Potential suitors are circling Assura (JSE: AHR)

And one of them is Primary Health Properties (JSE: PHP)

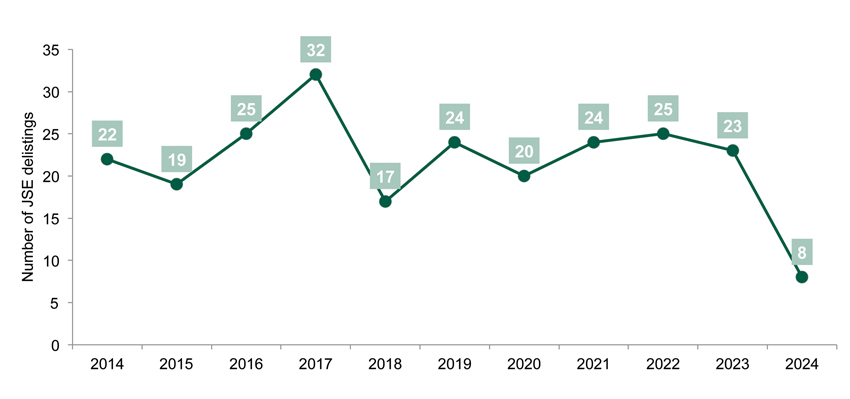

You have to feel for the JSE. They managed to convince two UK-based healthcare property companies to add a JSE listing and now one of them might be buying the other! Even if that doesn’t happen, it still looks likely that Assura will be acquired and delisted. Sigh.

There’s been a lot of activity around Assura and potential suitors. They’ve received an indicative, non-binding proposal from KKR and Stonepeak Partners of 49.4 pence per share. This would be structured as shareholders receiving the quarterly dividend of 0.84 pence and a cash consideration of 48.56 pence. This is a 2.9% increase on the last proposal that KKR put on the table. It would also be a 31.9% premium to the closing price on 13 February, before the action started with potential deals.

The board of Assura has decided that if this becomes a firm offer, then they would be “minded” (gotta love the British) to recommend the offer to shareholders subject to a review of its terms. This comes after a discussion with Assura’s major shareholders, who must’ve told the board that they would be quite happy with this number.

There’s a possible alternative on the table in the form of a non-binding proposal from Primary Health Properties. This would be an all-share combination (i.e. merger) rather than a cash buyout. It would value Assura at 43 pence per share, which is significantly lower than the cash option. Mergers also carry far more implementation risk than private equity cash deals. Understandably, the board has rejected the Primary Health proposal.

Primary Health is considering its options here. They at least have a clear cash price to aim for and an all-share merger would probably need to offer an even better implied price to Assura shareholders. Primary Health has until 7 April to announce a firm intention to make an offer or that they will not be making an offer. This is based on UK takeover law.

AVI: the operating leverage champions (JSE: AVI)

Here’s an example of doing a lot with a little!

AVI released results for the six months to December 2024. With revenue growth of just 1.1%, you wouldn’t expect fireworks. In fact, you might expect to see earnings in the red, as inflationary pressures on costs would normally punish a revenue performance like that.

Instead, we find gross profit up 4.6% thanks to strong gross margins. Group operating profit increased by 8.9%, benefitting from cost control that saw selling and administrative expenses come in flat vs. the prior year.

With only marginally higher net finance costs, HEPS came in 8.9% higher and so did the interim dividend. Remember, they achieved that increase off just 1.1% revenue growth!

The cash story is also impressive, with cash generated by operations up by 16.7%. Net debt did end the period quite a bit higher, as there was significant capital expenditure in the period.

A dig into the segmental performance reveals that Entyce Beverages did the heavy lifting here. Revenue was up 8.1% in that business and operating profit jumped by 43.9%, with revenue in both coffee and tea putting in solid results. As for Snackworks, a 1% decrease in revenue led to a 3.3% decline in operating profit – still a great example of resilience in the model. It seems as though consumers were happy to keep drinking their hot drinks, but they pulled back on the accompanying biscuits.

As for I&J, revenue was up 3.9% and operating profit improved by 13.5%. There was pressure on volumes that was offset by selling price increases and the benefit of a weaker rand on exports. Abalone had a poor year due to weaker demand in core Asian markets.

The Fashion Brands segment remains the ugly duckling in this business, with revenue down 6.9% and operating profit down 12.6%. It just isn’t a good fit at AVI, as this segment does the exact opposite of putting in a strong operating leverage performance. It’s a tough space, evidenced by Green Cross making the decision to close the retail business and discontinue the majority of wholesale lines.

Merafe signs off on a tough year (JSE: MRF)

Cyclical businesses can make you sick

Merafe’s share price is down 22% in the past 12 months. Pretty much all of that pain happened year-to-date, although it has been a choppy journey. The mining industry has been tough outside of gold and perhaps copper in the past year, particularly for riskier plays that have single commodity exposure.

Enter Merafe and its ferrochrome business, which was hit by surplus supply from China. Reading about demand issues is one thing, but the risk of China ramping up supply is quite another.

Sadly, given the fixed costs in the business, any pressure on revenue only gets worse by the time you reach profits. With revenue down 9% for the year, HEPS fell by 29% and the final cash dividend slumped by 64%. When you consider that cash generated from operations decreased by just 5%, the drop in the final dividend sends a message of nerves and uncertainty. As the interim dividend was flat year-on-year, the total dividend for the year was down 33.3% to 28 cents.

Interestingly, from a total return perspective, the dividend has essentially been offset by the share price decline over 12 months. Buying things for the trailing dividend is a fool’s errand.

Not much to smile about at Mpact (JSE: MPT)

An uptick in local economic activity would help

Mpact has released results for the year ended December 2024. Although revenue from continuing operations came in 3.6% higher, underlying operating profit took a nasty knock of 23.8%. This is the challenge when a business with high fixed costs just can’t achieve enough throughput in a weak demand environment. There were also some non-recurring expenses that added to the strain in this period. Speaking of strain, HEPS was 30% lower!

Cash from operations is another useful data point, down roughly 5%. That’s at least a lot better than the underlying profit performance and it would’ve helped to keep the balance sheet under control.

Although net debt is down from R2.7 billion to R2.4 billion, net finance costs were up 4.6% due to higher average net debt. The decrease in debt only happened right at the end of the period thanks to the proceeds from the sale of Versapak.

Return on capital employed was 11.7% vs. 16.6% in the prior year, impacted by lower profits and the capex programme that has been undertaken into a weak environment. Long-term decisions, even the right ones, can have short-term consequences.

Looking deeper, the Paper business saw revenue increase by 2.7% and operating margins decline from 10.9% to 8.3%. That’s a particularly nasty outcome. In Plastics, revenue increased by 8% and although you would certainly hope to see a solid profit performance off the back of that outcome, you would be wrong. The restructuring and site consolidation at FMCG Wadeville took operating profit in the Plastics division down by a whopping 52.7%.

The market will be watching for a strong recovery in the Plastics business in 2025. They simply cannot have a repeat performance of 2024.

Sun International had a strong finish to 2024 (JSE: SUI)

The second half was better than the interim period

Sun International released a trading statement for the year ended December 2024. Adjusted HEPS is expected to be between 11.3% and 14.7% higher for the year, which is a meaningful uptick vs. interim adjusted HEPS that was 9.1% higher. They clearly had a very good finish to the year.

I’m going to hope with everything I have that two-pot pension liquidity didn’t land up in gambling. Sigh.

Potential personal finance horror stories aside, Sun International seemed to have had its best growth in Sunbet (the online business targeting R900 million in EBITDA by 2028) and the Resorts and Hotels business. Urban Casinos were stable overall, with regional casinos continuing to struggle. There’s been a significant shift in behaviour away from casinos in favour of online betting. Finally, Sun Slots was “constrained by changing gaming dynamics” – that makes it sound like the shift to online betting is hurting that segment as well.

Ultimately, they don’t care too much where they make the money, as long as earnings are going up. The balance sheet also improved, with debt down from R5.7 billion to R5.2 billion over 12 months.

The market liked it, with the share price closing 6% higher.

Flat earnings and a lower NAV at Texton (JSE: TEX)

At least the SA property portfolio had decent letting metrics

Texton’s share price is currently trading at R4.00. Volumes are thin in this stock, so it can bounce around quite a bit when it crosses the bid-offer spread. Still, it was R2.50 a year ago, so the stock has made great progress in decreasing the gap to NAV – especially as NAV decreased by 9.6% between December 2023 and December 2024 to 643.40 cents!

Distributable earnings for the six months to December 2024 came in 1.83% higher overall. Net operating income in South Africa was up 17%, with the UK down due to disposals.

I think that the increase in the cash balance is one reason why the discount to NAV has decreased. Total equity on the balance sheet is R1.9 billion and they are sitting on cash of nearly R400 million. Sure, there are adjustments needed for working capital, but you get the idea. The group has shown strong propensity for investing in the US property market, so I wouldn’t hold my breath for anything different happening with this cash.

Nibbles:

- Although loans between companies within a group are normally very boring and don’t tell you much, there’s an exception to every rule. Vukile (JSE: VKE) announced that it has extended a shareholder loan of €40.5 million to Spanish subsidiary Castellana. This is intended to be converted to equity. This is obviously related to the investment pipeline in Spain, which is core to the Vukile investment thesis.

- US-based Solv Holdings is getting closer to South Ocean Holdings (JSE: SOH). In February, South Ocean announced that Solv now has a 20.19% stake. The latest news is that the CEO of Solv Africa, a portfolio investment of Solv Holdings, has been appointed to the South Ocean board as a non-executive director.

- Private equity house Capitalworks and Crown Chickens announced that they collectively now have a 15.05% stake in Quantum Foods (JSE: QFH). This is up from 11.44%, the level reached in September 2024.

- Trustco (JSE: TTO) seems to be moving ahead with its plans to delist from the JSE, Namibian Stock Exchange and OTC market in the US. An independent expert has been engaged and they are in the process of getting the expert approved by the JSE. They have also decided to withdraw all pending and announced corporate actions until the delisting has been completed.

- Fortress Real Estate (JSE: FFB) shareholders should keep an eye out for the circular giving them the option to accept the Fortress dividend as either a cash dividend or a dividend in specie of NEPI Rockcastle (JSE: NRP) shares. Fortress currently holds 16.26% in NEPI.

- Sygnia (JSE: SYG) has announced that the odd-lot offer price is R22.50 per share. Alas, it is being structured as a dividend and thus will be subject to dividends withholding tax, so shareholders will get a net R18.00 per share. In most circumstances, holders of 100 shares or less would be better off just selling their shares on the market. I don’t understand why this was structured as a dividend with a blanket “consult your tax advisors” statement when a stake of 100 shares is worth R2,250. Nobody with that stake will consult an advisor. They will just be impacted by the structure if they are an individual shareholder at a lower tax rate – and that’s exactly what most holders in that category would be.

- Following in the footsteps of many other small- and mid-cap names, Gemfields (JSE: GML) is transferring its listing to the General Segment on the JSE in search of a more appropriate set of listing rules for its size.