Afrimat goes large with Lafarge (JSE: AFT)

The market seems to like this news

Afrimat has a strong track record in dealmaking, which is both a blessing and a curse. A premium valuation and strong market response puts pressure on the group to perform, with a 7.9% rally in response to the group announcing the acquisition of Lafarge South Africa from Holcim Group.

This comes against the backdrop of tough results at Sephaku Cement, with the local business now only breakeven, as well as PPC whose local business has seen a drop in profitability. In a classic “blood on the streets” approach, Afrimat is buying into the market at perhaps the perfect time.

At first blush, it looks like a small deal with a purchase price of just $6 million. But of course, that can’t be right, as we know that Lafarge is a big business. If you keep reading, you’ll see that the shareholder loan account of R900 million also needs to be repaid to the seller, with R500 million repayable immediately and the rest payable within twelve months.

In the year ended December 2022, Lafarge had a net asset value of R1.4 billion and attributable EBITDA of R38 million, way down from R311 million in the prior year. The foreign owners of Lafarge are clearly gatvol of South Africa and were looking for an exit, one that Afrimat is happy to give them.

There are various conditions to be met, including by the Competition Commission who will probably use this as an excellent excuse to force all kinds of “social interest” provisions into the deal. It will also need Ministerial approval under the MPRDA, so you can be sure that this will take time to implement.

For Afrimat, this deal expands the national footprint of the construction materials division and drives efficiencies within that business. This is a Category 2 deal, so shareholders won’t be formally asked for their opinion on it.

City Lodge is profitable (JSE: CLH)

Occupancies have largely exceeded 2019 levels

In great news for the tourism industry, City Lodge has noted the continued recovery of the hospitality sector. January was not a good month, which was quite the hangover from what was a very strong festive season. The good news is that occupancies have improved since then, with March as a peak at 63% occupancy.

In May, occupancy of 56% was 400 basis points higher than May 2019.

More importantly, for the eleven months to May, group occupancy of 56% was a whopping 1,800 basis points (i.e. 18%) higher than the comparable period.

Before you get too excited, the interim reporting period revealed that much of the occupancy gain was driven by aggressive pricing, with the average room rate only 1% up vs. 2019 despite so much inflation. Since January though, average room rate has shown high single digit percentages vs. 2019, so that’s much better.

The strategy of focusing on the food and beverage offering is working, now contributing 17% of group revenue.

As at the beginning of June, the group had a cash balance of R297 million and borrowings of R300 million. This is a neutral net debt position, which is useful because the capital reinvestment programme is picking up the pace as the group refurbishes some of the older generation hotels.

For the year ending June, the group expects a more than 100% improvement in the headline loss per share of 8.7 cents. This means that HEPS has turned positive, so the group is finally profitable again!

MTN’s latest headache (JSE: MTN)

There is a fight with the board of IHS Holding Limited

You shouldn’t trust a company that doesn’t understand the use of plurals. I specifically checked this on Google and the company name really is IHS Holding, not IHS Holdings.

Unfortunately for MTN, this advice that I just invented is proving to be valuable. It’s also too late, with MTN holding a 26% stake in IHS which is a separately listed group on the New York Stock Exchange. The share price hasn’t been doing very well, so MTN has struggled to sell the non-voting portion of its shares.

This is a legacy governance issue that MTN highlights as having been considered in a shareholders’ agreement that noted MTN’s desire to be treated equally to other shareholders. In light of this shareholders’ agreement and the difficulties in disposing of non-voting shares, MTN submitted a governance proposal to the IHS board that was completely ignored and not tabled at the AGM.

MTN has requested the IHS board to call an extraordinary general meeting to consider the proposal. If nothing else, at least MTN’s lawyers are being kept well fed.

Watch the Nedbank odd-lot for some pocket money (JSE: NED)

The pricing has now been announced

Like we’ve seen at a few other locally listed companies recently, Nedbank is implementing an odd-lot offer to clean up the share register and mop up holders of fewer than 100 shares. Those who don’t specifically elect to keep their shares will end up with cash instead, so make sure you know what is going on here.

This means that if you have a position of less than roughly R23,000 in Nedbank and you want to keep it, you need to instruct your broker accordingly.

The offer price is around R234.067 and the current price is R230.32. The last date to trade is 27 June. If the share price drops to a level that makes it worthwhile, you could buy up 99 shares and potentially make an arbitrage profit.

Standard Bank highlights another strong period (JSE: SBK)

HEPS will be at least 20% higher in this period

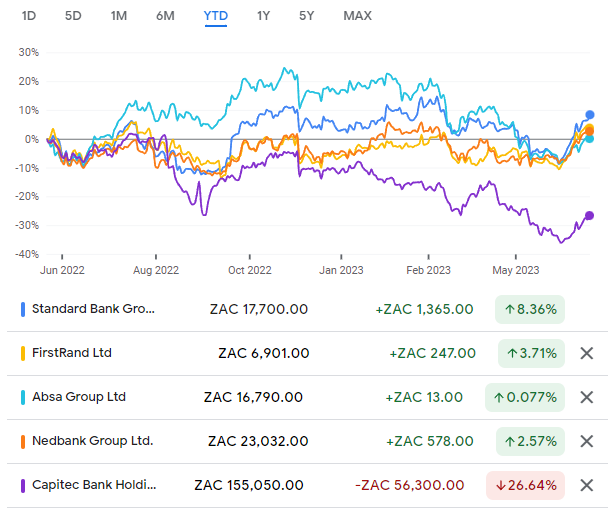

As I’ve written many times before in Ghost Bites, these conditions have been good for banks. They are enjoying healthy demand for credit (with inflation giving a helping hand) and they get to lend out the money at juicy rates. But sadly, local banks have fallen victim to a general souring towards South Africa.

You can see the pain in local banks from February onwards, as load shedding really took hold and then the Russian issues gathered momentum. Recently, with the lights mysteriously back on, the banks have bounced back and given juicy returns to anyone who bought the big dip. Also take note of how Capitec took a major knock this year simply from being far too expensive, particularly as the efficiency ratio started to move the wrong way as well.

Going back to Standard Bank, the group generates 46% of headline earnings in Africa, so there’s far more to the business than just South Africa.

Record revenue growth has been experienced in the five months to May 2022, up by more than 20%. Operating expenses are up by mid-teens, which is actually very high and somewhat disappointing in terms of what might have been for operating margin in this period. Higher incentives are at play here, so bankers are having a terrific year. There’s also tech and other cost pressures. To be fair, weighted average inflation across the countries of operation was 11.8%, so expense growth in the double digits was always on the cards.

Impairments are really coming through now, almost 50% higher than the comparable year. Importantly, the credit loss ratio is still within the through-the-cycle target range of 70 to 100 basis points. Home loans are under particular pressure, with Consumer Banking clients showing a credit loss ratio ahead of that target range of 100 – 150 basis points. Business and Commercial Banking clients are also running above their target range, so it was Corporate and Investment Banking that saved the day in terms of credit loss ratio. In difficult times, only the biggest balance sheets withstand the pressure.

The stories at Liberty Holdings and ICBC Standard Bank also sound promising.

Unsurprisingly, return on equity still exceeds group cost of equity. The guidance for the 12 months to December 2023 suggests that further improvement is coming, despite the higher credit loss ratio. Both revenue and cost growth guidance has been increased.

And for the six months to June 2023, Standard Bank expects HEPS growth of at least 20%. Based on the revenue growth and the positive JAWS (as revenue growth exceeded cost growth), I suspect it will be a fair bit higher than that. A 20% guidance is the minimum requirement to trigger a trading statement, so Standard Bank is playing it safe for now.

Transaction Capital changes the Mobalyz management (JSE: TCP)

This is apparently part of a succession plan initiated in 2022

Transaction Capital’s share price continues to plumb new depths, so the new management team at Mobalyz is going to be highly focused on fixing what used to be called the SA Taxi business.

It helps that founder Jonathan Jawno is coming in as chairman of Mobalyz. It also helps that Dave McAlpin is coming in as deputy chairman, which means he moves on from his role of Nutun CEO (leaving it to John Watling who has been joint CEO of Nutun for the past nine months). Sean Doherty moves from CFO of Mobalyz to CEO and Rob Monteith moves across from his CTO position at Nutun to be CTO at Mobalyz.

Simply put: the group is throwing everything but the kitchen sink at Mobalyz.

Terry Kier moves on from the CEO role at Mobalyz, taking on a role focused more on strategic relationships.

This wasn’t enough to stem the bleeding in the share price but at least the group is taking the issues seriously.

I think it is getting to the stage where bringing my in-price down again is worthwhile. This is a far more useful announcement than the fluffy attempt at improving the share price last week with an announcement about a new, unnamed funding partner.

Little Bites:

- Director dealings:

- An associate of a director of Equites (JSE: EQU) has reduced a loan facility with Investec from R18 million to R15.8 million, with Equites shares pledged as security.

- A director of British American Tobacco (JSE: BTI) has bought shares worth nearly £43k.

- Directors of Choppies (JSE: CHP) seem to be trading amongst themselves in terms of the rights offer currently underway, with Ramachandran Ottapathu picking up BWP 658k worth of rights from another director.

- Adcock Ingram (JSE: AIP) has managed to repurchase 4.8% of its issued share capital since the general authority was granted in November 2022. The average repurchase price is R51.40 and the current price is R52.90.

- The currency conversion for the Industrials REIT (JSE: MLI) take-private has been finalised, which means the scheme consideration is R39.25320 per hare.

- If you are a shareholder in enX (JSE: ENX), be aware that the offer circular for the mandatory offer by African Phoenix and concert parties at R6.41 per share has been sent out.

- At Eastern Platinum (JSE: EPS), the investigation of certain whistleblower allegations is well underway. These relate to undisclosed related party transactions involving the sale of chrome concentrate at discounted prices. An independent committee investigation is being conducted, with no comments on the allegations given at this stage.