Alexander Weiss of Trive South Africa shares his views on the local retail industry, including a technical analysis of both Woolworths and Shoprite.

South Africa’s ongoing energy crisis is making headlines for all the wrong reasons as companies battle against the detrimental effects of rolling blackouts and power disruptions, especially within the food retail sector. Food retailers face the cumbersome task of limiting food wastage and remaining profitable despite a growing nationwide energy crisis that has become troublesome for most.

As surging power outages persist and general economic instability arises, local food retailers have expressed concern over the financial repercussions of ongoing power disruptions. Loadshedding has emerged as a familiar yet unpopular theme among South Africans as rolling blackouts intensified during the second half of 2022 and well into 2023.

Food retailers such as Woolworths (JSE: WHL) and Shoprite Group (JSE: SHP) have seen the nation’s energy crisis depress bottom-line figures and cut into shareholder dividends, causing a wave of negative sentiment to enter the local food retail market.

Loadshedding and its Effect on the South African Economy

Despite reaching an all-time high in 2022, the South African economy has only grown by 0.3% from 2019’s pre-pandemic reading, significantly lagging behind the country’s 3.5% population growth. The South African economy contracted more than expected in the fourth quarter of 2022 against persistent loadshedding and rolling blackouts. Despite rallying in the third quarter of last year, Gross Domestic Product (GDP) declined by 1.3% in the fourth quarter, significantly exceeding analyst expectations of a 0.4% decline. This significant contraction in fourth-quarter GDP places South Africa on the precipice of a technical recession as market analysts forecast a further reduction in quarterly growth for the first quarter of 2023.

Food Inflation Surges as Nationwide Energy Crisis Persists

As South Africa’s consumer price inflation ticked up to 7% in February 2023, marginally up from January’s reading of 6.9%, “food and non-alcoholic beverages” emerged as the primary driver behind February’s inflation figure coming in higher than expected. With South African inflation rising for the first time since October 2022, “prices for food and non-alcoholic beverages increased by 13.6%” over the past year, reflecting the highest year-on-year increase in food prices since April 2009, around fourteen years ago. Food and non-alcoholic beverages contributed an alarming 2.3 percentage points to the headline consumer price index (CPI) reading of 7% for February.

Given the extent to which rolling blackouts have intensified nationwide, retailers have to mark up the prices of food items to remain somewhat competitive. Moreover, the intensity of power disruptions has exacerbated the concern over food supply constraints, resulting in many local food retailers taking precautionary measures to avoid excessive food spoilage and waste during extended blackouts.

Woolworths Holdings Limited (JSE: WHL)

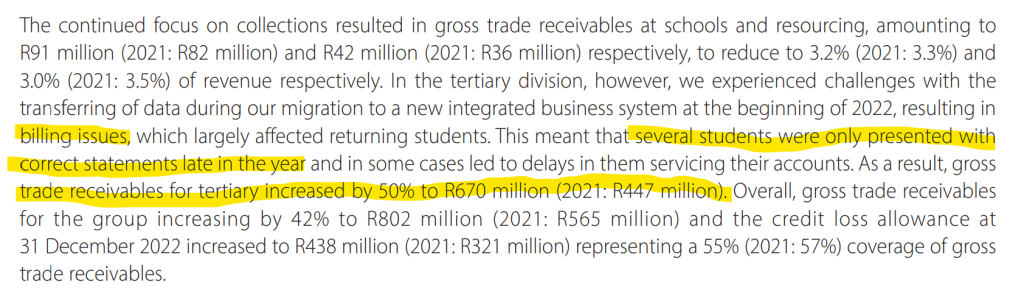

Famous South African multinational retail company, Woolworths Holdings Limited (JSE: WHL), reported record-high interim results for the half-year that ended 25 December 2022. Woolies’ shareholders would have been impressed to see the group report a stellar 75% year-over-year increase in half-year earnings per share (EPS) while free cash flow (FCF) per share surged 30% year-over-year. Despite double-digit growth in revenue and profitability, the price action on Woolies has not reflected the same positive sentiment in recent times, with the share price declining more than 15% since the beginning of March as market participants price in forecasts for slower growth.

Given the relaxation of COVID-related restrictions in Australia, the famous retailer benefitted massively from the influx of shoppers returning to stores. However, as consumer demand normalises in Australia, Woolies expects slower profit growth from continued operations due to the “debilitating power crisis” in South Africa. As Woolies struggles to grapple with “crippling power outages”, CEO Roy Bagattini has informed investors that the group is working with property owners at shopping malls to “move towards renewable energy.” Despite record-high earnings and growth, Woolies stated that the country’s energy crisis has “reduced its domestic adjusted operating profit by an estimated R15 million per month.”

Technical Analysis on WHL

The price action on Woolies reached the significant resistance level at R80.00 per share (green line) as bullish market sentiment sent the share price surging amidst record-high earnings growth. However, given the retail giant’s statement on how the “debilitating energy crisis” in South Africa slashes domestic operating profit by an estimated R15 million per month, Woolies has seen its share price trend lower, declining more than 15% throughout March.

Should negative sentiment persist, the price action could continue to trend lower toward the next support level at R60.00 per share (black dotted line). If that support level does not hold, the bears could see the price action tick down to lower support levels at R52.00 per share (black dotted line) or R49 per share (red line). These levels could be watched closely as a potential entry point for long-term investors. For the bull case, we might expect the price action to retest the resistance level at R80.00 per share (green line), which could lead to a potential breakout.

Shoprite Holdings Limited (JSE: SHP)

Africa’s largest supermarket retailer, Shoprite Holdings Limited (JSE: SHP), reported impressive interim sales growth for the half-year period that ended 1 January 2023. Despite the group realising double-digit sales growth, reporting a stellar 16.8% year-over-year increase in the sale of merchandise for the half-year period, CEO Pieter Engelbrecht raised concerns over the country’s ongoing energy crisis. Due to rolling blackouts and power disruptions, Pieter recently stated that Shoprite is “not reporting the level of profit and dividend growth that would normally be associated with this level of sales growth.”

Constant power outages have resulted in Shoprite incurring a “total spend of R560 million on diesel” for the six-month period that ended 1 January 2023. Should the country’s energy crisis persist or worsen, Shoprite could be staring down the barrel of an R1 billion annual diesel bill come the end of the next half-year period. Excessive spending on diesel has depressed the retailer’s bottom line, with “trading profit only increasing by 8.6%, leaving the group’s trading margin at 5.7%, down from 6.1% reported last period.”

Technical Analysis on SHP

The price action on Africa’s largest supermarket retailer has been consolidating sideways for the last eight months. The primary resistance and support levels are firmly at R255.00 (green line) and R211.00 (red line).

For the bull case, an opportunity could exist if the price action pushes above R240.00 (black dotted line), which could be the first resistance point in the price for the bulls, a share level towards the primary resistance of R255.00 (green line). The bears could see the price action continue its recent downtrend toward the significant support level at R211.00 (red line), which could be the first support level for the bears. Suppose the downtrend persists and the primary support level at R211.00 is tested. In that case, the possibility exists for either a retracement or, if the support level does not hold, the share price can decline to lower support levels.

Sources: Bloomberg, Moneyweb, Shoprite Holdings Limited, Woolworths Holdings Limited, Trading View, Resbank, StatsSA

For more investment research and to learn more about Trive South Africa as a gateway to the JSE and global markets, visit the website here.