ADvTECH: a masterclass in operating leverage (JSE: ADH)

This story is going from strength to strength

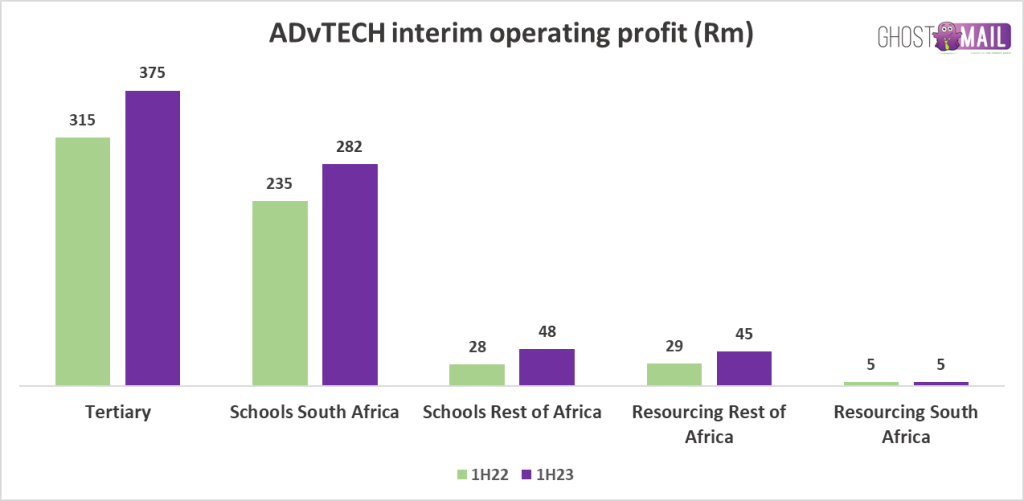

For the six months ended June 2023, ADvTECH put in an excellent performance that saw revenue up by 16% and operating profit up by 23%. Most pleasingly, operating profit growth was ahead of revenue growth in each of the four divisions. HEPS was up by a juicy 24% and the interim dividend increased by 30% to 30 cents a share.

Looking deeper, Schools South Africa grew student numbers by 6% and revenue by 13%, so price increases are helping greatly. Operating margin increased from 19% to 20.1%.

Schools Rest of Africa did even better, with student numbers up by 10%, revenue by 26% and operating profit by a fantastic 73% as scale benefits started to come through. Operating margin jumped from 18.1% to 24.7%.

In the Tertiary business, student numbers only increased by 4%. Thanks to pricing power, revenue was up 13% regardless and operating margin improved to 25.0%.

The Resourcing division certainly can’t boast these kinds of margins, with operating margin of just 5.9%. The good news is that revenue increased by 26% and operating profit was 44% higher, so it’s heading in the right direction.

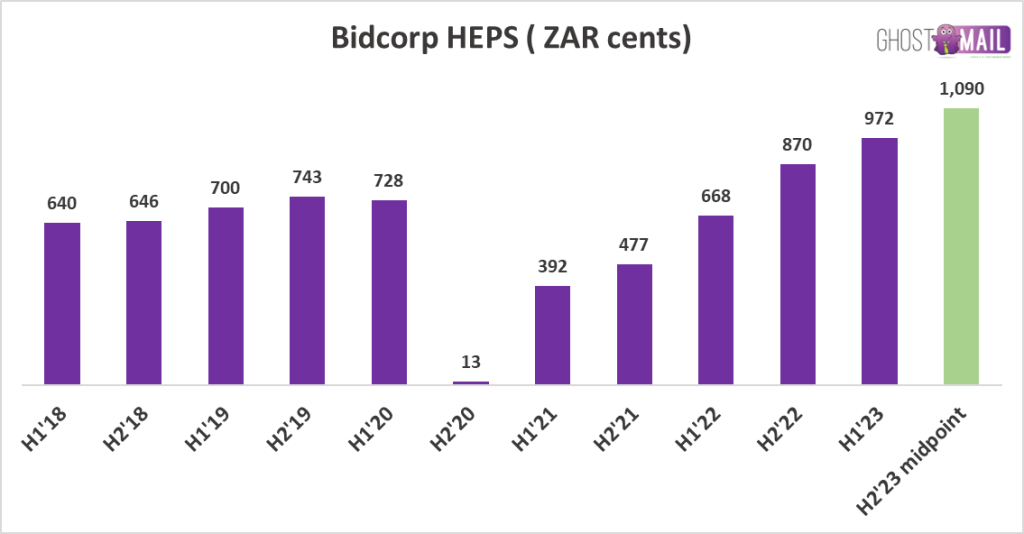

It’s all looking very good, so I decided to make a chart to do this performance justice:

There was a pretty awkward situation at the end of December 2022 when a systems migration led to a much higher trade receivables balance than would otherwise by the case. There’s a long way still to go in collecting the receivables, with R281 million of the R670 million tertiary balance collected. The company hopes to achieve a normalised debtors balance by the end of the year.

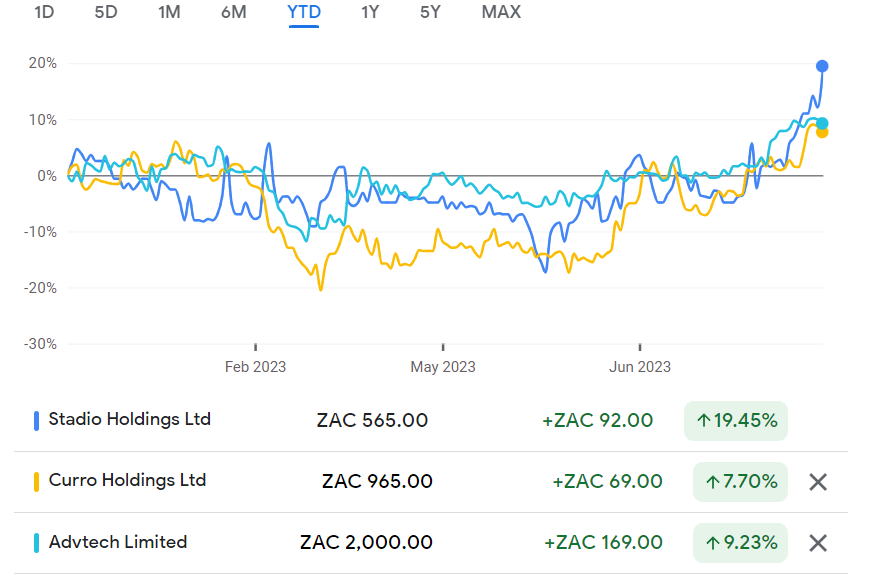

STADIO is leading the pack at the moment, but any of the education plays have been solid performers this year (although you needed a strong stomach):

CA Sales Holdings delighted the market (JSE: CAA)

The share price closed 9.7% after the release of results

This group is on a charge. Revenue is up by 22.5% for the six months to June and for all the right reasons, with volume increases alongside benefits of inflation, acquisitions and expansion into new regions. This is a proper growth company that is doing all the right things for investors.

If you want to understand more about how CA Sales Holdings generates revenue, you can refer back to the Unlock the Stock recording from April this year with the management team.

Even more impressive than the revenue performance is the operating profit jump of 75.5%. You need to read very carefully now, as HEPS was up by 21.5%. When you see such a big difference between operating profit and HEPS growth, you need to dig.

In this case, the reason is that operating profit includes a “gain on bargain purchase” (an accounting concept) linked to an acquisition in Namibia at a really great price that was below the fair value of the net assets acquired. This isn’t related to revenue, which is why the operating profit growth looks odd next to revenue.

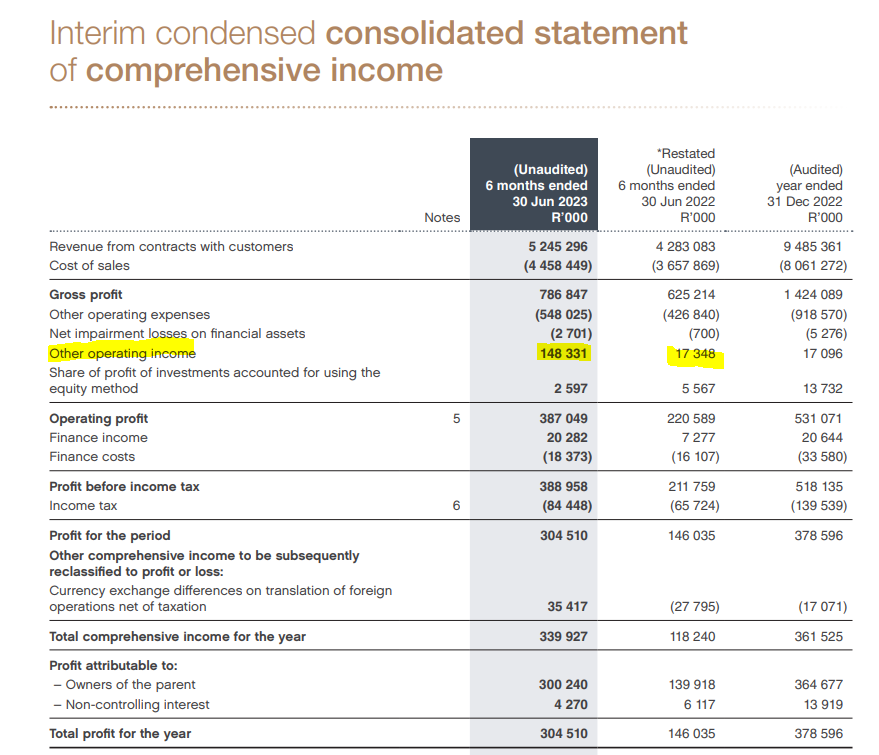

To show you how to find this kind of information, here’s the relevant line on the income statement that you can see is unusual:

CA Sales Holdings doesn’t pay an interim dividend, so no dividend has been declared for this period. If this performance carries on, the full-year dividend should be juicy!

Cognition inches forward (JSE: CGN)

The disposal of Private Property defined the latest financial year

Cognition Holdings has released a trading statement for the year ended June. HEPS has increased by more than 6x from 0.46 cents to between 2.68 and 2.78 cents per share. But with a share price of 92 cents, that earnings jump seems a little irrelevant.

Of far more relevance was the disposal of a majority stake in Private Property South Africa, which is why EPS is between 28.10 and 32.53 cents per share.

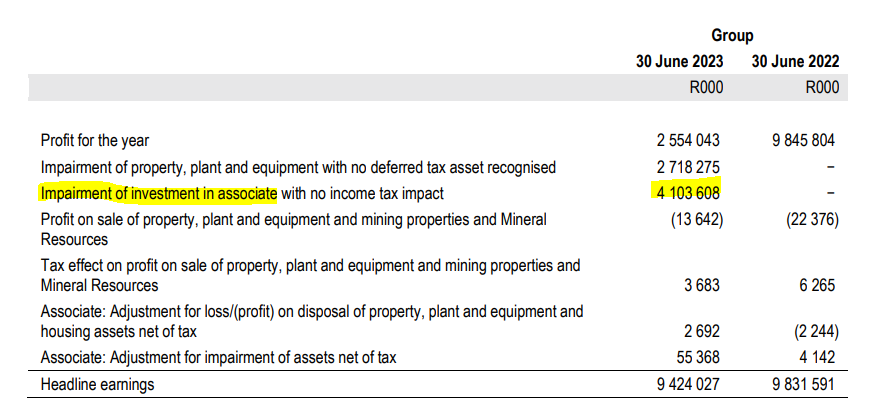

Italtile is suffering in this environment (JSE: ITE)

Volumes are down and HEPS has dropped 13%

Italtile is very much a casualty of broader South African pressures at the moment. Consumer confidence is low and the willingness to invest in property is even lower, with interest rates as a root cause of great stress on household budgets. When the priority list includes things like food and school fees, I’m afraid that new tiles for the bathroom are impossible to justify.

Italtile is generally regarded as a well-run business. With system-wide turnover up just 1% for the year ended June despite selling price inflation of 6.7%, even this business couldn’t afford a significant drop in volumes. And of course, lower volumes can only mean a drop in gross profit because of the manufacturing businesses in the group, taking gross margin down from 45.8% to 43.2%.

When the top of the income statement looks like that, the bottom half definitely won’t look like a beautiful new kitchen. HEPS fell by 13% and so did the total dividend, so at least the group managed to maintain its payout ratio.

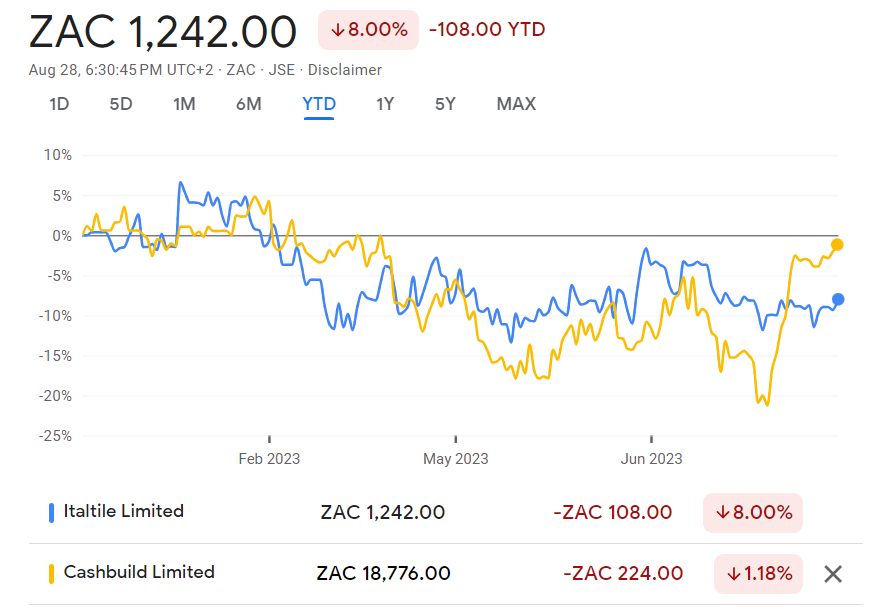

The recent share price activity in rival Cashbuild is quite extraordinary, leading to this year-to-date chart of the two rivals:

Murray & Roberts “is a group with a certain future” (JSE: MUR)

I don’t think the market believes a word of it anymore

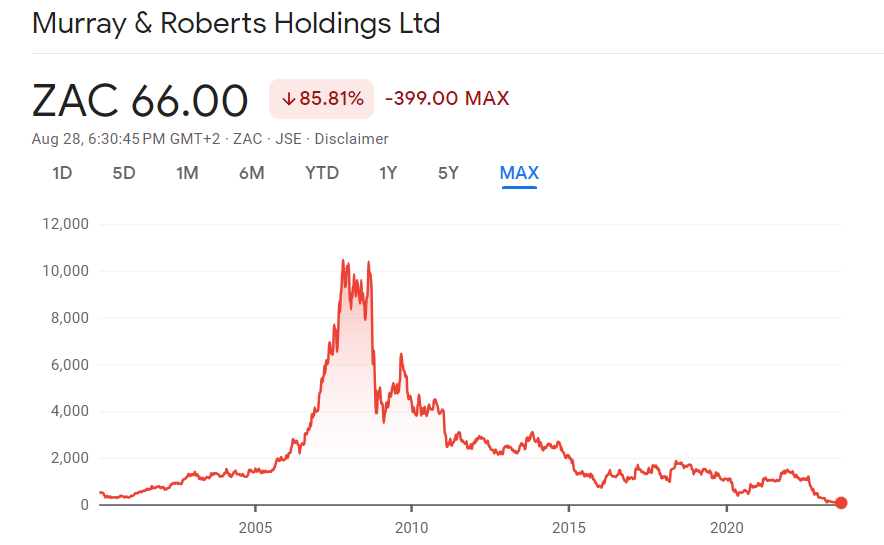

The Murray & Roberts share price tanked by another 12%, now trading at 66 cents. This is the same company that German group ATON wanted to buy for R15 per share back in 2018. At the time, the Murray & Roberts management team called it “opportunistic” and “poor value for shareholders” according to an article I found on Reuters. That offer was subsequently increased to R17 per share and was rejected again by the board in 2019.

You can’t make this stuff up.

This is perhaps why the market didn’t seem to care about the prospects section in the latest trading statement, which promised that “Murray & Roberts is a group with a certain future” – but not necessarily a bright one.

Of course, there was a destructive pandemic between 2018 and now. Nobody is denying that. Still, nobody I talk to in the market is particularly bullish on this story. With a headline loss per share from continuing operations of between -76 and -68 cents, it’s not hard to see why. If you include the full group and its various disasters, the headline loss per share is between -477 cents and -471 cents.

I can’t think of a better chart for SA Inc than Murray & Roberts. If you listen carefully, you can almost hear the vuvuzelas on this chart:

Little Bites

- Director dealings:

- Value Capital Partners has board representation at Altron (JSE: AEL) and has bought shares worth R37.5m.

- The credit executive of Capitec (JSE: CPI) continues to sell shares in the company, this time with a disposal of over R4.9m.

- The spouse of the CEO of Calgro M3 (JSE: CGR) bought shares worth nearly R50k.

- In what can only be described as disruption on a small scale, Disruption Capital (an associate of a director of Mantengu Mining JSE: MTU) has bought shares worth just under R2k. Separately, a director’s family trust sold shares worth R31.6k.

- Bringing an end to a very painful example of value-destructive M&A, Northam Platinum (JSE: NPH) has sold the rest of the shares that it had received in Impala Platinum (JSE: IMP) for the stake in Royal Bafokeng Platinum, which is being delisted. The company raised around R3.1bn from selling all the shares, with the latest disposal being worth R251m.

- Orion Minerals (JSE: ORN) has undertaken a detailed geological review and has increased the Mineral Resource for the Flat Mines Area. This has been incorporated in the Bankable Feasibility Study for the Okiep Copper Project. The study is being handed to the independent technical expert appointed by the debt advisor on behalf of the IDC and other interested debt financiers.

- Advanced Health (JSE: AVL) shareholders voted unanimously in favour of the proposed clean-out dividend of 20 cents per share, payable ahead of the delisting of the company.

- Hudaco’s (JSE: HDC) acquisition of Brigit (the fire business) has fulfilled all suspensive conditions and will become effective from 1 September 2023.

- Conduit Capital (JSE: CND) really needs to get the disposal of CRIH and CLL across the line. The fulfilment date for suspensive conditions was first extended from 1st July to 1st August, then to 1st September. The latest extension is to 30th September.

- Textainer (JSE: TXT) has confirmed the exchange rate for its dividend. A gross dividend of R5.64 per share will be paid on 15 September.