Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

African Rainbow Minerals to take a 15% stake in Surge Copper Corp (JSE: ARI)

Surge Copper is listed on the TSX Venture Exchange

From time to time, listed companies invest in other listed companies. This can be for portfolio diversification or more strategic reasons. In this case, African Rainbow Minerals has invested in a 15% stake in Surge Copper Corp, which is listed on a couple of exchanges including the Venture Exchange on the TSX (Toronto).

The subscription price works to an 18% premium to the 20-day VWAP. Before you panic, this isn’t very unusual. To build a 15% stake through on-market buying would inevitably be even more expensive, as the price would run higher in the process.

This looks like an early-stage mining group that owns the Berg Project, which has a Preliminary Economic Assessment showing an IRR of 20% (that’s in Canadian Dollars) based on copper, molybdenum, silver and gold resources. The company also has a 100% interest in the Ootsa Property, an exploration project which has similar resources.

This gives African Rainbow Minerals exposure to low-carbon energy transition metals.

At BHP, Blackwater has been bought by Whitehaven (JSE: BHG)

Clearly, names related to colours are in!

BHP Group and Mitsubishi Development each owned a 50% stake in a joint venture that in turn held the Blackwater and Duania mines. Whitehaven Coal has now paid $2 billion in cash to acquire those mines. There’s a preliminary adjustment of a further $44.1 million to be received from the buyer. A $100 million deposit was already received in October 2023.

On top of this, $1.1 billion is payable by Whitehaven over three years, with a potential further $900 million in a price-linked earnout structure. The earn-out is a maximum of $350 million each year for three years, with a cap of $900 million overall.

The total cash consideration for the deal is thus up to $4.1 billion, plus the completion adjustment amount of an estimated $44.1 million. Half of the net proceeds would be attributable to BHP.

Calgro M3 locks in Bankenveld District City (JSE: CGR)

This is a major boost to the development pipeline

First off: where on earth is Bankenveld District City? I’m hoping this video I found on YouTube is an accurate representation of what they are actually building, but at the very least it gives you an idea:

Calgro M3 is entering into a joint venture with Eris Property Group to acquire a strategic land parcel that will deliver between 20,000 and 30,000 housing units alongside commercial, retail and industrial spaces. That’s a huge opportunity. Calgro M3 and Eris will share the cost of the infrastructure installation (34% of the land), whereafter Calgro M3 will do the residential development and Eris will develop the rest.

Clever, isn’t it?

As at August 2023, the project pipeline at Calgro M3 was 20,239 units. This deal therefore more than doubles the project pipeline, with more than R18 billion in potential revenue. Goodness knows it’s easier said than done to do developments like these, but it’s a very interesting strategic step.

One wonders what the impact will be on capital allocation, as Calgro M3 has been active with share buybacks at a time when the share price has been cheap. It’s still at a modest valuation multiple, but more capital will presumably be applied towards this development now.

The share price closed 3% higher on the day.

Emira sells a Western Cape portfolio to Spear REIT (JSE: EMI | JSE: SEA)

Emira is reducing debt and Spear is growing at pace

The beauty of a market is that there is a buyer and seller for every asset. This means that someone can think of reasons to sell it and someone else can find reasons to buy it. Sometimes, it’s because of different plans with the assets. Other times, it has more to do with the different stages of business and strategic priorities.

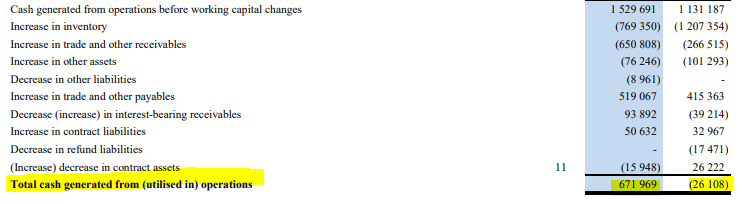

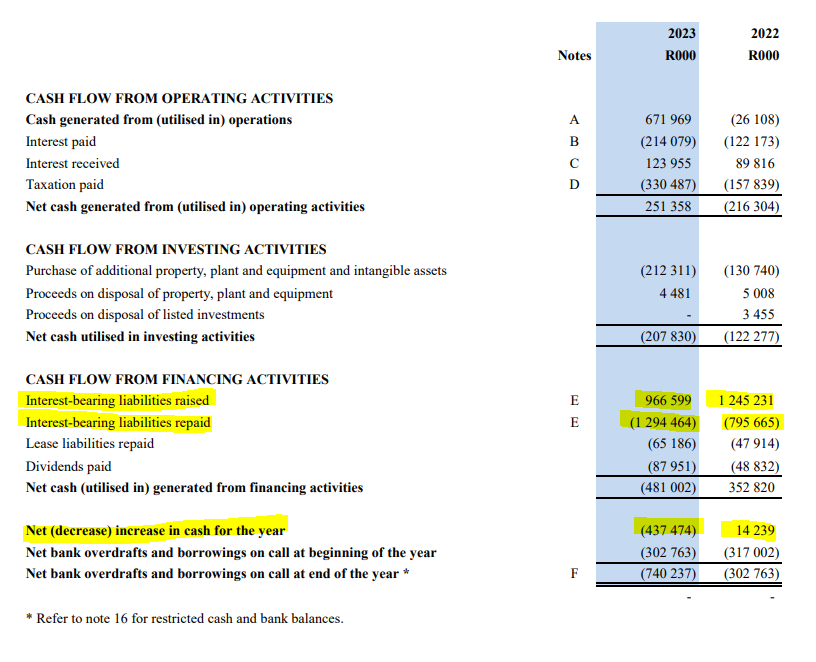

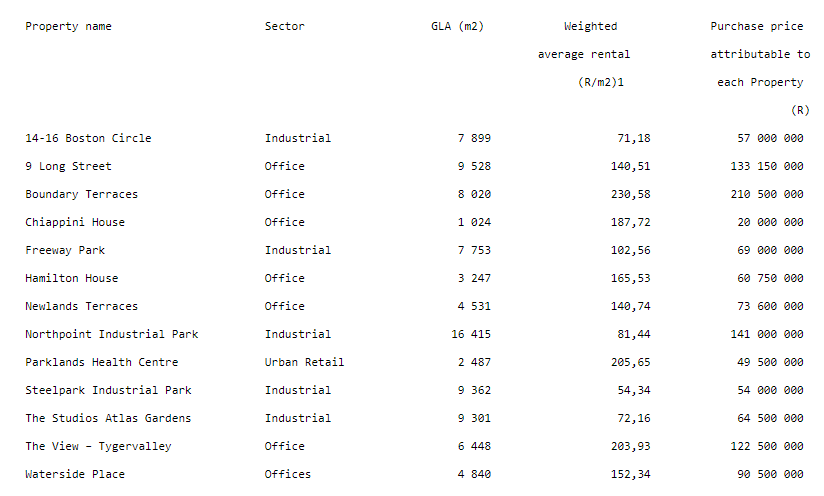

In this case, Emira is selling a portfolio of 13 properties in the Western Cape to Spear REIT for R1.146 billion. Spear is focused exclusively on the Western Cape and this is a pretty spectacular way to beef up the portfolio in one big deal. Emira is looking to recycle capital and reduce debt, which makes sense based on what I saw in their results last week.

In a particularly interesting twist, Emira is paying a transaction fee of R22.5 million to Spear that the latter can use at its discretion. Another fun term is that if Emira wants to incur capital expenditure on any of the properties prior to transfer, this can be done with Spear’s consent and with the understanding that Spear will refund Emira up to R15 million for such expenditure.

As you can imagine, there are many other property-specific terms in a deal like this, not all of which are worth highlighting here.

Here’s the portfolio:

The companies have confirmed that these values are in line with the fair market value as determined by the directors.

In the Spear announcement (which is a Category 1 deal announcement), the company notes that the acquisition price is a net operating income yield of 9.46% excluding the transaction fee payable by Emira to Spear. Including this amount would take the net initial yield to 10.1%. Given that’s a once-off amount, I would personally focus on the former number, not least of all because Spear will also incur once-off expenses for the deal.

One of the conditions to the deal is that at least 50% of the purchase price will be funded by mortgage bonds that can be raised over the properties. These approvals have been granted in principle.

If you are a shareholder in Castleview (JSE: CVW) then remember this deal is also relevant to you, as Castleview is the 59.3% shareholder in Emira.

Salares Norte commences production at Gold Fields (JSE: GFI)

This has been a 13-year journey

Gold Fields announced that Salares Norte has commenced production and delivered first gold, in line with the updated project schedule that was shared with the market in December 2023. The payback period is less than three years at current gold prices, which would be a wonderful return on investment if the good times continue.

The journey from discovery through to exploration, development and now commencement of production took a whopping 13 years. Mining isn’t a quick process, although companies obviously choose to delay or accelerate projects based on market conditions and availability of capital.

The all-in cost of gold production is $1,790 to $1,850 for 2024 and expected production volumes are 580koz. This gives it one of the industry’s lower cost profiles. The total capital cost was between $1.18 billion and $1.2 billion.

The rest of the group has a less enjoyable story to tell, with group production for the first quarter of 2024 coming in lower than planned. This was impacted by operational challenges at South Deep (a fatality on 2 January 2024 and many other far less serious issues) as well as severe weather conditions in Australia and Peru.

For now though, the company has left production and cost guidance unchanged for 2024.

Invicta: getting its bearings (JSE: IVT)

Or more bearings, I should say – as this is a familiar product category for the industrials group

Invicta has agreed to acquire 100% of Nationwide Bearing Company (NWB) in Doncaster, South Yorkshire in the United Kingdom. Invicta has tons of experience with bearings in South Africa, so this feels like a good fit.

NWB has been around since 1992 and has its own developed brand as well, with the products developed internally and manufactured by outsourced partners across the world. Invicta believes that it can add value in the supply chain here, using its scale to help source inventory.

The effective date was on 1 April. No, this isn’t a joke, especially not when R293 million is changing hands. There is the potential for the final price to be adjusted based on how the net asset value of NWB changes, to a maximum adjustment of £34,000 (and thus small in the greater scheme of the deal).

The purchase consideration is heavily front-loaded (£9.9 million), with two major deferred payments 6 months and 12 months after completion of the deal. The adjustment amount is payable 55 business days after the completion date.

The total purchase consideration is £12.355 million and the net asset value (NAV) of the entity was £8.7 million as at March 2023. Based on the adjustment for net asset value, it seems the NAV may be up to £10.2 million by completion date. Either way, it’s a premium to NAV. Profit for the year ended March 2023 (which is now a full year out of date) was £1.395 million. It’s a pity that profits for the year ended March 2024 aren’t given in the announcement.

Little Bites:

- Director dealings:

- The CEO of Trellidor (JSE: TRL) has bought shares worth R137k. With a share price down 42% over the past year, that’s interesting.

- Fortress Real Estate (JSE: FFB) announced that the scrip distribution will be at a 5% discount to the 5-day VWAP, which means a shareholder can elect to receive 5.77205 new Fortress B shares for every 100 shares held. The cash dividend is 81.44308 cents.

- Lighthouse Properties (JSE: LTE) has announced a scrip distribution reference price that is a 3% discount to the closing spot price on 28 March 2024. Shareholders can either receive a gross cash dividend of 27.69614 ZAR cents per share, or 3.67803 new Lighthouse shares for every 100 Lighthouse shares held.

- After a review of Pepkor’s (JSE: PPH) credit rating, Moody’s has left the credit ratings and stable outlook unchanged. This is based on Pepkor’s resilient business model, while recognising the risks of South Africa. I must remind you that a credit assessment is a completely different lens to an equity investment, so see this more as some downside reassurance rather than upside potential.

- MultiChoice (JSE: MCG) has agreed with Imtiaz Patel that he will extend his tenure as Chair until the conclusion of the Canal+ transaction, or a sooner date depending on how the deal goes. Elias Masilela will become the Deputy Chair.

- Trustco (JSE: TTO) has withdrawn the announcements previously released about the terms of the related party transaction with Next. This is because material terms have changed in subsequent negotiations. The company will release a further announcement when appropriate.

- aReit (JSE: APO) has declared a dividend of 33 cents per share for the year ended December 2023. I just can’t help but wonder where the financial results are, as I can’t recall seeing another example of a dividend announcement without the accompanying results.

- Oando (JSE: OAO) has been suspended from trading on the JSE based on the inability to meet the extended deadline to publish the 2022 year-end results. The company believes that it is close to completion on these, with the board scheduled to approve before 15 April.