Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Italtile can’t catch a break (JSE: ITE)

No signs of improvement in this sector yet

The building materials industry has been having a torrid time in this higher interest rate environment. Probably the only house improvements that I’ve seen anyone do for the past two years have been related to solar installations. After investing in homes during the pandemic, even well-off consumers have prioritised spending on travel and experiences after the world went back to normal.

None of this is good news for Italtile, which has seen HEPS for the six months to December 2023 fall by between 13.1% and 17.0%. This puts it on 65.8 to 68.8 cents.

The share price has lost over a third of its value in the past three years.

Mondi buys a small mill in Canada (JSE: MNP)

The deal is worth just $5 million, so it only gets a passing mention by the company

With a market cap of R143.5 billion, a transaction worth under R100 million really isn’t going to move the dial at Mondi. This is why the acquisition of the Hinton Pulp Mill in Canada only gets a voluntary announcement. Kudos to Mondi for even giving this level of disclosure.

The mill has the capacity to produce around 250,000 tonnes of pulp per annum. The seller is West Fraser Timber Co. and there’s a long-term partnership in place with the company. Mondi intends to invest in the mill, including for the expansion of the facility with a new kraft paper machine.

Will MultiChoice shareholders have multiple choices? (JSE: MCG)

The board is playing hard-to-get with Canal+

After the market celebrated the news of a non-binding offer from Canal+ for MultiChoice at R105 per share, the company stunned everyone with an announcement that the board feels that this offer underprices the company. This is perhaps a good time to point out that MultiChoice last traded above this level in May 2023, with a 52-week low of R62.31 and a 52-week high of R155.20. The volatility has been exceptional.

MultiChoice claims to have recently gone through a valuation exercise that puts the value “significantly above R105 a share” – but they don’t say by how much, nor do they give details of why. The company also points to public comments by Canal+ that there are many synergies in the deal, which MultiChoice believes need to be factored into a fair offer by Canal+.

The synergies point is highly debatable. There is zero obligation whatsoever for Canal+ to pay a cent towards synergies that it will bring to the table. It is an established principle in dealmaking that you don’t pay for the value that you are bringing. If they really want the deal, then they might share some of the synergies.

When you’re buying a broken car and you have the skill to fix it, do you make an offer based on what the fixed car is worth, or what it is currently worth? Exactly.

MultiChoice is so bold in its approach that they have lifted the cautionary announcement and said that they won’t even engage further with Canal+. This throws the door wide open to any other potential bidders, which is either the masterstroke of the year or a very silly move. If it works, perhaps shareholders will get a better outcome than R105 a share. If it fails, I suspect that the share price will move sharply lower (after the mandatory offer period below) and Canal+ will just keep building the stake by picking up shares at a cheaper price.

Another interesting twist to this tale is that Canal+ has breached the 35% ownership threshold in MultiChoice, which means that it may need to make a mandatory offer to shareholders based on the price recently paid for shares in the market. The TRP needs to rule on whether there should be an offer. Initially I couldn’t see a reason for there not to be, but then I remembered that this rule might be interpreted based on voting rights rather than economic interest. Due to the restriction on foreign voting rights in a local broadcaster, they may not be deemed to have breached the mandatory offer threshold!

There are many potential outcomes here, ranging from a hostile bid made directly to shareholders or another bidder emerging with a better price, right through to the whole deal falling over and MultiChoice directors being left with some egg on their faces.

Corporate M&A is many things, but it isn’t boring!

A brighter rainbow at RCL Foods (JSE: RCL)

Improved conditions in poultry have led to better earnings

Although RCL Foods has put in a substantial effort to diversify operations and be more than just a chicken business, the numbers at Rainbow still make a sizable difference. For the six months to December 2023, HEPS will be at least 30% higher than the comparable period, with the improvement attributed to Rainbow and the sugar business unit.

Despite having to deal with Avian Influenza in this period, Rainbow achieved better numbers as the turnaround plan was executed. In the sugar business, higher market prices helped them out.

In Groceries and Baking, performance was in line with the comparative period as volumes struggled.

Sun International releases the Peermont circular (JSE: SUI)

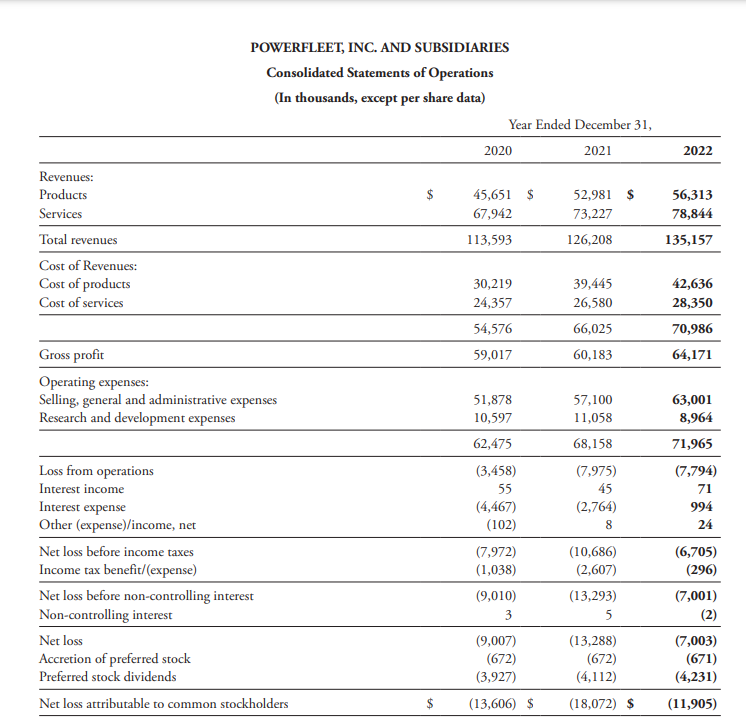

There are 11 properties in Peermont, with Emperors Palace as the clear flagship

For a transaction of this size, the release of the circular is a major milestone. In all its 158-page glory, you can see how corporate finance really works in practice.

The jewel in the Peermont crown is Emperors Palace, which has achieved an average EBITDA margin of around 40% in the past few years (excluding 2020). Sun International notes that this is in line with its largest casino operations, which shows that Emperors will slot right in beautifully.

There are 10 other properties in Peermont:

Peermont generated consolidated historical EBITDA of R1.056 billion in FY22 and R1.165 billion in FY23. The purchase price is based on an enterprise value of R7.3 billion. Based on the last twelve months to December 2023, this is EV/EBITDA multiple of 5.76x. That just shows you how ridiculously overvalued some assets are in South Africa, as you can pick up this group of casino assets on what feels to me like a rather modest EBITDA multiple.

The risk is on the balance sheet, with Sun International taking on R4.0 billion worth of debt in Peermont and borrowing the purchase price as well, so group debt will balloon from R5.9 billion to R13.2 billion. Sun International will pay reduce the dividend payout ratio to 50% for as long as the net debt to EBITDA ratio is above 2x and will pay 75% when it is below 2x.

So, it’s a risky gamble with strong potential upside. What else would you expect from a gaming group?

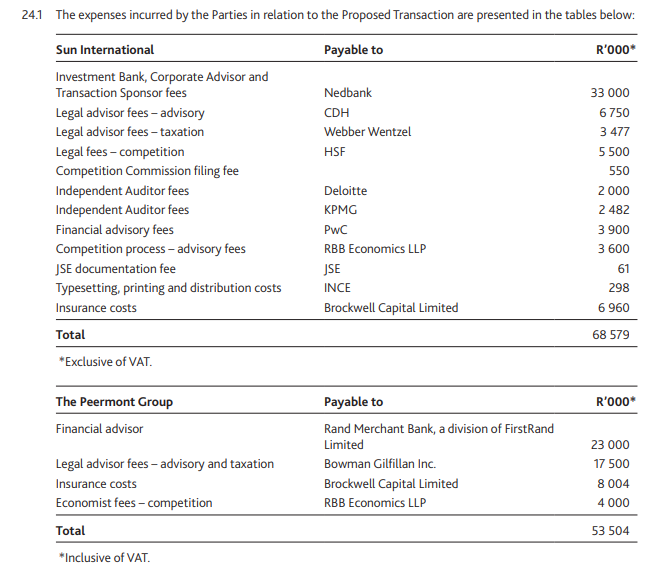

And in case you need a reminder of why people work extremely hard to break into the M&A advisory industry and then still put in incredibly long hours once they are in, here are the fees:

A bullish update from Vukile Property Fund (JSE: VKE)

The full-year performance should be ahead of even the upgraded guidance

The year ending March 2024 is proving to be a goodie for Vukile. This retail-focused REIT has unique exposure of 40% South Africa, 60% Spain. Total assets in the portfolio are worth R40 billion.

In South Africa, key metrics for November and December were positive and in line with expectations. Festive trading was particularly strong, with trading density up 7.6% in December. Township centres led the way with 13.2% growth, while rural centres grew 7.2% and urban centres only managed 4.5%. If we combine both November and December, we see township centres up 9.7%, rural up 3.3% and urban properties only 1.3% higher.

Fast foods were only up 5.4% in December, which is a modest performance that we’ve seen in other property updates as well. We know from the apparel retailer updates that clothing did well over this period, echoed by Vukile’s update that shows women’s wear sales up 14.5% in December and men’s wear up 8.1%. Notably, grocery sales were only up by 2.4% in December.

Moving on to Spain, Castellana (the name of the overall portfolio) achieved record footfall for the 12 months to December 2023, up 6.4%. Sales numbers grew 7.9% despite 2022 being a strong base. Unlike in South Africa, Black Friday was a relative winner with sales growth of 7.0% in November and 6.1% in December.

At category level, the winner in Spain was media and technology (up 19.5%), with health and beauty (14.2%) and food and beverage (12.3%) also putting in solid growth numbers. The leisure category finally moved ahead of 2019 levels, marking a full recovery from the pandemic (without adjusting for inflation, at least).

With nine months of the year now behind them, Vukile gave the happy news that full-year performance should be ahead of even the upgraded guidance for FFO per share (and cash measure) and dividend per share. It’s been an excellent year for the company.

Little Bites:

- Director dealings:

- The managing director of the Feed division at Astral Foods (JSE: ARL) has sold shares worth R1.2 million.

- A non-executive director of KAL Group (JSE: KAL) has bought shares in the company worth R224k.

- Renergen (JSE: REN) announced that the investment by Mahlako Gas Energy for a 5.5% stake directly in Tetra4 (the Virginia Gas Project) has met all conditions precedent. The R550 million should now flow. The market is waiting for helium to flow as well, so hopefully that isn’t too far away.

- Zeder (JSE: ZED) announced that the disposal of Capespan Group (excluding the pome fruit primary production operations and the Novo fruit packhouse) to Agrarius has been completed. Zeder has received R511.39 million from the disposal. Agrarius is a JSE-listed special purpose investment vehicle that is Shariah compliant and focsed on the agriculture sector value chain. It operates a R10 billion Shariah-compliant sustainability-focused asset-backed note program and raised this funding through the Sukuk issuances.