There are two types of people in this world: those who know what Vantablack is, and those who are about to go on a rollercoaster ride of discovery.

Friedrich Nietzsche once famously said “If you gaze long into the abyss, the abyss also gazes into you”. I reckon he was only able to make that kind of statement because Vantablack wasn’t invented in his lifetime, because there’s no doubt that Vantablack represents the very essence of nothingness. There is no light and no life at the bottom of this shade of black. Nothing is reflected. Nothing gazes back.

How is it that scientists came to create a black so black that it absorbs 99.96% of light – and how did one artist manage to corner the market on it?

The science-y bit

The name “Vantablack” represents a category of ultra-black coatings that exhibit total hemispherical reflectance (THR) levels below 1% across the visible spectrum. In other words – if a surface or object is coated with Vantablack, it will absorb up to 99.965% of visible light. Furthermore, these coatings possess the remarkable quality of maintaining consistent light absorption from nearly all viewing perspectives, meaning that Vantablack is capable of creating the illusion of two-dimensionality even when applied to a three-dimensional surface.

Vantablack was invented by Ben Jensen, the founder and CTO of Surrey NanoSystems, in 2014. In case you’re wondering how it actually works, I’ll give you the high-level explanation: a forest of vertical carbon nanotubes is “grown” on a substrate using a modified chemical vapour deposition process. When light strikes Vantablack, instead of bouncing off, it becomes trapped and continually deflected amongst the tubes, absorbed, and eventually dissipated as heat.

The use case for the world’s blackest black is interesting, ranging from scientific applications right through to luxury (think watch faces and really expensive custom car paint jobs). Within the scientific realm, Vantablack created a stir regarding its potential applications in cameras, telescopes and sensors. Its unique attributes render it an appealing substance for a variety of purposes, ranging from enhancing cinema projectors and lenses to adorning luxury goods and design pieces. Moreover, its remarkable light-absorbing capabilities hold promise for revolutionising the efficiency of solar panels and cells.

Sharing is for the poor

Sadly, you can’t go to your local hardware store, pick up a litre of Vantablack paint and transform your kitchen into a black hole. That’s because Surrey NanoSystems does a great job of controlling access to Vantablack, outright refusing to supply it to private individuals. Samples are provided only for applications that the company deems “valid” (like when BMW was allowed to cover a whole X6 in Vantablack for the International Motor Show in Germany in 2019).

And yet, by some method of persuasion, the British artist Anish Kapoor managed to get Surrey NanoSystems to sell him the exclusive rights to use Vantablack S-VIS, a sprayable version of Vantablack, in artistic applications. As you can imagine, artists around the world were less than impressed that Kapoor could be allowed to corner the market on what is essentially a colour, thereby prohibiting everyone else from using it to make art. Many felt that Kapoor was given access to Vantablack due to his immense wealth and fame, rather than his artistic merit, and those critics decried what “more talented artists” could do if they were given access to the same materials.

The capitalist readers in the audience will remind us that Surrey NanoSystems is a business, and this is how business works: the highest bidder always wins. Yet there is undeniably still an emotional pull and a feeling of unfairness that kicks in when someone monopolises something as intangible as a colour. Obviously we know that Vantablack isn’t a standard colour, and it requires much more time, skill and money to produce than the standard black pigment, which is why it holds more value. But still, that doesn’t erase the image of Anish Kapoor as the petulant child at the kindergarten table, holding onto the black crayon so that no-one else can colour with it.

Sooner or later, the other children at the table get tired of waiting for their turn. And in 2016, one artist decided to take a crack at Kapoor’s monopoly.

The revolution will be pink

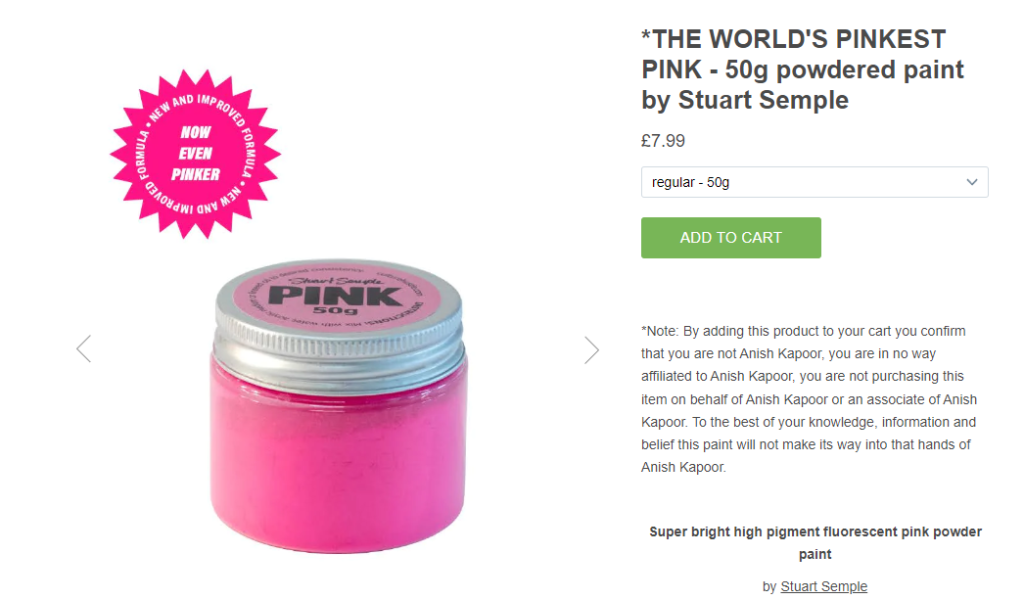

Stuart Semple is a painter who has been mixing his own pigments since his varsity days. One of these pigments was a fluorescent shade of pink, which Semple dubbed “the pinkest pink”. Frustrated by the Vantablack situation, Semple introduced sales of The World’s Pinkest Pink pigment through his online store in 2016, accompanied by the following caveat:

“By adding this product to your cart you confirm that you are not Anish Kapoor, you are in no way affiliated to Anish Kapoor, you are not purchasing this item on behalf of Anish Kapoor or an associate of Anish Kapoor. To the best of your knowledge, information and belief this paint will not make its way into the hands of Anish Kapoor.”

Of course it didn’t take long for troops of equally-irritated artists to rally behind Semple and his pink. Orders began trickling in initially, then quickly escalated to a surge, and eventually, an inundation. Five thousand jars were demanded, prompting Semple to recruit his family for assistance in grinding ingredients and fulfilling orders.

Artists who bought Semple’s pink went on to create art with it, and shared their pink creations online under the hashtag #sharetheblack. For anyone out of the loop at that time, it must have been a twilight-zone-esque experience to see so many people on the internet making art with pink while talking about black.

Of course it was only a matter of time before Kapoor rose to Semple’s challenge and got his hands on a tub of The World’s Pinkest Pink. And when he did, he promptly did this:

Nothing stays exclusive forever

For the longest time, Kapoor appeared to be doing nothing with Vantablack aside from hoarding it, which obviously didn’t endear him any further to his fellow artists. In the meantime, Semple kept at his one-sided feud, developing The Glitteriest Glitter as well as a cherry-scented superblack pigment called Black 2.0, both of which – you guessed it – were available to buy by anyone but Anish Kapoor. After Black 2.0 came Black 3.0, and then Black 4.0, which is capable of absorbing 99.96% of visible light. And unlike the highly technical, expensive and difficult-to-work-with Vantablack, Semple’s Black 4.0 is non-toxic and can be applied with a normal brush. It costs only $49.99 for a 150 ml bottle and can be bought online in just a few clicks.

It seems like too much of a coincidence that Semple went live with sales of Black 4.0 right before the debut of Kapoor’s first ever collection of Vantablack paintings at the Venice Biennale in 2022. The works on display apparently took 10 years of experimentation, scientific collaboration and careful application to create, which is how Kapoor is justifying selling each of them for £850 000 ($1.04 million, or roughly R20.03 million).

Spite is a powerful motivator. And while Stuart Semple will never make nearly as much money from his pigments as Anish Kapoor will make from selling one Vantablack painting, he will go down in history as the man that made the blackest black available to everyone.

Everyone except Anish Kapoor, that is.

About the author:

Dominique Olivier is a fine arts graduate who recently learnt what HEPS means. Although she’s really enjoying learning about the markets, she still doesn’t regret studying art instead.

She brings her love of storytelling and trivia to Ghost Mail, with The Finance Ghost adding a sprinkling of investment knowledge to her work.

Dominique is a freelance writer at Wordy Girl Writes and can be reached on LinkedIn here.