Advantage: Adcorp (JSE: ADR)

There’s a juicy jump in HEPS at Adcorp – if you ignore one of the Aussie businesses

Adcorp closed 17% higher on Monday, which sounds incredible unless you try to actually sell your shares, at which point you’ll learn about the pain of a bid-offer spread. The spread at Adcorp is approximately the size of Jupiter, with the associated drops being your tears as you try to cross the double and trade at anything close to the “price” shown to you on your friendly local data provider like Google Finance.

Stock illiquidity aside, the company has put in a solid performance for the year ended February 2023. Revenue is up by between 5.2% and 7.7% and HEPS from continuing operations has jumped by between 38% and 58%.

The “continuing operations” point is critical here, as including allaboutXpert Australia in the numbers takes the group into a very different position. HEPS from total operations is down by between 29% and 49%. This business has been classified as a discontinued operation as the company is being placed in voluntary administration.

Importantly, the balance sheet is ungeared, which is a fancy way of saying that there is no debt. The group is in a net cash position of R312 million.

Although these are somewhat encouraging numbers, the share price is down nearly 19% this year even after the latest rally.

Astral says “no dividend down 100%” (JSE: ARL)

They really wanted to drive the point home about this dividend – and the pain of load shedding

If you want to draw a direct line from governmental failures to the impact on the poor of South Africa, look no further than Astral Foods.

Despite a 5.7% increase in revenue for the six months to March, higher feed prices and of course load shedding drove an 88% reduction in group operating profit to R98 million. To be clear on the role that load shedding played, profits in the prior period were R785 million and the group notes load shedding costs of R741 million incurred during the period that couldn’t be recovered from the market.

Is this sustainable? Absolutely not. The Poultry Division (which produces South Africa’s staple protein) made a loss of R283 million. The group was saved by the Feed Division, which reported a profit of R381 million thanks to decent recovery of raw material costs.

To add insult to injury, net working capital increased by R705 million at a time when profits collapsed. This means that strain was put on the balance sheet, with a net cash outflow of R1.2 billion for the period.

The group has moved from a net cash position of R701 million at the end of September 2022 to an overdraft of R506 million at the end of March.

Unsurprisingly, all capex that doesn’t relate to emergency maintenance or measures related to electricity and water supply has been put on hold. In line with what we are seeing everywhere, private balance sheets are being used to do exactly what government should be doing with our corporate taxes.

Semigration is clear at Balwin (JSE: BWN)

Gauteng is becoming a smaller proportion of group volumes over time

At this stage, Gauteng is still the largest contributor to apartment volumes at Balwin. This is shifting quickly, with the percentage dropping from 61% last year to 48% this year. The Western Cape jumped from 32% to 40% and KwaZulu-Natal increased from 7% to 12%.

For the year ended February, revenue increased by 6% and HEPS jumped by 21% as the group’s focus on margin paid off. There is a healthy cash position of R607.4 million as at the end of February, which is lucky as I think that tougher times are ahead.

The number of pre-sold apartments has dropped sharply from 1,551 apartments at the end of August 2022 to 870 apartments at the end of February 2023. The company puts a positive angle on this number, noting that apartments were rolled out at pace to respond to semigration. That’s great, but what about demand in the coming period?

Another concern I have is the monthly rental guarantee at some developments, where Balwin is basically encouraging buy-to-let by derisking some of the economics for the buyer. In other words, Balwin is having to absorb more risk to drive sales.

Here’s another metric that tells a story: there were 1,648 mortgages originated by Balwin this period vs. 2,824 in the comparable period.

With a net asset value (NAV) per share of 824.38 cents vs. a traded price of 290 cents, the discount to NAV is a whopping 65%. The total dividend for the year was 24 cents, so the market has put Balwin on a dividend yield of 8.3%. With what is primarily a property development business rather than rental business being valued on such a high yield, the market is sending a clear message around its skepticism of the Balwin growth story.

I have shared this skepticism since I started writing publicly about the markets and I haven’t been proven wrong yet on this stock.

The good news story at Barloworld continues (JSE: BAW)

Key metrics have all gone in the right direction

Barloworld’s revenue from continuing operations increased by 12.9% in the six months to March, with solid contributions across the board. If you look at HEPS from total operations, you’ll see a drop because of the unbundling of Zeda. The correct metric is HEPS from continuing operations, which increased by 29.4% to 578.1 cents.

At EBITDA level, the performance was a mixed bag across the divisions.

Equipment Southern Africa managed to grow EBITDA by 22.7%, a juicy number despite a contraction in EBITDA margin from 12.9% to 11.4%. This was attributed to a change in sales mix, with machine revenue being higher in the current period vs. the prior period. It’s always important to remember that the mix effect can have a big impact on margins even if revenue seems to be doing well. This is simply because different products and services achieve different margins.

Looking abroad, Equipment Mongolia more than doubled EBITDA, with margin expanding from 16.7% to 19.8%. Equipment Russia suffered a 24.6% drop in EBITDA, even though margins were much higher at 17.8% vs. 11.9%. This was because of demand for aftermarket products in Russia, which carry higher margins.

Finally, food ingredients business Ingrain reported a 7.5% drop in EBITDA, with a margin of 14.1% vs. 17.6% in the comparable period. There were production issues in this part of the business, with unplanned breakdowns and other troubles.

The banks continue to do well, with net finance costs up by 49.4% because of an increase in working capital and obviously higher average interest rates. Net debt jumped from R2.5 billion in September 2022 to R7.1 billion in March 2023, with Barloworld noting that the first six months of the financial year traditionally see an increase in working capital.

Debt covenants are comfortable, with EBITDA : interest cover of 5.2x (needs to be over 3x) and net debt : EBITDA cover of 1x (needs to be lower than 3x).

Famous Brands thinks load shedding hurts its revenue (JSE: FBR)

I remain convinced that Eskom is helping these fast food joints out

When my power is off from 6pm to 8:30pm and I need to eat something, I don’t mess around. As a bachelor these days, it’s vastly easier to get takeout rather than something from the grocery story. Although my weapon of choice is Kauai (Brait (JSE: BAT) is sitting on a gem there), there’s little doubt in my mind that Famous Brands is a beneficiary of load shedding. Whether this means families getting burger specials for dinner or people going to coffee shops for a warm drink and wi-fi during the day, I just can’t see how this environment is bad for top-line growth in the industry.

With revenue up 15% and HEPS up 37% in the year ended February 2023, there seems to be some truth to my view, Covid-affected base period notwithstanding.

There are some fascinating trends vs. pre-Covid behaviours. The evening sit-down trade hasn’t recovered to pre-pandemic levels, with consumers making earlier bookings at the group’s restaurants. I can only assume that lockdown babies are taking their toll here, as any parent of a little one will know. The restaurant fun ends at 6pm when you have a small human with you.

The other trend is growth in food delivery, making this a sustainable channel in which Famous Brands can focus on its own delivery alongside third-party aggregators.

We might see more of an impact of load shedding in the next financial period, with franchise partner financial relief implemented from March 2023. In practice, this means a lower royalty and marketing percentage to help franchisees with sales generated during load shedding hours. In other words, Famous Brands needs to subsidise those hours a bit to retain its appeal to consumers.

With HEPS for the year of 488 cents and a total dividend of 363 cents, the share price of R64.30 represents a trailing Price/Earnings multiple of 13.2x and a trailing dividend yield of 5.6%.

Netcare’s normalised EBITDA margin excludes diesel (!) (JSE: NTC)

Well, that’s rather optimistic

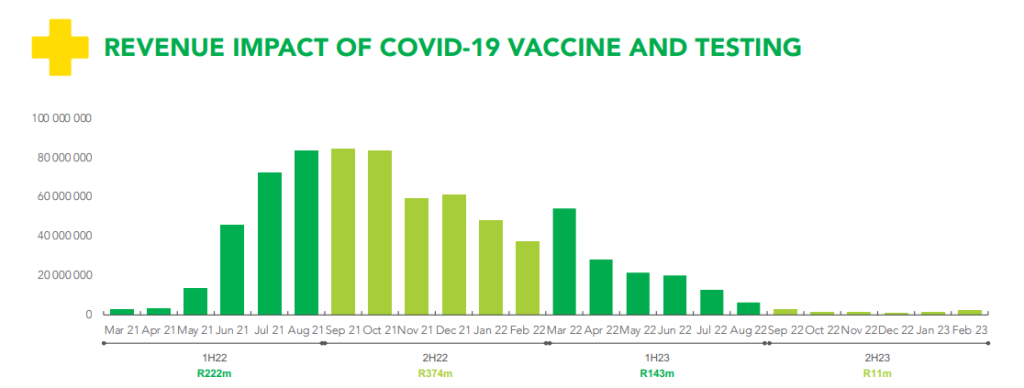

In the six months to March 2023, Netcare’s revenue has increased by 11.9% and normalised EBITDA improved by 220 basis points to 19.1%.

Here’s the outrageous part: one of the normalisation adjustments is the exclusion of diesel costs! I mean, really now? Is load shedding just a casual once-off bump in the road? How we all wish it were true!

To quantify the diesel impact, we have to consider normalised EBITDA of R2.015 billion vs. diesel costs of R67 million. In other words, including diesel costs would decrease EBITDA by 3.3%. This would mean an EBITDA margin of 16.9%, which is higher than the prior period but not as good as management would’ve liked us to focus on.

Netcare needs to deal with the reality we are all facing: load shedding isn’t about to disappear and nor are the diesel costs, at least not in the foreseeable future.

The good news for shareholders is that management is confident enough to increase the interim dividend by 50%, which means a higher payout ratio as HEPS increased by 40.4%. Thankfully, HEPS includes diesel costs!

A Premier performance (JSE: PMR)

Shareholders are being given their daily bread here

Premier has only been separately listed for a couple of months, having been split out from Brait after a long period of preparing the group to stand on its own feet. So far, so good, with a reasonably flat share price since listing (despite the negative sentiment around SA Inc.) and a trading statement for the year ended March 2023 that tells a great story.

HEPS will be up by between 32% and 42% on a reported basis, or 17% and 27% on a normalised basis. The adjustments to arrive at a normalised number include forex gains on cash and loans and a reversal of accrued withholding tax. Those are indeed unusual items, so I would go with the normalised growth rather than reported growth.

This is an impressive outcome under the economic circumstances, which of course gets the market wondering what Tiger Brands (JSE: TBS) might be managing to achieve in this environment.

Stefanutti Stocks lands an arbitration victory (JSE: SSK)

The share price closed 8.6% higher in a show of appreciation

It feels like construction companies are permanently in some form of dispute. Thankfully, this one has gone the way of Stefanutti Stocks and its shareholders, with an arbitration process leading to an award of R90.7 million excluding legal fees.

On that note, legal fees have also been awarded, so the other side is really hurting on this one.

With a market cap of under R200 million, this is big news for the company.

Spear REIT shows the value of focus (JSE: SEA)

No frills and no fuss – the way a property fund should be

As you would’ve picked up from the Balwin numbers further up, the Western Cape is the place to be right now. As a semigrant myself, I don’t for a second believe that the semigration trend will reverse anytime soon.

This is good news for Spear, with a portfolio focused exclusively on the Western Cape. Along with a sensible management style that delivers unspectacular but dependable results to investors, this has generated growth in the distribution per share of 11.31%. The loan to value ratio also decreased from 39.05% at 28 February 2022 to 36.30%, as the group has recycled capital and repaid debt at the right time.

Based on a full year distribution of 75.97 cents, the share price is trading on a trailing yield of 10.6%.

Little Bites:

- Director dealings:

- A director of FirstRand (JSE: FSR) has bought shares worth R3.8 million.

- The Chairman of WBHO (JSE: WBO) has sold shares worth R2.5 million.

- The Chief Strategy Officer at Investec (JSE: INL) has sold shares worth £329k.

- A director of Thungela Resources (JSE: TGA) has bought shares worth R196k.

- A director of Quilter (JSE: QLT) bought shares worth nearly £16.7k.

- After Mast Energy Developments issued new shares to lenders who converted to equity, Kibo Energy (JSE: KBO) has seen its stake in the company drop from 57.86% to 54.91%.

- At Jasco Electronics (JSE: JSC), the offer was accepted by holders of 19.08% of Jasco’s shares, taking CIH and the offeror to a combined stake of 74.42% in the company. With the listing being terminated on 23 May, this means that a significant minority stake is being taken into the private environment.

- Conduit Capital (JSE: CND) is in the process of selling Constantia Life and Health Assurance Company to Affinity Financial Services for R20 million. The date for fulfilment of suspensive conditions has been extended to 30 June 2023.

- Finbond (JSE: FGL) has renewed the cautionary announcement related to potential acquisitions in Southern Africa. Yes, the announcement references acquisitions i.e. plural.

- Primeserv (JSE: PMV) has also renewed its cautionary announcement regarding a potential acquisition in the staffing services sector.

- In one of the most incredible announcements I think I’ve seen on the JSE, Afristrat (JSE: ATI) distanced itself from a website called afristratpumpanddump.co.za – of course, all this did was alert basically the entire market to the existence of this website (and yes, it’s real). People out there are angry with the company.