Listen to the show using this podcast player:

Get ready for a masterclass in retail from Pieter Engelbrecht, CEO of South Africa’s largest employer. If you’re ready to learn about the secrets to Shoprite’s success, you’re in the right place.

It starts with the culture and commitment to delivering value to customers. You can then add the power of investment in data and systems, creating the foundation for an omnichannel model that has positioned Checkers as the biggest brand in South Africa – and not just in retail.

With the South African retail sector having to navigate tremendous challenges, Shoprite keeps coming out on top.

But how do they do it?

This podcast deals with topics like:

- The “secret sauce” at Shoprite and the culture in the group.

- The importance of inflation in the retail business model and how deflation makes things much tougher.

- The difference between Shoprite’s measure of inflation and the Official Food Basket used by the SARB in making decisions.

- The power of the Checkers brand and how Shoprite has taken it right to the top in South Africa – as anyone with a toddler on a Sixty60 bike can confirm!

- How value retailers can achieve such strong gross margins through efficiencies.

- The omnichannel strategy and the parallels to a global giant like Walmart.

- The elevator pitch for why an investor should consider Shoprite.

Shoprite believes strongly in the value of Ghost Mail in the South African investment ecosystem. They have sponsored this podcast for readers, but I was allowed to ask whatever I wanted to ask. Please do your own research and do not treat this podcast as an endorsement of Shoprite as an investment.

Full transcript:

The Finance Ghost: Welcome to this episode of the Ghost Stories podcast. Pretty big deal for me today. We are in earnings season, and today I get to speak to a man who is responsible for the largest employer in South Africa. That is a pretty big responsibility when he wakes up in the morning.

I sometimes feel scared that I have to write a newsletter for 40,000 people and not make any mistakes. That pales in comparison to what Pieter Engelbrecht is responsible for.

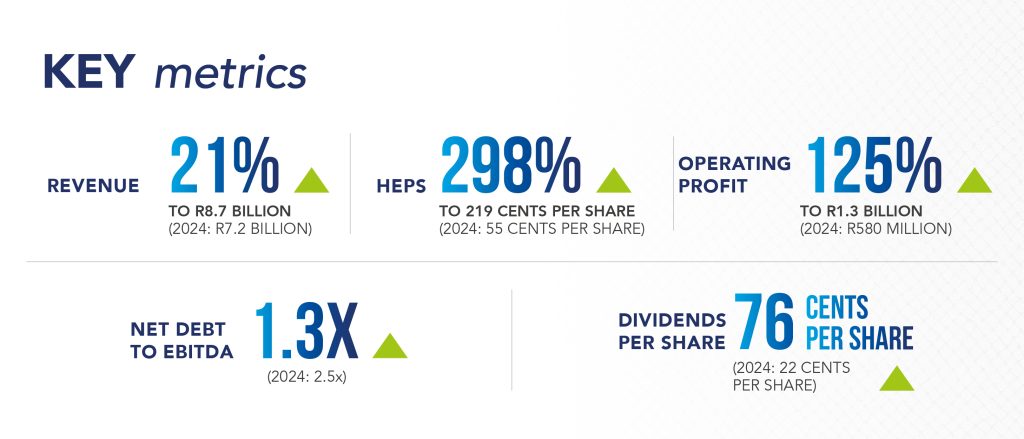

So, Pieter, thank you so much for doing this. You’ve released your interim results at Shoprite. I watched the presentation this morning. It’s amazing, what you guys have built, so congratulations.

And perhaps most of all, thank you for this podcast and for bringing these insights to the Ghost Mail audience.

Pieter Engelbrecht: Certainly, thank you very much for the opportunity.

The Finance Ghost: No, it’s a great pleasure, and I’m really looking forward to honestly just getting all of these insights from you, there’s so much to learn.

So I did watch, of course, the results presentation this morning, and congratulations, well done. And certainly, one of the key factors that came through is this very low inflation in South Africa, even price deflation actually. And we’ll speak about that just now. We will dig into that.

I know it’s a passion point for you, and as you correctly pointed out this morning, the regulators are making decisions around inflation, and your numbers look quite different to the official numbers. So we will dig into that for sure.

But before we get to that, I think the question on everyone’s lips really, is around understanding the ‘special sauce’ at Shoprite. Not the sauce you’ll find in the aisle, but the sauce that goes through the entire business.

Because – is it something they put in the water there in Brackenfell? I don’t know what it is, but somehow you just manage to you make it work. There’s been a bit of a slowdown, yes, in Supermarkets RSA, but you are still running way ahead of your competitors. I mean certainly my perception – and I won’t ask you to comment on competitors – Woolworths is keeping you honest in Checkers right now, but Pick n Pay is in disarray. Spar, as a wholesaler, is definitely landing in that same WhatsApp group.

It’s a tough environment for retail. We’ve seen a lot of pain in the apparel names as well. It’s really difficult. And yet, here you are, sales growth from continuing operations up 7.2%.

What is in the water in Brackenfell? What is happening there? How are you doing this at Shoprite?

Pieter Engelbrecht: It’s already a 10-year journey. It started in 2017 when I became the CEO. One of the first things that I thought would make a difference is obviously our people.

You mentioned that we’re the largest private employer, 170,000 people, and then you exclude all those peripheral merchandisers and trolley collectors, cleaners, DC personnel etc. So, it’s actually a much larger audience.

And for me, the number one thing was, that there must be mutual respect. So, it was driven very hard in terms of behaviour, because retail is a tough business. We’re not always the most sophisticated people. But it doesn’t mean you can be disrespectful.

Hence, it was driven so hard. This past Christmas visit (every year in December month I try to visit as many stores as I can, to get a feel for what’s happening in the business and maybe if we make some fundamental errors, I can pick it up, and we can fix it) – the attitude of the staff, towards their customers and in general, towards each other, was for me amazing.

I said to them in our first January meeting for the year, it was my best visit ever because of the people.

I don’t take leave; I just don’t come into the office for a couple of days. But in that time people come up to me and say, “But what is happening there at Shoprite and Checkers?”

I say “No, what’s happening?”

They say, “No, the people are so amazing, there is almost this feeling of, ‘Nothing is too much’. If we make a mistake, the manager gets in his car, brings you a hamper, apologises, and we try again – try and learn from our mistakes”.

My executive assistant next to me is also responsible for the call centre, so we scrutinise that all the time. If we make a mistake, we go all out to fix it. And we’ve got this saying in Shoprite (meaning the group) that “No customer leaves the store unhappy”. And then we expanded that later on, to say, “The sun doesn’t set on a customer complaint”.

I took that from a Xhosa sentence, that says: “Sebenza kakhulu, ilanga liyashona.”

Which directly translated is: You must work hard because the sun is drawing water. Almost saying, that the sun is setting. And then I came up with this thing to say, “The sun will not set on a customer complaint”.

And I think if you combine all of this in such a big workforce, it’s the general attitude of people. There are always exceptions, but there is nothing we don’t do to please our customers, and we live by it. That is the best explanation I can give you.

The Finance Ghost: So, Pieter, thanks. I think what you’ve spoken to directly there is the culture of the group. Which makes sense, because when you’ve got 170,000 people trying to pull together in a particular direction, then there’s no doubt that the culture has to work. That’s the only way that it’s going to actually come right.

So maybe not something they put in the water at Brackenfell, but maybe an understanding that the water is going to get taken away by the sun, as you said.

And so, you need to make sure that you do all these things properly, which is very cool. Look, whatever the secret sauce is there, it’s clearly hard to replicate – because otherwise your competitors would be doing so.

And they aren’t – because one of the stats in this set of numbers, is, as per Nielsen, you are growing at 2.3x the rest of the market, which is pretty incredible. So I think let’s dig into some of the components of that.

I really want to make sure that we cover inflation properly, so let’s do that now. It’s a key factor in your business.

And before we dig into internal selling price inflation versus official inflation, I just want to make sure for investors – who maybe haven’t worked in grocery retail or aren’t that close to it – why is inflation such an important component of your sales growth as a retailer? As opposed to just volumes growth, for example?

Why does inflation matter so much?

Pieter Engelbrecht: The simple answer would be that you may be growing volume, but the monetary value is not growing in line. So how are you going to cover your costs? Because the cost inflation is multiple times of your topline inflation. And that’s the problem. So that’s the short answer about why inflation is important to us.

The second part of it is, of course, because we’re so customer-focused, we have to be focused on how it affects their basket. So, it’s not all bad. For consumers, low inflation or deflation is fantastic.

In December alone, 14,000 items were cheaper than last year. That’s great for consumers, but we have a cost base to cover, and that’s just when this whole discussion comes in.

And then, you did mention, I never speak about competitors. You mentioned one in the premium market. Their internal inflation was over 7%. We went into deflation in December. And although for the six months, Shoprite Group outgrew the market 2.3 times, in December it was 5.3 times and in January it was 4 times. And this has been a continuation over the last six years, month by month.

So, it’s not a “one swallow” story kind-of-thing. There is a consistency of improvement and execution, and I have to bring it back to the incredible people of Shoprite who can execute like nobody else.

And you know, years ago, we were criticised because we don’t have a franchise model, and why not? Most of the largest oppositions have got big franchise businesses.

Then COVID happened, and after that the KwaZulu-Natal unrest. And at that point, (and I must say, including Sixty60) – it was all part of the same story, really, how the one flew into the next, and the one happened after the other.

But all of a sudden at that point, we realised that our corporate model is actually to our advantage. Because we’ve got real-time information, we’ve got real-time view on stock. And in crises, we can sit here, where I’m now sitting in this room, at that time, we had 4am meetings on unrest, and we’d make a decision, and two hours later, before the sun was up, 3,000 stores would have executed whatever we decided to do.

That strength of that has become what we almost thought was our Achilles’ heel. But it actually became the strength of Shoprite. The fact that we can take a decision, and an hour later I get a thousand photos to show that it’s executed.

Still on the inflation, I mentioned one retailer who’s not price-sensitive, so they can add up their prices as much as they want. But we are a value-retailer in the Checkers brand. It’s still fantastic for me, since last year, that Checkers has become the number one brand in South Africa.

I did say in this morning’s presentation that I know of no retailer, globally, where a food retailer has become a “loved” brand. It’s what we all dream about.

I had wedding photos with a Sixty60 theme…

The Finance Ghost: …I have many photos of my kids on their little delivery bike, I can tell you. “Look, the Checkers man, the Checkers man!”. I promise you. It’s basically a cult. It’s the cult of four-year-olds. And apparently weddings.

Pieter Engelbrecht: [Laughs]. Ya, there’s actually a long story I could tell you around the wedding thing… I wanted to do one on an airplane but eventually aviation didn’t give us approval to do it, they said people weren’t going to follow protocol.

[Laughs]

So those were all natural and sent to me a gesture.

But coming back to the inflation thing: so first we must say deflation. People think prices never come down – that’s a general perception, people think that prices just never come down, they always just go up and up. But it’s not true. There I mentioned, 14,000 items that were lower than last year.

Some of the categories where we over-index, like potatoes, rice, maize, etc. were up to -40, -50%, deflation. So, half the price of last year.

So, I think the South African consumer benefitted a lot from this.

If you sit on the other side – and we’re a publicly-listed company where our shareholders demand performance, dividends, and results – the cost base is a problem.

Without naming or shaming or anything, I live in Stellenbosch, and my rates, taxes, water – my municipal bill – have gone up by 35% this year. Now, I didn’t get a 35% salary increase. So how are you going to pay for that?

And I’m using this example because everybody’s in that boat. You now have to sacrifice something else. Because you didn’t get that kind of increase, that your cost inflation is. And so, we can go through a lot of line items where the cost inflation is just not – the cost of living has increased exponentially in South Africa.

And that’s why I say, when I think about my consumer, I’m very happy for them. We’re trying our best to give them better prices every day. That’s why I say, I know of no retailer in the world that sells a R1 item (6 US cents) for a packet of chocolate biscuits, there are 18 biscuits in the packet, and a packet of chips for R1. And making a kid happy.

That’s what we do. But in the end now we have to try and balance the whole income statement.

And that’s why we were also criticised for that for some time, about the high amount – or maybe it sounds high, but in context – of capex that we spend every year. So, for three years now, maybe even longer, we’ve spent R8 billion a year on systems, technology, AI, you name it.

And I said five years ago, if you’re not going to make those investments, to have a tool and have artificial intelligence and all these things helping you to make the best possible decisions based on your data set…

And there we are very fortunate. We’ve got 34 million customers, extra savings customers. We have an over 90% swipe rate. Over 90% of the people, when they shop, swipe their card. So, we can see what they’re buying: if they are in distress, if they are downsizing, if they are shifting categories, something new is coming, people are buying in a new category, so there is a trend change.

That is why I made this statement to say that the young people, the Gen Zs, they think differently about pets and children and how their lives must be. And much healthier than what we are (or me). I look at my son – and they’re very healthy in terms of what they eat. These days you have to be very alert to what’s on the product list.

People want to know: is there added sugar? What is the protein content? What is the fat? These are all things that the data and all the system investments that we’ve done are helping us with, to give the customer a better experience.

If you then add to that, staff that have a proper customer service inclination, attitude; it makes a strong combination. I think that’s probably the gist of what’s happened in the entire market.

Retail in South Africa is at a crossroads, I think. We can see it in the results, food retail in particular. I’ve spoken about the franchise model. We know about the court cases going on and the fights here and there, but I could see that over time the pressure on the gross margin was incredible on the franchisees, and a lot of them are not making money anymore.

The ones that are doing well are those that own also the property that they trade from. You can then cross-subsidise yourself.

But in general, if I’m a one- or two-store owner, where do I go, how do I monetise this investment? Retail franchise started let’s say roughly about 30 years or 35 years ago. A lot of good retailers left the corporates and opened a franchise, and they built up a fantastic business.

They worked hard, but could build a good life.

Now they’re at let’s say, retirement age, and they want to monetise the investment. How? I mean, you’re talking millions here. A store these days doesn’t cost R1 or R2 million to build and stock – equipment and aircon and generators and you name it. The only probable buyer is Shoprite. But we can’t, because we won’t be allowed to, because of Comp Comm and all of these things.

And maybe while I’m saying that to you, I also want to say that competition will always be there. I don’t think there should be a fear that Shoprite is going to own 100% of the market. I don’t think that is a possibility. It cannot happen.

But even if it had to happen, the one thing I can assure you is that Shoprite will never abuse that position. Our customers and the value that we give them is not changing.

That’s why I get this question quite a lot. Of all the FMCG retailers in South Africa, food retailers, we’ve got the highest gross profit margin. Not because we have the highest prices, everyone can see our prices. You can compare them every day. It’s because of efficiencies, and the way we think about how and what we give our consumers.

Having said that we’re running that kind of margin, people ask me: “But can this go higher?” And then my standard answer is, “I would not like to.”

I think if we can maintain ourselves through thick and thin; difficult and good circumstances; economic growth and not economic growth; if we can maintain our margin and especially our trading profit margin of around 6%, then that’s good. And that’s what we will honour. And then we also know we are also giving the best value to our consumers.

So even in a scenario where, let’s say, the market share of Shoprite grows more, there will never be a situation in which we will profiteer, or not look after the customer’s interest in the first instance.

The Finance Ghost: So much good stuff in there, I could listen to you talk about retail literally all day. There’s a lot of really interesting stuff.

You raised a lot of points there. You talked about the costs that you face, and how important inflationary increases are for that. And municipal rates are just one example. It’s energy costs, it’s security, it’s all that kind of stuff – that makes it really difficult.

And I think I’ve used the analogy before that it feels like in grocery retail, it’s the big snake. It’s the python squeezing the impala. You are the python in case that’s not incredibly obvious to someone listening to this. There are a few impalas, and I think what those impalas all have in common, is exactly the point you’ve raised, which is that they are franchise businesses.

I’ve written a lot about that, and I totally understand that point. To be able to do what you do (including things like omnichannel; Sixty60), you need to know where the stock is, where it’s actually sitting, so that you can fulfil.

I’m okto talk about your competitors, but I remember when Woolworths went and bought up their franchisees all those years ago – that’s why they can still compete with you.

It feels like everyone else who’s trying to actually make this work with a franchise network is really, really struggling. And it’s just fascinating how everything has gone in this direction. It’s such an interesting industry.

I definitely want to make sure we finish on the inflation point with that slide you had, which I know is important to you. I found it very interesting – around how you measure food inflation versus, let’s call it, “official food inflation” – the basket that decisions are made on.

I cannot believe how high our interest rates are in South Africa right now versus what I see on the ground. And I’m guessing you probably share that view, at least to some extent.

So, I’d like you to speak about that, and, you know, maybe someone at the SARB is listening.

Pieter Engelbrecht: I definitely share your sentiment. I mean, we’re so desperate for economic growth in this country. We know that it will change everything. We can’t continue just paying more grants and more grants while we actually pay it with debt. I mean it’s not like it’s money we generate; we borrow that money and it comes with an interest rate.

So, it does bother me that for quite a while now, we have such a big discrepancy between the official food inflation, and what we calculated. And not only us – I also want to refer to my peers. There is so much data available. It’s not that I want to poke in someone’s eye and say, “Listen, you’re doing something wrong”. I’m just questioning, how can we be only 5% different? And all the retailers have the same number, except one?

So, now we are sitting at – the lending rate is now 10.2%. We cannot sit in a scenario where we say, “We’re at 10.2% because we’ve got a target to reduce inflation” and we say food inflation is 4.7%, yet the retailers come and say, “But we are actually in deflation.”

Not only us – we can ask all the manufacturers, (I refer to them as brand owners, all the big ones in South Africa, there are many), and they will tell you the same story. They’ve got the same data.

So, it’s not as if we are short on data to be able to be as accurate as we could possibly be, to then help to make best monetary policy decisions. So that’s actually the big point that I was trying to make.

And then the difference in calculation, to put it very simply, is that the current official CPI on food is a static basket of about 450 items. That was a basket based in the height of loadshedding and that. So that basket looks quite different from what the basket looks like today.

We take – like in December, when we calculate our internal inflation (we do it every month), both cost and selling, we measure 56,000 items that were bought in December, and we then take into account combination buys, multi-buys, promotional items. And then say, okay, what was the price of these 56 items last year in December? And that’s our official inflation.

For me that is the truest reflection of what the real consumer inflation is. What I experience, because I made some choices – I changed brands, I buy more multi-buys, or I’m using my Xtra Savings card. You change your shopping behaviour, maybe you also change your diet – and I have different needs from when the market and the macro environment was completely different.

And that was the point that I just tried to make, is that it does concern me a little bit. Maybe that’s an understatement, but we’re not getting the economy to kickstart.

I said this morning, there are a lot of things that I’m seeing that can assist. I also said, “Hope is not a strategy.” I can’t live in hope that all the money that governments secure from the countries and donors etc. is going to be invested in infrastructure, because that will definitely create jobs, will kick start the economy.

We need the interest rates to come down. We cannot run at an over a 10% interest rate, if our inflation is actually not 5% but actually 1%, or 0.5%. That’s as simplistically as I can explain my thinking to you.

The Finance Ghost: I certainly agree with you about the state of play out there. You can certainly see it better than anyone in the stats that you have.

I think if you just look at how South Africans are spending on areas like online gambling – what is that at the end of the day? It’s the sale of hope. Like you say, hope is not a strategy, but when you are struggling – and we don’t have a large economy and we do not create jobs – then you will try to find that hope where you can.

And a lot of people believe that they can online bet and gamble their way out of it – because that’s what the adverts are implying. It’s very sad, and a lot of it would get better if we could just be a little bit less strict with interest rates.

So maybe someone, somewhere is listening. There I am willing to live in hope.

But maybe let’s move on from inflation then, and monetary policy, into the stuff you can control.

Omnichannel is certainly top of that list now. I recently reviewed Walmart’s results, and Omnichannel has been a huge part of their story. They’ve been telling the market about how profitable it is. It’s efficient fulfilment, it’s having the data, it’s the advertising layer that comes with it – it’s great to see that overseas.

Now, I see a lot of parallels with your business. And I know that you’re maybe not at the point where you’re talking about it as much as say, Walmart is – I picked that up in this morning’s presentation, certainly – but I guess it’s this overlay, right? It’s eCommerce, it’s AI, it’s logistics efficiencies, it’s the way that you can run this business at this incredible gross margin, but without having high prices.

All of this adds up into having, in my opinion, just the perfect machine for omnichannel. I look at what Walmart’s built, and I look at you, and I can see some really good similarities around how you’re actually building this thing out.

So, Sixty60 feels like it’s actually in early days in this journey. I just see it as a fulfilment engine across everything you’re building. Even if it maybe started out as “Get your stuff from Checkers”. Is that fair? To the extent you can talk about it and comment on that – am I thinking about it the right way?

Pieter Engelbrecht: Ja, you’re spot on. But before I go into the omnichannel, something on the gambling thing. I had a different view to one of my competitor’s CEOs. And I then, on Christmas Day actually, acknowledged to him that he was right, because one of the banks shared with us, some information on Black Friday.

Now Black Friday, that is an enormous day for Shoprite. And you know I said in the presentation that we’ve done exceptionally well. So let me just say that on such a day, we’re doing well north of a billion rand, and one of those banks, only one, said to me, on that day, they equalled Shoprite’s turnover in online gambling vouchers.

That blew my mind. I didn’t expect that.

If, on top of the inflation or deflation, you sit that – call it a billion rand or whatever – that should have gone to food or food-related products (or a large portion of it), it’s now gone into a black hole. It is something that needs attention.

I was asked what I’m going to do about it. There’s nothing I can do. I’m not the regulator. It’s not our job. There are people that understand that stuff much better than us. I just wanted to give you that sort of titbit of info.

Back on the omnichannel – we also made mistakes. Not everything we do works and is perfect, we just have this policy of “fail fast”. When we started with the idea of online, you will remember that our competitors have been online for much longer than us – 20 years ago.

But I never liked the concept of a web-based buying platform for food. Here’s how I can explain this the easiest.

So you log in, you’re now into Checkers, then you go where? You want to buy milk. You go to, refrigerated or chilled product. Okay, next click, you go, milk. Next click: there are 14 brands. So which brand are you going to buy? Next click is, what size? 500 ml, 1 litre, 2 litres, 3 litres? Then we go, is it low-fat, 2%, full-cream, skim? Okay, now… finally nine clicks later, I have a (bottle of) milk in my basket. That can mos never work.

The Finance Ghost: [Laughs] That sounds like more work than to go to the store.

Pieter Engelbrecht: But we also started with what the world has been doing. Ocado and them. And we had three distribution centres in the country (fulfilment centres) for pet and liquor. We tried those two. But we failed dismally. Very quickly.

It’s just not a sustainable model in South Africa. Long distances you have to travel, the cost of travelling, and the stock availability. Say somebody orders a bottle of wine from you, let’s say in Johannesburg, but now you don’t have a stock of it in that fulfilment centre, now that bottle of wine has to come from Cape Town all the way to Joburg. It just can’t work.

Then COVID happened, we had this thing: it needs to be app-driven. By then, we had already invested in the systems. We had a real-time view of the stock. What we thought was our Achilles’ heel, our wide spread of stores, all of a sudden became a benefit.

We realised, if we can pick from stores, within 90% of our addressable market we have plenty in terms of our store locations to fulfil from. And my only request at the time was that it was mission-driven.

That’s how we started. We started with like 500 products, and it was mission-driven in the sense that if you want to braai, then we might have ten items), you want to have breakfast, we have a collection of items. That’s how we started, and that’s how it evolved.

Now, it’s become true omnichannel. We have “pet” on there, all the rest of the businesses are coming onto that super-app. You’ll be able to navigate seamlessly between groceries (milk like I just said), to outdoor, to pet, to your pharmacy, your vitamins. So that’s what we’re building.

And then, of course, on top of that, there’s the drive on financial services, and also pharmacare. Because we saw from the data that there’s a tendency among customers. – when we were big in clothing, we learned the same thing – that at some point, without explanation or anything triggering it, customers started to not buy clothing at the hypermarkets.

It almost felt like people didn’t want to buy a shirt for work and throw it into a trolley with their milk and their chicken.

That’s how apparel stores then started to expand, and we saw a lot of retailers going into clothing. And now we see a similar trend in personal care, in health and beauty.

I get the impression that people feel, “Something I’m going to put on my face, doesn’t belong next to the chicken in my shopping trolley.”

Hence why we have this target to increase our pharma footprint. We have Transpharm, the wholesaler, and we have 140 pharmacy licences. So, we’re already in the game, we’re starting to take them out of the stores and into specialised separate standalone stores. And they’ performing very well.

It’s now a question of time, because what’s the best location that any retailer would want? It’s to be right next to Shoprite’s or Checkers’ front door, because they do all that hard work to pull the people there, and then you just fish off that, if you’re close by.

Those are very sought after premises, so it will take us time to get those sites for our own pharmacare ambition.

Then the other part is the financial services. I said that at the end of last year – that we re-platformed the system, and we have in the meantime opened / started / launched (very low-key) a money market account that’s free of charge within our environment. There’s only a charge to withdraw money, a R5 fixed fee. If you compare that to an ATM charge, there’s a big difference, because we expect you to go spend that money somewhere else.

There are a lot of things happening in the financial services world. I want to reverse a step, to say we spoke about the economy, and that the economy has to drive and grow. I think, because that economy has been shrinking, we’re now all meddling in each other’s businesses.

Telkom guys are into insurance and micro-advances; the retailers are going into banking. So we’re all in each other’s businesses, because we are all looking to grow. How do we do that if the economy is not growing?

I think that is what’s been happening in the environment. We’re very lucky that in the last 10 years or so, 8 years, we generated a lot of cash. We were able to spend 3% percent of revenue on capex, and invest in the systems, the supply chain. That has opened a lot of doors for us. It’s a busy place here in Brackenfell, I can tell you.

We have to run here! [laughs]

But I think that is what’s been happening, and we’re in a very fortunate position, such that we could invest, pre-invest to enable us to be in these markets. There are a lot of negotiations and talks going on. As usual, we will tell you, as and when we conclude. Not before. We like to deliver and then we tell you, instead of promising you what we’re going to do.

The Finance Ghost: I actually wrote on X earlier that I’m grateful to wake up in the morning and not run a business that competes with Shoprite. Although now I’m slightly scared you might get into financial media as well, based on that – because it sounds like nothing’s safe.

But jokes aside, you’re right. Everyone is in everyone else’s economic profit pool – and it’s a function of growth.

My thesis is: distribution and brand wins. If people can find you, and they trust you, they will buy different things from you. We know that’s how South Africans behave. So very interesting, what you’re building there.

Pieter, I’m conscious of the time. This is pretty much the end of my slot with you. This has been such a cool discussion.

I guess just last thing, two minutes to just leave people with, an elevator pitch: why should anyone invest in Shoprite? And I think just to couch that, specifically for the long term, because I think this really is the type of investment that you buy and forget. There are not many of them, and this is one of them.

So, the two-minute elevator pitch: why should an investor really feel good about their money being in Shoprite?

Pieter Engelbrecht: I hope I’m not going to go over the time limit you’ve given me, but you know, I want to start with the story that I visited an investor, a very, very large fund in Boston in America.

I met the CEO. They gave us some sandwiches for lunch, and he came in and he said to me, “Hello Pieter, let me just explain to you where you fit in my world. We are an over trillion-dollar fund.

Okay – I can’t even count to that. They said, “I think it will take you 36 years if you had to count to a trillion, if you count every second.”

36 years. I don’t have 36 left!

He says to me, “Out of this trillion dollars, 3% of our portfolio is in EMEA (you know Middle-East, Africa etc.) and in there is South Africa, and in South Africa is Shoprite. So you’re actually nothing in my life. “

I said, “Thank you for the lunch, I really appreciate that, it’s all good, I’ll go back home now.”

He said, “No, I’ll tell you one thing – the only share that I own in South Africa is Shoprite.” I said to him, “Why? Have you been to South Africa?” He says “No, but I can read.”

That’s where the saying of mine has came from, is actually that man. He said to me, for him, “Shoprite is not a retailer that sells stuff. It’s an institution.”

That is the message that I actually want to give.

Shoprite is not a cheap share. It’s like Warren Buffett said. If you buy a good share, you’re going to pay for it. If you want to speculate the market, then Shoprite is probably not your share to buy.

But what is that Shoprite offers? Stability, consistency, the brand equity by itself. It’s not for nothing that it’s the number one brand in South Africa.

And afterwards I asked myself, “Pieter, can you imagine South Africa without Shoprite?” Think about the suppliers, the farmers, that whole value chain – it’s not possible!

And that’s why I say Shoprite is a good investment.

The Finance Ghost: I think that gets the message across pretty well. It’s not my time limit, I could speak to you all day, but there are members of your team there who will come and hit me on the head if I use more than my slot. Because you are a man in demand, everyone wants to speak to you today, and understandably so. So, we are going to have to leave it there.

Pieter from my side, and to the team on that side, just a big congrats. It’s really fun to write about Shoprite, I get a big kick from it strategically, I get to see lots of similarities to what other retailers are doing overseas – like the best in the world, kind of retailers. So well done, congrats.

I hope this will only be our first podcast rather than our last podcast, because I’ve really enjoyed it and you’ve got so much to share. All the best for the rest of the discussions today, and certainly for the trading conditions that you’re in at the moment.

Thank you so much.

Pieter Engelbrecht: You’re very welcome and I thank you very much, also for your time. We appreciate that.