If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Afrocentric receives a complicated offer from Sanlam

This is a partial offer (an unusual corporate finance tool) at R6 per share

Afrocentric closed at R4.19 on Monday before the news broke on Tuesday of a partial offer by Sanlam. The share price moved to R5.10, still well below the R6.00 offer price. The price differential is being driven by the partial nature of the offer, as there is no guarantee that a shareholder’s entire stake can be sold.

Sanlam wants to acquire between 36.9% and 43.9% of the current share capital of Afrocentric. Sanlam reserves the right to acquire fewer shares or more shares than this range suggests. Assuming that range holds, Sanlam will hold between 55% and 60% of the Afrocentric shares after the transaction. The announcement notes that under no circumstances will Sanlam hold more than 74.9% of the shares in Afrocentric after the transaction.

The rationale here is for Sanlam to integrate Afrocentric’s product suite of affordable medical aid and health insurance products into its ecosystem. This gives Afrocentric access to a much stronger distribution network than it currently has, with the additional benefit of cross-selling other Sanlam products to the Afrocentric client base. There will be the opportunity to develop integrated healthcare solutions going forward.

For Afrocentric shareholders, this is an opportunity to partially liquidate their holdings, something that would otherwise be difficult to do with the low level of liquidity in the stock. Excess tenders are allowed, which means shareholders can try to sell more than their proportional share of the partial offer. Whether those excess tenders are accepted would depend on the total number of shareholders that accept the offer, as well as Sanlam’s decision to acquire more than the guided range of shares.

Critically, Afrocentric will not be delisting.

There’s another trick here, in that a condition precedent to the partial offer is that Afrocentric must acquire the shares held by Sanlam Life in ACT Healthcare Assets Pty Limited (AHA). Sanlam Life currently holds 28.7% in AHA and Afrocentric holds the rest. This would be an asset for share deal in which Sanlam Life would be issued shares in Afrocentric that would give it a 28.7% stake in the listed company. The intention is that the partial offer would then take Sanlam to a controlling stake.

There are effectively two deals here, but one wouldn’t happen without the other.

Datatec’s earnings are significantly lower

But there’s a special dividend of R12.50 per share after the sale of Analysys Mason

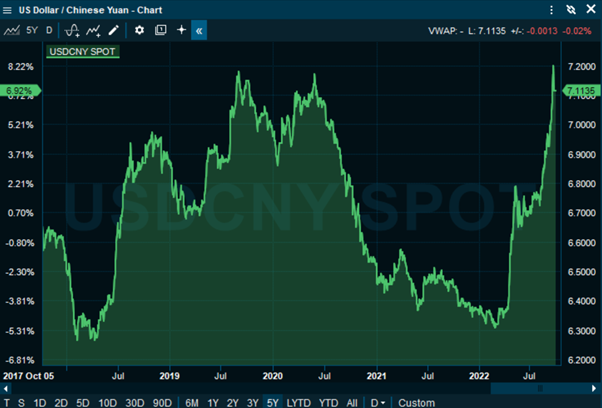

In the six months ended August, Datatec had to contend with multiple issues related to global supply chains and the strength of the US dollar, which has caused havoc for many companies.

The company expected Logicalis Latin America to struggle, with some signs of supply chains easing in the region. Going forward, Datatec will report on the Latin America and International arms of Logicalis separately to give investors more detail with which to assess the group.

In both Westcon and Logicalis, the good news is that the backlog remains high and order intake remains strong. Ongoing demand is part of why supply chains haven’t fully recovered.

It’s also important to note that Analysys Mason is still included in these numbers, as the disposal was concluded after the period. When you see the drop in earnings, it’s not because that business was sold. That impact isn’t in this HEPS result.

Headline earnings per share (HEPS) for this interim period is expected to be between 4 and 5 US cents, between 36.5% and 20.6% lower than the prior year. It’s even worse if you look at underlying earnings, which is the company’s way of presenting a cleaner view of the numbers with fewer once-off distortions. On that basis, earnings will be between 63.9% and 51.8% lower.

Related to the disposal of Analysys Mason, the initial proceeds on that sale are being distributed to shareholders in the form of a special dividend of R12.50 per share. There is a scrip dividend alternative that allows investors to receive shares to that value without the incurrence of dividend withholding tax.

The share price closed 2.9% lower at R41.61, so the special dividend is 30% of the market cap.

Tharisa reports higher production numbers

The net cash position also improved significantly from $48 million to $78.6 million

Tharisa is a platinum group metal (PGM) and chrome co-producer that is dual-listed on the JSE and the London Stock Exchange. This makes it both unusual and interesting. The latest production and cash balance numbers for Q4 also point to a company that is operating at a high standard.

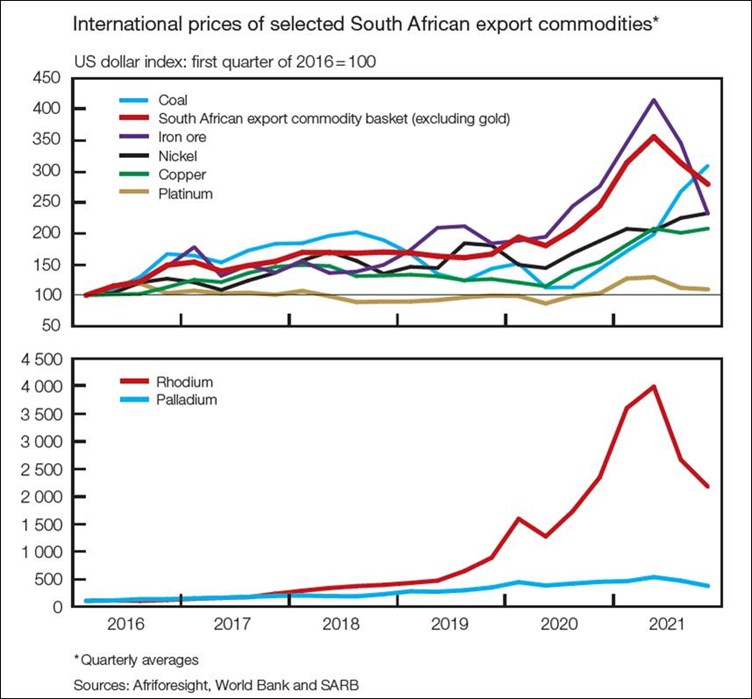

Higher rough feed grades and recoveries led to quarterly PGM production increasing by 7.6% vs. the preceding quarter and 13.6% year-on-year. Although the PGM basket price is 10.3% lower vs. the preceding quarter and 16.6% down year-on-year, the production numbers go a long way towards mitigating the impact.

Chrome concentrate production was up 6.8% vs. the preceding quarter and 5.1% year-on-year. Chrome pricing has retreated in this quarter (down 8.5% vs. the preceding quarter) but is still 35.7% higher year-on-year.

The balance sheet is looking good, with a cash balance of $143.4 million and a net cash position of $78.6 million.

The Karo Platinum project is due to break ground in December 2022 and there has been a lot of operational progress with the project, like filling key managerial positions.

Little Bites

- Director dealings:

- The CEO of Bell Equipment has acquired shares in the company worth R205k

- As was pointed out to me by a Ghost Mail reader, Discovery CEO Adrian Gore recently received shares in the company to the value of nearly R3.3 million. Although that’s nothing to write home about given his wealth and position in the company, it’s interesting that he paid the tax out of his own funds and kept all of the shares. The norm is to sell enough shares to cover the tax, so this is effectively a show of faith from the CEO in the current share price.

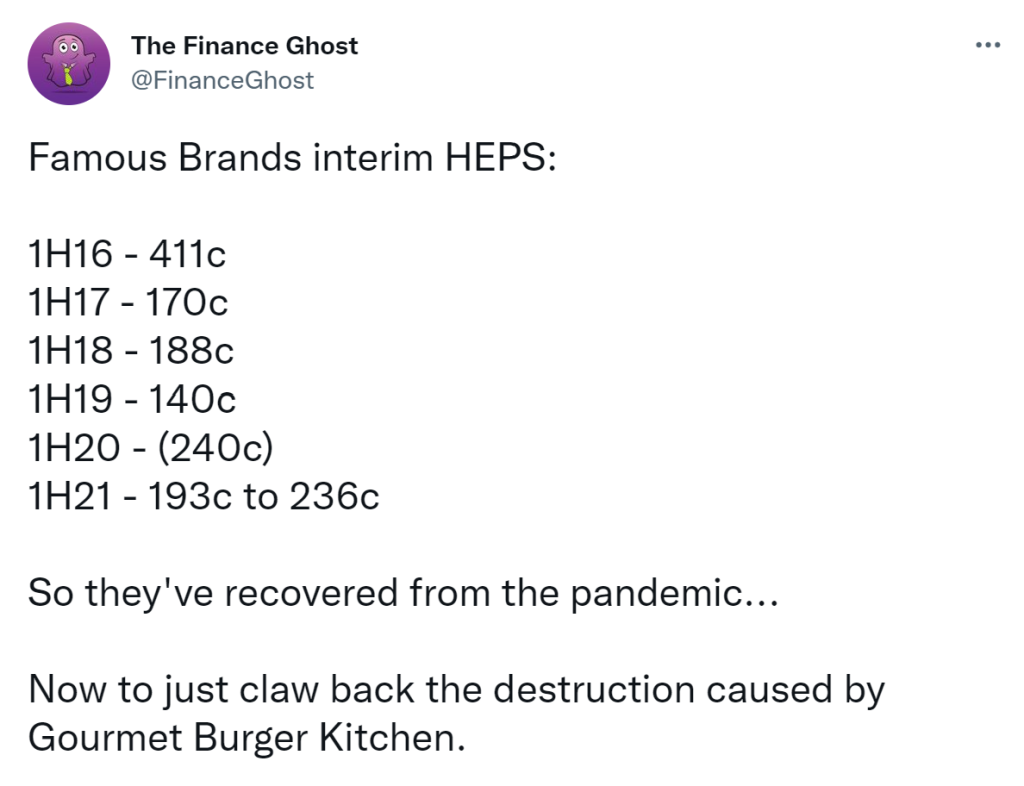

- Famous Brands will be acquiring properties from its founders in order to expand and reconfigure the head office and logistics centre in Midrand. The purchase price for the properties is R181 million, which is similar to the values at which the properties were shown in recent financial statements. This is a small related party transaction, so it can only go ahead if the independent expert provides a positive fairness opinion. BDO Corporate Finance has been appointed as independent expert and the opinion has been submitted to the JSE. Interestingly, the company doesn’t confirm whether the opinion is positive or not!

- Exemplar REIT released an updated trading statement for the six months ended August 2022. The expected increase in the distribution per share is now higher, coming in at between 50% and 51.6%.

- I haven’t been reporting on the several companies that are busy with regular buybacks. The sheer scale of Naspers and Prosus always deserves a mention though, with Prosus repurchasing shares worth nearly $165 million in the space of a week in early October. In a couple of days, Naspers managed to repurchase $48.5 million worth of shares. That’s a casual R3.8 billion in combined repurchases!

- Rand Merchant Investment Holdings has issued the documentation required to formally change its name to OUTsurance Group Limited. The expectation is that on 7th December, you would be able to trade in JSE:OUT in your portfolio. I hope they pay regular dividends, otherwise investors won’t always get something out.