Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Grindrod looks to extend its stay in Mozambique (JSE: GND)

This port is incredibly important, especially as South African infrastructure deteriorates

Grindrod holds an indirect 24.7% stake in the Maputo port. The current concession expires in 2033, so there’s only 10 years left of the current deal.

The good news is that the company operating the port has been in discussions with the Mozambique government to extend the current concession out to 2058. The even better news is that the government has issued an in-principle approval for the extension.

This facilitates increased investment to expand the capacity at the port, which is particularly important given the state of play at Transnet and the opportunities this creates for Grindrod and Mozambique.

Huge Group raises R300 million in pref share funding (JSE: HUG)

This settles existing debt facilities with RMB and leaves plenty leftover for investments

Huge has raised preference share funding from RMB. Instead of a loan, the bank subscribes for preference shares in a funding SPV (special purpose vehicle) and then the SPV can pass that funding on to group companies as required.

Under this structure, RMB will subscribe for R150 million in A preference shares and R150 million in B preference shares. The A shares are redeemable over five years, starting in year three. The B shares are redeemable in a bullet structure (a single redemption) at the end of year five.

The existing term debt facilities with RMB of R162.5 million will be settled with these proceeds. That leaves a solid amount over and above this settlement for further investments by Huge. Let’s hope they do a better job than in some of the previous deals and investments.

KAP’s earnings drop by at least 20% (JSE: KAP)

This is the lump of coal under the tree for KAP shareholders

KAP released a trading statement dealing with the five months to November 2023. The biggest issue is weakness in global polymer margins, with a direct impact on key business Safripol. This problem has dwarfed any of the usual suspects, like load shedding and Transnet port congestion. Safripol’s operating margin is “well below” the through-the-cycle guidance range of 7% to 9%.

PG Bison did fairly well in this period and the R1.9 billion MDF expansion project has been completed. Export sales have been strong but these are at a lower margin than domestic sales, so the mix effect means a slightly lower margin overall.

Unitrans saw performance go backwards due to the broader operating environment. The division has been restructured and those benefits will come through in the second half of the financial year.

Feltex (which plays in the new vehicle assembly value chain) had a decent period, with a steady order book supported by a recovery in assembly volumes.

There’s also good news at Restonic, which achieved volume and revenue growth in this period despite subdued demand in the furniture retail market.

Finally, Optix saw a dip in profits despite satisfactory growth in revenue. This is due to the costs of scaling the business in line with objectives.

KAP has a number of businesses (as you can see), but Safripol is the key. With poor performance in that operation, HEPS is expected to be at least 20% lower than the comparable period. They don’t give a tighter range than that, which suggests that the drop could be significantly worse than 20%.

The group is within debt covenants and raised a R3 billion revolving credit facility, so the balance sheet is managing for now at least.

SA Corporate gives a pre-close update (JSE: SAC)

This deals with the key metrics for the year ending December 2023

SA Corporate Real Estate has a varied portfolio that even includes residential units. Across the portfolio, it looks like the fund will achieve 4% like-for-like growth in net property income for the year ending December 2023.

The retail portfolio has seen a dip in 12-month rolling trading density growth, from 5.1% to 4.8%. Although reversions were slightly negative in the period ending June, they are expected to swing to between 2.5% and 3.0% for the full year thanks to favourable renewal activity.

Even the office portfolio is showing some signs of improvement, with vacancies down from 16.6% at the end of June to around 15% by the end of the year. Reversions have also moved positive, which is big news.

The industrial portfolio has one minor vacancy and will see reversions move negative for the full year due to the renewal of a motor showroom.

In the residential portfolio, rental escalations are between 3.5% and 4%.

The group is also busy with a restructure of its residential business, with full details available in the presentation at this link.

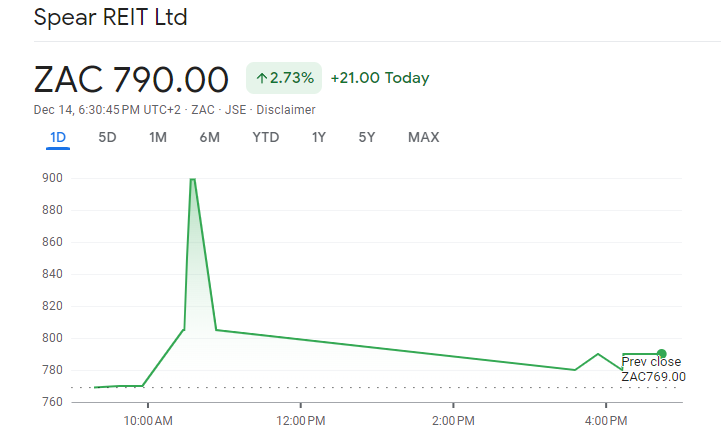

Spear expects flat distributable income per share (JSE: SEA)

The commercial office portfolio is a headache, but will hopefully be resolved soon

Spear REIT is known as the property fund that is focused solely on the Western Cape. Having recently done a roadtrip in northern parts of the country and having also done a lot of driving around the Western Cape where I have lived for the past few years, I can confirm that this is a solid strategy in South Africa.

But even the Western Cape infrastructure can’t make up for weakness in the commercial office portfolio, where the vacancy rate has gone the wrong way. This is because a large tenant vacated space in Parow and the area is being relet to more than one party. Negotiations with one party have dragged on, leading to an inflated vacancy rate as at 30 November 2023 (the end of the third quarter of the financial year). The fund believes that this vacancy will be addressed soon. They even channeled their inner Jerome Powell by referring to it as “transitory”!

The industrial portfolio is in much healthier shape than commercial, reflecting a vacancy rate of just 1.41%. Rental reversions are +5.4% and in-force escalations are the highest across the Spear portfolio, coming in at 7.66%.

Convenience retail is also doing pretty well, with a vacancy rate of 2.95% and positive rental reversion rate of 4.65%. In-force escalations of 7.24% aren’t far behind the industrial portfolio. 41% of the portfolio is occupied by national tenants on long-dated leases with solid payment records.

In other good news, at least Spear is managing to recover 96% of the cost of diesel supplied across the portfolio. There aren’t many funds that can say that! Importantly, once commissioned, Spear’s total PV solar production capacity will cover 25% of its demand.

The balance sheet reflects an improvement to cost of debt by 4 basis points since the interim period, but a significant year-on-year increase from 8.66% to 9.55%. The fixed debt ratio is just under 40%, which is still well below the target range of 65% to 75% of debt to be fixed for 24 to 36 months. The loan-to-value has moved higher, from 36.30% at FY23 to 40.70%. The target range is 38% to 43%. The disposal of the Liberty Life Building in Century City will reduce the loan-to-value ratio by 500 basis points by the end of FY24.

Although the second half of the year is reflecting an improvement on the situation in the interim period, management’s expectation is for distributable income per share to only be 0% to 1.5% higher year-on-year. It’s tough going in property at the moment.

In morning trade, it looked like somebody had finger trouble with a trade that went through way too high:

Tharisa: a tale of two commodities (JSE: THA)

PGMs have had an awful year, but chrome has been much stronger thankfully

Tharisa produces both PGMs and chrome, with the latter saving the story right now. The results for the year ended September 2023 reflect really tough times in PGMs (as we already know this year), while chrome prices have been on the up.

Let’s start with reef mined, which is the first step in producing these commodities. The volume of reef mined fell by 24.1%, with various issues related to the open pit mining process (including adverse weather). The company purchased ROM ore to maintain plant throughput.

Production of PGMs fell by 19.3% and sales of PGMs fell by 14.4%. The average PGM basket price tanked by 26.2% in dollars. Rand weakness mitigated this disaster somewhat, with prices in local currency down by 15.7%. The PGM market is so tough at the moment that the Karo Platinum Project timeline for commissioning has been pushed out by 12 months to June 2025. They can accelerate that timeline if markets improve.

Chrome production fell 0.2% and sales were up 0.3%, in both cases excluding third party volumes. Production may be flat, but the average chrome price was up 25.8% in dollars. In rand, it was up 44.7%!

Putting it all together, we find a 5.3% drop in revenue. That doesn’t sound too bad, but when combined with inflationary pressure in costs, the net impact is a 42.4% decrease in EBITDA. Profit before tax fell by 48.1%. The free cash flow situation is very different to the move in profitability, with that metric up by 15% and net cash on the balance sheet up by 60.9%.

In case you’re wondering about the commodity split, PGMs contributed just 29% of gross profit in this period, down from over 62% in the comparable period.

Looking ahead, production guidance for FY24 is between 145koz and 155koz PGMs (vs. 144.7koz in this period and 179.2 koz in 2022) and between 1.7 Mt and 1.8 Mt of chrome concentrates (vs. 1.58 Mt in both 2022 and 2023). At current commodity prices, the near-term growth is clearly going to come from chrome.

Little Bites:

- Director dealings:

- Carl Neethling has been leading a consortium that is looking to do a take-private of Ascendis (JSE: ASC). Together with his associates (under JSE rules – so don’t mistake this as meaning they are part of the consortium), there have been acquisitions of further shares worth R5.5 million. This takes the combined holding of Neethling and these specific associates to 11% of Ascendis.

- Now, here’s a substantial example of a show of faith in a company. The CFO of MAS (JSE: MSP) – the real estate fund that has suspended its dividend based on concerns about the debt refinancing environment in a few years from now – has bought shares worth R2.06 million.

- An associate of the Wapnick family – the people running Octodec (JSE: OCT) – has bought shares in that company worth R591k.

- A director of Remgro (JSE: REM) exercised share appreciation rights and sold the entire lot, not just the amount required to cover the tax.

- The CFO of RH Bophelo (JSE: RHB) bought shares worth R49k.

- The non-executive chairman of Primary Health Properties (JSE: PHP) and his associate have collectively acquired shares under the dividend re-investment plan worth just over £3k.

- The business rescue practitioners at Tongaat Hulett (JSE: TON) certainly aren’t going to be taking a break this December. The court has ruled that the meeting to approve the business rescue plan must be adjourned from 14 December to no later than 11 January 2024. The bigger news is that the plans need to be amended, presumably to take into account the payment of sugar levies based on a separate recent court blow to Tongaat Hulett. This business rescue is on a knife’s edge.

- Conduit Capital (JSE: CND) hopes to publish its financials for the year ended June 2022 (not a typo) by January 2024. The problem is that CCL (94.4% of revenue) is in liquidation, hence many things have needed to be finalised to make this audit work possible.

- The board of Afristrat (JSE: ATI) has reached the conclusion that the company is no longer a going concern. In fact, things are so bad that they won’t even use business rescue provisions, as there needs to be a reasonable prospect of the business being saved before this route can be followed. They do not believe that such a prospect exists. Ironically, the board is waiting for the outcome of a liquidation application ruling in court (the hearing was more than three months ago) before it can act on this conclusion. The reality is that the show is over at Afristrat. The company (and its shareholders) is a casualty of fraud in the Getbucks business that is part of the group.

- Khalid Abdulla, former director of AYO Technology (JSE: ACT), has been fighting the JSE’s recent censure and associated financial penalty at the Financial Services Tribunal (FST). Initially, a fine of R2 million was handed down by the JSE for transgressions. The reconsideration application was heard on 15 September and a decision has now been given, with the application being partially upheld. Aside from a wording change to the breach of JSE rules that led to the fine, the more relevant change is that the FST has reduced the fine from R2 million to R1.2 million. The rest of the application was dismissed, so the public censure is still in place and the fine is due immediately.

- Sanlam (JSE: SLM) has consolidated its stake in AfroCentric (JSE: ACT) under Sanlam Life. The total stake is 60% in AfroCentric. There is no actual change in holding here, but it’s a sign of the strategic thinking.

- Marshall Monteagle (JSE: MMP) announced the resignation of David Marshall as CEO. He has been in the role since 2009. Warwick Marshall is taking over the top job, having established the trading division of the group in 1993.