Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

ADvTECH signs off on another strong period (JSE: ADH)

These numbers look great

ADvTECH has released results for the six months to June 2024 and there’s a lot to feel good about. Revenue is up 9%, operating profit increased by 15% and HEPS put in a 16% increase. When you’re looking for your equity investments to deliver real growth i.e. ahead of inflation, these are the types of numbers you want to see.

The interim dividend of 38 cents per share is 26.7% up on the prior year, so there’s a bump in the payout ratio as well.

Perhaps best of all, operating margins have increased in each of the underlying divisions. Schools Rest of Africa is quite the story, with operating margin up 400 basis points to 28.7%. That’s higher than Tertiary at 25.8%, Schools South Africa at 20.3% and the relative ugly duckling in the group, Resourcing at 6.3%.

I think they would unlock an even better valuation multiple if they sold the Resourcing business and made themselves a pure-play education business.

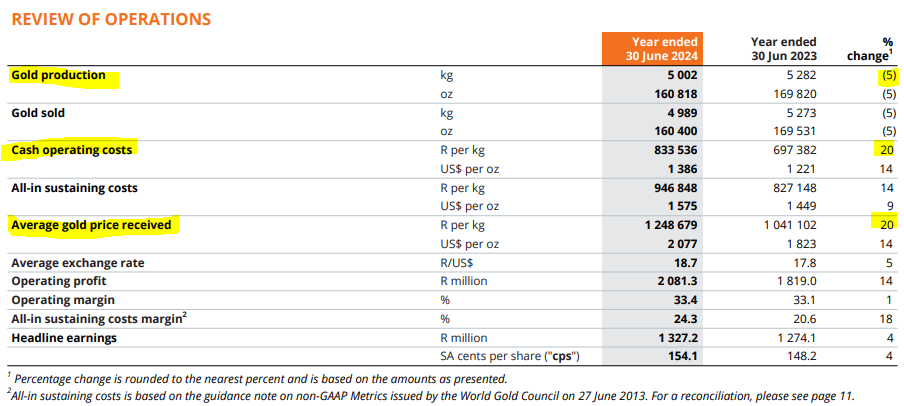

Harmony expects HEPS to more than double (JSE: HAR)

Some of this is a weak base, but well done to them for improving when it mattered

The gold sector has dished up remarkable variability in earnings performance this year. If you haven’t seen it before, this has been a great time to learn that the miners and the commodity don’t always perform equally. In fact, they rarely do.

Harmony has released a trading statement for the year ended June that reflects an expected increase in HEPS of at least 100%. In other words, it will at least double!

We will only get full details when results are released on 5 September. The delay is due to auditors needing to complete their work related to an undeveloped property. In the meantime, we know that production was 6% higher and ahead of guidance, supported by higher recovered grades. All-in sustaining costs increased by 1%, so you can quickly see how margins opened up and profitability jumped.

It’s not all perfect harmony though, with an impairment of R2.8 billion at Target North based on mineral resource estimates that suggest a lower recoverable amount vs. the carrying amount in Harmony’s books.

With a market cap of R117 billion and a share price that is up nearly 150% in the past 12 months, I don’t think investors will pay too much attention to that impairment.

Italtile has flagged a dangerous competitive environment (JSE: ITE)

The market doesn’t seem to care, based on recent share price momentum

With GNU-phoria having found its way into Italtile along with many other local stocks, the share price is up 36% over 90 days. Despite Italtile releasing some tough numbers and even tougher commentary early in the morning on Monday, there was no stopping the positive momentum.

With flat system-wide turnover, trading profit down 11% and HEPS down 7%, there’s not much to feel good about here. The ordinary dividend is down 8% for the year to June as well.

The market seems to be clinging to the second half performance at Italtile, which was better than the first half but by no means good yet. Trading profit for the second half was still slightly down year-on-year.

I would be cautious here, as Italtile has noted the emergence of aggressive new competitors and a situation where manufacturing capacity far exceeds demand. Manufacturing businesses have high fixed overhead structures, so depressed volumes lead to higher overhead absorption per unit and a substantial negative impact on profitability. Although I’m now sitting long Cashbuild in my portfolio, they don’t have the same manufacturing exposure that Italtile does. Also, perhaps even more importantly, the Cashbuild share price had been sold off sharply before I climbed in, having now made a full recovery and delivered me a delightful little return.

Based on how much cash there is on the balance sheet (up 76%), Italtile has declared a special dividend of 78 cents, which works out to 6% of the current share price. The total dividend is thus 127 cents. That’s clearly not the sustainable yield though. It’s interesting to note the confidence to pay this dividend when there is still so much uncertainty in the market. On one hand they are telling the market to be careful of lost market share and essentially a price war in the local market, while on the other they are paying out excess cash.

There’s also an interesting note around the energy requirements at the Ceramic business. Currently, 70% of energy requirements are provided by Sasol as the primary supplier of imported piped natural gas. Sasol will only be able to supply this energy until June 2027, so Italtile is looking for alternatives like natural gas and coal-based synthetic gas.

STADIO’s numbers are heading the right way (JSE: SDO)

The shape of the income statement looks good as well

STADIO has released results for the six months to June and they look strong. Right at the top, we find that student numbers increased 10%, revenue was up 16% (so pricing increased were also achieved) and EBITDA grew by 12%. Although there’s a bit of EBITDA margin pressure there (as the percentage growth is lower than revenue growth), core HEPS was up 20% and there’s much to celebrate.

Within these numbers, the acquisition of an additional 15.4% in Milpark Education is relevant. The non-controlling interest there is down from 31.5% to 16.14%, so STADIO is close to owning the entire thing now.

STADIO doesn’t pay an interim dividend, so don’t be shocked to see that there isn’t one this year either. With these numbers, there is seemingly a strong probability of an annual dividend. With no external debt at all, the strength of the balance sheet would certainly support a dividend.

Interestingly, there’s a resurgence in contact learning as things have truly normalised after the pandemic. Contact learning numbers grew by 9%, having grown just 3% in the prior year.

Little Bites:

- Director dealings:

- Burstone Group (JSE: BTN) has renewed its cautionary announcement around a potential strategic partnership with funds advised by Blackstone Europe. There is still no certainty at this stage that a transaction will be concluded, hence the need for caution.

- Lighthouse (JSE: LTE) has disposed of another R1.45 billion worth of shares in Hammerson (JSE: HMN)

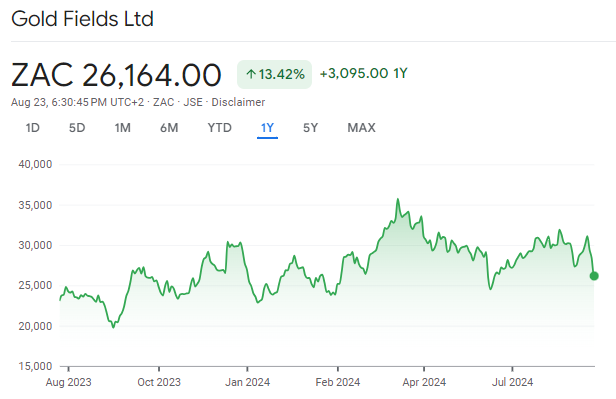

- Gold Fields (JSE: GFI) announced that Phillip Murnane has been appointed as CFO. He takes over from Alex Dall, who has been interim CFO since 1 May 2024 after the departure of Paul Schmidt.

- Salungano Group (JSE: SLG) renewed the cautionary announcement related to Keaton Mining, where the hearing date for the application for leave to appeal against the judgment that dismissed the business rescue application is still being awaited.

- Chrometco (JSE: CMO) has renewed its cautionary announcement regarding a material subsidiary. The stock is suspended from trading, so it’s not like anyone has the temptation to trade it anyway.