.87 per ADS in the same period of last year and 18% up quarter-on-quarter, reflecting robust growth in the company’s bottom line.

- Delving into Baidu’s cash flow statements, the company posted a highly impressive 212% year-over-year increase in its net cash provided by operating activities, coming in at RMB5.84 billion in the first quarter of its 2023 fiscal year, up from RMB1.87 billion in the same period a year ago. Quarter-over-quarter, Baidu saw its net cash provided by operating activities decline by 26% from RMB7.85 billion in the fourth quarter of 2022. Baidu’s free cash flow figure surged to RMB4.55 billion in the first quarter of its 2023 fiscal year, up from a negative figure of RMB107 million in the same period of last year but down from RMB5.92 billion in the fourth quarter of 2022.

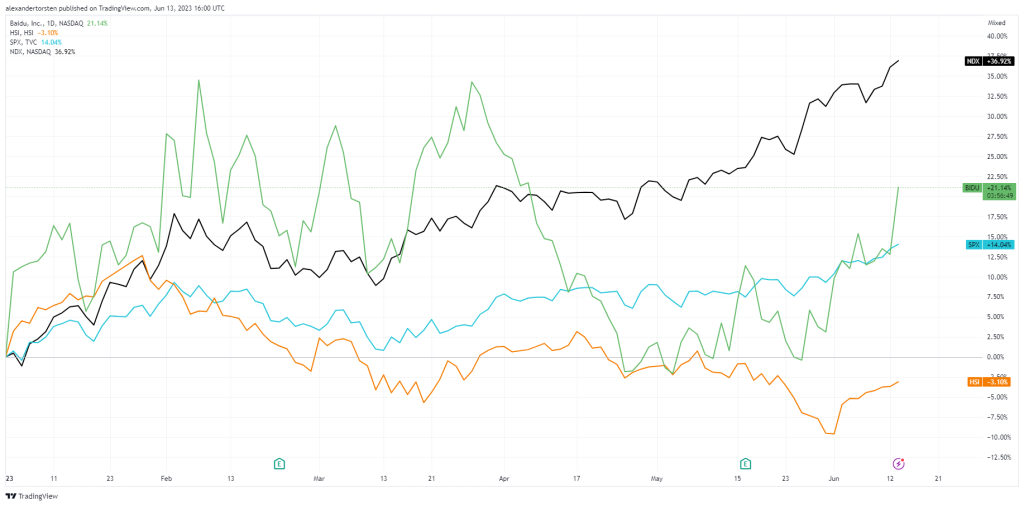

- Year-to-date (YTD), Baidu has proven relatively resilient, with its share price faring better than the Hang Seng Index, the renowned Hong Kong Stock Exchange barometer. Since the beginning of the year, Baidu’s share price has returned more than 20% to shareholders (green line), significantly exceeding that of the Hang Seng Index (orange line) and the S&P 500 index (blue line). Despite proving relatively robust amidst a turbulent macroeconomic environment coupled with lower-than-expected consumer demand, Baidu’s share price has meaningfully underperformed the NASDAQ 100 index (black line). The Chinese tech titan has struggled to enjoy the same growth trajectory as some of its U.S. peers, despite being one the world’s largest artificial intelligence companies.

- Baidu’s current trailing twelve-month (TTM) price-to-earnings (P/E) ratio sits at a multiple of 24.9x, the company’s lowest reading since its 2018 fiscal year, while its forward-looking P/E ratio sits at a multiple of 13.2x. This could excite market participants who believe Baidu’s current share price is undervalued relative to its historical earnings and growth potential, specifically concerning the hype around artificial intelligence and large language models. Looking at Baidu’s current trailing twelve-month (TTM) price-to-earnings (P/E) ratio, the multiple comes in slightly higher relative to Alibaba (NYSE: BABA) and NetEase (NASDAQ: NTES), whose multiples sit at 22.4x and 19.9x, respectively. Alphabet’s (NASDAQ: GOOGL) current trailing twelve-month P/E ratio of 27.6x comes in higher than Baidu’s. On a forward-looking basis, Baidu’s current P/E ratio comes in lower when compared to Alphabet and NetEase, whose multiples sit at 17.5x and 22.2x, respectively. In contrast, Alibaba’s forward-looking P/E multiple currently sits at 10.2x.

China Explores Limited Stimulus Measures Amidst Economic Slowdown

China is intensifying its efforts to rejuvenate its struggling economy. Still, due to mounting debt levels and concerns regarding financial stability, the scope of these measures is expected to be somewhat restrained compared to previous stimulus plans.

On Tuesday, the 13th of June, the central bank cut a key short-term interest rate that strongly influences interbank liquidity. Moreover, policymakers are contemplating a comprehensive range of stimulus proposals, including bolstering the real estate sector and domestic demand. This proposed course of action signifies a departure from the government’s usual cautious approach to stimulus, highlighting their apprehension over the economic slowdown following an initial surge driven by consumer spending earlier in the year, which has now lost momentum.

Nevertheless, the effectiveness of any stimulus measures, including the government’s flexibility in implementing them, will likely be hampered by the strained financial positions of local governments and the real estate industry.

China’s substantial debt burden presents challenges in rolling out an extensive support policy package. With business and consumer confidence remaining feeble, households hesitant to take on additional debt, inflation levels remaining low, and exports declining amidst global economic deceleration, it is no surprise that the Chinese government is looking to roll out a stimulus package.

Given the slowdown in domestic consumer demand, companies will be hoping for some form of a stimulus rollout. With revenues from online marketing services accounting for more than 50% of Baidu’s top-line figure in the first quarter of its 2023 fiscal year, a stimulus rollout plan aimed at reviving domestic consumer demand has the potential to increase companies’ advertising spend, which may bode well for Baidu’s online marketing services revenue stream.

Technicals

The daily chart of Baidu indicates that the company’s share price has enjoyed a much-needed breath of fresh air since slumping to its October low toward the end of last year as China’s economic lockdown depressed market sentiment.

With China emerging from a prolonged lockdown in the latter parts of last year, the company’s share price has benefitted from bullish sentiment, returning around 20% year-to-date (YTD). Despite the positive year-to-date performance, there is still an opportunity for a long position at a discounted price, with the share’s current intraday value of $143 per share offering the potential for a 20.70% upside as the share converges towards its estimated fair value of $172.60 per share (green line).

Should bullish sentiment continue to push the price higher, the $153 resistance level could become significant as traders look for a short opportunity toward lower levels. If the $153 level fails to act as effective resistance with a sustained break above, the next resistance level could be at $160, a share level toward the fair value estimate of $172.60 per share.

In the bear case, should lower-than-expected consumer demand result in a retracement toward lower levels, the $133 per share support level could offer an opportunity for a long at a further discount, especially for market participants that are bullish on Baidu’s long-term prospects within the realm of artificial intelligence. A sustained break below the $133 per share support level could trigger a sell-off to lower levels, with the primary support level of $116 per share (red line) offering an opportunity for a long at 48.79% discount from the share’s fair value.

Summary

With Baidu having launched its own ChatGPT rival product, ERNIE Bot, the chatbot has already topped Xinhua’s large language model rankings, performing better in a range of tasks relative to competing chatbots.

Amidst an era of surging demand for AI-related services, Baidu aims to utilise its chatbot to increase its customer base and “establish a new ecosystem around the ERNIE Bot.”

Generative AI represents a significant potential to those equipped to incorporate it across business segments, but geopolitical tensions and the risk of state intervention prevail as potential headwinds facing Baidu. Should the Chinese government roll out a significant stimulus package, Baidu is poised to benefit from the possible effects of increased consumer demand and higher advertising spending by companies.

Summary: Baidu Inc., Bloomberg, Forbes, KoyFin, Trading View