ADvTECH is rewarding shareholders with growth (JSE: ADH)

A 4.7% rally in one day is worth smiling about

Times are good at ADvTECH, as evidenced by a trading statement for the year ended December 2022. HEPS is expected to be between 18% and 23% higher, a lovely result overall.

The company also reports normalised earnings per share, excluding once-offs and corporate action costs. Those are sensible exclusions and the range isn’t terribly different to HEPS anyway, coming in at between 17% and 22% higher.

Despite Thursday’s rally, the share price is down 7.7% this year.

African Rainbow Capital: still no pot of gold (JSE: AIL)

NAV per share is down thanks to the management team getting rewarded above shareholders

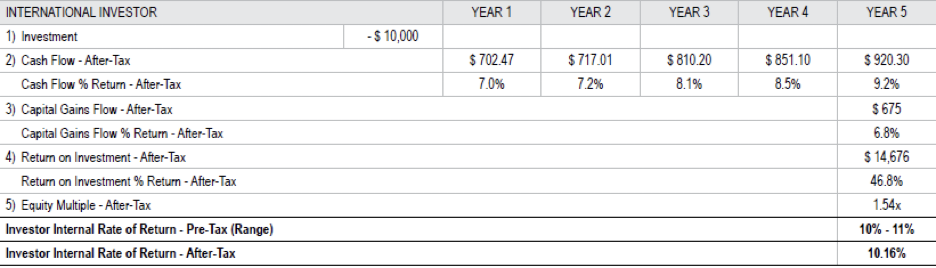

African Rainbow Capital has returned less than 12% in total over 5 years. I can assure you that the management team has done a lot better than shareholders in this one.

Consider that although the intrinsic investment value increased by just 0.2% over the six months to December 2022, the NAV per share fell by 1.1% because new shares were issued based on the performance hurdle being met. Clearly, “performance” means different things to different people. There is a timing lag here, as the shares were issued based on prior period performance. Still, the hurdle is just 10%, which is less than you’ll get on a government bond right now.

The only portfolio highlight really worth a mention is Rain, which is on course for over R2 billion in EBITDA for the year ended February. This investment is now 26.6% of the fund value.

In terms of exits, the investment in PayProp and Humanstate achieved an IRR of 19.7% which certainly isn’t bad.

Major follow-on investments include TymeBank and Tyme Global (R490 million to fund the acquisition of Retail Capital) and Kropz Plc (R472 million). TymeBank is now 14.1% of fund value and Kropz is 10.1%.

Overall, the fund has reduced its mining exposure and over 69% of the portfolio is at break-even or mature business stage. This means there is still a substantial speculative component.

With a new management fee structure in place, at least there will be more crumbs for shareholders. The share price has shown decent momentum recently, as investors punt at improved returns going forward.

AngloGold (JSE: ANG) and Gold Fields (JSE: GFI) to create the largest gold mine in Africa

But what happens to the stake held by the Government of Ghana?

Ghana has been a headache for a couple of banks holding exposure to sovereign instruments in the country, but it is the venue for a potential joint venture that would create the largest gold mine in Africa.

Gold Fields Ghana holds a 90% share in Tarkwa Mine, with 10% held by the Government of Ghana. AngloGold Ashanti holds 100% of the Iduapriem Mine. The parties have agreed a joint venture that would see Gold Fields operate the combined entity, with both companies contributing their mines in exchange for shares.

Gold Fields will hold 66.7% in this joint venture and AngloGold the remaining 33.3%. If you’re wondering where the Government of Ghana went, I think the structure will see Gold Fields contributing its 90% stake to the joint venture, with the government continuing to hold 10% directly in that mine. I’m not convinced that will work (or that this is even the intention – the SENS isn’t entirely clear), as I’m sure the government would want exposure to the combined entity.

The combined mines would have an all-in sustaining cost of under $1,000/oz for the first five years and below $1,200/oz over the estimated life of operation (at least 18 years).

Ascendis has no debt for the first time since listing (JSE: ASC)

The balance sheet is better – now the income statement needs to come right

The focus at Ascendis was on saving the group and putting together a sustainable balance sheet, which wasn’t easy with so many wolves at the door. The dust has finally settled after that process, with the next focus presumably being on profitability.

For the six months to December 2022, the normalised headline loss per share from continuing operations will be between 13.9 cents and 17 cents. This is a massive improvement from the comparable period but is quite clearly still a loss.

The UK court action isn’t going away for BHP (JSE: BHG)

There are 500,000 new claimants in these proceedings

BHP is still dealing with the aftermath of the Fundao Dam nightmare, a terrible incident in Brazil that saw tailings travel as far as 620km downriver, killing 19 people (according to Wikipedia) and destroying countless homes. BHP has spent around $5.9 billion on remediation and compensation programs.

Court action has been underway in Brazil for some time, with a claim in the UK now gathering steam. BHP believes that the claim is a duplicate of the Brazilian proceedings, but I somehow doubt that the lawyers behind this claim in the UK would be pursuing something frivolous.

BHP’s provision as at 31 December 2022 was $3.122 billion. The company can’t give a range of possible outcomes linked to the UK proceedings.

Strong earnings from Caxton and a sobering outlook (JSE: CAT)

The language around the Mpact stake seems to have toned down a lot

It’s amazing what a regulatory slap on the wrist can do to calm a company down. Gone are the days of SENS announcements that feel like someone’s angry kid wrote them. Instead, Caxton & CTP is releasing far more measured statements, recognising the good recent results from Mpact but highlighting the levels of debt and aspects of corporate governance as a concern.

Caxton’s own house looks to be in order financially, with HEPS for the six months ended December up by 36.4%. This result was driven by a 25.8% jump in revenue, as Caxton pushed through pricing increases to recover the costs of raw materials and operating expenses.

Volume growth “surprised on the upside”, which is what shareholders want to see.

Operating expenses climbed by 19.8%, so Caxton’s pricing power is critical here. There were abnormal costs included in this number, so a more maintainable view gives an increase of 15.3% – still very high.

The outlook statement is less of a good news story, with Caxton noting inflation and load shedding as likely causes of lacklustre growth. With a strong second half last year, the group is essentially warning the market that the year-on-year story might not be pretty. The focus is on managing costs and cash.

Exxaro grows HEPS by 28% (JSE: EXX)

Coal is by far the largest contributor to group revenue and EBITDA

At Exxaro, the energy and ferrous segments basically cover the cost of the corporate head office. All the profits are made by the coal business, which is why 2022 was a good year financially. Revenue in coal was up 43% and EBITDA was up 78%.

The cash came in the way you would hope, with cash from operations increasing by 79%, very much in line with EBITDA. With capex down by 33%, this was a strong period for free cash flow. The net cash position is much higher at R9.6 billion vs. R764 million a year ago.

The outlook section makes for interesting reading, with the company noting European interest in South African thermal coal. With South African coal at a discount to Australian coal, demand from the Pacific is expected to be strong.

It’s just a pity that Transnet is so bad, really.

A 30% jump in earnings at Hyprop but no dividend (JSE: HYP)

Shareholders will have to be patient for a full-year dividend

For the six months ended December 2022, Hyprop delivered growth in earnings that reflects a significant recovery in the retail property sector. Distributable income per share increased by 30% to 203 cents, driven by mid-teens growth in tenant turnover and a very low vacancy rate both in South Africa and Eastern Europe.

Sub-Saharan Africa still needs work, with a vacancy rate of 7.8% vs. South Africa at 1.5% and Eastern Europe at 0.6%.

Although a great deal of effort has gone into the balance sheet, the loan-to-value ratio has increased from 36.4% in June 2022 to 37.2% in December 2022 because of the weakening of the rand against the euro. This is despite R500 million being “raised” through the dividend reinvestment programme in 2022.

Despite this, the group isn’t paying an interim dividend because of concerns around infrastructure in SA and energy costs. A full year dividend will be the order of business here.

The share price has dropped over 6% this year, now trading at close to the 52-week low.

Investec made the most of positive conditions for banking (JSE: INL)

Both the local and UK businesses have growth earnings

In a pre-close trading update for the year ending March, Investec guided HEPS growth of between 22% and 29%. The UK has outperformed the local business, with adjusted operating profit growth of at least 15% vs. at least 10% in SA.

Return on equity is expected to be within the group’s target range of 12% to 16%. This is lower than the other South African banks but you need to remember that much of Investec’s business is in the UK, which typically has a lower required rate of return than South Africa because of the relative risk.

Interestingly, it sounds like the second half of the year was better in SA than in the UK, so the FY24 numbers might tell a different relative story. This will depend greatly on load shedding though, so market conditions are dynamic to say the least.

Investec runs at a very low credit loss ratio, expected to be between 25bps and 30bps. That’s around a third of the level seen at the large banks.

Not much twinkling at Libstar (JSE: LBR)

The gross margin trend is a little, well, gross

In the year ended December 2022, Libstar managed to grow revenue by 10.7%. That’s good. Gross profit could only grow by 3.7%. That’s bad.

The margin contraction (from 22.2% to 20.7%) is due to several factors and all the usual suspects are there, like load shedding and input cost inflation. Long story short: Libstar doesn’t have as much pricing power as shareholders would like to see. Pricing increases contributed 7.7% of sales growth and volumes contributed 3.0%.

Although operating cost growth was limited to 6.3%, this wasn’t enough to stop normalised EBITDA from decreasing by 4.1%, with margin dropping from 10.1% to 8.8%. There were pockets of EBITDA growth, but the overall group was negative.

Cash generated from operations was also marginally lower, down by 2%.

After trying and failing to sell the Household and Personal Care division, this is now being shown as a continuing operation once more. The company would still sell this division given a choice, as the focus is on food categories.

There are significant impairments in these numbers, including R98 million for the Denny Mushrooms’ Shongweni facility that burnt down in September 2022. Impairments are excluded from HEPS.

Speaking of HEPS, that metric fell by 12.9% as reported or 11.8% on a normalised basis. Either way, a double-digit decline isn’t tasty.

A final cash dividend of 22 cents per share has been declared.

PPC’s debt reduction is on track (JSE: PPC)

But the share price fell 9%, likely due to worries about demand

In the year ended March, PPC’s business faced different dynamics in its various countries of operation. South Africa and Botswana have suffered a drop in demand, whilst Zimbabwe and Rwanda are enjoying the benefits of infrastructure investment. You would almost expect it to be the other way around, right?

Do yourself a favour and do more research on Rwanda, though. It’s quite an economic story.

In light of pressure on demand, PPC’s focus has been on reducing debt. In South Africa and Botswana, net debt is expected to be down from R1.08 billion at the end of March 2022 to between R725 million and R775 million at March 2023.

The businesses in Zimbabwe and Rwanda are expected to be in a net cash position at the end of March 2023.

Right now, the strategy in South Africa is to maintain market share, an ongoing battle against cement imports that are often cheaper. The overall market is under pressure, with PPC’s cement sales volumes down by between 4% and 7% despite the modest pricing increases. PPC only expects a major price increase in 2024 to restore EBITDA margins.

With price increases of between 5% and 7% and production cost inflation of 11%, you don’t need to get the calculator out to know that margins are down. EBITDA margin for South Africa and Botswana is expected to be between 9% and 11% for the full year, down from 14.5%.

The big kicker here would be higher infrastructure investment in South Africa, which PPC is ready to respond to should it happen.

Sabvest Capital reminds us what an investment company can achieve (JSE: SBP)

NAV per share is 17.6% higher year-on-year

At Sabvest, you are investing alongside the Seabrooke Family Trust. Alignment with investors is strong, unlike at certain other investment funds where the management team is clearly getting the first, second and possibly third bite at the cherry.

Sabvest has achieved a 17% CAGR in NAV per share over the past 15 years. That is exceptional. The relatively tight discount to NAV vs. other investment holding companies is a result of this performance, as well as the portfolio that includes many unlisted companies.

If it makes you feel any better as a Transaction Capital shareholder, even Sabvest was on the wrong side of that stock. It’s not a huge position in the fund, but there’s an ugly bath to be taken there.

The group isn’t planning any new investments at this time and expects satisfactory growth in NAV per share in 2023. With a dividend of 90 cents for the year, there’s even a trailing dividend yield of around 1%.

Little Bites:

- Director dealings:

- A director of WeBuyCars bought shares in Transaction Capital (JSE: TCP) worth R9.9 million – and I plan to join that party on Friday morning, having observed some of the most aggressive forced selling in the market that I’ve ever seen

- Directors of STADIO (JSE: SDO) bought shares worth a meaty R5.03 million

- Directors of Motus (JSE: MTH) bought shares worth R1.9 million

- An associate of a director of Safari Investments RSA (JSE: SAR) has bought shares worth R254k

- It’s nice to be a listed company director, like the director of Gold Fields (JSE: GFI) who sold R22.9 million worth of performance shares awarded back in 2012. Not bad for sticking around for a decade.

- Andre van der Veen of A2 Investment Partners is now on the board of Nampak (JSE: NPK). Given A2’s track record in transactions, I suspect that this was the main driver of a 7.5% rally in the share price.

- The process at the regulators took so long that Northam Platinum (JSE: NPH) needs to update the transaction circular for its offer to shareholders of Royal Bafokeng Platinum (JSE: RBP). The company is targeting 8th May as the date for the distribution of the circular.

- Sanlam’s (JSE: SLM) partial offer to shareholders of AfroCentric (JSE: ACT) is unconditional in terms of the number of acceptances, but hasn’t met all conditions precedent yet. This means that the offer date needs to be extended by Sanlam for everything to still work out, with that date extended to the earlier of Friday 26th May or 10 business days after all conditions precedent are fulfilled.

- Literally a day after telling the market that the mandatory offer by GMB Liquidity Corporation hadn’t achieved all regulatory approvals yet, Grand Parade Investments (JSE: GPL) announced that the Competition Commission’s conditions for implementation of the offer were acceptable to the offeror. I actually have no idea what happens in a mandatory offer if the Comp Comm wants to block the transaction or put onerous conditions on it! Any corporate lawyers reading this, please do let me know how that would work?

- Buffalo Coal Corp (JSE: BUC) is being taken private. There is more liquidity in the Namib Desert than this stock, so I don’t think many people will care.