Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

A major win for Coronation against SARS (JSE: CML)

And indeed, a win for corporate South Africa

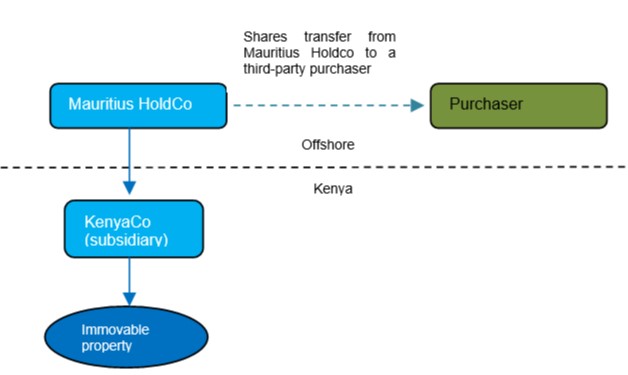

This is the news that many had been waiting for. The Constitutional Court delivered judgment on the landmark tax matter between SARS and Coronation, with Coronation as the victor. This has important ramifications for offshore structures put in place by local corporates.

The full impact of this matter was R794 million, which Coronation had provided for in full. This is a great windfall for shareholders, especially as the SARS fight had ruined the Coronation dividend for a year. Investors will be very happy to see this cash kept within the company (and hopefully paid out as a dividend) rather than paid to the tax authorities.

Insimbi is selling two underperforming businesses (JSE: ISB)

And there’s an innovative structure to help the buyers pay for them

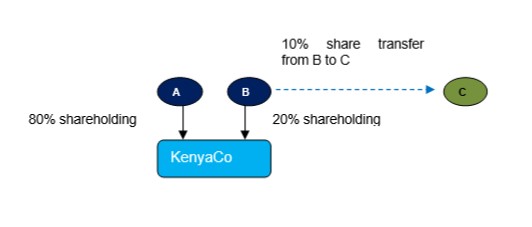

In listed companies, we are quite accustomed to seeing asset-for-share transactions. In these deals, the companies buy assets (usually private companies) and pay for them by issuing shares to the sellers. In Insimbi’s latest announced deals, they are doing things the other way around.

The core outcome here is the disposal of the AMR Booysens Business and the AMR WR Business, both of which are underperforming. The trick is that the disposals are linked to specific repurchases of shares from shareholders who are related to the buyers of these businesses. Effectively, most of the proceeds from the specific repurchases of shares will be used to pay Insimbi for the businesses.

In both underlying transactions, the repurchase price is R1 per share. Insimbi closed at R0.80 on Friday but has a 52-week high of R1.35, so the repurchase price isn’t as silly as it may look. This is an illiquid stock where the price can move significantly in a single day.

The repurchases represent 11.41% of Insimbi’s total shares in issue, with a total value of R43.05 million. Insimbi will get back R30 million for the disposals, so the shareholders in question are pocketing a net R13 million from these transactions. Frustrating as that may sound, these businesses are currently making losses, so shareholders need to think about the long-term picture.

This is certainly an interesting structure, with Mazars Corporate Finance appointed as independent expert to opine on the deal. The opinion will be included in the circular.

Motus gave an important strategic update (JSE: MTH)

Proper capital markets days are thin on the ground in SA, so pay attention when you see them

Listed companies need to meet a minimum disclosure requirement under regulations, but nothing stops them from going beyond that. Although very few take the route of hosting capital markets days and really talking to the market, there are those that do. This is to be applauded, with Motus as the latest such example.

The full presentation is available here and I recommend checking it out.

The group targets 65% of EBITDA in South Africa and 35% from international operations. They also target 50% of EBITDA from vehicle sales and the other half from non-vehicle sales. In both cases, they are currently in line with these targets, so no major changes are expected there.

The acquisitive activity has been focused on building out the international arm of the business, which makes sense when the group has its roots in South Africa and has roughly 20% market share in its home market for vehicle sales. Beyond the UK and Australia in terms of vehicle sales, the business that really has them excited is the aftermarket parts business in the UK and Asia. They call this the best growth potential for the group.

Of the many slides in the deck, one that jumped out at me deals with a structural shift in the South African car parc. That’s not a typo – this is the correct term for the total number of vehicles on the road in a given country or segment. With owners keeping their vehicles for longer (and often financing them over a longer term), there’s more demand for value-added products and services. This is a great opportunity for Motus, with strategies in place to develop products (e.g. telemetry) and markets like insurance. They even manage to bring the buzzwords like AI and machine learning into it!

Overall, the flavour of the strategy is to build annuitised revenue streams that are less cyclical than new car sales. Aftermarkets parts and value-added services sit squarely in this strategy.

Remgro has confirmed that Mediclinic is still very boring (JSE: REM)

Margins are down and earnings are flat

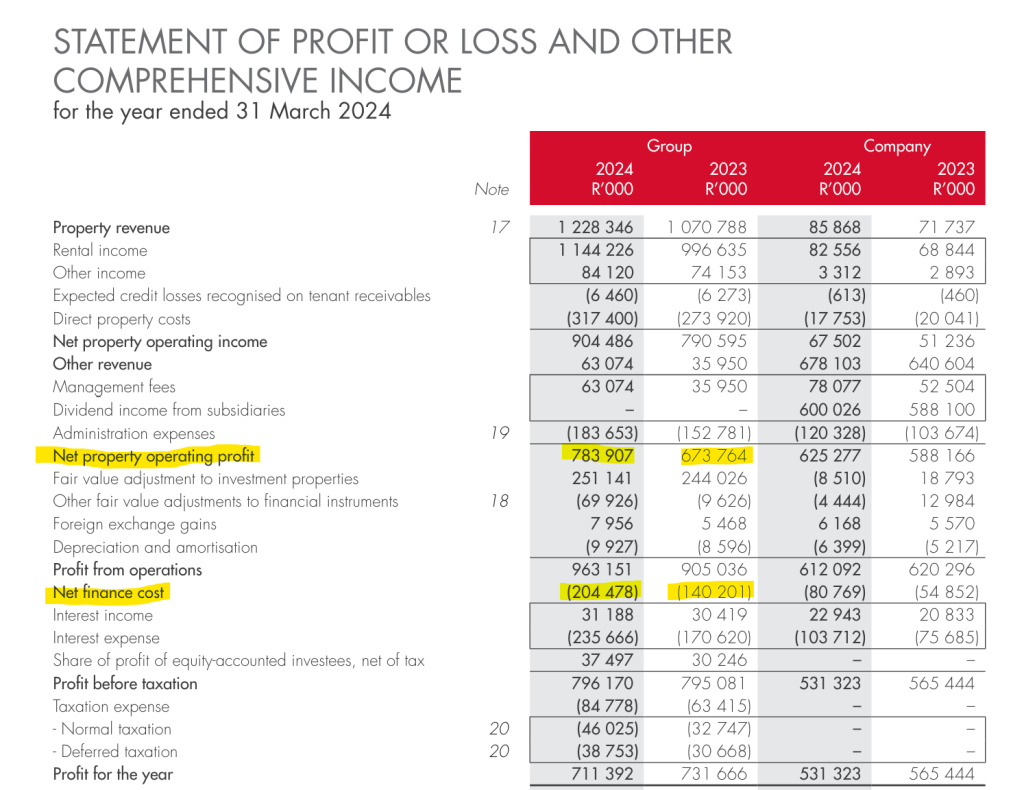

Hospital groups generally confuse me from an investment perspective. Although you would expect them to be licences to print money, the reality is that return on capital tends to be sub-par. Despite this, Remgro was happy to take Mediclinic private along with its consortium partners. The latest numbers for Mediclinic (covering the year to March 2024) have done nothing to convince me that this sector is interesting.

Group revenue may have increased by 5% at Mediclinic, but adjusted EBITDA was down 2%. Adjusted EBITDA margin contracted from 15.8% to 14.7%, with margins in both Switzerland and South Africa going the wrong way. At least margins in the Middle East were slightly up. Adjusted earnings came in flat in dollar terms for the year.

The second half was an improvement on the first half of the year, so perhaps some of that momentum will be carried forward. Even then, I just don’t see the appeal of hospital groups as equity investments.

Spear is recycling R160 million worth of capital (JSE: SEA)

The buyer for this property is The City of Cape Town

Spear REIT is selling 100 Fairway Close for R160 million to The City of Cape Town, which also happens to be the current tenant. This is an exit from a commercial office building, which Spear is happy to do as part of optimising the portfolio in the context of the pending Emira Western Cape portfolio implementation.

This also creates further headroom on the balance sheet, which is important as part of the broader funding and planning around the Emira deal. After this disposal, Spear’s loan-to-value will be between 23% and 23.5%. The strategic target for the loan-to-value ratio is between 38% and 43%, with management looking to operate at 39% on a go-forward basis after the Emira acquisition.

The yield for the disposal is 9.8%. This reflects some of the challenges in the office sector, even in Cape Town. The price of R160 million is identical to the value at which the assets were carried as at February 2024, the date of the last published annual financial statements.

Vunani suffers a sharp decline in profits (JSE: VUN)

The fund management and insurance businesses are to blame

Vunani had a year to forget for the 12 months to February 2024. HEPS has plummeted from 30.1 cents to just 7.4 cents. Despite this, the final dividend was only slightly down from 11 cents to 9 cents.

The decrease in profits wasn’t because of some kind of non-operating adjustment. Alas, operating profit tumbled from R124.6 million to R55.2 million. A combination of a drop in income and an increase in operating expenses did the damage.

If you look at the segmental results, there’s still no turnaround in sight for the institutional securities broking business, which made a loss of R12.4 million this year after a loss of R9 million in the prior year. Insurance also swung into losses, with a result of negative R7.6 million vs. positive R10.3 million in the prior year. A blow was also dealt by the fund management business, which saw profit drop from R21.2 million to R9.5 million.

It was only the asset administration business that made a decent, consistent contribution. Profit was R34.6 million this year vs. R33.7 million in the prior year.

If Vunani was serious about creating shareholder value, they would’ve at the very least walked away from the institutional securities broking business by now. Instead, they are willing to still carry those losses for some reason, which really doesn’t work when the rest of the group also goes the wrong way.

Little Bites:

- Director dealings:

- There are some very large disposals of Dis-Chem (JSE: DCP) shares by directors and prescribed officers. An associate of director Stanley Goetsch sold shares worth R165 million. Saul Saltzman sold shares worth R38.4 million. Christopher Williams sold shares worth R51 million. They sure weren’t shy to take advantage of the recent rally in the shares.

- A director of Investec (JSE: INP | JSE: INL) sold shares worth £1.34 million.

- As part of the related party deal for Novus (JSE: NVS ) to acquire Bytefuse, an associate of the CEO of Novus received R10.8 million in Novus shares in exchange for the shares in Bytefuse.

- Jan Potgieter, ex-CEO of Italtile (JSE: ITE), sold shares worth R2 million.

- An associate of a director of Safari Investments (JSE: SAR) purchased shares worth R1.1 million.

- A director at City Lodge (JSE: CLH) sold shares in the company worth R132k.

- In a trading statement for the year ended March 2024, Marshall Monteagle (JSE: MMP) flagged a major jump in HEPS from negative 4.4 US cents to positive 5.8 US cents.

- Castleview Property Fund (JSE: CVW) released a trading statement for the year ended March. It reflects the final dividend per share as being 42.147 cents per share. This is well more than double the comparative period, but Castleview went through so much restructuring that I wouldn’t put too much focus on the year-on-year move.