Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Alexander Forbes is the buyer of OUTvest (JSE: AFH | JSE: OUT)

This sub-scale business needed a new home

OUTsurance Group is focusing on its core competencies, which is a good thing. OUTvest was a good attempt at getting into the investments game back in 2017, but they didn’t manage to achieve scale in the business. I must give credit to management for recognising that the business was simply too small and difficult to justify continued involvement.

It didn’t take long to find a buyer, with Alexander Forbes jumping in to acquire 100% of OUTvest. There are certain conditions precedent that need to be met for the deal to go ahead, like regulatory approvals. The idea here is that OUTvest will then be part of a full-scale investment house that will allow it to reach its potential.

In the Alexander Forbes announcement about this deal, the company highlights the digital nature of the OUTvest solution and how this is a good strategic fit.

The deal is below the categorisation threshold for both companies, so this is a voluntary announcement and the value hasn’t been disclosed.

Argent Industrial is showing solid HEPS growth (JSE: ART)

Once again, we have an industrial business moving in the right direction

Here’s another example that supports my overall thesis at the moment that industrial businesses are in a better position than consumer businesses. Argent Industrial has released a trading statement dealing with the six months ended September. HEPS is expected to be between between 12.6% and 32.6% higher, so that’s very encouraging.

This is a range of 204.1 cents and 240.4 cents. For reference, the share price is around R15 and was up 3.7% in the aftermath of the earnings release.

Despite a strong year of underlying performance, the share price has been incredibly choppy and is trading slightly below the levels seen at the beginning of 2023. One of the great frustrations in the market is that you can be “right” about the underlying business without getting rewarded by the share price.

AVI is focusing on margins in this environment (JSE: AVI)

Comments at the AGM point to a soft environment, but strong cost control at AVI

At the company AGM, the chairman of AVI gave an update on trading conditions in the first quarter of the year. Revenue is up 5.2% year-on-year, which isn’t much to get excited about. Volume performance is mixed across categories and I&J is still struggling, with poor catch rates and an unfavourable sales mix.

The good news, however, is that gross margins have expanded because of price increases and cost controls. Operating profit growth for the quarter was “pleasing” despite the I&J challenges, with operating margin also expanding. This means that operating profit growth was higher than revenue growth.

Final allocations in the hake long-term rights allocation were made on 1 October. I&J’s quote is materially in line with the allocation initially made in February 2022, with a final reduction of around 5% relative to the rights held before the 2020 fishing rights allocation process began.

At De Beers, rough diamond sales are looking rougher by the day (JSE: AGL)

The lab-grown debate rages on – and my view is unchanged

Anglo American has released the latest sales data at De Beers. Cycle 9 2023 achieves sales of a paltry $80 million, way down from $454 million in Cycle 9 2022 and also lower than $200 million achieved in Cycle 8 2023.

The company keeps trying to convince the market that this is a deliberate decision to hold back on sales while supply and demand equalises.

Let me reframe that for you: we would like to sell more diamonds, but they aren’t moving quickly enough through retail stores and hence we have to hold back on sales because there isn’t enough demand.

I will say it again: lab-grown diamonds are disrupting this market. The 20- and 30-somethings out there want to buy experiences, not things. There are many people who are more than happy with a pretty ring for half the price, with the rest of the budget available for travel or the wedding itself.

As the excellent American Swiss billboard outside Canal Walk screams to people passing by on the highway: diamonds are for everyone.

Will the De Beers marketing machine manage to convince people that mined diamonds are still superior? Or will demand continue dropping, with mined diamonds only finding a market in premium jewellery? And in the interest of giving a balanced view, can lab-grown diamonds stay this cheap, or are they currently running an unsustainable economic model to try win market acceptance before ramping the price?

We can debate it all day long, but the De Beers numbers are telling quite the story.

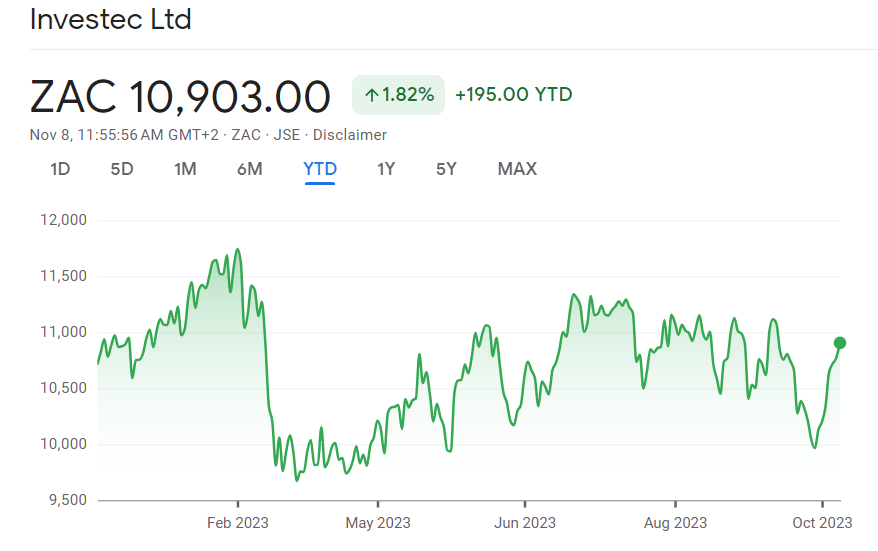

Investec did even better than expected (JSE: INL)

Earnings guidance has been revised higher

Back in September, Investec released a pre-close update for the six months to September 2023 that indicated a HEPS range of 33.8 to 35.8 pence vs. 32.0 pence in the comparable period.

The financial services group has released a further trading statement that now reflects a HEPS range of 36.5 to 37.5 pence. This is obviously great news for shareholders.

The updated guidance means that the growth in HEPS is between 14% and 17.2%. This is measured in GBP, so that’s a hard currency return.

The share price is up roughly 16% over the past 12 months. The year-to-date performance is flat though, with this very interesting chart that shows how many times the price has tried to break higher:

Lesaka reports an operating profit for Q1’24 (JSE: LSK)

This platform is still sub-scale, but there are promising signs here

Lesaka Technologies really is an interesting story. If you want to hear that story directly from the management team, you should watch the recording of the recent Unlock the Stock event featuring the company:

We now have results for Q1’24 and the highlight here is that the company has reported an operating profit. That might sound ridiculous, but there are many nuances to this story. The swing into profitability is a result of cost reduction initiatives in the Consumer business and the contribution from the Connect business that was recently acquired.

Unfortunately, there’s still a very big difference between operating profit ($228k) and the net loss attributable to Lesaka ($5.6 million). The net interest charge of $4.5 million is the biggest driver of that difference, up sharply from $3.6 million in the comparable quarter.

Having reminded you that the overall Lesaka platform is still sub-scale, let’s dig into the segments. The Merchant division (which includes Connect) reported revenue of $121.4 million, up 24% year-on-year. EBITDA margin is 6.6%, which is a structurally low margin because of the way that airtime sales are reported. In the Consumer division, revenue was $15.6 million and adjusted EBITDA margin was 15.9% vs. a loss last year.

Another important point to highlight is that the net loss of $5.6 million includes $5.9 million worth of depreciation and amortisation and $1.8 million in stock-based compensation. This is why cash from operating activities is actually a positive $3.3 million, with a total decrease in cash of $3.6 million in this quarter that takes the cash and cash equivalents balance to $55 million.

The balance sheet will also be helped by the specific repurchase of shares that Finbond is currently busy with, as Lesaka will sell its stake in Finbond back to that company for R64.2 million.

Lesaka sits firmly in the growth stock bucket, requiring you to take a long-term view on financial inclusion and fintech in the township economy in South Africa.

MiX Telematics has published first half results (JSE: MIX)

The results for the first six months of the year look pretty good

MiX Telematics reports quarterly because of the US listing. To make life more complicated, the company reports quarterly numbers under US GAAP and then six-monthly numbers under IFRS, which is the type of reporting that South African investors are accustomed to.

I’ll focus on the interim results reported using IFRS. Total revenue is up 13% in constant currency and subscription revenue is up by the same percentage, with the acquisition of Field Service Management having contributed 490 basis points worth of growth.

But despite revenue of R1.38 billion, profit for the period is only R38 million. These aren’t exactly juicy margins, are they? To be fair, this includes forex losses of R15.9 million and a R10 million charge from the income tax effect of net foreign exchange losses. Even with those adjustments, it’s not a high margin business.

Adjusted EBITDA increased 58% year-on-year to R343 million, with margin up 580 basis points to 24.8%.

It’s good to see that free cash flow of R45 million isn’t terribly different to profit for the period. Cash generated from operations was R270 million, so the business is quite cash hungry in terms of capital expenditure. Of the R224.8 million in capital expenditure in this period, R173.2 million was attributed to in-vehicle devices.

The company recently announced a proposed merger with Powerfleet, which would create a significantly larger business with benefits of scale and an expanded investor base on the Nasdaq. It’s early days for that transaction, as shareholders will need to be convinced of the benefits.

Little Bites:

- With the announcement of the merger with 1Life and the broader relationship with Telesure, it’s not great news that the Clientele (JSE: CLI) group CFO is resigning with immediate effect after 11 years with the business. His replacement on an interim basis is Tiffany-Ann Boesch, the former CFO of PPS.

- Ascendis Health (JSE: ASC) renewed the cautionary announcement related to the potential take-private by a consortium led by ACN Capital IHC, an entity owned and controlled by Carl Neethling. Discussions are still in progress and it’s quite possible that no deal will take place here, which is why shareholders are advised to exercise caution.

- Conduit Capital (JSE: CND) has renewed its cautionary announcement related to the liquidation order against CICL (the main subsidiary in the group) and the impact that this will have on the financial results for the year ended June 2022.

- The next time you feel like your personal admin is falling behind, just remember that Go Life International (JSE: GLI) is holding its AGMs for the years 2018 – 2023 on the same day in November!