Accelerate isn’t really accelerating

Interim results for the six months to September reflect a mixed bag

Accelerate Property Fund’s share price is down 9.9% this year and the company is still trading at a huge discount to Net Asset Value (NAV) per share. The NAV is R5.00 and the share price is R1.00, so I wasn’t joking by describing it as huge.

With significant exposure to the office sector, Accelerate is suffering with substantial group vacancies. The vacancy rate has actually worsened from 17.3% to 19.9% based on gross lettable area. The bulk of the vacancies are in B- and C-grade office space and low income industrial space.

In such a difficult market, watch out for the weighted average lease expiry, which has moved from 5.9 years to 3.9 years. You want to see short-dated expiries in a booming market, not an ugly one where the last thing a landlord wants to do is renegotiate with a tenant.

In terms of debt, the loan-to-value (LTV) has improved from 48.5% to 42.1% but the interest cover ratio has gotten slightly worse (1.9x vs. 2.0x). Keep a close eye on this, as Accelerate has agreed with lenders to temporarily reduce the interest cover ratio covenant to 1.7x.

Due to the dividend reinvestment alternative offered to shareholders in July, the NAV per share has fallen from R6.20 to R5.00.

Overall, the fund remains under pressure and issues like load shedding certainly don’t help. It’s not easy to fill new space in this environment, so the vacancy rate at the newly redeveloped Fourways Mall is slowly coming down.

To try and improve the balance sheet, there are still non-core properties worth R566 million that are earmarked for sale. Disposals of R255 million (not included in the previous number) have been signed, which would drop the LTV by 170 basis points and reduce fund vacancy levels by 3.7%.

As was the case last year, there is no interim distribution by the company. The fund annoyingly doesn’t disclose distributable income per share, but a quick calc based on 1.224 billion shares in issue and distributable income of R110.6 million suggests distributable income per share of around R0.09 for the interim period.

With a share price of R1.00, that’s a yield of 18%. Is that enough to justify the risk?

An unusual use of treasury shares

DRA Global has raised almost R93 million by placing treasury shares

This is quite technical, so try follow as best you can.

If a listed company repurchases shares, it can do so in one of two ways. They can either be repurchased by the listed company itself (in which case the shares are cancelled) or by a subsidiary, in which case the shares still exist but the group effectively holds shares in itself.

There are other ways for a subsidiary to end up holding shares in its parent company. In all such situations, those are called treasury shares.

Usually, you hear nothing more about them. In the case of DRA Global though, the company has placed the treasury shares with Apex Partners and raised nearly R93 million in the process. This makes Apex a 8.54% shareholder in the group through a single deal.

As treasury shares were used, there is no change to the number of shares in issue, as this wasn’t an issuance of fresh shares.

Offer for Grand Parade is fair and reasonable

The board has recommended that shareholders accept the mandatory offer

With GMB Liquidity Corporation having breached the 35% ownership threshold in Grand Parade, a mandatory offer is triggered. The price in this case is R3.33 per share and shareholders can choose whether to accept it or not. This is different to a scheme of arrangement where a shareholder vote binds all shareholders to the outcome.

KPMG was appointed as independent expert and the firm has concluded that the offer price is both fair and reasonable to shareholders, which is a little unusual in mandatory offers. This means that the offeror (GMB) isn’t necessarily getting a great deal. If it was a good outcome for GMB, the offer would be determined as unfair (too low relative to fair value) but reasonable (higher than or equal to the current traded price).

On this basis, the independent board has recommended to Grand Parade shareholders that they accept the offer.

Harmony concludes the Eva Copper deal

This is a major strategic milestone for Harmony

In a deal that was first announced in October 2022, Harmony will now count Eva Copper as a group subsidiary and will hand over R3 billion for the pleasure. This is being funded through available cash and revolving credit facilities, with the company noting that it is comfortably within debt covenants even after this acquisition.

As South Africa’s largest gold miner by volume, there are two sources of diversification for Harmony in this deal: metal (this is a copper asset) and geographical (it is in Australia).

The company is busy reviewing the existing feasibility study. They will now focus on finding the most effective way to execute the project and finance the capital requirements to bring the mine into production.

There’s just one hurdle left for Implats

Well, one regulatory hurdle at least

The Impala Platinum (Implats) vs. Northam Platinum saga continues, with the companies locked in an ugly battle for Royal Bafokeng Platinum. A few lawyers have significantly improved their bank balances thanks to this fight.

With the latest extension to the longstop date, the offer period would’ve been open for over 12 months. If you think that large M&A deals happen quickly, you are horribly mistaken.

The final outstanding condition for the Implats offer is the issuance of a Compliance Certificate by the Takeover Regulation Panel. It took a lifetime to get Competition Tribunal approval for the deal, so the company was no doubt hoping for a speedy resolution of this outstanding item.

Alas, Northam has accused Royal Bafokeng Platinum of non-compliance with the Takeover Code, which in turn has resulted in delays to the issuance of the all-important Compliance Certificate.

Just to add further spice to the story, Implats has previously complained to the TRP about elements of Northam’s firm intention announcement, so it seems likely that Northam won’t be allowed to issue its offer circular until this is sorted out.

The elephant in the room has nothing to do with the regulatory process. No, Implats has a bigger problem – it has been outgunned by the Northam offer, so it doesn’t seem likely that the Implats offer in current form would be good enough to get the desired outcome. Implats reserves the right to increase the offer, so let’s wait and see what happens.

Mondi sells more Russian assets

This is unrelated to the proposed disposal of the large Mondi Syktyvkar assets

Mondi has agreed to sell its three Russian packaging converting operations to the Gotek Group for around €24 million at current exchange rates, though the deal is denominated in rubles (RUB 1.6 billion).

The loss on the disposal is €70 – €80 million at current exchange rates, so that’s a significant loss as a direct result of the geopolitical conditions we find ourselves in.

Much like the disposal of the Mondi Syktyvkar business (which is far more important as the deal is approximately 10x larger than this one), approval will be needed by the Russian Federation’s Government Sub-Commission for the Control of Foreign Investments.

I’m very pleased that I don’t have to be the Western suit-and-tie who attends that meeting.

MTN pre-close update

A 7% drop in the share price tells you what to expect here

Ahead of financial year-end (December), MTN has updated the market on trading conditions. These have been ugly in the final quarter of the year, reflected in the share prices of telecommunications companies that have come under pressure.

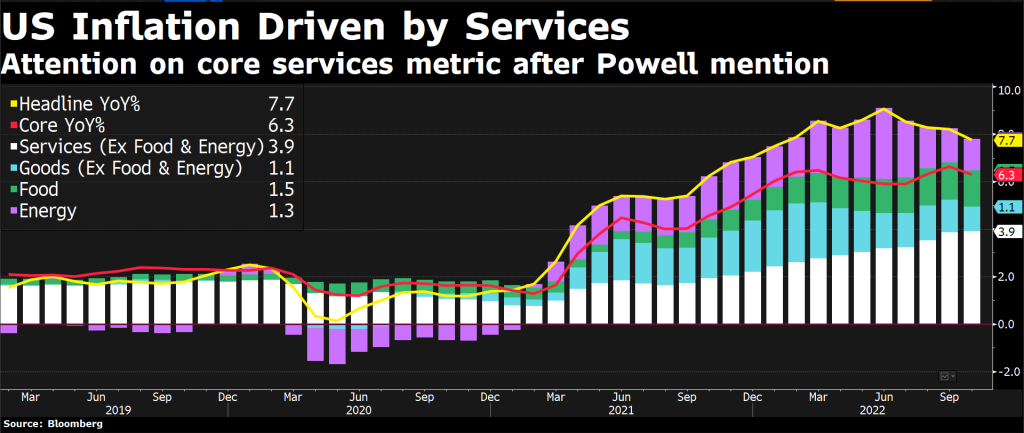

The group’s most important markets are South Africa, Nigeria and Ghana. Recent inflation rates across those markets are 7.5%, 21.1% and 50.3% respectively. That’s not easy.

Another issue that isn’t easy to manage is lack of availability of foreign currency, a problem that is plaguing a number of South African companies with African investments. Where companies need to get cash out of places like Nigeria, they are being forced to do it at “parallel rates” that are far less favourable than the theoretical market rates.

MTN Group has upstreamed R17.3 million in the 11-month period to November, including R6.5 billion from Nigeria. Holding company leverage ratios are flat vs. the Q3 levels.

Energy costs are a major consideration. Although MTN’s energy bill represents 5% – 7% of group costs, load shedding also puts a capital expenditure burden on the group as it needs to upgrade its towers. We’ve seen this coming through in Vodacom’s numbers as well.

Despite group revenue growth of 14.8% in the 11-month period to November, group EBITDA margin deteriorated since the last update in September. This is because of the pressure in the South African business, where revenue growth has slowed to 3.2%.

In Nigeria, service revenue grew by 21.3% and EBITDA margin was broadly in line with the 53.6% reported in the third quarter results.

The announcement does give an update on Ghana but mainly in terms of subscriber numbers, which have been topical recently as MTN was forced by the regulator to remove unregistered subscribers in that country. Of the 5.7 million subscribers that were initially barred at the end of November, 20% have been restated.

There is some good news in the fintech side of the business, where revenue is up 13.6% vs. the 12.9% reported in Q3. The ongoing build out of the agent and merchant network is contributing to this acceleration. More good news is that the Ghanaian government is planning to decrease the e-levy on electronic transactions from 1.5% of value to 1.0%.

A managed separation of the fintech business is underway and is expected to be completed in the first quarter of 2023.

Despite the obvious pressure on free cash flow, the dividend guidance of at least 330 cents per share for FY22 remains in place. The group also believes that it is still making solid progress in driving return on equity towards 25%.

Steinhoff: the end is nigh (for ordinary shareholders)

You can either lose all your money or almost all your money

Well, there we have it. The show is over at Steinhoff, with the creditors holding the keys to the business. The share price fell 64% on Thursday and I’m not sure why it didn’t fall further.

Again, I am thankful that I got out of this thing at the start of the year. For those who have been caught up in this pain, I truly feel sorry for you. It’s a hard lesson in understanding that no matter how interesting the underlying operations are (like Pepco in Europe), the holding company balance sheet is critical.

I won’t go into the technical details of the debt restructure. All you really need to know is that if shareholders vote in favour of the proposed restructure, the lenders will hold 100% of voting rights and 80% of the economic interest, leaving 20% behind for existing shareholders in the form of a new equity instrument that the group envisages will be unlisted.

If shareholders don’t vote in favour of the proposal, the lenders will own everything.

That’s it. Simple as that. Goodnight and goodbye, Steinhoff shareholders.

Little Bites:

- Director dealings:

- The interim CEO of Hulamin has bought shares worth R363k

- A director of Mediclinic has sold shares worth R10.5 million, so he didn’t hang around for the payment by Remgro and friends under that offer

- A non-executive director of British American Tobacco has acquired shares worth $81.5k

- Des de Beer has bought another R551k worth of shares in Lighthouse Properties

- JD Wiese has bought preference shares in Invicta worth R7.9 million

- The investment entity of the management team of Ninety One has bought another £56k worth of shares

- The company secretary of Impala Platinum has sold shares worth R971k

- An associate of a director of Vukile has sold shares worth R1 million as part of a communicated plan to the market to reduce its debt with Investec

- Mergers and acquisitions / major transactions in shares:

- In another example of a failed B-BBEE structure (one that ends up “underwater” because the equity value ends up being lower than the outstanding debt), Redefine needs to restructure its empowerment trust because of a deficit of R1.9 billion. It’s a double-whammy of bad outcomes, as the executive incentive scheme (in which executives borrow money to buy shares) is also underwater. Borrowing money to buy shares is ALWAYS dangerous, even in property companies where there is supposedly a reliable yield.

- Sable Exploration and Mining Limited noted that PBNJ, which is currently making a mandatory offer for the shares in the company, now holds a stake of 45.5% in the company.

- Sebata Holdings has agree to sell its 55% stake in Freshmark Systems for R24.75 million. The profit after tax for the year ended March was R3.9 million, so that’s a decent P/E multiple for such a small company. Perhaps they will now have enough money to fix their website?

- As part of a B-BBEE deal that was put in place way back in 2007 by Italtile, there have been tranches of repurchases of shares from Four Arrows Investments. The final tranche is now taking place, with a repurchase of shares at R11.51 per share. The deal value is over R77 million and the price is based on 83% of the 10-day volume-weighted average price (VWAP). The Italtile share price is under pressure at the moment based on prevailing consumer conditions.

- The former CEO of Cashbuild has agreed to sell a large block of shares to the company in a specific repurchase transaction. With the share price having fallen 25% this year, it’s probably not a bad time for the company to effectively be investing in its own shares. This is a substantial deal worth over R194 million, representing around 4% of all shares in issue by the company. A circular will be issued to shareholders and they will need to approve the proposed transaction.

- The scheme of arrangement for the delisting of OneLogix has been approved by shareholders and will go ahead once other outstanding conditions have been met.

- After receiving shares in Mast Energy Development as partial settlement for an outstanding debt, Kibo sold shares worth nearly £240k to realise some of the stake in cash. Kibo now holds a 57.86% stake in Mast.

- As part of its ongoing strategy to reduce the stake in Tencent and repurchase its own shares, Prosus has sold further shares in Tencent and now owns 26.99% in the Chinese tech giant.

- Earnings:

- South Ocean Holdings, a business that has nothing to do with fishing and everything to do with manufacturing electrical cables, has released a trading statement for the year ended December 2022. HEPS is expected to be 46% lower, coming in at 19.76 cents. The company blames the usual issues facing our industrial firms, like rising input costs, load shedding and Transnet.

- Notable board changes:

- Freshly unbundled group Zeda has announced that Lwazi Bam has been appointed as Chairman of the Board. As the ex-CEO of Deloitte Africa, he brings huge experience to the board.

- Spar has announced the appointment of Mike Bosman as the Chairman of the Board, which means that Andrew Waller will resume his role as Lead Independent Director. With extensive experience on other listed boards, shareholders will hope that Bosman’s appointment will go some way towards improving the governance smell currently found at Spar.

- The Chairman of the Board of Hyprop has stepped down to become the CEO of investment firm Arise. The new Chairman is Spiros Noussis, who was formerly the joint-CEO of NEPI Rockcastle.

- Texton is on the hunt for a new CCFO after Pinny Hack resigned from the company.

- Orion Minerals has appointed Peet van Coller as its new CFO. This comes off the back of successful capital raising activities with Triple Flag Precious Metals and the IDC, which are now in final implementation stages.

- Housekeeping:

- Nampak’s proposed rights offer is so huge that a share consolidation is being proposed as part of the deal, just to allow the rights offer price to be fixed at a practical level. This is literally a step to avoid Nampak becoming a penny stock with an extremely low share price that would make it difficult to trade.

- If you are a shareholder in Industrials REIT, you should refer to the announcement released on Friday regarding the choice between a cash or scrip dividend.

- Emira Property Fund, Transcend Residential Property Fund and Castleview Property Fund are all changing their year-end to March to simplify the group reporting structure. Castleview is the majority shareholder in Emira and Transcend is controlled by Emira.

- Kaap Agri Limited is looking to change its name to KAL Group Limited, with an expected implementation date towards the end of February.

- Progress reports by suspended companies:

- In a quarterly progress report (a requirement when a listing has been suspended), Afristrat set out the numerous issues that the company has been dealing with. These range from the lack of an auditor through to legal action in Botswana against the management team who allegedly stole from the business. To add to this horrific situation, there is also a liquidation application underway that the company is trying to defend in court. In case you’re feeling bad about your festive season and you want something to make you feel better, go read the detailed announcements to see what this company is dealing with.

- Similarly, Conduit Capital released a quarterly progress report. With the major business in the group placed under liquidation, nobody is quite sure what (if anything) is left. The company is prioritising the conclusion of the audits of the remaining insurance companies in the group, so that should bring some clarity once released. I doubt it will be an answer that delivers much good news for shareholders.