If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Corporate finance corner (M&A / capital raises)

- AYO Technology Solutions and African Equity Empowerment Investments (AEEI) have terminated their proposed joint acquisition of Italian Summer. Don’t even try and Google what that business does, because you’ll just feel upset about not going on an international holiday.

Financial updates

- The talk of the town was Thungela, which closed 3% higher after releasing its interim results for the six months ended June 2022 and declaring a huge dividend. After banking operating free cash flow of R8.9 billion, the net cash position jumped to R14.8 billion. An interim dividend of R8.2 billion has been declared, which equates to R60 per share. This is almost three times the price you could’ve bought Thungela at immediately after its unbundling by Anglo American! There is some negative news around full-year guidance, with export saleable production guidance revised downwards to 13.0Mt – 13.6Mt from previous guidance of 14.0Mt – 15.0Mt because Transnet still can’t provide a proper service. The FOB cost per export tonne is thus expected to be significantly higher than original guidance, up to R1,025 – R1,065 from previous guidance of R870 – R890. With an adjusted EBITDA margin of 64% in this period, Thungela continues to be one of the greatest beneficiaries of the energy squeeze in the aftermath of the pandemic. It’s just a pity that Transnet Freight Rail can’t properly support this industry, evidenced by comments like these:

“We have commenced with trucking volumes between sites in order to further optimise stockpile management and train distribution patterns. We have also initiated a trial to assess the viability of trucking coal volumes to ports as an alternative to rail transport.”

Thungela SENS announcement, 15 August 2022

- Absa is the latest bank to release results for the six months ended June 2022. In a reminder of how big this group is, the announcement kicks off with a summary of key statistics, like 2.8 million digitally active customers and over 35,000 employees. Absa operates in 15 countries, which is where the “Africanacity” branding comes from. That Africanacity certainly found its way into Headline Earnings Per Share (HEPS), up by 29.8% as reported or 27% on a normalised basis. Net asset value per share increased by 9% and return on equity improved to 17.7%, a solid result. The cost-to-income ratio tells a good story, improving from 54.9% on a normalised basis to 51.4%. As the operating environment has improved, so too has Absa’s confidence in being able to pay dividends. The interim dividend of 650 cents per share is more than double last year’s interim dividend of 350 cents per share. The share price is up more than 20% this year.

- Spur is celebrating the end of the pandemic and the return of children with stressed out parents to its restaurants. There are more than enough of those parents who are desperate for a burger, beer and supervised play date, with restaurant sales for the year ended June 2022 up by 28.2% year-on-year. Of course, an environment of inflation and pressure on consumers could blow out Spur’s candles prematurely, as those parents are buckling under the pressure of fuel and grocery costs. Looking deeper, Panarottis posted the highest growth rate (31.4%) and RocoMamas was lowest with 25.3%. The broader Specialty Brands segment grew 52%, which includes the likes of The Hussar Grill. Sit-down restaurant formats took the biggest knock in the pandemic, so logically they have bounced back the strongest. Despite SARS taking a bite out of this year’s result with a R22 million once-off tax charge, HEPS still increased by between 27.5% and 32.5%. You don’t need gourmet food to make money. You just need a liquor licence, a kiddies play area and staff who are willing to sing birthday songs.

- Transcend Residential Property Fund has released financial statements for the six months ended June 2022. Net asset value (NAV) per share is up 3.3% over the past six months and the loan-to-value has improved from 44.9% at 31 December 2021 to 39.3% at 30 June 2022. Occupancy is 97.1% and the board must be feeling confident about the balance sheet, with 100% of distributable earnings declared as a dividend (27.43 cents per share, 8.8% higher than the interim dividend last year).

- Eastern Platinum has reported results for the second quarter of 2022. Revenue was up 2.5% year-on-year for the quarter and 3.4% for the six-month period. Margins were higher, with mine operating income increasing by an impressive 25.2% for the quarter and 59.1% for the six-month period. 84% of revenue is generated from an offtake agreement for chrome concentrate production. The rest of the revenue is from sales of PGM concentrate to Impala Platinum. There’s a problem though: the counterparty to the offtake agreement (Union Goal Offshore Solution Limited) has been slow in making payments, with $17 million currently owed. Any default on this amount would significantly impact the company’s liquidity.

- Get your diary out: Grindrod Shipping has confirmed that results will be released on Wednesday, 17th August after market closing in New York. The earnings call will be on Thursday afternoon SA time.

Operational updates

- In sad news, there has been a loss-of-life incident at the Moab Khotsong mine owned by Harmony Gold. An investigation is underway, as mining groups take employee safety incredibly seriously (as they should) and always try and find ways to improve.

Share buybacks and dividends

- British American Tobacco is still busy with its daily share buybacks.

- Schroder European REIT has announced its third interim dividend for the year ending September 2022. The interim dividend is 1.85 euro cents per share and a special dividend of 0.10 euro cents per share has been added for good measure based on the successful execution of the Paris, Boulogne-Billancourt business plan.

- Capital & Regional will pay an interim dividend of 2.5 pence per share on 7th October. The group plans to offer a scrip dividend alternative as well.

Notable shuffling of (expensive) chairs

- Sappi has made some heavy-hitting independent non-executive director appointments. This includes Louis von Zeuner, who has run a gauntlet of note. His CV includes post-curatorship chairman of African Bank, chairman of Tongaat Hulett (he stepped down at the end of June) and directorships at Transnet and Cricket South Africa. If ever you want someone to run into a burning building with you, this is your man. The other new appointments to the board are Nkululeko Sowazi (co-founder of Tiso Investment Holdings and current directorships at Grindrod and MTN) and Eleni Istavridis (senior roles at Bank of New York Mellon and other financial institutions).

Director dealings

- Co-founder of Mr Price, Stewart Cohen, has sold shares in the company that were held in an investment trust. Get ready to feel poor: the value of the shares is R19.6 million.

- Entities linked to Des de Beer are mopping up shares in Lighthouse once more, this time with a value of R3.7 million.

- An entity associated with a director of Dis-Chem has sold shares worth nearly R5.2 million.

- The CFO of Alexander Forbes joined in on the partial offer bonanza, offering shares to New Veld and banking R385k in the process.

- The CEO of Spear REIT continues to keep his kids interested in the market by buying them shares in the property fund.

- A director of BHP Group has acquired shares in the company by participating in the dividend reinvestment plan.

Unusual things

- In a media statement over the weekend, Mpact responded to Caxton’s rather inflammatory announcement on Friday. The first point Mpact makes is that no offer has been received from Caxton, so the board cannot support a separate merger filing as they don’t know if it will be in the best interests of the company and shareholders. Mpact also notes that it has been disclosing the Competition Commission investigation in its annual financial statements since it was initiated in 2016, with the Commission not seeking to impose a penalty against Mpact. The fight continues.

- Things are just going from bad to worse for Afristrat Investment Holdings. Auditor Nexia SAB&T has resigned with immediate effect, citing reasons ranging from “instability in the financial reporting and accounting functions throughout the foreign subsidiary entities” through to “significant doubt around the Group’s ability to continue as a going concern” and best of all, the fact that the auditors doubt they will get paid because they haven’t even been paid for historical audits. Afristrat now needs to find new auditors. Good luck.

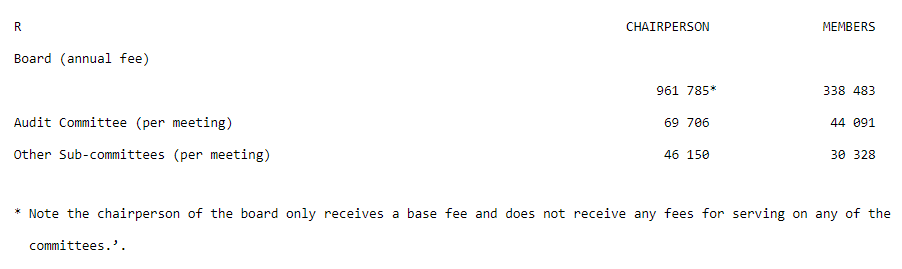

- Equites Property Fund needed to amend the resolution linked to director fees and I felt this was a good opportunity to show you what non-executive directors earn for attending meetings: