Adcock Ingram’s numbers went backwards (JSE: AIP)

Sometimes, operating leverage works against you

Adcock Ingram has released results for the six months to December 2024 and they were below expectations. Demand was an issue, particularly as pharmaceutical wholesalers went through a period of destocking. For a production-focused business like Adcock Ingram, a drop in volumes is bad news for margins.

Sure enough, a 1% decrease in revenue was made worse by a 5% decline in gross profit and a 9% drop in HEPS. This is a classic case of operating leverage working against a company, as fixed manufacturing costs are only your friend when volumes are going up. The worst of the pressure was felt in the prescription business, where revenue fell just 5% and yet profit was down 52%!

Sadly, they do not expect to see an increase in output at the Wadeville facility in the next six months. The single exit price adjustment of 5.25% should relieve some of the margin pressure. In the meantime, Adcock Ingram plans to find more brands and partnerships to boost sales.

The interim dividend fell by 8% to 115 cents per share.

AECI expects a huge drop in HEPS (JSE: AFE)

The market didn’t seem to mind

AECI’s share price came into this update down 12.7% in the past year. It had tanked 22% over 6 months. The market knew that there were troubles at the firm, with a trading statement confirming that earnings are deeply in the red.

How red, you ask? Well, HEPS is expected to be between 32% and 42% lower. The expected range is 662 cents to 770 cents for the year ended December 2024. Although the direction of travel is clearly negative, the market responded positively with the share price up 5.4% by lunchtime trade.

The release is strongly based on a narrative of this being a transition year full of difficult decisions that were required to position AECI for better growth going forwards. For an example of a silver lining in the group, AECI Chemicals actually grew EBITDA by 25%. AECI Mining’s EBITDA was down 13%, but there were large once-off costs related to plant shutdowns and the momentum into the end of the year was positive.

If we read deeper, we find that there were R860 million worth of non-recurring costs in the group. This included R467 million went to transformation project costs and R186 million linked to business sales. They’ve also noted R204 million in investment spend on statutory shutdowns, although we are now really stretching things to suggest that a statutory requirement is non-recurring. Is it a once in a lifetime requirement? Happy to be corrected if that’s the case, but I somehow doubt it.

AECI Schirm Germany also remains a headache, with R56 million in turnaround costs. This excludes substantial non-cash impairments that impacted earnings per share (EPS) but not HEPS.

AECI Much Asphalt is recognised as a discontinued operation as it is being sold to Old Mutual Private Equity for R1.1 billion. That deal is expected to close in the first half of 2015. They recognised R732 million in impairment costs on this asset, net of tax.

After a year of focus on the turnaround, investors will expect to see results in 2025.

An ugly set of numbers at Anglo American and things are getting even worse at De Beers (JSE: AGL)

Do you believe me yet about lab grown diamonds?

I first started writing about lab grown diamonds in August 2023. To my knowledge, my column in the Financial Mail (alongside my writing in Ghost Bites of course) was one of the first arguments put forward in South African financial media about the threat to mined diamonds. A lot of people disagreed with me at the time.

Billions of dollars in impairments later at De Beers and those dissenting voices have all but disappeared. The debate now isn’t whether lab grown diamonds are a fad. It’s whether mined diamonds have any staying power at all.

My view hasn’t changed in the past 18 months. Mined diamonds should be luxury products (they should always have been luxury products instead of affluent products) and this means higher prices and lower volumes. Unfortunately, this doesn’t work for the way De Beers and the broader diamond industry has been set up in terms of the cost base, so there is much pain and disruption in this space.

If you search the words “lab grown” in the latest Anglo American report, you’ll find the reference in the impairments section. There’s something rather poetic about that, as disruptive forces have precisely that effect on dominant players in the market: a reduction of value. At Anglo, you’re just witnessing an extreme version of it.

The net impairments of $3.8 billion at Anglo took the loss attributable to shareholders to $3.1 billion. To ignore impairments and get a sense of maintainable earnings, we can look at headline earnings of $875 million for the year. Sadly, that’s way off $2.5 billion in the prior year. HEPS is the metric that the market will use and it fell by a spectacular 65%.

If you wondered why Anglo needed to strip a huge dividend out of Anglo Platinum before that demerger, wonder no longer. Between that dividend and the sale of the steelmaking coal and nickel businesses, they will generate cash of roughly $6 billion. Of course, this in no way solves the huge headache of what to do with De Beers. They are planning to “separate” it, but who will buy it? Are they hoping to just unbundle it to shareholders and make it their problem?

Even copper production fell by 6% year-on-year, so there really isn’t much to hang your hat on here. They at least generated much stronger profits in copper, up from EBITDA of $3.2 billion to $3.8 billion. Sadly this was nowhere near enough to make up for the drop in iron ore from $4 billion to $2.7 billion.

De Beers is a small part of Anglo, with a loss of $25 million in this period vs. profit of $72 million in the last period. The lab grown issue therefore isn’t the biggest challenge at Anglo American. It’s just a juicy story that shows how no company or sector is immune from disruption.

They have copper on the brain at Anglo and it is now the largest individual contributor to EBITDA. To add to that momentum, they separately announced that a memorandum of understanding has been entered into by Anglo’s 50.1% owned subsidiary and the Chilean state-owned mining company Codelco for a framework to implement a joint mine plan for the adjacent copper mines owned by the two companies in Chile. Anglo reckons that the net present value (NPV) uplift is $5 billion and half of that will be attributed to the subsidiary. It therefore seems as though $2.5 billion in value has been created here for Anglo shareholders, according to my interpretation at least. It’s all paper money anyway, for now.

That almost makes up for the $2.9 billion impairment that was recognised at De Beers in this period. Diamonds may be a small contributor to profits at Anglo, but there’s still a carrying value of $4.1 billion here. Also, they calculate the carrying value using a discount rate of 8%, which in my view is impossibly low. It should be a lot higher to reflect the risk, in which case the impairment would’ve also been higher. Here’s the relevant section:

As a fun final comment, one of the strategies is as follows (lifted straight from the report): “De Beers also announced the launch of DiamondProof™, a new device to be used on the jewellery retail counter for rapidly distinguishing between natural diamonds and lab-grown diamonds.”

I just love the name DiamondProof. They are still trying to desperately convince the world that natural diamonds are chemically superior to lab-grown diamonds. Both are diamonds – one is just a much cheaper way of getting them. Consumers have voted with their feet (or ring fingers).

Flat revenue at Barloworld (JSE: BAW)

Will this inspire more shareholders to take the money and run?

With Barloworld under offer from the consortium that includes its CEO, the release of a trading update for the four months to January 2025 is a helpful way to assess recent performance. With revenue growth of just 1%, there hasn’t been much performance to talk about!

Of course, as you dig deeper, you find divergence in growth. The southern African mining sector has been struggling with lower commodity prices (with the exception of gold and copper), which means less capital investment in the assets that Barloworld supplies. Thankfully, the environment in Mongolia is one of growth and this helped to offset the pressure.

Despite a 4.7% drop in revenue in Equipment southern Africa, they managed to generate higher operating margins and offset some of the impact in that business. As for Mongolia, revenue growth of 80% is pretty wild. Before you get too excited, the Russian business saw revenue drop by 23.3% and is only slightly above breakeven levels. Over at Ingrain, revenue grew 1.6% and both gross and operating margins moved higher.

If you read between the lines here, I think there’s a decent chance that the profit performance was better than revenue growth. Still, it’s not a strong period at group level. A pre-close update closer to the end of March will hopefully give more details on profitability.

And in case you’re wondering, the independent investigation into potential export control violations is ongoing.

Flat earnings at Blue Label Telecoms (JSE: BLU)

It remains by far the best performing telecoms share price over 12 months

Those who were willing (and able) to pick through the Blue Label Telecoms web of financial reporting were richly rewarded in the past 12 months. So were those who opted to depend entirely on the analysis of others. And of course, momentum traders got on this train for the ride as well.

This is the beauty of the markets: there’s something for everyone. Personally, companies with such complex structures aren’t for me, hence I’ve avoided Blue Label (to my own detriment).

The numbers for the six months to November 2024 reflect flat core HEPS of 47.20 cents. Finance income helped get them to a flat result, as they were down 6% at EBITDA level.

There’s a long back-story to the deal, but essentially Blue Label has increased its economic interest in Cell C by 10%. Those who are punting Blue Label are particularly bullish on the prospects of Cell C, which does seem to have gotten into its stride in terms of its latest strategic positioning.

Distribution per share guidance is unchanged at Equites (JSE: EQU)

Property disposals have helped to reduce the loan-to-value ratio

Equites Property Fund released a pre-close update dealing with the year ending February 2025. They had a busy period of selling properties in their UK portfolio, with the first slide in the deck reminding the market that they intend to remain invested in the UK. Still, the focus remains on deploying capital into the South African market, where demand for prime logistics assets is apparently outpacing supply.

This doesn’t mean that there were no disposals in South Africa as well. Property funds are constantly looking for ways to recycle capital and improve returns. Equites is no exception, although they do note that they are close to the end of their South African disposal programme.

The impact of all these disposals is that the loan-to-value ratio is expected to improve by 400 basis points. It was 41% at August 2024 and is expected to be 37% by the end of February. The timing of property disposals might still impact this.

Naturally, they are also enjoying the decreasing interest rate environment, with new debt being priced lower than the debt being replaced.

Distribution per share guidance of 130 to 135 cents per share is unchanged.

Gold Fields enjoyed a jump in earnings despite production and cost challenges (JSE: GFI)

Thank goodness for such a strong year in the gold price

Over 12 months, Gold Fields is up 42%. AngloGold, which released absolutely incredible results earlier in the week, is up 80%. This is because AngloGold did everything right at a time when the gold price was favourable, whereas Gold Fields has some iffy underlying metrics around production and costs.

For example, gold produced by Gold Fields fell by just over 10% and all-in sustaining cost per ounce jumped by 25.8%. Although there was strong momentum in the second half of the year vs. the first half, it’s still a pity that they missed out on making even better profits. Perhaps the gold price will continue to increase and give them a chance to make up for it.

Shareholders might be wishing that they held more AngloGold instead, but there’s still nothing to feel sad about with an increase in the total dividend for the year of 34.2%.

Hulamin isn’t concerned about the latest US tariffs (JSE: HLM)

This shows you how inflationary a tariff system actually is

Hulamin has noted that around 11% of its rolled products volumes are achieved through exports to the US. This obviously makes the group sensitive to changes in the tariff structure, especially if South Africa gets hit with additional tariffs.

For now at least, we aren’t being penalised with specific tariffs. Instead, Hulamin has been paying a 10% flat rate duty that applies to most (but not all) countries. The US has now ramped that up to 25% and has made it applicable to all countries, including those that were previously exempt from the 10% duty.

Hulamin reckons that they are probably in the same net position here, as all competitors will now be subject to the 25% tariff. They hope that their relative increase in volumes might offset any overall volumes pressure.

It’s obviously difficult (if not impossible) to guess how markets will respond to tariffs. Perhaps the bigger lesson here is that tariffs are inflationary in nature, as all these aluminium products will become more expensive in the US.

A tough set of numbers at Mondi (JSE: MNP)

Margins and cash flow went the wrong way

Mondi didn’t have a particularly great time in the year ended December 2024. Revenue increased by just 1% from continuing operations. If we exclude forestry fair value gains from EBITDA, we find that EBITDA fell by 3%. This means that EBITDA margin contracted, which isn’t a surprise in the context of such tepid revenue growth.

Sadly, those forestry fair value gains are part of headline earnings and they were far lower this year than in the prior year. Combined with the dip in operating earnings, this drove a decrease in HEPS of 58%.

Cash generated from operations was also in the red, down by 26% due to working capital outflows. Despite this, Mondi kept its ordinary dividend at 70 euro cents per share. Companies would rather donate their most loved family members to science than cut their dividends.

Tiger Brands expects to meet earnings guidance (JSE: TBS)

Margins have been the recent highlight here

Tiger Brands has released an operating update for the four months to January 2025. With inflation down at roughly 2.5% for food and non-alcoholic beverages, one would hope to see a meaningful uptick in volumes. Growth in group revenue of 3% for the period means that there was a modest improvement in volumes, so perhaps South Africans are so used to tightening their belts that they keep them tight even when they don’t have to?

At least margins have a better story to tell, with product mix and efficiencies both relevant here. Although Tiger doesn’t give specifics, they make it fairly clear that operating profit has grown by a higher percentage than revenue. They expect to see earnings growth in line with the previously provided guidance to the market for the six months to March 2025. I’ve gotta tell you that I spent some time digging around for that guidance and all I could really find was an expectation of “high single digits” operating margin. The comparable interim period saw operating margin of 6.9%, so we can therefore deduce that margins will indeed be higher year-on-year.

On the corporate front, the sale of the Baby Wellbeing division is pending competition commission approval. They are also busy with the disposal of Empresas Carozzi in Chile, with most of those conditions expected to be fulfilled in March 2025.

Focus areas within the continuing business include work on distribution channels for Albany, a deliberate focus on the “Power Brands” (where Tiger gets the best return on marketing spend) and general efficiencies in the group. So, all good stuff.

Tiger is up 28% over 12 months and is trading on a P/E of 15.7x. That feels rather high to me.

Nibbles:

- Director dealings:

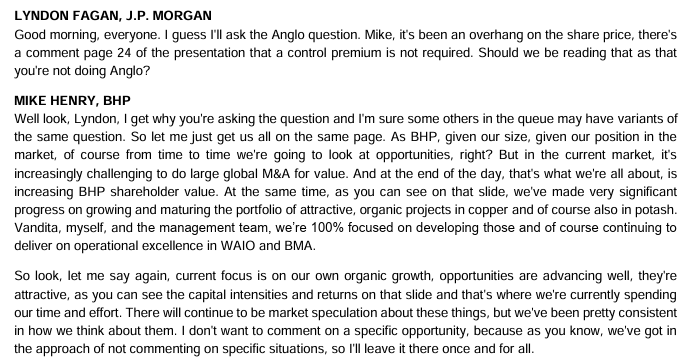

- A non-executive director of BHP Group (JSE: BHG) bought shares in the company worth around R1.2 million.

- Super Group’s (JSE: SPG) disposal of its stake in SG Fleet has achieved another milestone. Australian courts have approved the dispatch of the scheme documents to SG Fleet shareholders for the general meeting of SG Fleet shareholders to approve the scheme. The SG Fleet independent expert has opined that the scheme is fair and reasonable. SG Fleet shareholders (including Super Group) must now attend the meeting and vote.