Dis-Chem: a tale of two halves (JSE: DCP)

The share price is trying to tell us something – but what?

Dis-Chem is a quality retailer in my books. There are elements of the strategy that make a lot of sense to me, like the investment in baby categories (and associated acquisitions). The problem is that the share sense has been expensive since the IPO, which is why Dis-Chem hasn’t been a good investment for those who got carried away in the IPO hype back in 2016. A share price return of around 9% in roughly 6.5 years isn’t a happy outcome!

The performance this year has been very interesting compared to Clicks, with a major sell-off in the price:

This isn’t what you expect to see from a company that just reported HEPS growth of 17.4% after growing revenue by 7.4%. There’s clearly something here that the market is worried about.

The likely culprit is the performance in the second half (H2) of the year. In the first half (H1), HEPS increased from 48.7 cents to 70.3 cents, or 64.3 cents if we exclude a property gain. The full-year number includes the gain as well, so in my view we can just subtract the H1 number from the full-year number to isolate the second half of the year that didn’t include the property gain anyway.

In other words, the H2 performance this year is 116.5 – 70.3 = 46.2 cents. In the comparable H2, the performance was 99.2 (FY22 result) – 48.7 = 50.5 cents.

Hang on. What happened here? HEPS fell by approximately 8.5% in the second half of the year after growing by 31.9% in the first half (excluding the property gain)!

Read that again if it all went over your head. Remember, companies report on the first six months and the full-year result. If you subtract interim numbers from final numbers, you can isolate second half profits. This does not work for the balance sheet, as the balance sheet is a snapshot at a point in time rather than a measure of performance over a period of time (like an income statement).

With slow like-for-like growth and all the inflationary pressures on expenses that we can imagine, this truly is a tale of two halves for Dis-Chem. If separate financial statements were required for the second half of the year vs. the first half, that story would be very obvious. In the absence of that information, we have to dig into the numbers.

The clue to take a deeper look was the share price movement, which doesn’t make sense vs. the HEPS performance even if the valuation was a bit expensive.

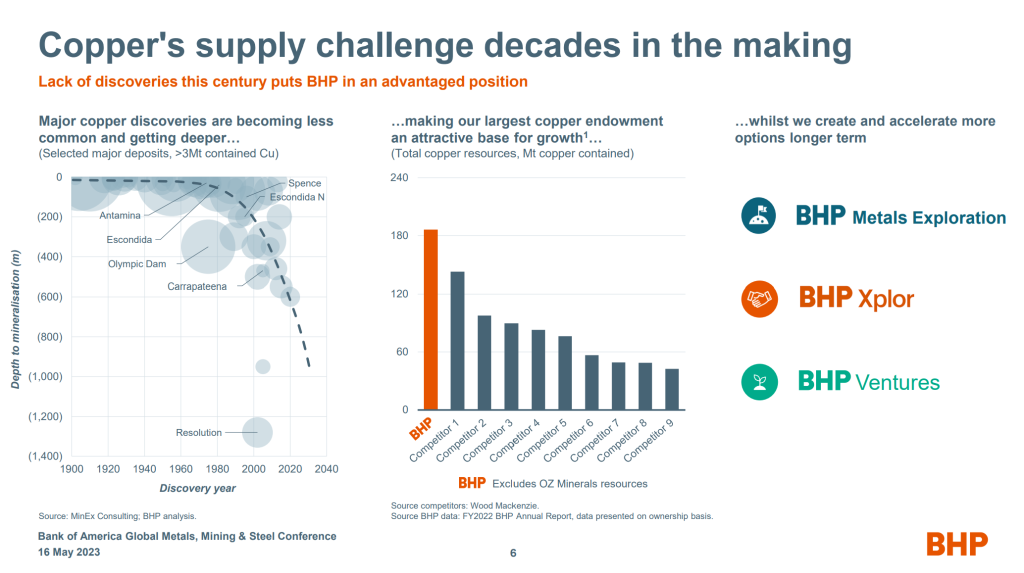

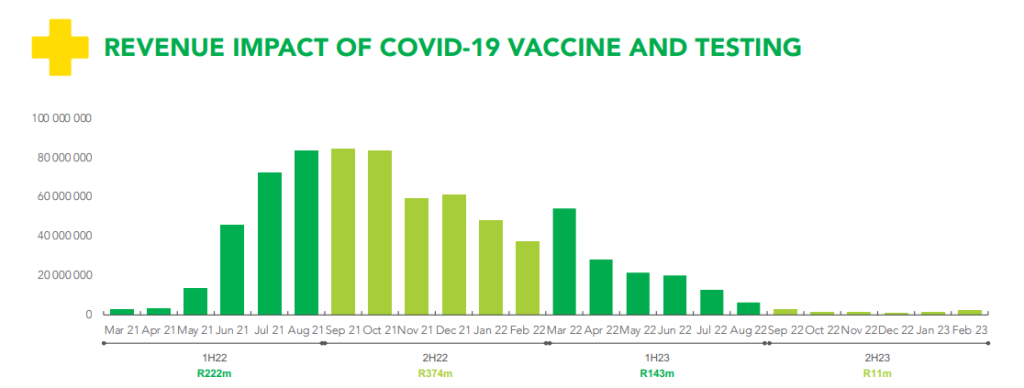

As an aside, I enjoyed this chart from the slide pack:

Nampak sheds another 11% (JSE: NPK)

A trading statement has laid bare the extent of the pain

Nampak has lost well over a third of its value this year. Over 5 years, the share price is down around 96%. In summary: it hasn’t been great.

It’s exceptionally difficult to get money back to the mothership where it is so desperately needed, with Nampak recognising profits in its African countries and then suffering huge forex losses to get the money back to South Africa at just about whatever rate is available.

A cocktail of forex losses and higher interest rates is deadly for a company in Nampak’s position. This is why the headline loss per share for the six months to March has come in at between -53 and -58 cents per share vs. headline earnings per share of 35.6 cents in the comparable period. Remember, headline numbers exclude the impact of any asset impairments.

If we take the impairments into account by using earnings per share instead, we find a loss of between -380 cents and -420 cents per share vs. earnings per share of 34.9 cents in the comparable period.

When the share price is just 65 cents per share, this means that the company is a dead man walking unless a substantial amount of equity is injected and the balance sheet is rectified. For existing shareholders, any rights offer would most likely be intensely dilutive and would wipe out a big chunk of the remaining value. The size of the required rights offer will be “announced in due course” by the company based on negotiations with lenders and progress made on the restructuring plan.

Tharisa’s operating profit fell by 29% (JSE: THA)

But HEPS is up and you need to assess this result very carefully

The Tharisa results need to be read carefully, as revenue is up by 0.4% and operating profit is down by 29.0%. That isn’t very unusual in this environment sadly, as inflationary pressures are causing difficulties for many companies.

The eyebrow-raiser is that HEPS is up 13.5% despite the drop in operating profit. The interim dividend is flat year-on-year despite the jump in HEPS, which is the final clue that a deeper look is required here.

When you see a big swing in HEPS vs. operating profit, the usual reason is that there have been substantial changes to the balance sheet. A classic example is debt, with net finance costs impacting HEPS but not operating profit, as the latter tries to isolate the results of the underlying businesses regardless of how they are funded.

Although net finance cost did move year-on-year, the quantum is nowhere near enough to explain the swing in HEPS.

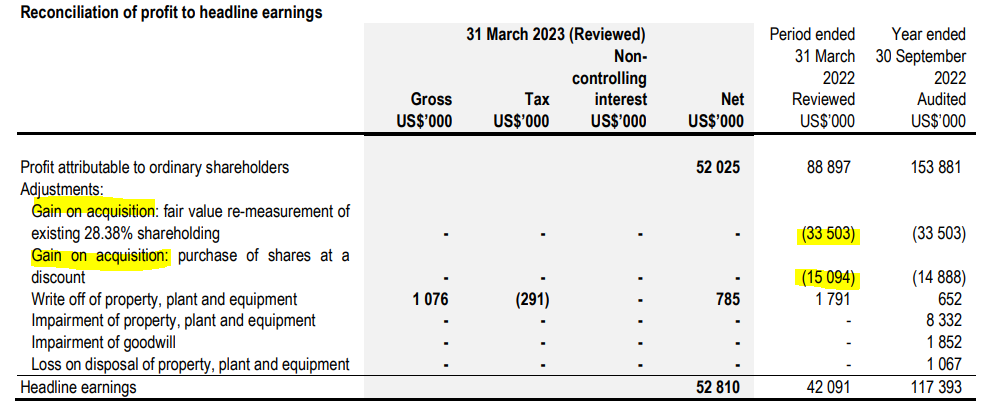

Now you need to really go digging, particularly for the note that reconciles headline earnings to profits. Here’s what that looks like:

In this case, the comparable period included massive accounting gains on an acquisition of a subsidiary. These are reversed out for a HEPS calculation but they also don’t sit in operating profit, so that was a red herring to try and understand the HEPS move vs. the operating profit move.

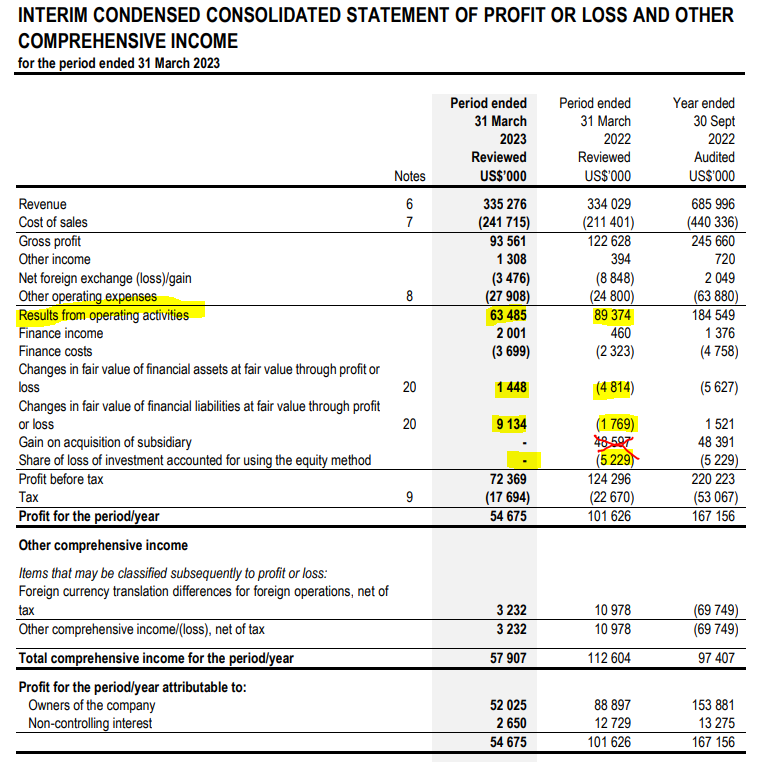

Back to the income statement we go, with important highlights below:

The gain on acquisition of a subsidiary was already dealt with in the HEPS note, so that’s crossed out in red. The other yellow highlights are important. In summary, HEPS looks far better than operating profit because the share of losses from an associate are gone and the fair value changes in financial assets and liabilities went sharply in the right direction. The single biggest swing is in the value of the option held by the Republic of Zimbabwe to increase its shareholding in Karo Platinum, with the fair value of the option more than halving. I had to go digging in the notes to find that, but I didn’t want you to panic with another screenshot.

Long story short: the fall in operating profit is what I would focus on rather than the increase in HEPS. The fall was driven by a 61.4% decrease in gross profit in the PGM operations (with production and basket prices well down), mitigated to some extent by a 66.9% increase in gross profit in the chrome operations.

And there you were, thinking that can always just blindly rely on headline earnings as a measure of performance! You often can, but sometimes you can’t.

Tradehold gives guidance on net asset value per share (JSE: TDH)

There are good explanations for the large decrease

Companies that are judged based on net asset value (NAV) per share are susceptible to big negative moves that may not necessarily mean something bad for shareholders.

In particular, if assets are unbundled to shareholders or if there is a large disposal and subsequent special dividend, then the company has deliberately made itself smaller and NAV per share drops. The trick is that shareholders are holding another asset somewhere (either an unbundled company or the special dividend in cash), so the combined picture is fine.

Having said that, a disposal at a price below the value that shareholders were banking on would reduce NAV per share because the value of that asset was actually too high in the NAV calculation.

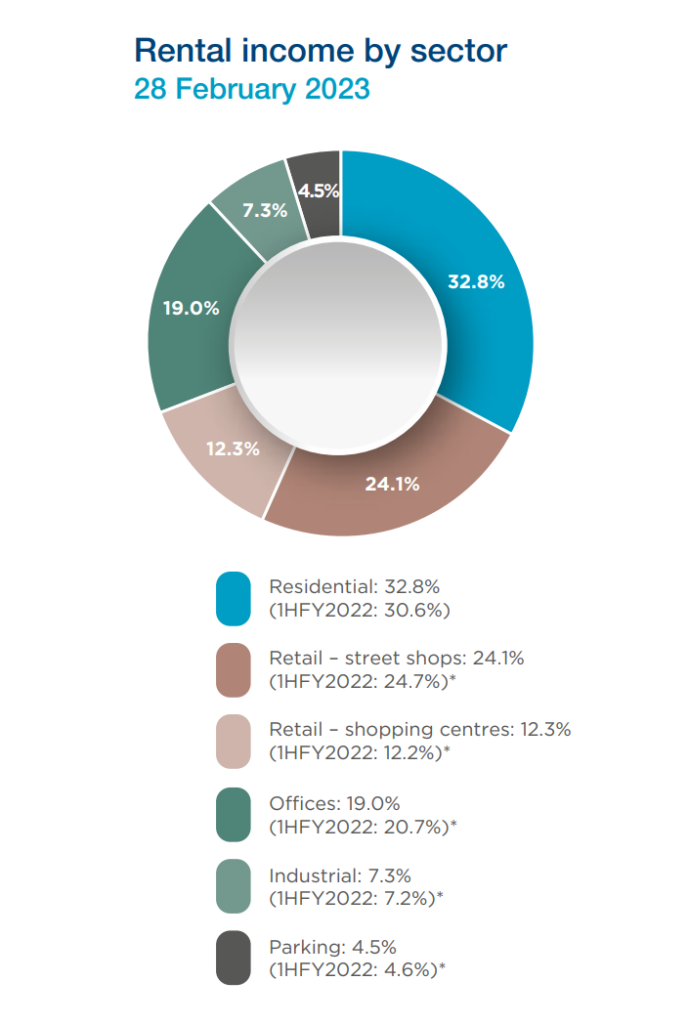

Tradehold is a perfect example of these issues, with NAV per share expected to be between R6.97 and R7.97 lower. If you adjust for the special dividend related to the Moorgarth disposal of R4.34, the drop is less nasty. Aside from the dividend, the disposal of Moorgarth hit NAV per share by R3.80. With a total impact from those two issues of R8.14 on NAV per share, this means that the ongoing operations have been a positive contributor to NAV per share in the year ended February 2023.

If you just read the NAV per share headline and nothing further, you would never pick that up.

The latest NAV per share is between R11.50 and R12.50, with the share price trading at R7.49.

Tongaat releases a business rescue plan – for a subsidiary (JSE: TON)

Creditors are set to receive 7 cents in the rand from Tongaat Hulett Developments

Read very carefully here: this business rescue plan is for a subsidiary of Tongaat Hulett, not the group company. The all-important plan at group level is due at the end of May, along with plans for two other subsidiaries.

The plan released on Friday is for Tongaat Hulett Developments, the property company that owns a substantial amount of land in KwaZulu-Natal.

Not only is the equity in this subsidiary worthless, but even unsecured creditors have lost everything. “Secured” creditors hardly do any better, expected to receive 7 cents in the rand. In other words, they lose 93% of the debt owed by the company. If the company had gone into liquidation instead of business rescue, secured creditors were estimated to only receive 2.5 cents in the rand.

The important lesson here is that “rescue” is a relative term. Some companies emerge from a business rescue with the brands in one piece and a new owner. Other processes are simply a better outcome for creditors than would’ve otherwise been possible in a liquidation. Either way, you don’t ever want to be an equity holder when a company goes into business rescue.

Little Bites

- Director dealings:

- In a rather unusual announcement, Michiel le Roux (ex-CEO and chairman) has bought shares in Capitec (JSE: CPI) worth nearly R4.5 million and a prescribed officer in the bank sold shares worth R1.39 million. I have no position in Capitec, but when the incredibly wealthy director is buying a position that is small as a percentage of total wealth vs. an officer in the bank selling a chunk amount, I tend to maintain my bearish view on Capitec in the context of its valuation and broader SA pressures right now.

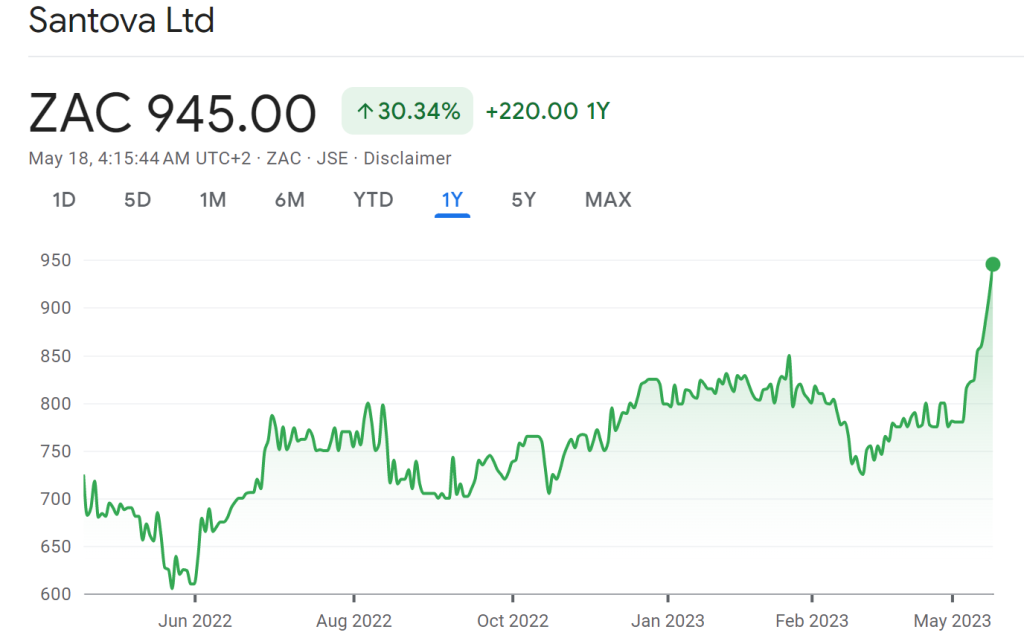

- Although an associate of a director of Santova (JSE: SNV) bought shares worth nearly R93k, the much more important news was a sale of shares by a director worth nearly R4.3 million,

- In an encouraging sign for Transaction Capital (JSE: TCP) shareholders, Sabvest Capital (JSE: SBP) – the investment vehicle of director Chris Seabrooke – has bought another R1.4 million worth of shares at a volume-weighted average price of R7.09. I would ideally like to see more director buying from other directors as well before I add further to my position.

- For the budding geologists among you, Europa Metals (JSE: EUZ) has released drilling results at the Toral project. This is the 2023 drilling campaign being run by Europa Metals and Denarius Metals Corp. You’ll be thrilled to know that Hole TOD-043 is both thick and well-mineralised. That’s about all I can tell you really, other than a comment that the CEO sounds happy with the “robust” nature of the resource.

- Utterly obscure company CAFCA Limited (JSE: CAC) released results on Friday. With a market cap of R43 million and almost no trade in the stock, you haven’t been missing out if you’ve never heard of this cable manufacturer based in Zimbabwe. The company reports in Zimbabwean dollars, so there are numbers on the balance sheet running into the billions. Sadly, the paper in the annual report is worth more than the currency.