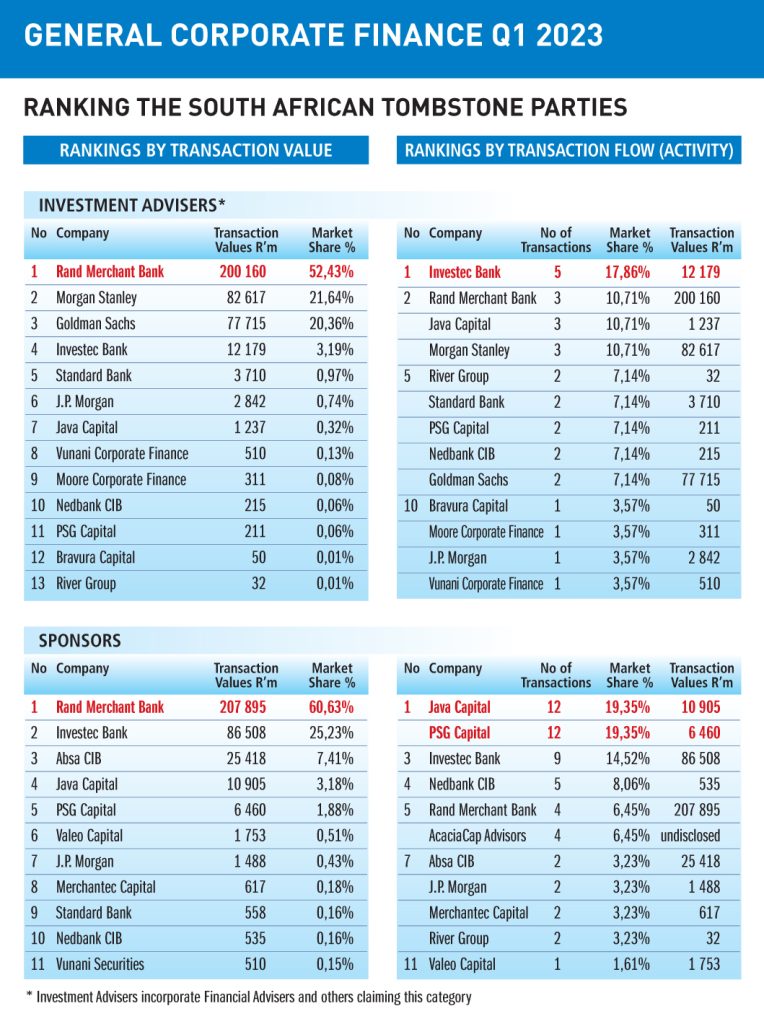

BHP (JSE: BHG) and South32 (JSE: S32) give strategic update presentations

There’s some interesting stuff in here to sink your teeth into

I enjoy it when companies make these types of presentations available. There’s almost always overlap with the most recent results presentation, but focusing on something other than the latest results means that you tend to notice new things.

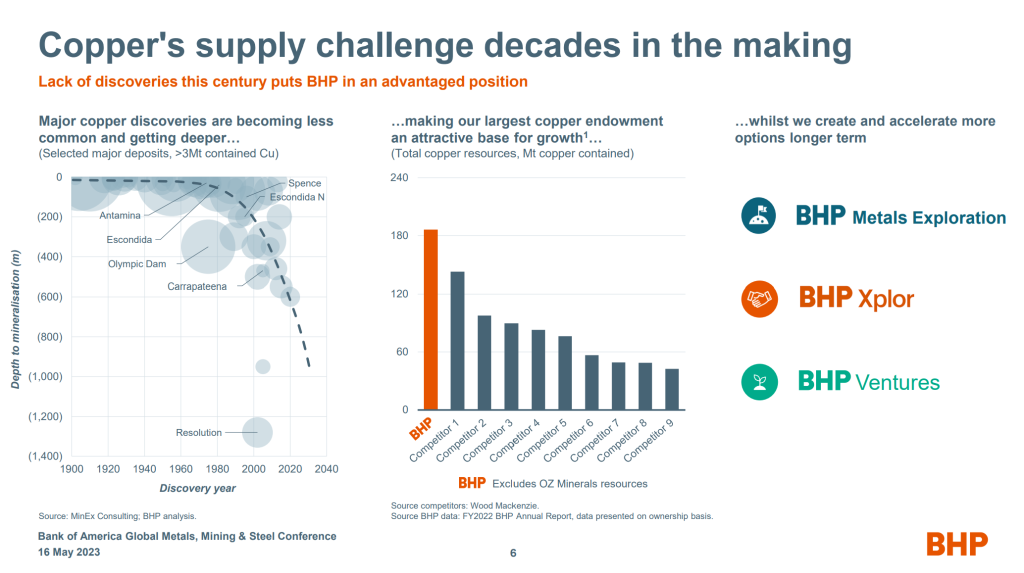

Both BHP and South32 presented at the Bank of America Securities 2023 Global Metals, Mining and Steel Conference.

At BHP, the focus on copper in this presentation is clear. Here is just one example, showing how long supply and demand imbalances can take to develop:

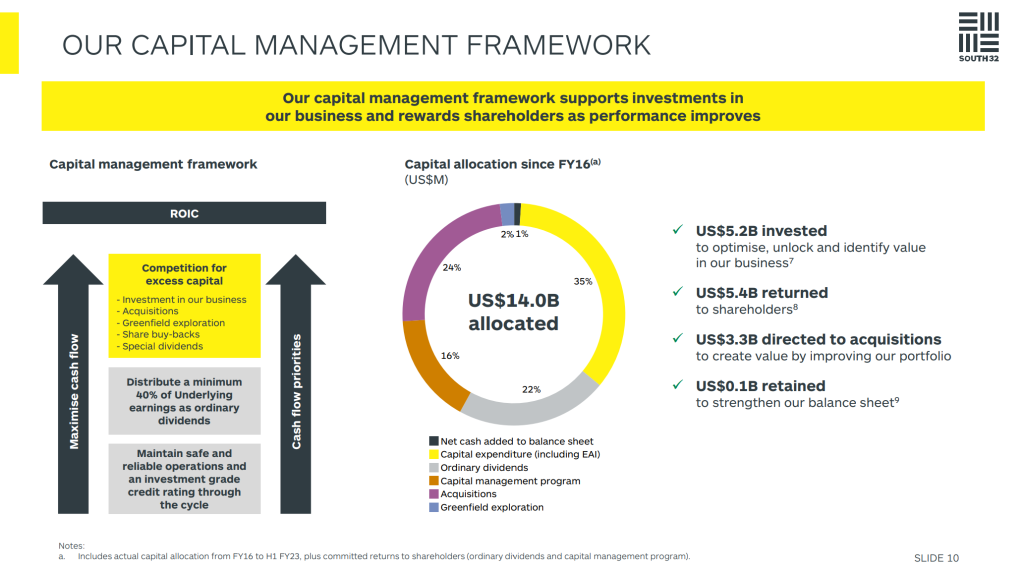

The South32 presentation is available here. This is a good example of the kind of slides that you’ll find in the deck:

I love the concept of “competition for excess capital” and especially the list of options given for excess capital. This is a lovely way to understand how share buybacks end up happening in companies outside of US tech companies – a company investing in its own shares is supposed to be a capital allocation decision. In US tech, it ends up being an anti-dilution mechanism to try and offset the effect of share-based compensation that is little more than a way to hide staff costs as non-cash expenses.

Thankfully, there’s none of that nonsense at South32.

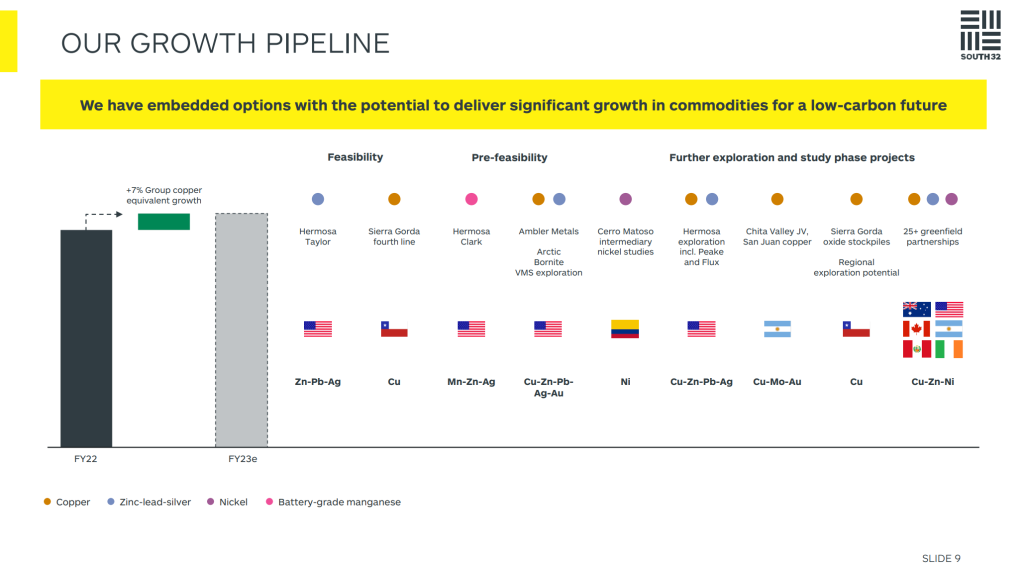

In addition to the capital allocation learnings in the deck, there’s also some cool stuff on how mining projects are developed by these groups:

It’s all about taking projects from the “study phase” through to pre-feasibility, then feasibility and finally full operation. The trick lies in choosing which projects to focus on, an incredibly difficult task that is literally a case of throwing darts at a moving target as commodity dynamics change.

Welcome to the world of mining.

Octodec releases interim results (JSE: OCT)

Over the past year, the share price has gained over 20%

In the six months ended February, Octodec’s rental income grew by 3.2% and distributable income after tax was 10.7% higher. With the management team clearly feeling better about the world around them, the dividend per share is 20% higher.

The net asset value (NAV) per share is 3.9% higher at R24.0 per share. With the share price closing at R10.29 on Tuesday, the discount to NAV is a whopping 57%.

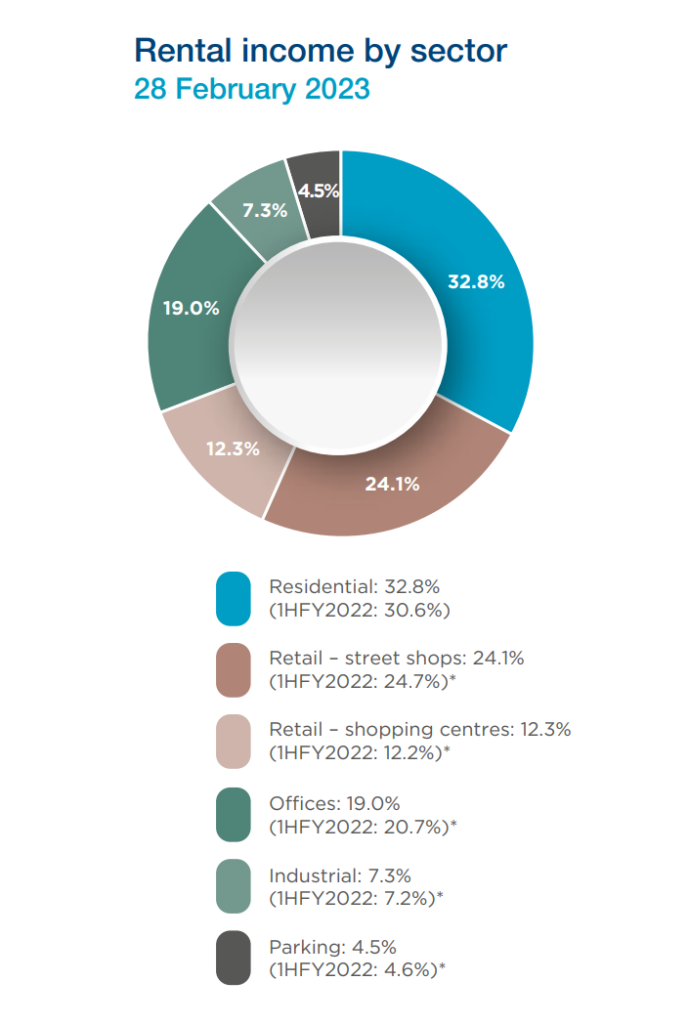

Although the fund has residential property as its highest source of income, the portfolio is more diversified than most people realise. Here’s a useful chart from the earnings update:

Purple Group announces a R105 million rights offer (JSE: PPE)

This will enable a R150 million capital raise in EasyEquities that Sanlam is also supporting

If ever you needed an example of the price driving the narrative, look no further than Purple.

When the price was clearly far too high and I was making myself unpopular on Twitter by pointing that out, everything was absolutely in love with the company. With the price having come down to earth with a bump, now the company gets given a hard time on Twitter.

If these emotions weren’t present in the market, there would never be opportunities to take advantage of them.

With a market cap of roughly R1.5 billion, a rights offer of R105 million is significant but by no means earth-shattering. This amount will enable Purple to follow its rights in a R150 million capital raise by EasyEquities, as Purple holds 70% in that company. Sanlam holds the other 30% and is supporting the raise.

In turn, EasyEquities will use the capital to accelerate expansion and move into international target regions including Kenya.

Pricing for the offer will only be announced later this week.

In the meantime, we know that four shareholders collectively holding 27.12% in Purple Group have committed to follow their rights in full. No commitment fees are payable for this.

All eyes will be on the pricing announcement on 18 May.

Reunert is a rare good news story in this environment (JSE: RLO)

This company is on the right side of load shedding, which helps greatly

In an update for the six months ended March 2023, Reunert delivered solid results in its segments.

The Electrical Engineering segment increased cable production in a period with no labour disruptions. As a double whammy of good news, margins also improved as supply chains eased in the aftermath of the pandemic.

In Applied Electronics, one of the drivers of performance was demand for renewable energy products and services as load shedding continued.

The Information and Communication Technology segment performed in line with expectations, which included high credit losses against the remaining lease and loan receivable book. The sale of this book funded the purchase of Etion Create.

Investors should note that a R44 million insurance payout in this period has helped operating profit. For reference, operating profit in the comparable period was R465 million, so that’s a material impact.

HEPS has increased by between 31.9% and 41.9%, Although the payout is part of the good news, there is clearly positive momentum in the operations as well.

Santam reflects on a promising quarter (JSE: SNT)

Despite tough conditions and changes to the group structure, it sounds good for Santam

For the three months ended March, Santam focused on bedding down its new operational restructure and improving the underwriting performance in the motor class of insurance. The property class was hit by claims related to power surges – thanks Eskom!

The Conventional Insurance segment achieved gross written premium growth of 6%. Despite best efforts, the underwriting result still came in below the target range of 5% to 10%.

Importantly, no adjustment was made to the contingent business interruption claims that did damage to the Santam brand during the pandemic.

Investment returns in this segment were volatile, but better than in the comparable year.

Santam doesn’t give any details on the performance of the Alternative Risk Transfer business, other than to give an overall positive commentary on it.

In the Sanlam Emerging Market partner business, Shriram in India achieved 23% growth in gross written premium, but net earned premium was in line with 2022 because of the lag between writing and earning the premiums. In India, most premiums are written annually in advance. The underwriting performance was weaker because of higher claims in the motor book due to inflationary impacts on repair costs and higher claim severity.

In Africa, the disposal of 10% in the SAN JV to Allianz is expected to close in the second half of 2023.

In other M&A news, the Competition Tribunal approved the acquisition of the MTN device insurance book. Santam is allocating R60 million to this initiative and believes that the underwriting profits will be sufficient to achieve the required return on capital. 400,000 policies will be added to the Santam licence.

After a volatile run, Santam is still up 4% year-to-date but down nearly 7% over 12 months.

Tharisa’s HEPS has moved higher (JSE: THA)

The share price has been stuck in a range since July 2022

PGM and chrome business Tharisa has released a trading statement for the six months ended March. It’s a bit of an odd one, as they give an earnings range with a tolerance of 10%. They also give a percentage change based on the earnings range but ignoring the “tolerance” – I don’t think I’ve seen this approach anywhere else in a trading statement.

If I interpret the tolerance correctly, HEPS could actually be between US 15.3 cents and 19.8 cents, which is a wide range vs. US 15.5 cents in the prior period. Without the tolerance, the guidance is for HEPS of between US 17 cents and 18 cents per share, which is growth of between 9.6% and 16.1%. I wish they wouldn’t make it harder to understand with the “tolerance” included in the guidance.

If you closely follow the markets, you’ll know that a trading statement is triggered by a 20% change in earnings. HEPS doesn’t trigger this but EPS does because of a once-off number related to the Karo Mining acquisition.

I would just focus on HEPS.

Little bites:

- Director dealings:

- Alphamin (JSE: APH) announced its Q1 numbers back in April. If you’re interested in digging deeper, the Q1 financial statements are now available at this link.

- On 15 May, Calgro (JSE: CGR) managed to repurchase 3.71% of shares in issue for R14.8 million. It’s unusual for small caps to get meaningful buybacks done, hence the special mention.

- Growthpoint (JSE: GRT) announced that both Fitch and Moody’s affirmed the company’s credit ratings and outlook.

- Impala Platinum (JSE: IMP) has bought another 0.07% in Royal Bafokeng Platinum (JSE: RBP), so the holding has inched up to 45.76%.

- The acquisition of Mediclinic (JSE: MEI) by a consortium of Remgro (JSE: REM) and Mediterranean Shipping Company has now received approval from the South African Reserve Bank. All regulatory approvals have been obtained and the UK court is expected to sanction the scheme on 24 May.

- Efora Energy (JSE: EEL) is suspended from trading and has finally released financial statements for the year ended February 2021.

- In a step that you won’t see very often, 4Sight Holdings (JSE: 4SI) has completed its redomicile to South Africa from Mauritius.

- The circus at Pembury Lifestyle Group (JSE: PEM) continues. Two of the schools in Joburg have been instructed to close until the properties are rezoned. I have to include this screenshot purely because I’ve never seen such a ridiculous sentence on SENS in my life – it literally sounds like a recording of a child who had a busy day at school and needs to give ALL the details on the drive home. Highlights mark where it begins and ends: