Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

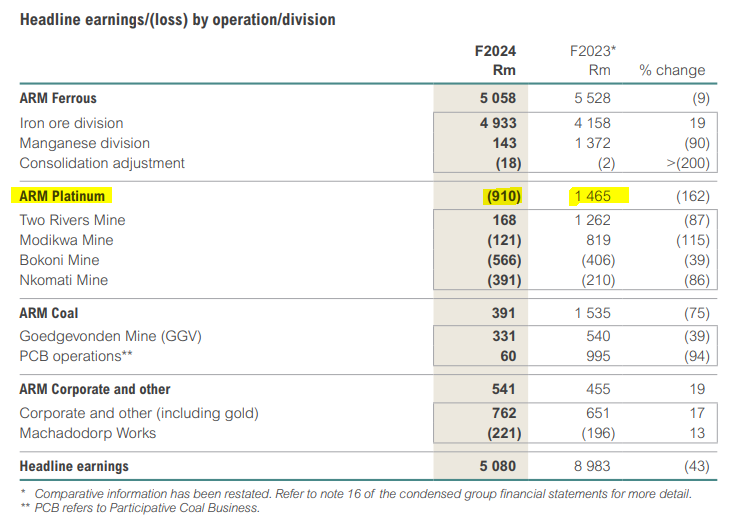

Anglo American is calling all pockets for its Anglo American Platinum stake (JSE: AGL | JSE: AMS)

Instead of just unbundling the full stake, they are selling some of it first

The latest trend on the JSE seems to be a placement of shares in a subsidiary, following by an unbundling of the remaining shares. The rationale varies from group to group, but this is proving to be a powerful way for a group to unlock some cash and then release the rest of the stake to shareholders.

Anglo American is taking this route with its 78.56% stake in Anglo American Platinum. Amplats is already listed of course, so getting institutional investors to take a piece of that stake before an unbundling is going to require some incentivisation in the form of price. Anglo American wants to sell approximately a 5% in Amplats through an institutional placement, with the rest due to be unbundled to shareholders at some point in the future.

They’ve appointed three major banking groups, both locally and abroad, to try and get this placement done. The PGM sector is in disarray at the moment, so it’s going to be really interesting to see what the market demand looks like – and especially at what price. Naturally, unless you’re an important institutional investor, your phone won’t be ringing with a call from the banks.

AngloGold looks for riches in Egypt (JSE: ANG)

The group is acquiring Egypt’s largest and first modern gold mine

AngloGold has announced that it is acquiring Centamin, a gold producer whose flagship asset is the Sukari gold mine in Egypt. If the deal goes ahead, Centamin shareholders will be paid a combination of AngloGold shares and cash, giving them a premium of 36.7% to the closing price on 9 September. Centamin shareholders will also be eligible to receive the dividend due to be paid on 27 September.

To give an idea of just how large this deal is, Centamin shareholders will hold 16.4% in the enlarged AngloGold group after the deal. In return for allowing this dilution, AngloGold shareholders will be invested in a high quality gold mine that will reduce group costs per unit of gold produced. The deal will also be free cash flow per share accretive from the very first year.

For the deal to go ahead, Centamin shareholders will need to vote in favour of it. The Centamin directors have unanimously recommended that Centamin shareholders do exactly that. The directors have also given irrevocable undertakings to vote in favour, but their ownership stake is immaterial in the group context.

As usual, there are also regulatory hurdles to overcome. These deals aren’t simple and they don’t happen overnight.

If you’re interested in learning more, you’ll find the corporate presentation on the deal here.

Attacq achieved great growth in this financial year (JSE: ATT)

Nobody can be upset about 19% growth in the full-year dividend

Property fund Attacq has released results for the year ended June 2024. The TL;DR is that distributable income per share increased by 19.9% and the full-year dividend was up 19.0%. With that kind of growth in the key metric for a property fund, it feels like we barely need to read any further.

One thing that always needs to be checked is the balance sheet, particularly the loan-to-value ratio. Thankfully, that has improved from 36.8% to 25.3%.

In terms of capital allocation, the focus has been on the acquisition of 20% in Mall of Africa as well as further additions to investment property. On the disposals side, the notable move was to sell the remaining 6.45% investment in MAS for R773.1 million.

The share price return over the past 12 months of around 60% is a pretty great summary of the recent momentum not just in the sector, but in Attacq itself.

Bowler Metcalf had a spectacular year (JSE: BCF)

And no, this isn’t just a year-on-year fluke thanks to a soft base

Bowler Metcalf is one of the better small caps on the JSE, although they’ve certainly had a tough couple of years in the build-up to this excellent result. Still, the 57% increase in HEPS for the year ended June 2024 isn’t just because 2023 was a weaker year than the preceding few years. At 161.38 cents in HEPS, they are running well above even the 2021 level of 127.31 cents.

This result was driven by a 10% increase in revenue, with the group also managing to become more efficient over time and increase its return on equity to 13.4%. That’s the highest level in any of the recent years, indicating that the group is going from strength to strength. After substantial capital expenditure in 2024 and a decent pipeline into 2025, it seems there’s a strong chance that they could beat the record cash generation achieved this year.

The share price has limited liquidity, so caution is needed around the bid-offer spread and position sizing. The share price is up around 60% in the past 12 months, so those who decided to stomach the small cap risk have been well rewarded.

Caxton gets a rap over the knuckles from the JSE (JSE: CAT)

The exchange is unhappy with announcements released by Caxton in 2022

Those who have followed Caxton and Mpact closely over the past couple of years will know that the relationship between the companies is less than friendly, despite Caxton being heavily invested in Mpact.

Among many rather colourful things that happened along the way, Caxton released announcements on 12 August 2022 and 6 October 2022 that included all kinds of statements related to Caxton’s views on Mpact’s alleged behaviour and how the packaging market works. There were all sorts of allegations and pseudo-allegations that were made, which the JSE feels were not in line with the requirements for the use of the SENS platform. Caxton had no direct obligation or legal duty to make the statements about another listed company, with the JSE clearly wanting to put a stuff to fights like these over SENS.

Caxton got away with a public censure rather than a fine as well. The company has also been forced to retract the specific statements made over SENS.

Despite negative volumes, Libstar grew revenue and improved its margins (JSE: LBR)

This is the power of being able to put through pricing increases

Libstar has released results for the six months to June 2024. The revenue growth of 5.2% won’t set your pants on fire, but it’s worth digging deeper into that number to note that selling price inflation and mix contributed 5.4%, with volumes down 0.2%. That’s an interesting outcome.

The ability to put through pricing increases helped grow gross margin from 21.2% to 21.5%, assisted by cost management as well. That’s just as well, as operating expenses increased by 8.2% with insurance costs as a major pressure point, along with the usual suspects like salaries and wages. This means that the gross margin improvement was largely offset by expense growth, leading to normalised operating profit only growing by 5.3% and showing negligible improvement in margin.

Normalised EBITDA has increased by 13.4% and that margin increased from 7.2% to 7.7%. This tells us that depreciation was higher in this period than the prior period.

Another good news story is that net finance costs have decreased by 11.1%, thanks to lower average borrowings during the period. The debt to EBITDA ratio improved from 2.1x to 1.6x, way below lender covenants of 2.5x.

This decrease in finance costs helped drive an improvement in normalised HEPS of 11.4%. HEPS calculated without the normalisation adjustments was 32.4% higher, but this is affected by foreign currency and other moves.

If there’s a downer in this result, it’s on the cash generated from operations line which showed very little growth despite the uptick in earnings. This is because of the higher stock levels in the group and shipment delays that are making this difficult.

The group has been through a major strategic rethink and the results are clearly showing here. They’ve made a number of changes to the internal structure and reporting lines. The earnings announcement was also accompanied by the news that Libstar sold its interest in Chet Chemicals, which is part of the Household and Personal Care category. The buyer is a company called Mithratech, which is a subsidiary of Morvest Group.

With Libstar generating over 94% of its revenue from perishable and ambient products, this business just isn’t a great strategic fit within Libstar and doesn’t sit well with a strategy to simplify things. As the deal is so small, they haven’t disclosed the selling price.

Uninspiring numbers at Old Mutual, despite what we’ve seen at financial services peers (JSE: OMU)

There are no Sanlam growth rates happening here

Old Mutual has released a trading statement for the six months to June. At a time when other financial services groups are releasing exceptional numbers, I’m afraid that there’s no excitement here. It seems as though the Personal Finance segment was the problem, specifically in the life business. Group overheads also played a role here, with those challenges offsetting the performance in Old Mutual Insure, Old Mutual Corporate and the Mass and Foundation Cluster.

Old Mutual’s preferred performance metric is adjusted headline earnings, which put in a move of between -2% and 8% for the interim period. The midpoint of that is positive at least, so it’s a disappointing period rather than a poor period. Adjusted HEPS is up by between 2% and 12%. Although it’s potentially an inflation-beating performance, it doesn’t look good relative to what we’ve seen elsewhere in the sector.

Sanlam’s share price is up 25% in the past 12 months and Old Mutual is down 0.4%.

Texton sells a UK property below book value (JSE: TEX)

They plan to recycle the capital – but into what?

Here’s the funny thing about Texton: with the share price at R3.90 and the net asset value (NAV) per share sitting much higher at R7.12, they could sell off all their assets at a pretty significant discount to book and still create value for shareholders – provided they return the capital to those shareholders.

Sadly, I don’t think we will see that happen. When Texton talks about recycling capital, they inevitably mean investing it in US-based property funds. This is why the discount to NAV probably isn’t going anywhere.

Perhaps they will shock me with the proceeds from the sale of the Heapham Road Industrial Estate in Gainsborough in the UK. The disposal price is £7.3 million and the value of the asset was disclosed as £8.25 million as at June 2023, so although they’ve sold it at a discount to NAV, they’ve technically sold it at a premium to what the share price is implying.

Let’s see what happens next with this capital.

The market is supporting the Vukile story (JSE: VKE)

My bullishness on property in this market cycle continues

Something that makes me happy as a holder of the REIT sector in general: market support for capital raising initiatives, like we’ve just seen at Vukile.

Something that irritates me as a holder of the REIT sector in general: the fact that institutions will always participate in these capital raisings at a discount, which means retail investors are diluted by more than they should be.

I understand why companies do it though, especially when they are looking to quickly raise the capital and get on with things. If you’re going to include retail investors as well, you can’t raise R1.5 billion overnight. Just consider that for a moment: R1.5 billion raised in the time that it took people to have dinner and then breakfast.

Vukile initially wanted to raise around 5% of its market cap, but increased that to 7.7% based on demand in the market. The placement is at R17 per share, a discount of 4.6% to the pre-launch closing share price. Without the discount, it’s a lot harder to get institutions to bite at the cherry, which is why the challenge of dilution in capital raisings isn’t about to disappear.

At least in the case of Vukile, the discount is manageable because there is solid demand for the shares. When we get near the top of the cycle, even the less successful funds will be able to raise capital at minor discounts. When that starts happening, it’s time to take profit on the REITs and move on to something else.

For now, I’m still strongly invested in the property sector in my tax-free savings account and I’m quite happy with that situation.

WBHO has grown earnings and declared a dividend (JSE: WBO)

This is why the share price is up 85% in the past year

If you’re looking for a feel-good story about SA Inc, this one just might do it. Construction group WBHO has grown revenue from continuing operations by 16% for the year ended June 2024. That’s a good start to the income statement, leading to a great outcome like HEPS from continuing operations jumping by 18.7%.

There’s a final cash dividend of 230 cents per share, which is a whole lot better than nil cents per share in the comparable period. This tells you just how much things have improved in the industry, although I must point out that the order book has decreased from R32.6 billion at June 2023 to R30.6 billion at June 2024.

It’s not every day that a share price marches with this enthusiasm towards the top right-hand side of the page:

Little Bites:

- Director dealings:

- A director of a major subsidiary of Tiger Brands (JSE: TBS) received shares worth R1.43 million and appears to have sold the entire lot, as no mention is made in the announcement of this being only the taxable portion.

- NEPI Rockcastle (JSE: NRP) has released the details of the scrip dividend alternative. The default option is a capital repayment rather than a cash dividend or scrip issue, with both those alternatives available as well. The decision will mainly come down to the different tax consequences.