The Trader’s Handbook is brought to you by IG Markets South Africa in collaboration with The Finance Ghost. This podcast series is designed to help you take your first step from investing into trading. Open a demo account at this link to start learning how the IG platform works.

Listen to the podcast using the podcast player below, or read the full transcript:

Note: examples used in this podcast should not be interpreted as advice. They are for informational purposes only.

Intro: Welcome to The Trader’s Handbook, a limited podcast series brought to you by IG in partnership with your host, the Finance Ghost. Over the course of our upcoming episodes, we are delving deep into the world of trading, helping both novice and seasoned traders alike navigate this exciting field. Join us as we unravel the intricate strategies and insights that define this dynamic landscape and the beautiful puzzle that is the markets. IG Markets South Africa is an authorized financial services and over the counter derivatives product provider CFD. Losses can exceed your deposits.

The Finance Ghost Welcome to episode six of The Trader’s Handbook and thank you for making time for us in your busy week. This is a great podcast series that I’m collaborating on with IG Markets South Africa. As ever, Shaun Murison of IG is here with us to share his endless insights into trading. And I must say, I have already learned a lot actually, and the results are starting to show in my demo account, although it does seem to depend on when I open it. Some days look better than others – welcome to trading! Anyway, perhaps more on that later. Welcome, Shaun. And you must be pretty excited to talk about some of the topics we’ve got lined up today, like technicals and trading signals. I mean, this is very much your wheelhouse, isn’t it?

Shaun Murison: Yes. Great to be here again, and that’s my favorite thing to talk about. Obviously, technical analysis is something that I do believe in and something I employ in my personal trading. Yeah. Excited about this one.

The Finance Ghost: Fantastic. I know you had a rough morning of traffic following the trend of people driving to work, trend following in the markets is definitely a bit more fun!

I’ve certainly learned over the past couple of months that trading is actually very different to investing. I obviously knew this to some extent, but I think you have to actually experience it to know for sure. And that’s why the demo account is just so important. We keep encouraging people to open one and give it a bash themselves because you really need to see this stuff play out real time as the strategies are different.

Speaking of time, the time horizons are really different. My background is very much one of investing, not trading. This is a new skill for me. Investing is a much longer time horizon than trading. In trading, this means that being tactically correct seems to be more important than getting things strategically right over the long term.

I’ll give one recent example from my demo account. I took that advice of actually focusing more on what the trend looks like and a little bit less on what I think this company looks like ten years from now. I went long Telkom in my demo account. I don’t think I would dream of being long Telkom in my investing account, but the trade worked magnificently to be honest. The reason I did it is because I looked at these South African stocks that had already run in the post-GNU euphoria and Telkom was left behind. Honestly, nothing had happened in that share price and it didn’t really makes sense to me.

If the whole of SA Inc has moved up, logically why didn’t Telkom? I had it on a watch list and then I learned that ideally you need to wait for some kind of confirmation that you’re not the only person in the world who thinks this way. Doesn’t help to be, you know, the only penguin in Antarctica who thinks something. You need to have a whole lot of other people believing much the same thing, because that’s what makes a market move. And when I saw it start to have some positive momentum, I went for it and I’m bearish telcos in general. So that’s why I say this is a good lesson for me in trading versus investing, because I wouldn’t be long Telkom any other way. But it doesn’t matter when you’re trading – what you’re looking for is what the chart is telling you and the momentum.

Of course, the skill to develop in that space, or at least one of the skills, is to understand technical indicators. That’s how traders do a lot of the work that they do. I think it’s actually quite useful for investors, too. I firmly believe that even for a dyed-in-the-wool long term investor, it’s very foolish to ignore some of what you can learn from traders, because why wouldn’t you try and time your entry point a bit better, you know? And Shaun, you said a few times before on this series that markets are basically a voting system, which is something that has definitely stuck with me. How does this actually relate to technical indicators? Why do these things actually work and do they work?

Shaun Murison: Look, the subject is very broad and I think there are some concepts that work better than other concepts. But when we talk about a voting system, if you are subscribing to the idea of technical analysis or using technical analysis, the summation of those votes would essentially be the price. To me, when you’re looking at technical analysis, your price is your best indication.

The first technical indicator that you should look at, because if you think about it very simply, is price – that share price, or that FX price, or that commodity price is aggregating all the data out there. Rational investor, irrational investor, retail trader, asset manager – it’s summarising all that information and spitting out a result, and that result comes out in the price.

Technical indicators are generally derived from price or volume, or price and volume. It makes sense as a starting point to look at that price information because it will spit out a result and that will result in a trend. Then we say, okay, well, the market’s in an uptrend and we can assess what we think we should do next. When we see prices turning from down to up, essentially it’s giving us an indication that selling pressure has reverted to buying pressure. It’s a major turning point where buying has come into the market. I think good technical analysis will reflect what’s happening fundamentally in the market. It’s our job just to just try gauge that general direction using these indicators and hop on board.

The Finance Ghost: For those who aren’t familiar with what technical indicators actually are, let’s compare it to fundamental analysis which is very much about digging into the company’s income statement balance sheet, their outlook, a lot of what they are saying, looking at stuff like margin trends over the last couple of years. That’s something that I always do. I look at what’s happening with working capital etc. – it’s very much this deep dive type of thing. And obviously the depth varies. You get people who really do go and read as much of the financials as they can. I very much apply an 80-20 principle because the amount of time it would take me to read every company to that level of depth is going to more than offset the benefit I would get from it, because time is the only truly finite resource in this world.

Technical indicators, that’s something completely different, actually. That is very much based on share price charts. It’s looking at how the price is moving, not necessarily what the underlying company is actually doing. Is that the best way to summarise the difference between the two? Because not everyone will be familiar with this concept of technical indicators.

Shaun Murison: Yeah, it’s summarising everyone’s assessment and how they’re taking action on that share, rather than looking at those fundamentals that are driving price, we’re looking at actual price, the result of how people are interpreting those fundamentals.

The Finance Ghost: When I started to realise that technicals are well worth paying attention to, I’d look at how a share price would move in relation to something like earnings coming out or whatever the case may be, and the thing would move 3%, or 6%, or 5%. It’s hard to make a case for why it was 3%, or 6%, or 5% on a fundamental level. But then you go look at the chart and you see, hang on, that’s really interesting, this thing dropped down to levels where I’ve seen it trading in the past year. And isn’t it interesting how it seems to drop to those levels quite often and then turn higher? In your world, Shaun, that would be a support level. If you look at enough charts, you can see a lot of this stuff is real. It works, it’s out there, I can see it. And that’s what makes it, I think, quite exciting.

I would imagine that some of the technical analysis then turns into this concept of trading signals. I always get that horrible image in my head of the classic “selling forex” trading courses advertised on the side of a Mercedes AMG, that Instagram cliche. That’s obviously not what this is. We’re talking about proper trading here with a reputable, licensed, proper place. But let’s get into trading signals and how these relate to technical indicators. Are these things actually related or are they completely separate concepts?

Shaun Murison: Okay, so I think you’re referring to IG signals, trade ideas generated in the platform. If you log into the IG platform, we have a whole lot of tools to help you analyse the market. Client sentiment indicators generally show you how clients are placed on a position – majority long or majority short. We have fundamental data. You can access balance sheets, income statements etc. and then technical analysis tools as well. Now, the signals function is shorter-term trade ideas, which are generated using technical analysis indicators. Those are third party experts and they look at different asset classes. Those trading signals are related to technical analysis or technical indicators.

The Finance Ghost: Yeah. And the point is, there’s a lot of stuff sitting behind it, like client sentiment, a lot of that data that you guys have. That’s why I want to clearly differentiate this from some of the real nonsense you see on social media. It’s quite damaging, I think, to the entire industry when I see stuff like that. I actually see less of it these days. I don’t know if it’s been clamped down on. I’m really hoping it has, because it’s super damaging, maybe it’s just not so much on Twitter or X now because it gets shut down. I’m sure there’s still plenty of it on Instagram and goodness knows where else, probably on TikTok. But I think that process in the background to create these trading signals must be pretty interesting, actually. Things like measuring the sentiment, etc. Who do they get sent to? How often is it and on which devices? Is this something that every IG client gets their hands on? Is it something that is ever made available to non-clients?

Shaun Murison: Those trading signals all generated under the signals tab on the IG trading platform are third party research, generated by companies PIA First and Autochartist, independent analysts with decades of market experience. To get those ideas, you would need to log into the IG platform on your computer or on your mobile device. If you’re not an account holder, you still have access to something like a demo account where you can still access that same data and all the client center data and all those other things are also still there, even if you don’t have a trading account with us. So, yeah, it is accessible via the demo account system.

The Finance Ghost: Just on the subject of devices, what is the option to trade on a mobile, on IG versus desktop for example?

Shaun Murison: I mean, with an IG account, you can access the markets through your trading app, or you can download an app directly to your phone. It’s the same account, it’s just linked and in different formats. Obviously, on a laptop, you have access to a little bit more in terms of research and capabilities. The screen’s bigger. You can do more on a computer than a small screen via mobile device. But most things are accessible on either mobile or the mobile app, or from your trading platform on your computer.

The Finance Ghost: Yeah, I’m also a little bit old school when it comes to screen size. My mobile is still not something that I run my whole life on, unlike some people who I know do get that right.

Shaun Murison: Yeah, I mean, you can see that appetite for mobile trading has grown. I think more than half the transactions done through trading through an IG trading account are now via mobile device rather than from an actual computer. People like to be on the go. They like to watch their charts and stocks and portfolio from anywhere and don’t have to be logged into their desktop.

The Finance Ghost: I imagine a lot of trading going on in the back of Ubers on the way to somewhere else and all sorts of things. Fascinating. So just one more question on these. Well, actually, a couple more questions on the trading signals. I don’t think we’re done with that quite yet. And one of them is in terms of which markets these are actually available for. Is this across the whole set of indices, forex stocks etc? I know my background is stocks, so I tend to frame everything in that way, which is actually not right. And that’s something that, as we go through the series, we’ll need to actually lift the lid on some of the other stuff you can do, forex indices etc. There’s certainly more to life than single stocks, shockingly for me!

Shaun Murison: I think we should talk about some of those other products on one of the future podcasts because there benefits to some of the other asset classes. Certainly cost would be one of them.

But in terms of, you know, what markets trading signals are available for, it’s generally forex, gold, oil, broader commodities indices. There’s not the whole suite of shares offered on trading signals at this point in time. The other analysts and I do provide trading views on a number of companies and that would be content created for the IG website, whether in video form or in written form.

The Finance Ghost: Okay, perfect. And the reality is no one can get every single trade right. Absolutely no one. It’s one of my pet hates, when I see some of the really rubbish online content. It’s just nonsense. No one gets every trade right. Anyone who’s telling you they do is full on lying because the markets are not that easy. So in terms of these trading signals, I guess it’s a hard question to answer, but how reliable are they really? Maybe asked differently, what is a good win rate for a trader? And do these trading signals tend to drive those kind of percentage win rates? I know it’s a tricky question, but I think it’s important that people understand that just because you get a trading signal doesn’t mean it’s going to work every single time.

Shaun Murison: Yeah, look, past is not indicative of future. I mean, obviously you read that everywhere.

The win rate can be misleading because if you say that, it really depends on the type of strategy you’re employing, right? If you’re trading and you have a higher win rate, then what are your losses relative to the profits? If you’re taking small profits and running big losses, that system is still not going to be profitable, even if you’re right more often than you’re wrong. On the flip side, you might have a situation where you’re only right 40% of the time, but you’re making a hell of a lot more money when you’re right than you’re losing when you’re wrong. A system like that can still be profitable and there are a lot of different ways to view it.

But in terms of the trading signals that are offered on that platform, I think they vary in terms of success rate across different asset classes. They’re there to teach and I always encourage people to do their own analysis first and use that as a cross-reference. If you are interested in those signals, maybe just look at them on the asset classes that you’re looking at trading. Run them forward, compare them to analysis and see how you find them. If you find that they’re not working out as well relative to your approach to the market, then, well, you could do the opposite.

But I’d say just track it if that is something of interest to you.

The Finance Ghost: Yeah, it’s quite funny to think of people just basically doing the opposite. I remember in my investment banking days I spoke to someone on the desk and I remember them saying they had this favourite analyst because he was always wrong. I thought, but that’s terrible! And they were like, no, no, no, it’s great because he’s always wrong. It’s fine, just be consistent. If you’re always right, if you’re always wrong, I can work with that. It’s when you get it mixed then it gets a bit harder.

Shaun Murison: Look, just on that, we know the stats on retail traders and we post them on the website. We have those client sentiment wheels on the platform as well. And so when you look at those client sentiment wheels, some people say, well, you know, that can be seen as a contrarian indicator as well. If the herd is going long, maybe it’s time to go short on something. If the herd is going short, maybe it’s time to go long, but that is obviously in the public domain and obviously IG is one of the biggest in the world. In terms of the retail sentiment that we provide to our clients in that platform, it is quite an interesting indication.

The Finance Ghost: I’ve learned the hard way, as we’ve shared on previous shows, that contrarian short and contrarian long are not the same thing. I think the contrarian longs, you’ve got a lot better chance of coming out okay. Contrarian short is properly risky stuff.

I would refer people to that pairs trading show that we did previously, which is a very good way to take a short view on something, but to change that trade a bit by taking a long view on something else. That pairs trading show was cool, and I’ve actually done a pairs trade now. We’ll see how that one plays out.

I think let’s get into some of these technical trading indicators. Now, obviously, we recognise it’s not so straightforward on a podcast to talk about this stuff because ideally you need to see a chart in front of you. What I’ll do is I’ll make sure that in the show notes, there are one or two examples, and then you can go find that on the website. Go check it out.

We’ll start slowly with the technical trading indicators, as we do need to cover them. And what I think we should cover first is maybe just the basics like trend indicators as a nice place to start. Something like moving averages, for example. I’ve seen shorter term ones, like 20-day. I’ve seen longer term ones, like 200-week moving averages. Just work out how long 200 weeks is – that’s a very long time worth of market data.

Why are these things useful, Shaun? I know they’re useful because I’ve seen them referenced enough times, and I’ve seen stocks behave in a certain way relative to those moving averages. Obviously not every single time, but they do seem to be a pretty useful indicator. So how do these things actually work, and why are they helpful?

Shaun Murison: Okay, so let’s start off with the moving averages. Earlier on, I said most technical indicators are derived from price activity, whether it’s a share price or commodity price. And so, when you look at a moving average, it’s just smoothing out that price data. It’s averaging out the price data. If you looked at a 20-day moving average, it’s an average of the last 20 days of share price data, which would be considered shorter term. If you’re looking at a 200-day moving average, it’s considered a little bit long term when you’re looking at the short term trading type environment.

And just a simple application of that as the way to assess what’s happening in the market: what is the trend?

If the price is above that moving average, the trend is up. If the price is below the average, that trend is down. We make a habit in technical analysis of trying to follow the general trend. That’s just one gauge that you can use to help assess that trend. When you’re talking about moving average crossovers, that’s a little bit fancier here. We add two moving averages to a chart, and we’re looking for shorter moving average to cross above that longer term moving average, let’s say 50 above the 200, and say, well, those two trend lines, it’s a stronger signal that there’s an uptrend in place.

Source: A Traders’ Guide to Moving Average (MA) Strategies | IG South Africa

Coincidentally, that’s actually a famous signal: the 20 above the 50. It’s called the golden cross. This is supposed to be quite bullish for markets. Inversely, when that 50 crosses below that 200-day simple moving average, that’s supposed to be a bearish signal, a negative signal for markets referred to as the death cross.

For me, the way I use it is that I know that the trend is up, but it might not be an indication for me to get in right now. It’s saying which side of the market should I be on when I get in? And I might use other technical tools like price levels or other indicators to time buy signals into an uptrend or time sell signals into a downtrend.

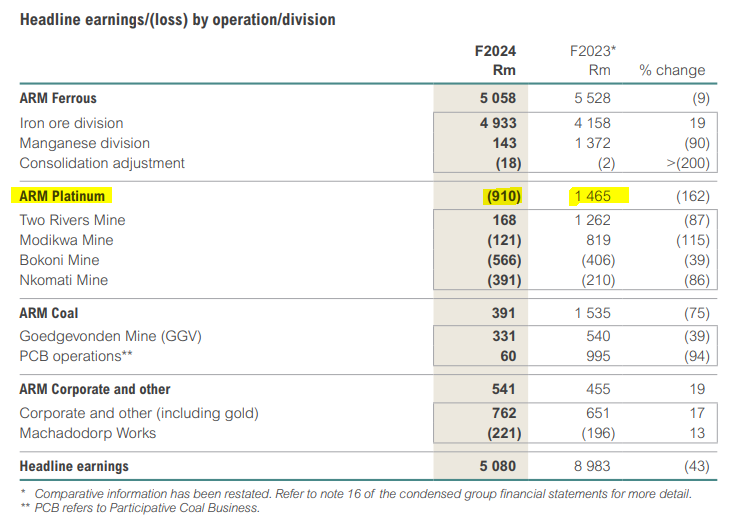

The Finance Ghost: Yeah, the opposite of the golden cross, usually called the death cross – and maybe given where the PGM sector is at the moment, it should be a golden cross and a platinum cross on the way down! PGMs have taken so much pain, we can just keep the commodity theme in there.

These things are useful, and if you see them play out on a chart, you’ve got to actually practice with the stuff – you’ve got to see it in the flesh. It’s very, very hard to believe that just adding some kind of moving average to a stock price chart really helps you, but it does. That is the reality.

Practically speaking, how do traders actually do this? For example, on the IG platform, can you go and add all of these moving averages to any stock price chart, or do you need to do it somewhere else as part of your analysis and then bring that through to executing a trade?

Shaun Murison: No, moving averages, like a whole host of technical indicators, are available on the IG platform. It’s just a matter of clicking on the indicator tab, adding it to your chart, and it obviously automatically computes that for you. You just need to change the settings. Maybe you prefer using a 200-day moving average, then change the setting to 200. It’s an automated process. You can do it on mobile, you can do it on the platform. Very, very easy.

The Finance Ghost: Yeah, perfect. And that’s where you start to see people posting these very intricate charts online. If you’ve followed any of the good accounts on this, you’ll often see them post a chart where it’s not just a share price, it’s often got a whole bunch of other lines on it. If you’ve always wondered what those are, the various different lines, one of them is almost certainly going to be a moving average because it is quite a commonly used technical indicator. It’s got to be one of the most commonly used ones, right?

Shaun Murison: Yeah. The very, very popular one is a 200-day moving average on a daily chart. The saying goes that the bulls live above the 200-day moving average and the bears live below the 200-day moving average. It’s just a simple filter for a longer-term view on the market in terms of which side of the market you should be on, which way you should be trading the market.

The Finance Ghost: Yeah, that makes a lot of sense. It goes back to that point about being contrarian. If you are sitting above that average and you’re feeling bearish, you’ve got to understand that you are doing something different to pretty much everyone else and you need to be careful. It doesn’t mean you’re wrong, it just means you need to be careful. All comes down to risk weightings, right?

I think let’s do one more technical analysis piece just to end the show. And that is the MACD or the moving average convergence divergence. Now, this is starting to sound quite fancy, of course, and it uses moving averages and a histogram. What we’re just trying to show you here is that drawing a basic 20-day is a very entry level step into technical analysis. There really is a lot more that people can do. And again, you know, this is something that I saw on that academy article, which I’ll post the link to, but I think just high-level, this is a nice example of how fancy some of the moving average analysis can get. It’s a nice place to end off and leave people wanting more in terms of how interesting this stuff is. So, more or less an explanation of how MACD works, what is the thinking behind this thing? Is it widely used? Is it a bit niche?

Shaun Murison: Okay, so the MACD is one if you want to impress your friends. You could add it as a chart and there’s a lot going on there. But like you said, MACD stands for moving average convergence divergence. It’s actually not that difficult when you break it down. It’s just showing you the relationship among multiple moving averages. You’ll see there’s a zero line on that indicator. And when that blue line, the MACD line, crosses above zero, it’s saying that these two moving averages are crossing in a positive fashion, the assumption there would be the market’s in a positive trend. When that blue line crosses below the zero line, it’s saying that there’s a negative cross of those two moving averages and so bearish assumptions for the market.

Source: How to Use the MACD Indicator when Trading | IG South Africa

In the simplest of forms, MACD is actually moving averages just represented differently on your chart. Instead of putting a moving average on the price or overlaying it on the price, it’s a separate indicator window at the bottom. But it is mathematical formulas and it’s a different representation of moving averages.

The Finance Ghost: When you say MACD, it just makes me hungry! I think of the Big Mac Index, which is for purchasing power parity. Maybe the golden arches should be a technical indicator there as well somewhere?

Shaun, I think it’s really been a great show and a very nice intro to just some of the concepts in technical analysis. Obviously, we’re going to talk through more of them. I think we’ll try and build it into different shows rather than having literally 25 minutes straight of technical analysis. But we’ll see how it goes because it can be quite hard to follow if you’re not sitting there with the charts. And the last thing I just wanted to raise, I alluded to it earlier, that I’ve done a pairs trade now, so we’ll see how it works. I decided to go long Nedbank short Standard Bank, so short the “better” bank and here comes my contrarian side. In a pairs trade, you need to be contrarian because you need a gap to close. Nedbank was sitting on a single digit P/E when I looked. Standard Bank has enjoyed a better valuation and a big part of my thesis is just the sheer amount of selling by Standard bank directors recently.

That’s not a technical indicator, but it is something that investors use a lot and I think traders should look at as well: what are insiders doing? And you’ve obviously got to differentiate between someone just taking share options and bombing them into the market to pay their tax or even just selling all of them. That is a signal, yes, but I think it’s when people have been hanging on to shares for a long time and they start letting them go at a time when other stuff looks a little bit worrying as well – that’s a very nice indicator.

Some of Standard Bank’s challenges include their China exposure at the moment and some of the African currencies they’re exposed to. Let’s see what happens.

As I said, it’s in my demo account. I’m going to see how it goes. It’s one of those trades where you have to have a strong stomach, like so many. The first day I looked, it was thousands in the green and then I looked again and it was in the red. But that’s just how it goes. That’s why you need to make sure your position sizing is correct. And that’s why the demo account, I think is just so important as a starting point for anyone.

I’ll finish there and just refer people to go and open that demo account, give it a go. Go back and enjoy the other shows in the series. There are a good few of them now. Shaun, as always, I look forward to doing the next one with you. We can see whether my pairs trade is working out or not. We will no doubt also have a look at a bunch of other great things. For now I was happy to bank the Telkom money, so thank you for teaching me something about the importance of following a trend in trading and putting some of my fundamental hats back in the cupboard. I’m not trying to own this thing for ten years. Sometimes, I’m trying to make a quick buck, literally, and move on.

Thank you very much for all the insights and as I say, really looking forward to the next one.

Shaun Murison: Cool. Thanks for having me.

CFD losses can exceed your deposits.

In our gorgeously diverse country. There really is a new reason to trade every day. Current affairs to political news can make the markets move and cause volatility, which can be advantageous to a trader. Diversify your portfolio by opening a trading account with IG and explore the possibilities of CFD trading or practice your trading skills on an IG demo account.