Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Grand Parade’s HEPS is vastly higher, but don’t get excited (JSE: GPL)

The jump is for non-recurring reasons

Grand Parade Investments has released results for the year ended June 2024. HEPS is up by more than sevenfold from 2.56 cents in the prior period to 19.20 cents in this period. And no, this isn’t because the underlying investments are suddenly shooting the lights out.

In fact, profit from equity-accounted investments actually decreased from R121 million to R114 million. Aside from a couple of other line items, the real reason for the improvement in HEPS can be found in operating expenses which decreased from R102 million to R58 million. This is due to the costs of the substantial restructuring transactions in the base period.

The current level of profitability is probably a reasonable approximation of where the group will be going forward. The year-on-year percentage move certainly is not.

Hyprop is a step closer to saying goodbye to the problematic African portfolio (JSE: HYP)

One deal has become unconditional and the other is hopefully nearly there

In early August, Hyprop announced that it was finally getting out of the portfolio in Nigeria and Ghana that had caused many headaches. The disposals of the portfolios in each country were structured as separate deals.

The deal to dispose of the properties in Ghana has become unconditional, so that’s one down at least. The Nigeria deal is in the process of fulfilling its conditions precedent.

Jubilee Metals has secured stable power in Zambia (JSE: JBL)

This is key to the copper strategy

Jubilee Metals’ Zambian copper strategy has an initial processing capacity target of 25,000 tonnes of copper per year. There are two sites to help them get there: the Sable Refinery and the Roan Concentrator. To meet the target, they will have open-pit mining operations and reprocessing of surface waste.

A stable power supply (or lack thereof) has been a significant challenge. Thanks to a recently signed agreement with Lunsemfwa Hydro Power Company, they have been enjoying uninterrupted power for the past week and this will continue into the future with 100% renewable power.

In other important news, the Roan front-end module has achieved its design capacity and the Roan operational team is now running it day-to-day. Munkoyo open-pit operations have been ramping up, with the higher grade ore to be delivered to the Sable Refinery and the rest stockpiled for further processing. And finally, their large waste rock project is set to begin a commercial trial in November this year thanks to Roan’s front-end module.

Jubilee has a very exciting copper strategy and now has the power to implement it, literally.

NEPI Rockcastle looks to tap the bond market (JSE: NRP)

Here’s a good reminder that there’s more to a balance sheet than equity

It’s easy to forget that companies use public markets to raise debt as well as equity. NEPI Rockcastle (JSE: NRP) has delivered a great reminder of that fact, with a plan to raise EUR 500 million under the existing EUR 4 billion medium-term note programme.

Essentially the way this works is that companies go through the pain (and expense) of setting up an umbrella debt programme with a set of rules that the market comes to understand. When they actually need the money, they then raise debt under the programme based on the terms that were already assessed by the market. For the JSE and other public markets worldwide, the debt market is an important part of their business. For corporates, it’s a vital way to spread funding risks and be less reliant on banks.

To add further intrigue to this debt offering, this is a green bond structure, so the money will be used for projects that meet the eligibility requirements based on the green finance framework adopted by the company.

Overall, this is a great example of how the largest funds can really take advantage of the best that debt markets have to offer. The ultimate winner in that is equity holders, as a cheaper cost of debt means more profits for equity investors.

South32 got an important grant from the US government (JSE: S32)

It always helps when the government helps you pay for things

South32 announced that the Hermosa project in Arizona in the US has been selected for a $166 million award from the US Department of Energy (DOE). Hermosa’s project offers the only clear pathway to produce battery-grade manganese from locally sourced ore for the North American electric vehicle battery market.

Energy is always a matter of national importance, so you can understand why the government wants to push things along there. The intention is for the grant to support the development of a commercial-scale manganese production facility, with the DOE providing 30% of the cost of the facility up to a maximum of $166 million.

This means that South32 is still on the hook for the bulk of the cost, as it should be, so they will need to get themselves comfortable with the business case. They are engaging with potential customers and looking for supply opportunities.

In the meantime, they are busy with certain construction projects at the facility, supported by a $20 million grant from the Defense Production Act Investment Program. If you can get the government to help de-risk your project, why not?

And in news from the Taylor zinc-lead-silver project, construction there is progressing as planned. The intention is for this project to have shared infrastructure with the Clark project at Hermosa, which is the subject of the US government support.

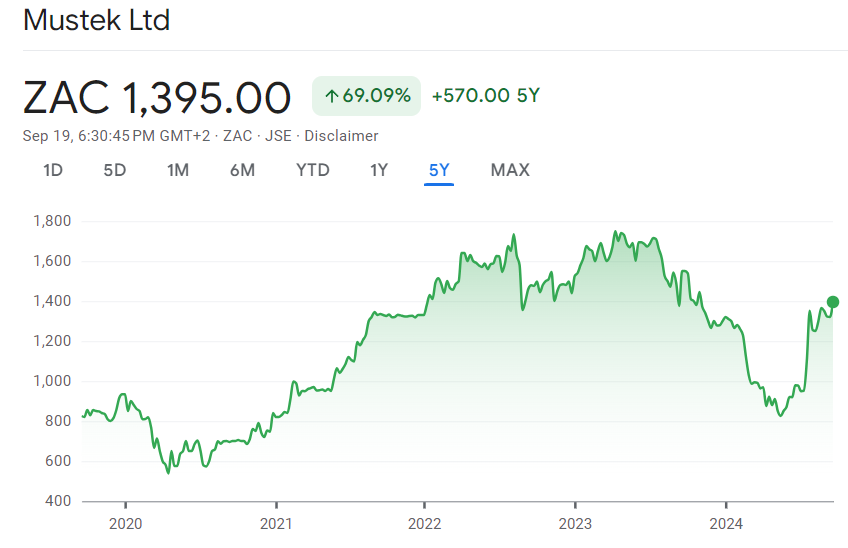

Signs of life at Trellidor (JSE: TRL)

Investors will treat this one with caution

Trellidor has been a source of pain for many investors, with the share price having roughly halved in value over 5 years. It’s been a rollercoaster ride of note along the way, with people initially taking the “stay home and stay safe” trend very literally in the pandemic. Those were good times, with the share price trading at around R3.50.

Subsequent labour and supply chain challenges along with demand issues took the share price below R1.20 in early 2024. It closed at R2.06 on Monday, so you can forgive shareholders for having whiplash from this volatility.

In early September, an initial trading statement indicated that HEPS would be at least 22.4 cents, a much better outcome than 4.20 cents in the prior period. The even better news is the updated trading statement, which gives a range for HEPS of between 35.68 cents and 36.52 cents.

Thanks to all the pain previously suffered, investors will take a while to really believe in Trellidor again. The midpoint of the guided range is a Price/Earnings multiple of around 5.7x at current levels.

Texton is still trading at a huge discount to NAV (JSE: TEX)

Share buybacks are the only option here – but the board has other priorities

Texton’s net asset value (NAV) per share is R6.25 and the share price is R3.40. Even if you knew nothing else about the company, your head should already be spinning with thoughts of how share buybacks could make a difference here. If the directors really believe in the NAV, they should be using all excess cash to buy the shares back at what looks like a bargain price relative to the NAV.

The good news is that Texton has been recycling capital, with R71.9 million of non-core assets sold. The bad news is that they love investing in international property investments even though the market simply won’t pay close to NAV for that exposure, with R30.6 million deployed in such investments over the same period as the aforementioned disposals. For reference, R34.2 million was used for capital expenditure in the South African portfolio. Share buybacks? Just over R300k.

The capex is necessary and can be value-adding for investors. As for the international stuff, it speaks volumes that Texton’s board believes more in that opportunity than in simply buying back their own shares at a 45% discount to NAV.

Even more strangely, the dividend per share is up by 4.5%. If nothing else, at least pay a flat or lower dividend and use the excess cash for more buybacks!

Nibbles:

- Director dealings:

- In the recent Lighthouse Properties (JSE: LTE) bookbuild to raise capital, Des de Beer subscribed for shares worth R15.1 million. An associate of a different director subscribed for nearly R3 million in shares.

- An associate of a director of Discovery (JSE: DSY) sold shares worth R11.9 million.

- A director of Aspen (JSE: APN) sold shares worth R2.9 million.

- The CFO of Metrofile (JSE: MFL) has bought yet more shares, this time to the value of R210k.

- A prescribed officer of Thungela (JSE: TGA) sold shares worth R148k.

- Due to the vesting of share awards, there was selling by various directors / prescribed officers of Woolworths (JSE: WHL). In several cases, the sales exceeded the amount needed to settle taxes. This counts as a sale in my books, particularly given the current pressures in the business.

- Primary Health Properties (JSE: PHP) has been included in various JSE indices. This is important as it means that index tracking funds (like ETFs tracking those indices) will need to buy the shares.

- Mantengu Mining (JSE: MTU) has made some major changes to the board. These include Alastair Collins moving from chairman to Chief Legal Officer (you won’t see that career path every day) and Jonas Tshikundamalema appointed as Chairman in his place.