Eastern Platinum releases annual results (JSE: EPS)

The outstanding amounts from Union Goal remain a major problem

The cash flow picture at Eastern Platinum is concerning. In the year ended December 2022, the company burnt through $5.4 million in cash from operations, after generating $890k in the prior year.

One of the major problems is that customer Union Goal hasn’t been paying Eastern Platinum, leading to a suspension of shipments to that customer in the third quarter of 2022. The company is now relying on free market sales and this introduces uncertainty into the business.

Revenue for the year fell by 27% and the headline loss worsened from $0.01 per share to $0.02 per share.

Finbond’s slightly-less-bland cautionary (JSE: FGL)

There still aren’t many details to work off here

A “bland” cautionary is a horrible thing. Basically, a company releases an announcement warning shareholders to be cautious because something may or may not be happening. Nobody even knows if it is a positive or negative step.

The market hates these announcements and with good reason, as they tend to do more harm than good. Finbond has at least improved on its cautionary that was released on 4th April, with an almost immediate follow-up that gives some information at least on what the company is up to.

The cautionary relates to potential acquisitions in Southern Africa. It’s still bland, with some salt and pepper at least added to it.

Harmony makes progress in Papua New Guinea (JSE: HAR)

The Tier 1 Wafi-Golpu Project is a copper-gold deposit

Developing mining assets really isn’t a simple process, especially in emerging and frontier markets that introduce many sensitivities around state participation and development of local communities. Harmony Gold has a joint venture in Papua New Guinea with Newcrest Mining and the parties have signed a Framework Memorandum of Understanding with the government. The terms demonstrate how challenging the process can be.

Aside from social contributions that need to be made by the project, equity participation by the fiscus is also covered in the agreement both in terms of royalties and the option to buy an equity stake. The State of Papua New Guinea has the right to purchase up to 30% in any mineral discovery at the project, exercisable at any time before the commencement of mining. The price would be based on a pro-rata share of accumulated exploration expenditure.

In other words, Harmony and Newcrest would carry all the development risk, with the government able to invest at the last minute at a price that only reflects the costs to date, not the risk that was taken along the way.

The company describes the project as “one of the world’s premier, undeveloped copper-gold deposits” – so it must be worth it!

Kibo Energy releases an update on its projects (JSE: KBO)

The company is still confident that deadlines set for 2023 will be met

Kibo Energy has various projects in the UK and South Africa.

In this update, the company didn’t give any further information on the MAST Energy Developments projects. At the Sustineri project, the company is awaiting final laboratory results to finalise an off-take agreement for synthetic oil production in phase 1. At National Broadband Solutions (a long duration energy storage project), a change in ownership at the client has necessitated additional reciprocal due diligence processes. And in the UK portfolio, there is slower progress than expected in the engineering and design study, with funding constraints as one of the concerns.

Still, the CEO sounds upbeat, noting that the company is confident of meeting deadlines in 2023. Kibo has been struggling with a very weird issue in its shareholding voting mechanisms which has been forcing the adjournment of meetings. This needs to be resolved soon or it will start impacting the company.

Nu-World’s profitability has taken a big knock (JSE: NWL)

Get ready for pain after Easter in this share price

Before a long weekend, there’s a graveyard shift on SENS where companies release bad news in the hopes that nobody will notice. This time around, Nu-World was the culprit.

For the six months ended 28 February 2023, HEPS fell by an abysmal 45% to 55%. The company blames broader economic circumstances, high inflation and rising interest rates.

Nu-World is a consumer goods business that sells a variety of mainly durable products, like appliances. That’s not an appealing business model when consumers are taking strain.

The great Rebosis fire sale is now on (JSE: REA | JSE: REB)

The business rescue plan is being implemented

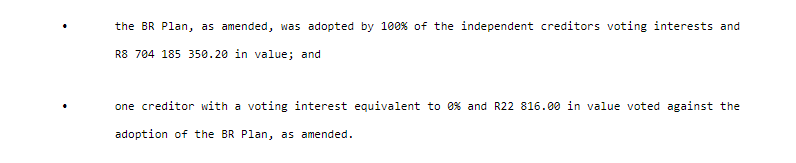

The Rebosis business rescue plan was almost unanimously accepted by creditors. There’s always that one person in every residential complex, WhatsApp group or “I demand to the speak to the manager” setting that refuses to conform, with no better example than this:

Someone out there is very angry about that R22.8k!

The business rescue practitioners are now being paid the princely sum of R4,000 per hour. What do you get for this amount? Well, a plan to settle debt by selling as many of the properties in the group as possible.

I know, right? I also suddenly feel like I’m working too hard for my money.

In a separate announcement, Rebosis invited members of the public to apply for the public sale process. There’s a non-refundable registration fee of R5,000, presumably to weed out opportunists and those with nothing better to do with their time.

The entire process should be wrapped up by the end of July.

If you are wondering what the business plan looks like (and what the practitioners really get paid for), you’ll find it here>>>

WBHO looks to implement a follow-on B-BBEE deal (JSE: WBO)

The original transaction was implemented in 2006 and is about to expire

With WBHO’s first B-BBEE deal on the verge of being wound up, the company is proposing a new deal that includes three different trusts.

There is a share incentive trust that will operate for the benefit of employees up to junior management level who meet certain minimum qualifying criteria, including having been employed by the group for at least five years. There is also a trust that will benefit employees above junior management level, but excluding prescribed officers and directors. These trusts will own 90% and 8% in the new scheme respectively.

The remaining 2% will be held by a defined beneficiary trust that will operate for the benefit of black women, youth and black people living in rural and under-developed areas.

The deal will be implemented through WBHO issuing 4,000,000 shares to the special purpose vehicle (SPV) through which the three trusts will hold their stakes. The price will be R0.01 per share. WBHO also reserves the right to issue further shares to the SPV to maintain its B-BBEE score, for a period up to 15 years after the deal is implemented.

This is a notionally funded structure, which means the SPV needs to pay off imaginary debt for the shares over 15 years based on the 30-day VWAP, minus R0.01 per share. Inevitably, these deals fail to pay off the debt within the stipulated period, leading to only a portion of the shares eventually vesting in the hands of participants.

This complicated structure is expected to result in a 3.0% decrease in diluted HEPS for WBHO.

Little Bites

- Director dealings:

- The company secretary of Sasol (JSE: SOL) sold shares worth R382k.

- An associate of a director of Ascendis Health (JSE: ASC) bought shares worth R95k.

- Philip Kotze, CEO of Clover Alloys (SA), has joined the board of Orion Minerals (JSE: ORN). This is part of the broader strategic partnership between the companies that saw Clover Alloys invest around R80 million in Orion’s recent capital raise.