Attacq is having a decent end to the year

A pre-close update shows promising improvement in some key metrics

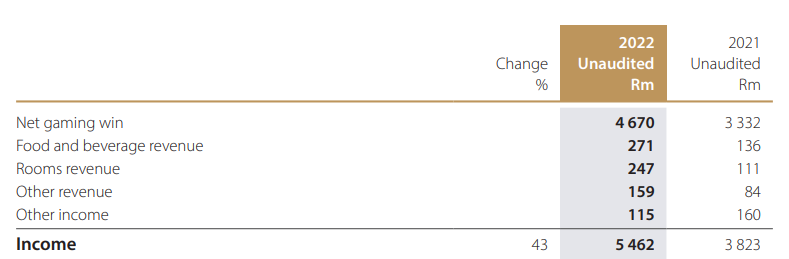

In a pre-close update related to the six months ending December 2022, Attacq highlighted higher collection rates and occupancy rates in the South African portfolio. This is obviously good news.

The client retention rate is much higher, which is also good news, although negative reversions have deteriorated from -3.1% to -5% (which means new leases are still cheaper than old ones).

Trading density has increased by 18.5% as the impact of inflation and improved retail conditions work through the system.

In October, turnover reached 122.8% of 2019 levels despite footcount still running well below those levels. The footcount vs. turnover trend is in line with what I’ve seen in most property funds.

The fund is recovering 68% of diesel costs for load shedding in the retail portfolio and 84% in the commercial (office) portfolio. The full cost is being recovered in the industrial portfolio.

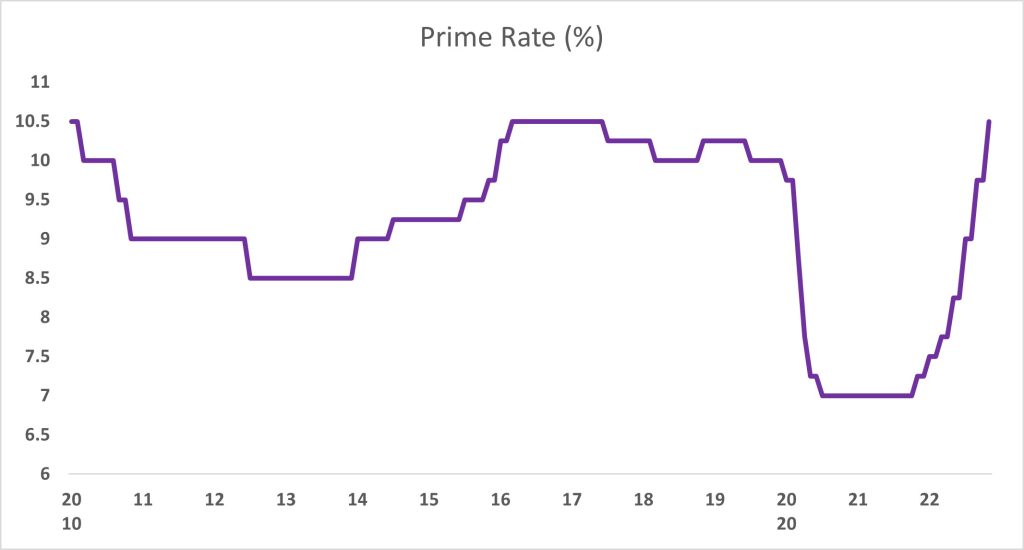

Looking at the balance sheet, the gearing ratio has increased from 37.2% at the end of June to 38.7% at the end of September. 74.6% of debt is now hedged vs. 84% in June and the total weighted average cost of debt has increased from 9.4% to 9.6%.

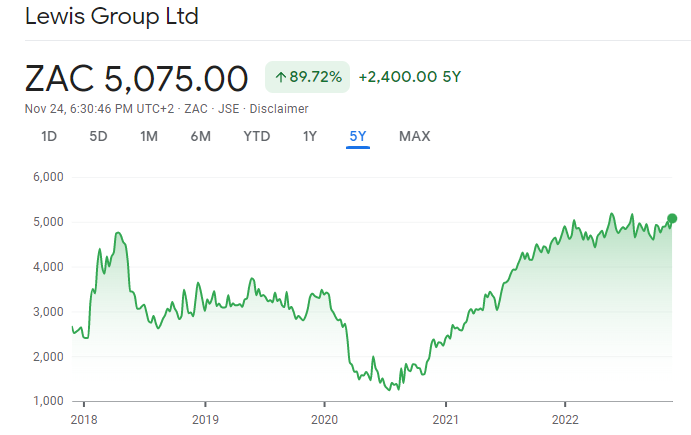

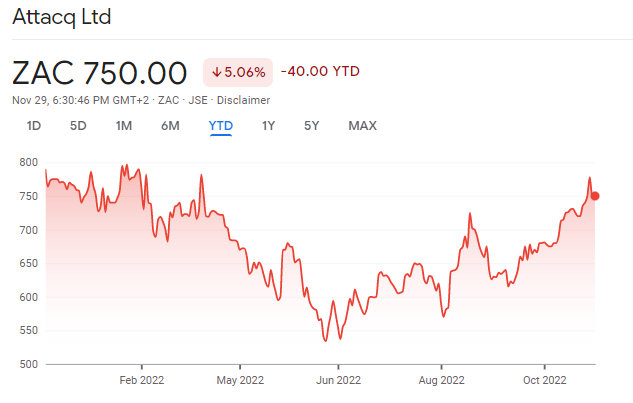

This has been a rollercoaster year of note for the share price:

Capital Appreciation Group jumps on earnings

A 9.7% jump on strong volumes marks a huge reversal in market sentiment

After Capital Appreciation Group spooked the market with the GovChat announcement, the release of detailed results seems to have settled the jitters.

In the six months ended September, revenue grew by 22.5% and growth outside South Africa was particularly high, albeit off a small base. There are now 22% more point of sale terminals in the wild, with a total estate of over 315,000 terminals.

With substantial investment in expenditure to drive growth, trading profit only increased by 2% and EBITDA was flat. This means a 600 basis points reduction in EBITDA margin to 25.6%, which is still an attractive level. If you’re wondering where the expense growth was, the appointment of 81 new staff members (excluding the 23 Responsive employees acquired with that company) will give you a clue.

Headline earning per share (HEPS) ignores the GovChat impairment and increased by 4.4%.

The cash generative quality of the business certainly comes through in this result, supporting interim dividend growth of 13.3% and a 20.1% increase in cash available for reinvestment. Finance income increased by 53.2% as a result of a higher cash balance and increased interest rates.

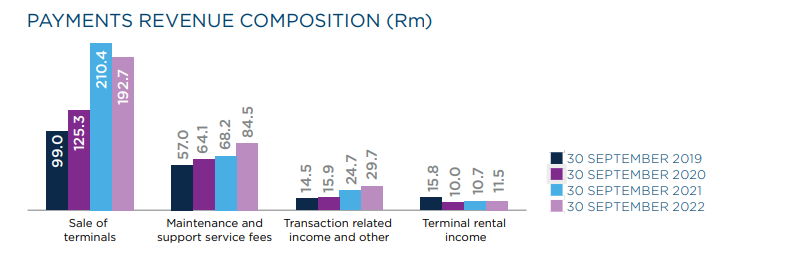

Looking deeper, the Payments division grew revenue by just 1.4% and experienced a 5.4% decline in EBITDA. The Software division grew revenue by 75.4% and EBITDA by 57.1% but one must remember that there was a major acquisition in this division.

This chart does a great job of showing that the revenue pressure in the Payments division was mainly due to a slow-down in terminal sales vs. a monumental period last year:

The group outlook is “cautiously optimistic” for the Payments business as supply chain challenges start to disappear. The Software division is enjoying a strong pipeline. The group balance sheet has more than enough cash to fund any acquisitions that the business may come across.

Going forward, investors will hope for a happy ending of some kind for GovChat and margin improvement in the Payments division, with revenue growth in Software continuing to do well.

Crookes Brothers suffers a collapse in profitability

An operating profit is more than offset by fair value losses

The accounting rules for agriculture businesses are quite different to other companies. The requirement to recognise fair value movements in biological assets can cause spectacular swings in the numbers.

When it comes to revenue and operating profit, the Crookes Brothers numbers don’t look too terrible. Revenue is up by 1% and operating profit is down 37% but is still a positive R82.5 million. The problem is that fair value losses of R99 million (only slightly lower than last year) smash that number into oblivion, taking the group into a headline loss.

Looking at cashflow is always useful in a situation like this and that doesn’t tell a great story either, with cash generated from operations down by 61% to nearly R29 million.

Unsurprisingly, no interim dividend has been declared.

It’s the end for Etion: a value unlock story of note

Etion will leave the JSE after delivering major returns to recent shareholders

As the next step (but not quite the final one) in the value unlock process that commenced in 2020, Etion will repurchase almost all of the ordinary shares in the company and will then be delisted. The repurchase price is 55.58 cents per share, slightly above the traded price before this announcement. All public shareholders will be able to exit in full, with one shareholder (a related party) remaining to wind up the company.

After the delisting, there will be an “agterskot” payment to shareholders. Much like “lekker,” the Afrikaans language has delivered us a word that is hard to beat. This means a contingency payment to be made at a later date provided certain conditions are met.

It’s not the biggest agterskot in the world, mind you. The value of 55.58 cents per share equates to R313.7 million and the agterskot will be a maximum of R17 million, net of taxes.

Since 2020 when the value unlock was announced, the return is about 8x!

Vukile boasts positive reversions in SA and Spain

The tide seems to be turning for property funds

With its share price up by around 15% this year, Vukile is reporting promising metrics across both major portfolios.

In South Africa, rental reversions swung into the positive which is a big deal, as many funds are still in the red. With trading densities up 7% and net operating income up 4%, the like-for-like valuations increased by 3%.

In Spain, the Castellana portfolio has put in a solid performance with net operating income growth of 7.5% and positive reversions of 4.6%. Remember, this means that new leases are being signed at a rate that is 4.6% higher than the lease being replaced (on average).

Looking at the balance sheet, 87% of group interest-bearing debt is hedged. The loan-to-value has been maintained at 43%.

The interim dividend of 47.32 cents is up 16.8% on the corresponding period. Funds from operations was 80.8 cents per share.

The group outlook is upbeat with a note of caution, with guidance for the full year unchanged.

Little Bites:

- Director dealings:

- There are only three certainties in life: death, taxes and Des de Beer buying shares in Lighthouse Property (this time worth R660k)

- An associate of a non-executive director of Grand Parade Investments has sold shares worth R24.5 million

- A trust related to a director of FirstRand sold shares worth R18.3 million to acquire units in a unit trust – this sounds to me like some clever wealth management structuring but I’m not 100% certain.

- Tharisa released a trading statement for the year ended September. Fully diluted HEPS is expected to be between 7% and 9% higher than the prior year. If you’re wondering why the trading statement was triggered, it’s because EPS is expected to be between 41% and 44% higher.

- The offer by Taylor Maritime Investments for all the shares in Grindrod Shipping was accepted by holders of 73.78% of the maximum potential issued share capital of the company.

- Capital & Counties Properties (Capco) and Shaftesbury are in the process of a recommended all-share merger, which means the companies need to give each other permission to pay dividends. Capco’s dividend is 1.7 pence per share, covering the six months to December.

- In similar vein to the issues experienced in Nigeria, MTN Ghana is at risk of losing subscribers because of the need to register SIM cards. From 1 December 2022, those who haven’t completed stage 2 of the process (the biometric capture) will be barred from the network. MTN will communicate the impact to the market on 2 December. The group share price shrugged off this news.

- In the nine months to September, Buffalo Coal Corp’s revenue jumped by 33% and the loss decreased by 97%. This means that there was still a loss for this period, although the third quarter actually reflects a small profit of R2 million. With a year-to-date loss of under R1.5 million, it looks like the full year just might sneak into a profit. The company has also appointed a new CEO.

- The JSE has censured a former director of AEEI and the former CFO of AYO Technology. There are various reasons for the censure, with the overall theme being poor application of financial controls.

- Herman Bosman will step down as CEO and financial director of RMB Holdings will effect from 1 December. Brian Roberts (current CEO of RMH Property) will take over as group CEO and Ellen Marais (current company secretary and financial manager) will take the reins as financial director.