Barely a bronze performance at Anglo American Platinum (JSE: AMS)

Earnings have been crushed by commodity pricing and production issues

Mining is a tough game. Even the biggest names can get hammered from time to time, especially if production issues come through at the same time as commodity pricing pressures. This is exactly what has happened at Anglo American Platinum.

In a trading statement dealing with the six months to June, the company noted a sharp decline in rhodium and palladium US$ prices (47% and 29% respectively) as a major driver of the drop in revenue. Although the weaker rand does help our local mining industry, it thankfully didn’t weaken by enough to offset that kind of commodity price drop. The rand basket price for PGMs fell by 15% year-on-year.

To add to the pain, sales volumes fell by 12%, a direct result of lower refined production from the Polokwane smelter due to the ramp-up in January after its rebuild. There were also maintenance requirements and of course the ongoing joys of Eskom, particularly load curtailment.

To add further insult on top of the insult that was already added to injury, inflationary pressures on costs caused a decrease in margins.

Overall, HEPS is likely to be down by between 65% and 75%. To truly appreciate the magnitude of this number for the company and even the fiscus based on associated taxes, headline earnings will drop from R26.7 billion in the comparable interim period to between R6.7 billion and R9.4 billion. On a per share basis, this means a drop from R101.40 to between R25.44 and R35.69 per share.

The share price was trading at roughly R888 in late afternoon trade.

Datatec hangs on to R167.7 million in cash (JSE: DTC)

A scrip dividend is like a miniature rights offer

When listed companies are looking to retain cash, they can offer a scrip dividend alternative to shareholders. This is the option to receive more shares instead of a cash dividend, often incentivised through a calculation ratio that makes the scrip dividend more lucrative than the cash dividend. There are also tax considerations.

Every shareholder that receives shares instead of cash is effectively participating in a small rights offer. Conversely, every shareholder electing cash instead of shares is choosing not to participate.

This can be an effective and cheap way for a corporate to retain equity capital. In the case of Datatec, the cash dividend was R270.8 million and the scrip dividend was R167.7 million, so that’s a substantial portion of shareholders who were happy to receive shares in lieu of cash.

Merafe deliberately reduced its production (JSE: MRF)

The company prefers to scale down during a period of peak electricity prices

Ferrochrome producer Merafe has reported on production from its joint venture with Glencore. For the six months to June 2023, production fell by 9% vs. the comparative period.

This is due to a planned pullback in production, driven by higher electricity costs over the winter season. Only the Lion smelter operates over the peak period.

The odd thing about this is that the comparable period also included winter, so this is surely more to do with electricity pricing reaching an inflection point, rather than pure seasonality?

Either way, attributable production is down.

Oceana’s US subsidiary is proactive with debt (JSE: OCE)

Daybrook has refinanced its facilities early based on a tightening credit market

Balance sheet management is critical to success in any corporate, especially when debt has been raised as part of a corporate action. When Oceana acquired Daybrook Fisheries in the US all the way back in 2015, term debt at the time was $142 million. Depressingly, the announcement reminds us that the exchange rate at the time was roughly R12 to the dollar!

In 2019, the debt was refinanced with a final payment due in September 2024. The net debt balance as of June 2023 was $95.6 million, so there was still a very long way to go. Regular refinancing of debt is nothing unusual in the market, as corporates look to maintain a target debt : equity ratio.

With US credit markets tightening as rates have increased, the group decided to be proactive and refinance this facility well before the due date. As part of this, $15 million was repaid from cash generated during the year, so the new facility is $80.6 million. All the current lenders participated in the refinancing led by Bank of Montreal, with the refinance being 1.4 times subscribed.

Yes, banks compete for the right to lend to corporates! This isn’t your most recent home loan application, that’s for sure.

The new facility matures in 2028 and pricing on the “performance component” of the debt cost is unchanged, ranging from a spread of 1.75% to 2.5% depending on the level of debt in the group. The base rate that the spread is added to is unchanged, being the Secured Overnight Financing Date Rate (SOFR) which is 5.2%.

Here’s the really scary maths though: the original facility was R1.7 billion and the balance after the latest repayment is around R1.5 billion. Without the latest $15 million repayment, the rand value of the debt had made no progress since 2015. That’s what happens when a currency devalues to the extent that the rand has.

Orion draws down on Prieska funding (JSE: ORN)

This is a big step for the company

Putting funding arrangements in place is one thing, but meeting the conditions precedent is quite another. Finally, when all is ready, the company can draw down on the debt and actually get the money.

With conditions having been met for AUD30 million worth of facilities, Orion can get its hands on the money. AUD20 million is from the IDC and AUD10 million is from Triple Flag. The initial drawdown is AUD13.8 million, or around R167 million. This will be pro rata on both facilities.

The money will be used for pre-development mine works, including trial mining in the upper levels of the mine and construction and commissioning of mine dewatering installations.

Richemont’s share price takes a 9.5% knock (JSE: CFR)

The market had a wobbly over the US growth, or lack thereof

Richemont announced its sales performance for the quarter ended June 2023. There is no information on profitability, so this is purely a revenue announcement.

At group level, sales grew 14% as reported or 19% at constant exchange rates. That’s hardly a bad outcome, so why did the share price take such a knock?

It seems as though the performance in the Americas was to blame, where sales fell 2% in constant currency or 4% as reported. This is now the third largest region, overtaken by Europe which grew by 11% in constant currency or 10% as reported. The largest is Asia Pacific, with a major rebound in China driving growth of 40% in constant currency or 32% as reported.

Retail growth was the major driver of performance here, contributing 68% of group sales with direct-to-client sales now at 74% of total sales. The difference between those two numbers is online sales, which were flat year-on-year. The YNAP pure-play online business saw sales drop by 8% in constant currency. Farfetch is investing in that business and Farfetch itself is very well named, as the economics of purely online retail for high-end products are more than farfetched.

Jewellery significantly outperformed watchmaking, up 24% in constant currency vs. 10% for the expensive timepieces.

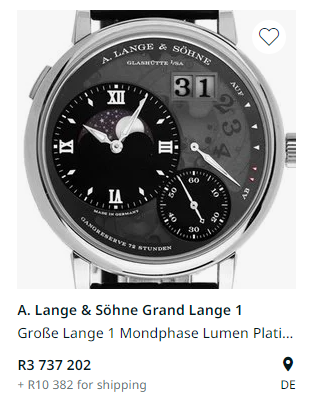

And when I say expensive, here’s a good example:

It will take more than a few tenders to get one of those.

Schroder’s property portfolio dips in value again (JSE: SCD)

Increasing property yields continue to put property valuation movements in the red

Properties are valued based on yields. The higher the yield (required return by investors), the lower the property value. This is the same way that government bonds are valued.

In the case of a property firm, the yield is driven by net operating income. In order for property values to increase during a period of higher prevailing interest rates in the market, the net operating income would need to grow faster than the offsetting effect of a higher required rate of return.

This is why Schroder’s property portfolio has seen a 0.8% decrease in value in the last quarter, as the valuation yield has increased to 6.4%.

If we dig deeper, we find that office assets fell by 2.4% as the yield moved higher by between 5 and 15 basis points. Industrial assets were up 1.2%, with static yields and growth in the returns generated by the properties. The retail portfolio was flat.

Interestingly, one of the pressure points in the valuations has been “sustainability-led provisions” which I think means cash outflows related to upgrading the properties to be more efficient. Elsewhere in the announcement, Schroder talks about sustainability-led capex initiatives.

The loan-to-value is 24% as at the end of June, slightly up from 23% at the end of March. This metric is net of cash.

Little Bites:

- Director dealings:

- The credit executive at Capitec (JSE: CPI) sold shares worth nearly R2 million.

- An associate of a director of Emira Property Fund (JSE: EMI) bought shares worth R1.58 million.

- An associate of the CEO of Southern Sun Limited (JSE: SSU) has bought shares worth R465k.

- The CEO of Argent Industrial (JSE: ART) has bought shares worth nearly R223k.

- A director of Acsion Limited (JSE: ACS) has purchased shares worth R17.5k.

- The CFO of ArcelorMittal (JSE: ACL), Siphamandla Mthethwa, has resigned with immediate effect. The announcement notes that the immediacy is due to “personal reasons” (among other reasons it seems). Uncertainty usually isn’t good to see, with the company moving to calm the market by announcing the current Strategy Officer, Gavin Griffiths, as the interim CFO.

- Equites Property Fund (JSE: EQU) announced that GCR Ratings has affirmed its credit ratings, but the outlook has moved from positive to stable.