Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Castleview releases its first interim results in current form (JSE: CVW)

The substantial injection of assets was only in the second half of last year

Castleview’s results are not comparable at all against the prior interim period, as the acquisition of the I Group portfolio took place in the second half of the 2023 financial year. The interim results to September 2023 thus reflect that portfolio and the comparable period doesn’t.

Instead, we should just focus on the current numbers, like the net asset value of R8.40. The current share price is R8.50 but there is basically no liquidity here, so the similarity of share price to net asset value reflects the injection of assets in exchange for shares.

The interim distribution is 10.676 cents and the loan-to-value is 48.4%.

Copper 360 targets EBITDA of over R650 million in FY25 (JSE: CPR)

Spreadsheets are easy; execution is hard

Copper 360 is off to a decent start as a listed company. With results now out for the six months to August, the company is still all about the narrative rather than anything else. Junior mining requires many leaps of faith in the construction phase.

The important thing to remember is that the Measured and Indicated Mineral Resource statement shows that copper at Rietberg Mine is higher than originally though. This requires R95 million more in capital for construction, but it also takes the FY25 EBITDA forecast from R360 million to R570 million.

Once you add in the recently announced Nama Copper deal, the EBITDA target for FY25 moves to at least R650 million.

It’s not all good news, though. If you read all the way down the announcement, you’ll find that copper recovery was only 43.5% vs. 71%. That’s a long way off plan, driven by inefficient crushing (leading to the decision to bring that in-house rather than rely on a contractor) and a fine materials recovery process that needed work.

The market cap is R2.5 billion. It feels to me like too much of that FY25 EBITDA target is already priced in here.

Hudaco announces a local bolt-on acquisition (JSE: HDC)

The group is acquiring Plasti-Weld for R56 million

This is a small transaction and hence a voluntary announcement, so don’t get too excited about the level of detail coming your way. For example, we don’t know what valuation multiple has been paid by Hudaco for this acquisition.

What we do know is that Plasti-Weld imports and stocks plastic welding equipment and other tools. It also manufactures plastic welding rod and has 15 staff, all based in Gauteng.

Hudaco believes that this is a good fit for the engineering consumables segment, specifically as a bolt-on acquisition to the thermoplastic pipes and fittings business, Astore Keymak.

The purchase price has been based on three years’ worth of historical profits as well as profits for the first year after the effective date. The maximum purchase price is R56 million, which suggests that there is an earn-out structure here.

The deal will be funded in cash by Hudaco.

Huge Group: covering themselves in glory once more (JSE: HUG)

The latest own-goal is the release of a trading statement and results on the same afternoon

The concept of a trading statement is clearly understood in the market, yet there are always companies that embarrass themselves by releasing a trading statement and full results either a few days apart or, much worse, on the same day.

A trading statement is supposed to be an early warning that results will be materially different from the comparable period. It’s completely daft to release a trading statement early in the afternoon and then full results later that day, as the trading statement gives an expected range and the results give exact numbers.

This isn’t Huge Group’s first blunder in the market, so I’m not really surprised to see this. You may recall their disastrous attempted acquisition of Adapt IT. I don’t take the company very seriously and neither does the market, with a share price of R2.10 on a net asset value (NAV) per share of R9.60. The company sees itself as an investment holding company, so the NAV per share is theoretically the fair value of the underlying portfolio. The NAV is up 2.3% year-on-year.

As a final comment, around 40% of the investment portfolio is attributed to preference shares in Huge Connect. Hilariously, these are valued based on a required rate of return of 10%, which is lower than the SA Government bond rate. I would value them on a required return much higher than that, which would bring the NAV down significantly. This is just one reason why the NAV per share and the share price live in different postal codes.

In reality, I suspect that the share price is at a discount to a plausible NAV. I just don’t think the fair value is anywhere near R9.60 per share.

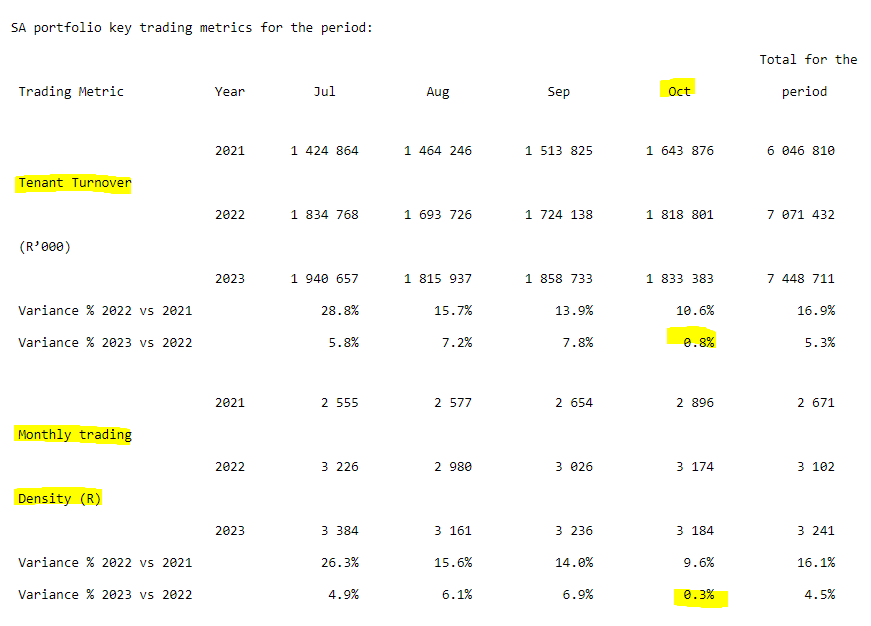

I can see consumer weakness in the Hyprop numbers (JSE: HYP)

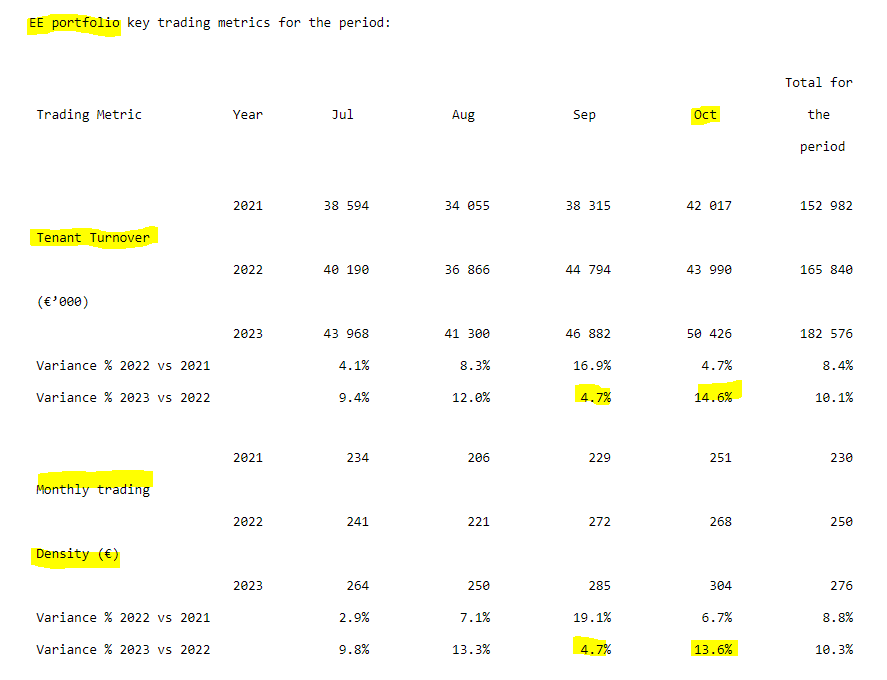

Just look at the trend in monthly trading density vs. last year

The Hyprop pre-close update dedicates many paragraphs to giving examples of stores that have opened in the malls. You can safely ignore all of that, as it tells you nothing about financial performance.

Here’s the table that matters, showing how growth in tenant turnover and trading density (sales per sqm) almost disappeared in October vs. previous months:

Vacancies and rent reversions look good at Hyprop, but that October number really worries me. Retailers are desperate for a decent end to the year and now we have hectic load shedding on top of everything else.

The growth rates in Eastern Europe look at lot better than they do here, although I’ve also highlighted September to show that slow months can happen anywhere:

I am hoping that October was somewhat of an anomaly in the South African portfolio. Time will tell.

Things are not sounding good in Nigeria and Ghana from a macroeconomic perspective, so that’s an unhappy read-through for companies like MTN. Massmart-owned retailer Game seems to have pulled out of space in Ghana, with Hyprop trying to fill that space accordingly.

The loan-to-value ratio is 37.8%, so the Hyprop balance sheet is in good shape. Strong support from shareholders for the dividend reinvestment programme certainly helps.

Lewis pulled it together in the second quarter (JSE: LEW)

After a very slow start to the year, management interventions paid off

Lewis released results for the six months to September. They tell a tale of two quarters, as growth was a paltry 1.1% in the first quarter. After a kick-up-the-you-know-what, new product ranges and advertising campaigns drove growth of 8.5% in the second quarter. Over six months, growth was thus 4.8%. Not great, but could’ve been much worse.

Encouragingly, gross profit margin was up 140 basis points to 40.7%. This helped achieved operating profit growth of 7.5%, which means there was positive operating leverage (an improvement in operating margins) despite the tricky broader environment.

The banks certainly got their pound of flesh though, with net finance costs up from R44.8 million to R62.3 million. Even where local retailers are doing well operationally, they are working for their bankers. There are foreign exchange distortions in there as well.

Headline earnings fell by 14.6% and HEPS was down 6.6%, with the fall partially shielded by the share buybacks that Lewis is most famous for.

If you’re wondering how consumers are doing out there, then my final comment is that credit sales grew 19.5% and cash sales fell 14.4%. Ouch.

Despite the drop in HEPS, the interim dividend is up 2.6% to 200 cents per share.

Lighthouse sells a big chunk of Hammerson (JSE: LTE)

The group has freed up R616 million in the process

Lighthouse has clearly run out of patience with Hammerson, deciding to let go of R616 million worth of shares so that the capital can be redeployed in yield-accretive opportunities. These sales were achieved on-market, which shows you how useful liquidity can be.

This was a Category 2 transaction that didn’t require shareholder approval.

Of course, all eyes will now be on what Lighthouse does with the capital!

Mahube Infrastructure declares a solid interim dividend (JSE: MHB)

Be cautious though, as there were bumper dividends from investments that funded this

On a closing share price of R4.84 and with an interim dividend of 35 cents declared, Mahube Infrastructure might look like quite the yield play. Caution is always required when dealing with interim dividends and assuming that they can be annualised, though.

Mahube invests in infrastructure assets like solar and wind, so the underlying cash flows are about as predictable as the wind itself. Revenue in the six months to August 2023 increased by 39% and HEPS was up 65%.

The jump in dividend income earned by the company was because of a special dividend from two solar projects that were refinanced. Therein lies the rub: special dividends are not designed to be repeated.

These are strong numbers from the fund, but I certainly wouldn’t imply an annual yield by doubling the interim dividend.

Purple Group put in a surprisingly resilient revenue performance (JSE: PPE)

I fully expected revenue to drop this year

Against a backdrop of much higher interest rates and inflation, I anticipated a decrease in revenue at Purple Group as investors find it increasingly difficult to keep adding to their portfolios. I was wrong, as revenue actually increased by 0.8% to R276.1 million. I think that’s impressive.

The pressure did come in expenses though, which were up substantially by 31.9%. Most of this pressure was in the cost of servicing institutional clients, but take note of the inflows mentioned further down. We also saw R25 million in expenses in the Philippines, out of a total expense base of R241 million. These costs drove a swing from profit attributable to ordinary shareholders of R44 million to an attributable loss of R24.9 million.

Looking deeper, I’m even more surprised (and rather pleased) to report that EasyEquities revenue grew by 11.1% to R237.8 million. Active clients were up 17.5% but retail inflows fell by 28.1%. Institutional inflows were up by a huge 169.9%, so institutional revenue is now 39.7% of total revenue, which is a huge increase from 9.7% in 2022.

Thanks to higher client numbers, the cost of service per active client fell by 10% to R170. The cost to acquire an active client is R96 per client.

GT247.com felt the revenue pain, down by 34.5% to R37.3 million. The profit after tax was R2.4 million vs. R11.3 million in the prior year. I was glad to note the introduction of a product called EasyTrader, which aims to take the capability in GT247 to the more sophisticated clients in EasyEquities. This is absolutely the right thing to do.

I wasn’t surprised to see a drop in revenue of 40.1% in EasyCrypto. Interestingly, client assets are up in value, so perhaps people really are just HODLING on their favourite blockchain assets?

In my view, despite the fact that there’s a loss, this is probably the most impressive result I’ve seen from Purple. I genuinely expected a significant drop in revenue.

Reinet’s NAV has dipped since March 2023 (JSE: RNI)

The dividend is slightly higher year-on-year, though

Reinet can perhaps best be described as Johann Rupert’s “stay-rich” fund, with investments in companies like British American Tobacco and Pension Insurance Corporation. The net asset value (NAV) per share has dropped 1.8% between March 2023 and September 2023, but a proper long-term view shows an 8.5% CAGR in euros since March 2009.

An inaugural dividend from Pension Insurance Corporation of €57 million helped Reinet increase its interim dividend from €0.30 per share to €0.28 per share.

In addition to the two major investments, the group holds investments in various private equity funds. These stakes contribute 21.2% of the investment portfolio excluding cash.

Resilient’s tenants have little in the way of real growth to report (JSE: RES)

At least rental reversions are positive

Resilient released a pre-close update covering the 10 months to October. Comparable sales growth was 5% over this period, which means the fund’s tenants are struggling to stay ahead of inflation. Some regions are running far lower than that number for various reasons.

Despite the overall pressure, vacancies are down and reversions were extremely positive, with leases for new tenants up by a whopping 26.5%. Across renewals and new tenants, leases were up 7.9%.

It feels like landlords are playing catch-up, but they will need proper underlying growth to support ongoing rental increases.

Load shedding certainly won’t help. By December 2023, Resilient will have solar backup that will supply 27.5% of the group’s energy consumption.

Things are looking far better in France, where sales increased 10.1% for the nine months ended September.

In terms of the balance sheet, Resilient received 50% of its dividend from Lighthouse in shares and the rest in cash. Resilient also sold its remaining interest in Hammerson, receiving R1.2 billion vs. the original purchase price of R746.4 million.

Des de Beer is retiring as CEO at the end of 2023, with Johann Kriek appointed as his replacement.

Full-year guidance of R4.00 per share has been affirmed. The current share price is R40. You don’t need your calculator to work out the yield.

Salungano is still trying to refinance its business (JSE: SLG)

The company is falling further behind on financial reporting

Salungano is suspended from trading because it hasn’t released its 2023 financial statements. In order to release those financials, it needs to conclude a refinancing process so that it can be seen as a going concern. Although a Chief Restructuring Officer has been appointed, it takes time to get these things right.

It doesn’t help that subsidiary Wescoal Mining is in a voluntary business rescue process. The publication of the business rescue plan has been postponed to February 2024.

And on top of all this, the interim results for the six months to September are due for release soon and that deadline is obviously going to be missed because the March year-end results aren’t done. These problems tend to compound over time.

Spar says farewell to its dividend (JSE: SPP)

You won’t even find it lurking at the back of the store

I’ll start with the good news: turnover at Spar increased by 10.1%. That largely brings me to the end of the good news.

Operating profit tanked by 47% from R3.4 billion to R1.8 billion. The company tries to soften the blow with its view that R1.4 billion is non-recurring. That just means that they hope the same problems won’t happen again. It doesn’t mean that there won’t be new problems.

Locally, SPAR Southern Africa only grew turnover 5.1% in a period where price inflation was 9.7%. This tells you that volumes went firmly the wrong way. It was even worse at Build it, with turnover down 4.3% as consumers bought food rather than household improvement products. You need to Eat it more than you need to Build it. Luckily, people still got sick, so the pharmacy businesses achieved 19.2% turnover growth.

In Ireland and South West England, turnover was up 8.1% in euros and 21.9% in rands. The food services business did well, assisted by a recovery in hospitality.

In Switzerland, turnover fell 3.3% in local currency and increased by 13.6% in rands. Food is so expensive in Switzerland that residents travel across the border to buy food. Life in Europe, hey.

Despite property funds telling a great story about retail in Poland, SPAR Poland isn’t seeing enough of that happiness. Turnover was only up 5% in local currency or 19.9% in rands. The business is still heavily loss-making though, leading to a decision to sell the operations in Poland. Finding a buyer might not be so easy. This acquisition has been a terrible story for Spar, in fairness with a completely unforeseeable pandemic in the middle that made integration very tough.

There are no excuses for the catastrophic SAP roll-out though, which cost Spar R1.6 billion in turnover in KZN and R720 million in lost profits. They’ve also had to write off R94.1 million because they’ve had to change their approach to the SAP roll-out in other regions.

The group isn’t in breach of any debt covenants at this stage. To be prudent though, the dividend is now a thing of the past. With HEPS down 47.7%, that’s the right approach.

The stock has lost 40% of its value in the past 5 years. If only the same could be said for food prices.

Little Bites:

- Director dealings:

- Adrian Gore has entered into a large hedge over his Discovery (JSE: DSY) shares, in the form of buying put options with a notional value of R578 million at a strike price of R110.26 and selling call options with a notional value of R927 million at a strike price of R176.71. Simply, what’s happening here is that he is buying downside protection at R110.26 per share and funding it by giving up upside above R176.71 on a bigger value of shares. The current share price is R133. Separately, a director of a major subsidiary of Discovery sold shares worth R1.03 million.

- A prescribed officer of Standard Bank (JSE: SBK) has cashed in, selling shares worth R11.1 million.

- A prescribed officer of Old Mutual (JSE: OMU) has bought shares worth R2.9 million.

- The CEO of AECI (JSE: AFE) bought shares worth R216k.

- A non-executive director of Gold Fields (JSE: GFI) bought shares in the company worth $15.2k.

- An associate of two directors of Delta Property Fund (JSE: DLT) has bought shares worth R45.9k.

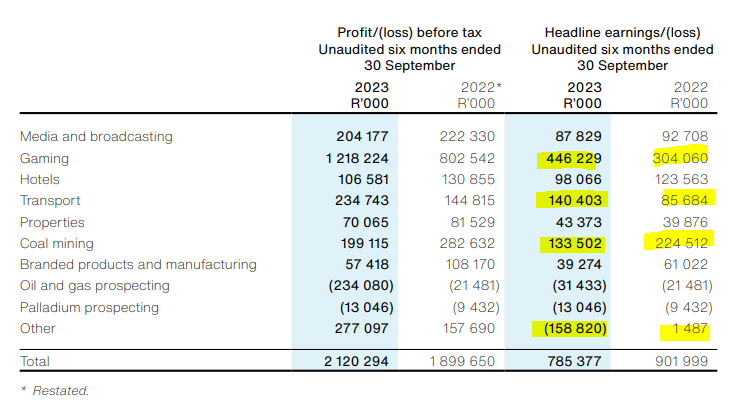

- After releasing results the previous day, Hosken Consolidated Investments (JSE: HCI) released a cautionary announcement related to a proposed transaction. The cautionary doesn’t even say whether this is an acquisition or disposal. We will have to wait and see if anything more concrete is announced at some point.

- Fortress (JSE: FFA | JSE: FFB) has released the circular for the transaction to repurchase all Fortress B shares by giving those shareholders NEPI Rockcastle (JSE: NRP) shares as payment. EY is acting as independent expert and has opined that the transaction is fair and reasonable to both classes of shareholders. After the last failed attempt to address the dual-share class structure, the company will be hoping that this one goes through.

- In what will probably not be loved by the market as a succession story, Bell Equipment (JSE: BEL) has announced Ashley Bell (currently a non-executive director) as the replacement for Leon Goosen as CEO. This is no comment on Ashley at all and I’m sure he’s a capable guy, but the market tends to be nervous of family businesses that choose to bring management back in-house vs. having an unrelated person in charge. Time will tell.

- The business rescue practitioners dealing with Tongaat Hulett (JSE: TON) have published the updated business rescue plans. There are two plans because there are two bidders! Kagera Sugar was initially identified as the preferred bidder, but that group has fallen away. The two horses in the race are now the Vision Consortium (which includes Robert Gumede) and RGS Group, which produces sugar in Mozambique. In terms of the local economy, it’s really important that Tongaat is rescued here. Creditors will vote on the plans on 8 December.

- Orion Minerals (JSE: ORN) has received R5 million from Clover Alloys and has issued shares accordingly.

- AYO Technology (JSE: AYO) announced that deputy chairman, Khalid Abdulla, is retiring with effect from 1 December.

- With a market cap of just R5 million, it doesn’t get more obscure than African Dawn Capital (JSE ADW). In the six months to August, the company generated revenue of R7.9 million and a loss before tax of R8.2 million. Obscure, and getting more obscure it seems.