Remgro has released results for the six months ended December 2021 and has declared a dividend.

This group was established in the 1940s and is spearheaded by the famous Rupert family. There are numerous investments made across nine sector platforms. These platforms are healthcare, consumer products, financial services, infrastructure, industrial, diversified investment vehicles, media, portfolio investments and social impact investments.

The most significant investments are a 44.6% stake in Mediclinic, 30.6% in RMI, 57% in Community Investment Ventures Holdings (CIVH), 31.7% in Distell, 80.4% in RCL Foods, 3.3% in FirstRand, 100% in Siqalo Foods, 50% in Air Products South Africa, 24.9% in TotalEnergies South Africa and 43.5% in Kagiso Tiso Holdings. These investments contribute around 92% to Remgro’s intrinsic net asset value (INAV).

An increase in HEPS of 139.4% is clearly due to the base effect of a pandemic-ruined comparable period. Given Remgro’s position as an investment holding company, the increase in INAV per share is more important. This metric increased by 14% since June 2021 to R202.47.

Yesterday’s closing share price of R147.50 reflects a discount to INAV of 27%, which is typical of these structures on the JSE. Remgro specifically highlights this discount in the SENS by referring back to the closing price on 31 December 2021 which matches the end of the reporting period. The discount based on that price was 35.2%, a similar level to the discount as at 30 June 2021.

Investors love to see cash land in their bank accounts, so an increase in the interim dividend per share of 66.7% to 50 cents will be met with happiness. This is a tiny yield though, so don’t pile your money into Remgro if dividends are your primary focus.

There are some significant corporate actions being executed by investee companies.

One of the high-profile deals is Heineken’s acquisition of Distell and the carve-out of Capevin. Remgro will roll into the new structure in both entities, so Remgro shareholders will retain exposure to the Distell group.

Another important one is RMI’s unbundling of Discovery and Momentum Metropolitan. Remgro supports the unbundling but doesn’t indicate what it will do with the shares once received.

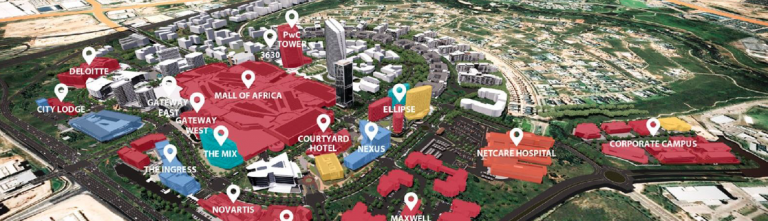

Remgro invested over R2.1 billion in CIVH in July 2021. In November 2021, a deal with Vodacom was announced that will see significant assets and cash contributed by the telecoms giant to a subsidiary of CIVH that holds the existing investments in Vumatel and Dark Fibre Africa. Although Remgro is diluting its holding to make space for Vodacom, the resultant entity is much larger and bringing in a telecoms partner can only be a good thing.

In November 2021, Remgro disposed of its investment in Grindrod Shipping for R1.19 billion. Remgro isn’t shy to take advantage of market cycles.

Invenfin, Remgro’s venture capital platform, is selling its 50.5% interest in Ad Dynamo. Another transaction by Invenfin that will be of interest to many is the disposal of one third of its Bolt investment for R179 million. This approximates the total investment by Invenfin in Bolt to date, so the remaining two-thirds of the investment is now “free” – the return is 3x money and counting!

This group is huge and always busy, so there were other transactions as well. This is in addition to the ongoing news in the various portfolio entities, many of which are listed.

Remgro’s share price is up 11.5% this year but still has a long way to go to reward long-standing shareholders, with a 28.5% decrease over the past 5 years.