Attacq posts the Waterfall deal circular (JSE: ATT)

Here’s a good example of how corporate finance works

Attacq’s proposed transaction with the Government Employees Pension Fund (GEPF) has been in the news for a while now. It did great things for the share price, much to my enjoyment as a shareholder. The GEPF is taking a 30% stake in the Waterfall portfolio and the price on the table is effectively a lower discount (15%) to the net asset value than the listed share trades at. This triggered a value unlock for shareholders.

To get the deal across the line, Attacq needs shareholder approval. This means that a circular has to be sent to shareholders. You’ll find it here.

Other than the price, another highlight of the deal is that the proceeds from the sale will help Attacq reduce its gearing ratio from 38.1% to 26.3% based on December 2022 numbers. This is achieved without losing control of the Waterfall business, as Attacq will retain a 70% shareholding in it and will manage the properties for a fee.

Assuming the transaction goes ahead, the net asset value per share based on December 2022 numbers would be R16.779. Attacq is trading at R8.40. You don’t need to get the calculator out to see why the investment by the GEPF at a 15% discount to adjusted NAV of the portfolio is a good one.

The cost of the deal to Attacq is R11.3m, with Java Capital getting R5m for the corporate finance work and ENSafrica taking home R2.1m on the legals. EY gets nearly R1.8m as the reporting accountant.

Castleview to move higher in the Collins structure (JSE: CVW | JSE: CPP)

Transactions like this aren’t unusual in the listed space

Castleview Property Fund currently holds 25.7% in Collins Property Projects, a subsidiary of Collins Property Group (previously called Tradehold). This is where the logistics and industrial portfolio with a net asset value of around R3.6bn is held.

To make life simpler for Collins and to give it 100% control of its major operating subsidiary, the 25.7% stake will be acquired by Collins Property Group in exchange for the issue of listed shares to Castleview. This is effectively just a swap to the top, giving Castleview a 21.78% stake in Collins.

The issue price is R13.64 per share, which is much higher than the traded price of R7.35 because this is more like a NAV-for-NAV deal that is designed to avoid hurting Collins shareholders. If Collins was acquiring the underlying stake at NAV and issuing shares at a discount, it would be extremely damaging for existing shareholders.

This is a Category 2 transaction for Castleview and for Collins and so no shareholder approval is needed for either listed company.

Curro’s interim report is out: insert A+ puns here (JSE: COH)

Recurring HEPS is up by 36%

After 25 years of trying to plug the gap between government schools and very expensive private schools, Curro has released a set of numbers that looks strong. Weighted average learner numbers increased by 3%, revenue was up 16% (thanks to tuition fee growth of 14%) and recurring HEPS jumped by 36%. Recurring HEPS is the right metric because the base period included subsidy income received by Meridian.

It does give a sense of inflationary pressure on middle-income households in this country that tuition fees grew by 14%, while obviously noting that learner numbers are part of that. Still, tell us again about that average inflation number? Despite this, credit loss provisions were flat year-on-year, which actually suggests an improvement in credit quality considering the jump in revenue.

Despite the big jump in earnings, cash from operating activities only increased by 2% because of tax and interest payments along with working capital requirements.

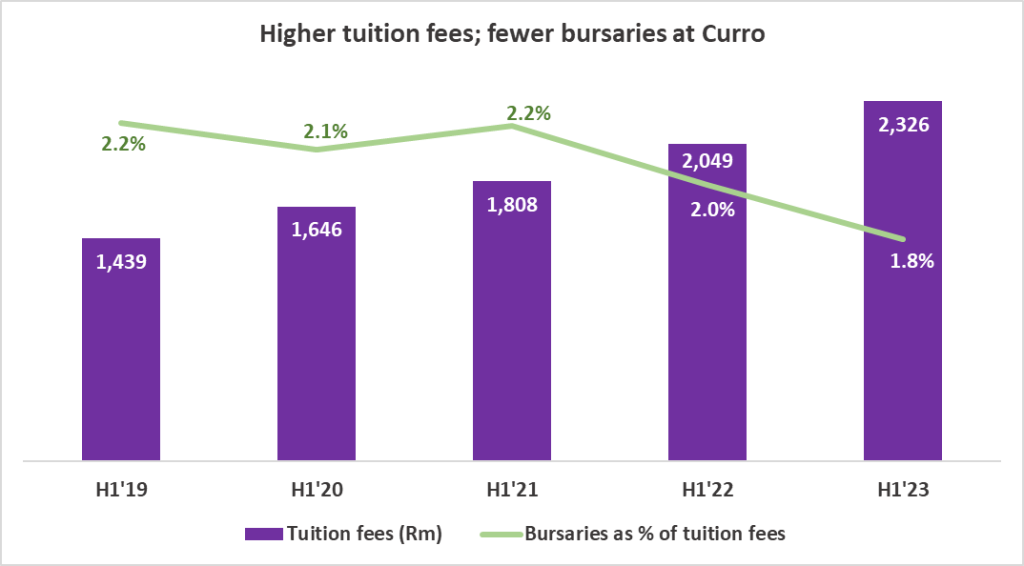

The group reports its various income sources in great detail, allowing me to create this chart of the day:

Curro is a business, so being able to reduce the percentage allocated to bursaries is actually good for shareholders. Welcome to the inevitable emotional conflict that comes with investing in private school education.

If you would like to attend the Unlock the Stock session featuring Curro that is scheduled for 31 August at midday, then register at this link. It gives you a wonderful opportunity to ask questions directly to the management team, brought to you by A2X.

Jubilee Metals pushes forward with chrome and copper (JSE: JBL)

With PGM prices under pressure, diversification is very helpful

If you’ve been following recent mining updates, you’ll know that the PGM players have been under immense pressure. Focusing on a single commodity (in this case the PGM basket gets treated as one exposure) is dangerous and leads to volatile earnings. This is what Jubilee Metals is trying to avoid.

For context to how volatile mining can be, we can look at the Jubilee share price over the past few years. After it went crazy in 2021 and traded above R4 a share, it’s all the way down at R1.60. A negative move in the mining cycle and a general shift away from riskier equities has not been kind to investors. Having said that, it’s still up over 250% with a five-year lens!

The company cannot control the share price but it can control its strategy. In an update to investors, Jubilee noted the continued expansion of the chrome operations at a time when chrome prices are supportive of this decision. The company is actively seeking additional chrome processing partnerships to increase production.

On the copper side, the roll-out in Zambia is ahead of schedule with commissioning of the Roan upgrade scheduled for October 2023. Jubilee is also busy with refining process trials to find better ways to recover copper from historical tailings materials. This is a major opportunity in Zambia and the CEO’s commentary around the trials is bullish.

Kore Potash affirms ongoing governmental support (JSE: KP2)

This might help settle the serves among investors

Kore Potash has been in the process of negotiating the required construction contracts for the Kola project for what feels like forever. Along the way, there’s been some awkwardness with the government of the Republic of Congo, which didn’t do anything to improve the growing nervousness among investors.

The company seems to be on the front foot now, announcing the receipt of a letter from the Ministry of Mines of the Republic of Congo that affirms ongoing support for the project. Of course, this is by no means a guarantee that the government won’t get jittery again if there are further delays.

Kore Potash is dealing with numerous moving parts here. The planned timeline is that the Engineering, Procurement and Construction (EPC) contract will be finalised by January 2024, with the financial proposal in place a few weeks later.

As the company is in the process of raising more funding to help it reach that date, this letter is critical.

RMB Holdings confuses basically everyone (JSE: RMH)

Strap yourself in and read carefully

After presumably a number of awkward boardroom discussions, RMB Holdings has released an announcement about the Atterbury loan problem and has withdrawn its cautionary announcement. Instead of trading with caution, you can now trade with confusion.

Atterbury owes R487m to RMB Holdings. R162m will be repayable by the end of December 2023, unless Atterbury can’t afford that repayment, in which case it’s repayable in June 2024. Interest is payable at JIBAR plus 2.75%.

The remainder of the loan (R325m) will be settled at the same time that the R162m is settled, by the issuance of shares in Atterbury to RMB Holdings, calculated based on June 2023 NAV. This would increase RMB Holdings’ shareholding from 27.5% to 38%.

In case the R162m is not repaid by June 2024, then the entire amount (i.e. plus the R325m) becomes payable immediately, along with interest.

Ok. Great. But if Atterbury doesn’t have R162m in 2024, then how exactly would they suddenly find the R487m? They will be in the exact same position that we find ourselves in today, having bought themselves nearly another year and given themselves the option to part-settle in equity.

Either the market is a lot smarter than I am (very possible) or people didn’t read properly (always plausible), with the share price up 7% for the day. It doesn’t sound to me like this is a win for RMB Holdings but I’m happy to be corrected.

From bad to worse at Salungano (JSE: SLG)

The signs of trouble were there when directors resigned in July

Things are now going very badly for Salungano, with the listing having been suspended by the JSE for the company’s failure to publish its financials for the year ended March. If that wasn’t bad enough, a mining contractor of Wescoal Mining (a wholly-owned subsidiary of Salungano) has taken legal steps to liquidate that subsidiary, with a notice of opposition to the application due to be heard this week.

In response, Salungano has launched a court application to place Wescoal Mining in business rescue. This includes the mining operations at the Khanyisa and Elandspruit mines.

Dear, oh dear. The share price has lost over half its value this year and shareholders are now stuck.

Thungela: a perfect example of mining cycles (JSE: TGA)

The interim dividend has dropped by 83% year-on-year

Coal prices have not been a happy story this year, leading to a sharp drop in year-on-year profitability at Thungela. HEPS has plummeted from R67.23 to R22.46 and the interim dividend per share is down at R10 from R60 last year. This means that the payout ratio has also come down significantly when expressed in terms of HEPS. Thungela has declared 33% of adjusted operating free cash flow as a dividend.

Despite this, adjusted EBITDA margin is still at 31% which is hardly a low level. It just looks ugly compared to 64% last year.

The group gives an optimistic view that the current pressure on the coal price won’t last, with ongoing demand for coal and underinvestment in most of the world in coal supply (except for China, India and Indonesia). None of this really helps if we can’t get the coal to our ports, with Transnet Freight Rail again covering itself in glory with a 13% deterioration in the coal run rate year-on-year. Things at least got better towards the end of the period after a terrible first quarter with derailments.

The acquisition of the Ensham business in Australia for R4.1bn is expected to close at the end of ths month. To put that number in perspective, Thungela has R13.6bn in net cash and is about to pay a dividend of R1.4bn.

The market reacted positively to the update, with Thungela closing 4.8% higher.

Little Bites:

- Director dealings:

- Value Capital Partners has board representation on Altron (JSE: AEL) and has bought another R14.9m worth of shares in the company.

- A director of AngloGold (JSE: ANG) has bought $121k worth of shares in the company (in the form of American Depository Receipts).

- The selling of shares by directors and associates of Argent Industrial (JSE: ART) continues, this time to the value of R350k.