African Media Entertainment rides a radio recovery (JSE: AME)

The trading statement is highly encouraging

Covid wasn’t great for the radio industry. That statement may not make sense at first blush, but the live events and music festivals held under the radio station banners are highly lucrative and nobody wanted to attend them as masked balls.

Things are better now, with African Media Entertainment guiding growth in HEPS for the year ended March of between 21% and 40%.

AYO Technology flags a large loss (JSE: AYO)

The headline loss per share has more than doubled

For the six months to February, AYO Technology has guided for a headline loss per share of between -75.63 cents and -82.49 cents. That’s huge when the share price is only R3.05! The headline loss per share in the comparable period was -35.90 cents.

The company has attributed this to lower gross margin, restructuring costs and fair value adjustments on options.

Finance costs hurt Deneb in this period (JSE: DNB)

And if you split out insurance proceeds, it’s worse

Deneb is part of the HCI stable and the company holds some interesting assets, though you would be forgiven for thinking otherwise based on the absolute lack of commentary on the underlying operations in the result.

Although revenue at Deneb managed to grow 14%, gross margin pressure meant that the increase in gross profit was unexciting.

With the usual inflationary pressures factored in alongside higher net finance costs, HEPS fell by 15%. If you exclude the business interruption proceeds insurance in this period, it fell by 45%!

eMedia: from Anaconda to Afrikaans Turkish telenovelas (JSE: EMH)

Diversification has helped at a time when advertising revenue is dropping

eMedia owns not just e.tv, but also other assets like YFM (the radio station) and local film studios. This diversification has been helpful in a period of extended load shedding, with the company believing that Eskom has cost the TV advertising industry a whopping R500 million in revenue.

I think it’s pretty good that group revenue only fell by 0.6% in this environment, with profit down by 10.3%. The market clearly didn’t see it coming, with the share price dropping 9.7% on the day. A 20% drop in the dividend (and hence a lower payout ratio) may have been a driver here.

I found myself thoroughly intrigued by a note that Afrikaans Turkish telenovelas have been a major audience generator in the eVOD platform. This is the local version of a Netflix Originals strategy!

To give context to the results, group profit was R377 million and within that number, we find smaller subsidiaries like Media Film Services with net profit of R45 million and YFM on R15.9 million.

Frontier Transport Holdings – are you on the bus? (JSE: FTH)

You may not even be aware that these businesses are listed

Frontier Transport Holdings is one of those companies that only a close market watcher will likely know about. Part of the Hosken Consolidated Investments (JSE: HCI) stable, it includes businesses like Golden Arrow Bus Services.

For the year ended March, revenue increased by 15.1% but operating expenses increased by 18.9% over the same period. This margin pressure was driven by issues like fuel costs, with EBITDA only 2% higher as a result.

Thanks to a reduction in debt and thus finance costs, HEPS was up 5.9%. The full year dividend of 57 cents is a 9.6% increase on the prior year.

HCI’s solid result is underpinned by gaming and hotels (JSE: HCI)

A helpful contribution from coal doesn’t hurt, either

Hosken Consolidated Investments (HCI) is a fascinating group. It’s always a busy time on SENS when the company reports, as the reporting cycle is the same as the other listed companies that are part of the HCI group, like eMedia, Deneb and Frontier Transport Holdings. Those have all been covered separately today.

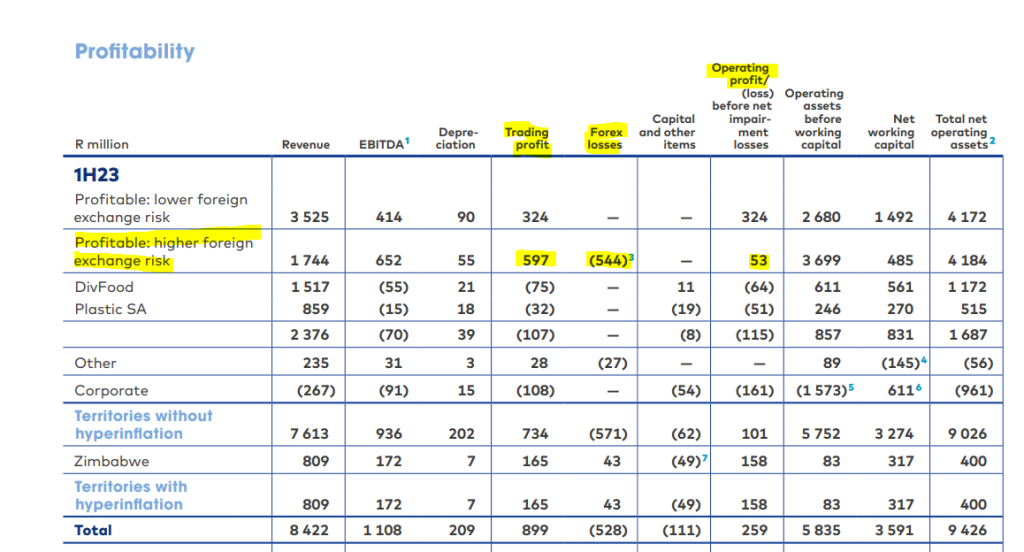

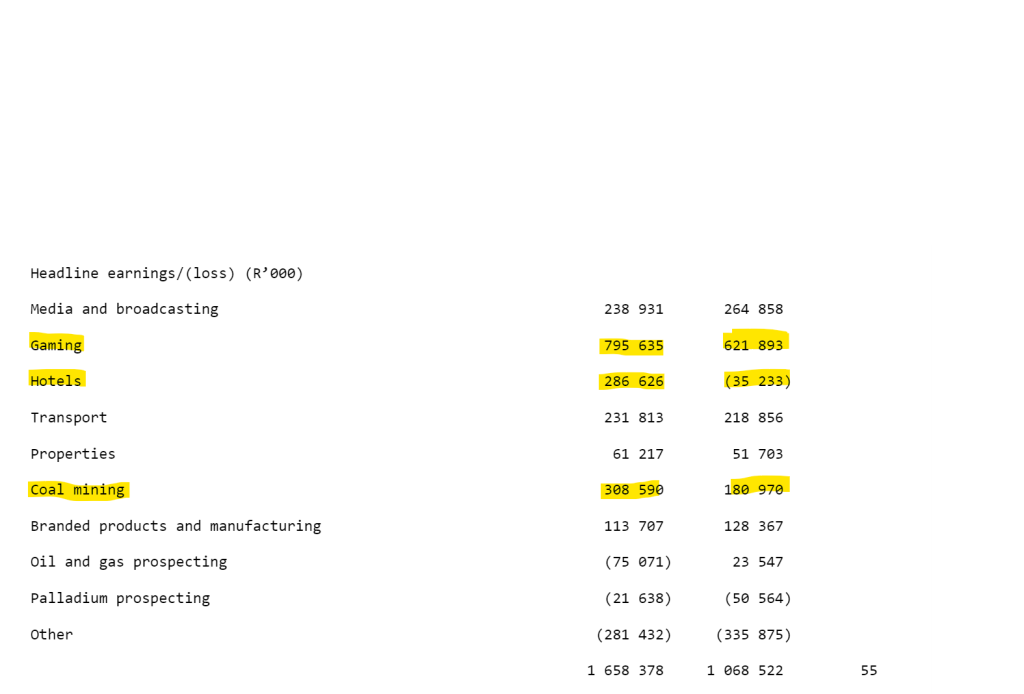

The easiest way to get a quick sense of the group is to use this table directly from the earnings release for the year ended March 2023:

The headings are cut off, but the latest period is on the left. You can immediately see the improvement in gaming and hotels, with coal also a lot higher. Note the pressure in media and broadcasting, particularly the television assets that don’t perform well during load shedding.

Your eyes aren’t deceiving you. In the bottom right, that is indeed a 55% jump in headline earnings.

With an investment focus on oil and gas prospects in Namibia, the group decided not to declare a final dividend. Watch this space.

Lewis feels the bite of economic pressure in SA (JSE: LEW)

Thanks to the ongoing share buybacks, HEPS managed to inch higher

Furniture retail group Lewis is well known among investors for a share buyback approach that has produced far better results for shareholders than would otherwise have been the case. Lewis trades at stubbornly low multiples, so share buybacks tend to be lucrative.

Share buybacks only get you so far, though. Lewis is facing considerable pressure in its operations, driven by broader challenges in South Africa.

Perhaps the biggest concern is that cash sales are moving sharply in the wrong direction. Cash retailer UFO suffered a sales drop of 12.5%. Group credit sales grew by 18.1% while cash sales fell by 16.3%. Ouch. It does at least help that the quality of the book has improved year-on-year, with the impairment provision improving from 40.4% of the book to 36.2%.

Total group revenue increased by 3.1% and gross margin improved by 10 basis points to 40.6%. Lower shipping rates have been helpful here. Despite this, operating profit fell by 8.3% as inflationary pressures in the cost base were too much to bear.

Here’s where the magic of share buybacks comes in: although headline earnings fell by 9.8%, headline earnings per share (HEPS) was actually up by 1%!

Life’s core business is performing strongly (JSE: LHC)

A VAT dispute settlement overshadowed the latest results

For the six months ended March 2023, Life Healthcare grew revenue by 12.9% and normalised EBITDA by 13.9%. That sounds great, until you read about normalised earnings per share only increasing by 1.1%. You can largely thank the tax dispute with SARS for that, with Life having paid R246 million in VAT of which R199 million was provided for in the prior period. This was despite Life having “strong legal and tax opinions” on this.

Something we aren’t reading about very often at the moment is margin expansion in Southern Africa, yet Life has managed to enjoy the right side of operating leverage in the land of load shedding. Revenue was up 11.6% and normalised EBITDA increased by 13.5%. In the AMG business in Europe and the UK, revenue grew by 15.5% and normalised EBITDA by 10.8%.

Net debt to EBITDA at 2.17x is higher than the comparable period at 2.03x, but remains manageable.

Strategic focus areas at the company include further investment in molecular imaging in South Africa and renal dialysis clinics, also in the local market. The hospitals have always had to be able to function with emergency electricity, so this is one of the few industries where capital expenditure is still going into the core business rather than into power backup solutions. Capex in Southern Africa was R514 million in this period, of which R418 million was on refurbishment and “portfolio optimisation” – classic boardroom terminology.

Despite the decent core results and a 13.3% increase in the dividend per share, the share price closed 7% lower.

Importantly, Life is still in discussions with various parties regarding unsolicited offers received for the AMG business in Europe.

Margins under pressure at MiX Telematics (JSE: MIX)

The impact on HEPS from a tax charge was severe

In the year ended March 2023, MiX Telematics managed to grow revenue by 15.7% or 10.3% on a constant currency basis. The acquisition of FSM was a positive contributor here, responsible for 4.5% of the 11.9% constant currency growth in the subscription revenue line specifically.

Margins went the wrong way though, with gross margin down 110 basis points and operating margin down 190 basis points. The additional pressure in operating margins was due to restructuring costs, the benefits of which should start coming through.

Because of a massive deferred tax charge on intercompany loans, HEPS fell by 46%. On an adjusted basis excluding restructuring costs and the deferred tax charge, it was slightly up year-on-year.

Old Mutual was a mixed bag this quarter (JSE: OMU)

A group this size usually has winners and losers in any given period

In an update for the three months to March, Old Mutual reported a 1% drop in Life APE sales mainly because of China, without which the sales number would’ve been 7% higher. Persistency is under pressure, which means that Old Mutual’s clients aren’t necessarily hanging on to life policies.

Gross flows increased by 22%, with Futuregrowth as a strong contributor here. Unfortunately, outflows in wealth management across all platforms was a partial mitigator of that good news story around flows.

Loans and advances were flat year-on-year, which tells me that Old Mutual is being cautious in this environment.

On the insurance side, gross written premiums increased by 19%.

Squid games at Premier Fishing and Brands (JSE: PFB)

There’s a tasty jump in operating profits at the company – but no dividend

For the six months to February, Premier Fishing and Brands reported a 15% jump in revenue, with the squid sector as the major driver of the strong jump in revenue. Lobster and hake deep sea also did well.

The problem is that shareholders of Premier didn’t get the lion’s share here, with a large part of profits attributable to minorities. This led to a drop in HEPS of 61.6%.

There’s also trouble on the balance sheet, with profits not flowing through into cash in the way that the company would’ve liked. There is no interim dividend.

Reinet flags a 2.9% drop in NAV year-on-year (JSE: RNI)

The compound growth rate since 2009 is 8.8% in euros

The drop in NAV at Reinet over the past year is mostly attributable to the stake in British American Tobacco (JSE: BTI), a company which I don’t believe is as defensive as the market likes to think it is.

The private equity investments had a good year, up by 26%. Although everyone only ever talks about the stakes in British American Tobacco and Pension Corporation, Reinet actively reinvests dividends in new opportunities that can be quite exciting, like technology funds.

The proposed dividend of €0.30 per share is 7% higher than the comparable period.

Southern Sun’s profits beat FY20 (JSE: SSU)

This is despite a lower occupancy rate than pre-pandemic

There are two ways to think about the occupancy rate. If you’re bearish, you might argue that a full recovery in occupancy isn’t coming for a long time, with a structural decrease in business travel and economic pressures on leisure travel. If you’re bullish, you could argue that there is runway for further improvement in this story.

Or, you could simply read the Southern Sun announcement, in which case you’ll see commentary around a normalisation of travel patterns except for the Sandton node. Structurally lower activity in Sandton has been a theme of the post-pandemic world, with devastating effects on office property owners in the area.

Welcome to the markets, where people can look at the same piece of information and form completely different views.

The year-on-year performance is a little silly, with EBITDAR (that’s not a typo – it’s the standard measure in hotel groups for operating profit) more than doubling from R590 million to R1.4 billion. The more interesting approach is to compare it to FY20 (where only one month was impacted by Covid), in which case EBITDAR is 6.2% higher despite occupancy of 51.5% vs. 59.3% in FY20.

In a great demonstration of how sensitive profitability is to occupancy above the point where fixed costs are covered, occupancy was only 30.6% in FY22. So, occupancy increased by roughly 68% (51.5% vs. 30.6%) and profits increased by approximately 140%. Welcome to hotel economics.

Winter is coming. The group notes the uncertainty around demand over this period, particularly with load shedding. The good news is that the balance sheet is in good shape to weather this storm.

The share price has made a full recovery vs. pre-Covid levels but seems to have run out of steam in 2023:

Stefanutti Stocks: under construction (JSE: SSK)

Valuation is everything – as evidenced by this share price move

The markets can be confusing. A company can release seemingly solid results and watch its share price drop. Stefanutti Stocks can release a headline loss per share of -38.73 cents for the year ended February 2023 and watch its share price close 9.6% higher.

It all comes down to what the market was pricing in. When it comes to Stefanutti Stocks and its broken business that is being restructured, this bruised and battered fighter isn’t exactly priced for great expectations.

The restructuring plan is being implemented over the year ended February 2024. It includes everything from the sale of non-core assets through to a potential equity capital raise.

This is a perfect example of a speculative punt on a turnaround story. With an operating profit from continuing operations of over R100 million but a total loss from continuing operations of -R37.5 million, there is something to save here underneath layers of difficulty.

Texton looks to take the PIC out at a good price (JSE: TEX)

A large specific repurchase is on the cards

Texton is proposing a repurchase of approximately 19.8% of its share capital from the PIC at a price of R2.15 per share, a substantial discount to the current traded price of R2.41. That may sound strange, but there’s absolutely no chance the PIC could sell a stake that size on the open market without smashing the price into oblivion.

Here’s the funny part: the repurchase will come out of existing cash resources, but Texton may then require a rights offer for its strategy. At what price does the management team think a rights offer can be achieved?!?

Assuming a rights offer goes ahead, is there really a saving here for shareholders net of transaction costs on the buyback and the rights offer?

Little Bites:

- Tsogo Sun Gaming (JSE: TSG) has built a 10% stake in City Lodge (JSE: CLH) very quickly, which obviously has gotten the market talking about potential takeout activity. The City Lodge announcement doesn’t specifically mention Tsogo Sun Gaming, but the companies that own the 10% stake were figured out by financial media houses to be part of the Tsogo Sun Gaming group.

- With the scheme of arrangement for the take-private of Mediclinic (JSE: MEI) sanctioned by the UK court, the listing on the JSE will be terminated on 7 June.

- It won’t make much of a dent, but every bit helps – Nampak (JSE: NPK) has sold a property in Tanzania for $5.5 million, payable over four instalments until August.

- Capital & Regional Plc (JSE: CRP) will issue shares equivalent to 2.6% of share capital under the scrip dividend.

- Impala Platinum (JSE: IMP) has acquired another 0.06% in Royal Bafokeng Platinum (JSE: RBP). The total stake is now 45.89%.

- The CFO of Telemasters (JSE: TLM) has retired (for the second time!) with the company in the process of finding a replacement.