Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Ascendis is making profits again (JSE: ASC)

The market will consider this in weighing up the offer for the shares

The offer on the table for Ascendis shares is 80 cents per share. The market will give that careful thought after the company just announced that for the six months to December 2023, HEPS from continuing operations was between 9.2 cents and 11.2 cents. Remember, that’s an interim number, not a full-year number.

From total operations, HEPS was between 11.4 cents and 14.0 cents.

In both cases, this is a swing into the green from a loss-making position in the comparable period.

Detailed results are due on 28 March.

Barloworld’s margin resilience has proven useful (JSE: BAW)

The pain of a revenue drop has been partially mitigated

Barloworld released a trading update for the five months to February 2024. Group revenue has fallen by 5.5% and EBITDA is down 2.5%. The improvement in EBITDA margin from 11.5% to 11.9% has helped substantially here as revenue fell. Operating profit margin has dipped from 8.9% to 8.7% though.

Equipment Southern Africa saw revenue drop by 4.9%, attributed to a 17.8% drop in machine sales due to lower demand from mining customers. Parts sales were up 13.2%. Operating margin went the wrong way in this business, with operating profit down 7.5% and margin coming in at 7.1% vs. 7.3% in the prior period. EBITDA margin moved slightly higher though, from 10.3% to 10.4%. EBITDA came in at R1 billion. The highlight in the division was 38.1% growth in the profit attributable from the Bartrac joint venture.

The order book is a worry in the local business, down from R5.7 billion to R3 billion.

Equipment Eurasia saw revenue drop by 11.1%, with Barloworld Mongolia up 24% and VT down 30%. Despite this, operating profit from core trading activities grew by 17% as the mix shifted towards after-market sales. Good cost control was also a major contributor here. The firm order book grew massively from $15.9 million in the prior period to $119.8 million. EBITDA in Mongolia was $20.1 million, up a whopping 78.6%. This is an EBITDA margin of 25.9%, which absolutely dwarfs the Southern African business in terms of margin. In VT in Russia, EBITDA was $17 million, which is 19.8% lower than the previous period.

Ingrain, the consumer industry business, suffered a 5.2% reduction in revenue. Exports felt the pressure thanks to Durban harbour issues and competitive pricing of starch. EBITDA was R318 million, down 9.9%. Operating profit fell by 16.9%. To address the concerns in the trajectory of the business, Barloworld is right-sizing the business. That can only mean a reduction in jobs.

On the whole, it remains quite shocking to me to see how poor the South African performance is relative to places like Mongolia. This is a clear indication of the broader decay in South African conditions.

EOH reports on a very poor interim period (JSE: EOH)

Operating profit has all but disappeared

EOH’s revenue for the six months ended January 2024 was R3.1 billion, which is below the R3.2 billion achieved in the comparable period. That difference has dropped straight to the bottom line, with operating profit plummeting from R142 million to R9 million.

Adjusted EBITDA is R97 million vs. R171 million in the prior period. Whichever way you cut this, it hurts.

The headline loss per share came in at 11 cents per share. Funnily enough, that’s better than the headline loss per share of 17 cents per share in the comparable period. The thing you need to remember is that the comparable period included tons of debt, whereas this period is theoretically the new and improved version of EOH. Interest costs dropped from R102 million to R68 million but this still wasn’t enough to help the group move into profitability, all because of the challenges in the core business.

EOH makes it clear to the market that the issues experienced towards the end of the prior financial year continued into the first half of this interim period. The problem is that the business still relies to a large extent on public sector and other lumpy contracts, so I can’t really see it getting better despite EOH’s hopes for the contrary.

Master Drilling: record revenue and a helpful ZAR move (JSE: MDI)

The dividend is up 10.5%

Master Drilling reports its numbers in both USD and ZAR. As you might imagine, the percentage moves can be very different.

Revenue for the year ended December 2023 was up 7.2% in USD to a record high of $242.8 million. Despite this, HEPS in USD only increased by 2.1% to 14.5 cents. The story in ZAR looks different, with HEPS up by 15.1% to 267.7 cents.

The dividend in ZAR increased by 10.5% to 52.5 cents. That’s a very modest payout ratio, especially in the context of cash from operations being 42% higher. The company is investing in new technologies to remain relevant, so it does make sense that a high proportion of earnings needs to be retained.

Debt decreased slightly from $46.1 million to $44.1 million. Including cash, the gearing ratio was flat at 7.8%.

The group sounds confident about the pipeline and committed order book. They are currently working towards a 75% fleet utilisation rate.

Nampak chips away at the debt (JSE: NPK)

There’s a long way to go, but this disposal sure does help

Nampak needs to dispose sufficient assets to raise around R2.6 billion. This will do wonders for the balance sheet and will result in a far more focused group. As a step on that journey, Nampak has agreed to sell Nampak Liquid Cartons, Nampak Zambia and Nampak Malawi for R450 million.

The buyer is a consortium of Corvest (a private equity arm of FirstRand), along with Dlondlobala Capital and two key management members as well.

Nampak Liquid Cartons operates in South Africa, selling paper liquid packaging products. Nampak Zambia focuses on conical cartons (with supplementary income from bags, crates, bottles and more) and Nampak Malawi helps Nampak Zambia and Nampak Zimbabwe sell various products in the Malawian market.

The net asset value of the disposal assets comes to R399 million. Profit after tax is R104.7 million for the year ended September 2023. A Price/Earnings multiple of 4.3x tells you where the market is on risky African assets.

This is a Category 1 transaction as it is more than 30% of Nampak’s market cap. A detailed circular will thus be released.

In a separate announcement, Nampak noted a cyber attack on the group’s IT systems. There has been no impact on manufacturing facilities, so it’s not obvious to me why they released a SENS announcement on this topic.

Salungano flags substantial losses (JSE: SLG)

At least EBITDA is positive

Salungano Group has released a trading statement for the year ended March 2023. The headline loss per share is between 50.65 cents and 57.65 cents, which is a lot when the share price is only 50 cents! HEPS in the comparable period was 6.13 cents.

The group achieved positive cash from operations at least, with EBITDA of between R80 million and R120 million.

Spar is treading water and needs to do better (JSE: SPP)

I think they can win from some of the Pick n Pay pain though, so I’ve taken a modest position

Spar is very much the “other guy” in grocery retail at the moment. Shoprite is the superstar, Pick n Pay has been left for dead in the mud and Woolworths is standing on the second step on the podium wondering how Shoprite made it to the top.

Spar? Well, it’s an odd one. When they aren’t scoring own-goals in South Africa with the ERP system, they are fighting difficult conditions in the European markets. Despite this, the group isn’t in anywhere near the trouble of the likes of Pick n Pay. With the share price down 38% in the past year and trading very close to 52-week lows, there’s some resilience in this performance that caught my eye. I’ve taken a small speculative position accordingly.

It’s going to be a while until things come right, assuming they do. Group turnover increased by 8.8% for the 24 weeks ended 15 March. Of course, you have to dig deeper than that.

SPAR Southern Africa grew wholesale sales by 5.7%, with grocery up 5.0% and TOPS up 12.8%. Volumes were under pressure, with core grocery and liquor turnover growth of 6% vs. price inflation of 7.2%. Build it could only manage 1.1% growth, but at least that’s heading in the right direction again. The pharmaceutical business grew by a strong 17.7%.

Looking abroad, BWG in Ireland and South West England is a jewel in a highly uninspiring crown. Turnover was up 6.6% in EUR terms and 16.9% in ZAR. SPAR Switzerland saw turnover fall 4.7% in CHF terms and increase 8.8% in ZAR. They have a real issue in that market with locals buying groceries across the border, as Switzerland is such an expensive place to live. SPAR Poland remains a mess, with turnover down 4.2% in PLN and up 13.2% in ZAR.

In other words, rand weakness made all the difference here, without which the turnover result would’ve been poor. Like I said, there’s a lot of fixing up to do.

SPAR is trying to sell the business in Poland and hopefully that will happen sooner rather than later. With group net debt of R11.5 billion, management believes they can achieve an optimum debt structure without tapping shareholders for funds. If that doesn’t work out, I’ll regret my speculative position here.

Another thing they desperately need to get right is the SAP implementation in KZN. It is still not running at the correct efficiency levels.

There are some encouraging signs in recent trading performance, particularly in February (even after taking the leap year into account). EBIT margin is under pressure though thanks to the irritation of the SAP system.

There’s a bumpy ride ahead. I’m just hope that SPAR can get its house in order quickly enough to take advantage of the mess at Pick n Pay. If not, then Shoprite will just keep pulling further and further ahead.

Tharisa’s share repurchase plan excites the market (JSE: THA)

When used properly, share repurchases are great

The concept of a share repurchase is quite simple, actually. When shares are trading at a valuation that the company believes is too cheap, a share repurchases is preferred to a dividend as it helps the company mop up shares at a low price. This is earnings accretive for the shareholders who choose not to sell their shares. Over time, this becomes a very important component of returns.

Tharisa is commencing with a share repurchase programme of up to $5 million, taking advantage of the pressure on the share price that has been felt across the PGM market.

The share repurchase programme can technically run until February 2025, or until the allocated amount has been used up.

The share price closed 11.5% higher in response, ironically making the share buyback slightly less lucrative for shareholders!

Overall, this is solid capital allocation discipline and that’s exactly what investors like to see, especially in mining groups. The sector is notorious for questionable capital discipline.

Vukile gives an encouraging pre-close update (JSE: VKE)

The recent R1 billion capital raise shows that the market supports this growth story

Vukile’s pre-close update is incredibly detailed. You can find the full document here.

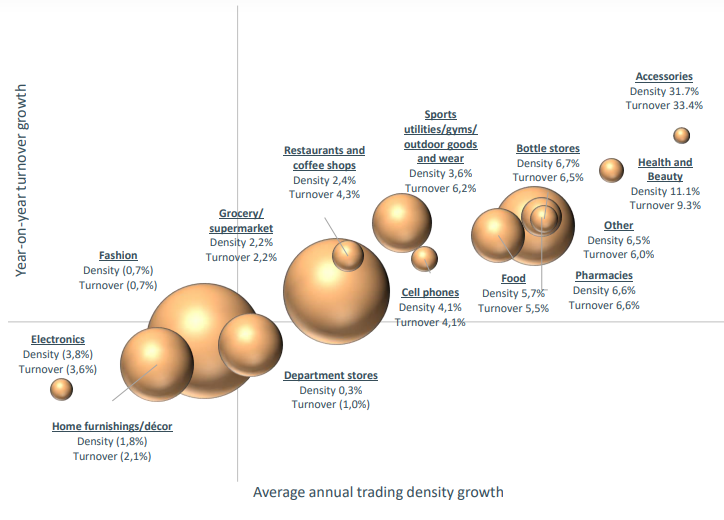

In the South African portfolio, the like-for-like net operating income growth in 5.4% for the period ended February 2024. Retail vacancies fell slightly, with rural and value centres effectively fully let. That part of the market is incredibly strong at the moment. Commuter and township vacancies increased slightly, so it’s still difficult to get the positioning exactly right in the lower-income market. Reversions moved higher to +2.6% and trading densities are also 2.6% higher, so that’s encouraging. KZN is the exception, with trading density down 3.8%.

This chart gives you a really good idea of just how strong the pharmacy / health and beauty combination is:

Pick n Pay exposure in the Vukile portfolio is 6.2% of total rent. 4.4% is in the lower LSM brands, which is actually a good thing in this case.

In the Spanish portfolio, footfall achieved record levels and tenant sales are growing strongly, reflecting overall positive momentum in that economy. The average rent increase came in at 9.92% from 1 April 2023 to 29 February 2024. The group also sounds happy with the investment in Lar España by Castellana.

In terms of capital allocation, Vukile wants to increase the stake slightly in Lar España. They avoid bidding wars on Spanish assets and are happy to be outbid. In contrast, they are selling down the stake in Fairvest and allocating that capital into Lar España shares and the roll out of solar.

The R1 billion from the equity capital raise is currently in a money market account earning 9.25% interest. They plan to invest all the money by September 2024, with 35% gearing on new assets.

Guidance has been upgraded to reflect growth in FFO per share above 6% and growth in the dividend of over 10%. Vukile is doing really well at the moment.

Little Bites:

- Director dealings:

- Three Anglo American (JSE: AGL) non-executive directors took advantage of the “shares in lieu of fees” scheme. That’s a purchase in my books, with a total value of £31k.

- Keep an eye on enX (JSE: ENX) and the planned shareholder meeting for the proposed sale of Eqstra Investment Holdings to Nedbank. The meeting is scheduled for 3rd April and a company called Inhlanhla Ventures (which holds 1.12% of enX shares in issue) has made an urgent application to the High Court to interdict the company from proposing the resolution. This relates to a transaction in 2020 in which Inhlanhla defaulted on obligations and lost shares in a company called eXtract Group. enX has responded to the application and received legal advice that the Inhlanhla action doesn’t have reasonable prospects of success. For now at least, the board plans to go ahead with the meeting. If a judge grants an interdict, then that’s a massive spanner in the works for this deal.

- Copper 360 (JSE: CPR) has released the circular related to the share subscription facility with the GEM Yield funds that are willing to invest up to R650 million in ordinary shares. This also comes with substantial share warrants. If you’re a shareholder here, you need to have a very careful think about what this means for the group’s prospects and your current and future dilution as a shareholder. I must point out that if you’re shocked by dilution when investing in a junior mining house, you didn’t do your research on how this sector works.

- Deutsche Konsum (JSE: DKR) has announced that the company intends to withdraw its secondary listing on the JSE. I am really not surprised, as there’s absolutely no point in a listing that has zero liquidity.

- Textainer (JSE: TEX) will be delisted on Wednesday 27 March 2024 due to the implementation of the Stonepeak deal.

- Randgold & Exploration Company (JSE: RNG) released a trading statement for the year ended December 2023. The headline loss per share is between 30.84 cents and 33.16 cents. This is a deterioration of between 33.47% and 43.47% vs. the prior year.