Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Absa bids farewell to Arrie Rautenbach – and not on a high (JSE: ABG)

The market wasn’t shy to celebrate this news

The markets don’t care about your feelings, that’s for sure. As Absa announced that Arrie Rautenbach would take early retirement from the CEO role, the share price rallied. He will step down from the CEO role in October 2024 and will then serve gardening leave for six months. That’s a lovely thing where an executive is paid a small fortune to sit around and do nothing, unable to work for anyone else. Hence, there’s time for gardening.

Charles Russon will take the Interim CEO role from October 2024. He currently runs Absa’s Corporate and Investment Bank (CIB). Yasmin Masithela will replace Russon at CIB, another internal promotion. If nothing else, at least internal succession plans seem to be working.

It’s hard not to imagine Jason Quinn reading this from his chair in the CEO’s office at rival Nedbank and smiling. He was overlooked for the Absa CEO role as the group went with Rautenbach instead, but Nedbank swooped in and offered him the top job. I suspect that may have triggered the requirement for gardening leave as part of Rautenbach’s early retirement package, just in case a competitor tries something similar.

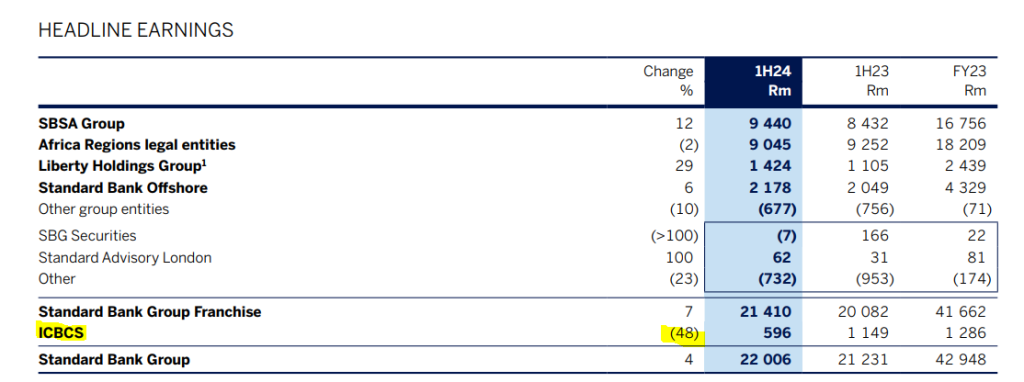

Absa also released results for six months to June 2024 and they aren’t great. Total income was up just 3% and HEPS fell by 5%. Return on equity dropped from 15.7% to 14.0%. A silver lining, if you can call it that, is that the dividend per share was consistent at 685 cents, so they upped the payout ratio to avoid a dip in the dividend. They had plenty of space in the payout ratio to do it, as HEPS was 1,227.7 cents. Another useful metric is NAV per share, with grew 6% to R180.14.

The pain point was the presence in Africa, as headline earnings in Absa Regional Operations (the African division) fell by 12%. Along with a flat performance at CIB and just 1% growth in Relationship Banking, this was enough to ruin the growth in the Product Solutions Cluster and Everyday Banking. Perhaps the new CEO could start by just choosing more sensible names for Absa’s segments that make it clearer what they actually do.

By lunchtime, the share price was nearly 5% higher at around R165. Although the NAV per share increase might be part of that, I think the market has also sent a message here in support of the change in CEO.

Argent makes an acquisition in the UK (JSE: ART)

The international growth strategy is no secret at Argent

Argent Industrial has made it pretty clear recently that international growth opportunities are the focus. Although things are definitely feeling better in South Africa these days, they are sticking to their guns and pursuing opportunities abroad.

The latest such example is the acquisition of Standmode, which owns Mersey Container Services in the UK. It’s a large transaction, coming in at around R160 million as the cash price. Argent is acquiring 100% of the group.

Mersey manufactures modular buildings, offices, mess units, toilet and shower blocks. I don’t think there’s anything else in Argent that already does this, so this is diversification in terms of both geography and business model. Although this is riskier than a standard bolt-on acquisition, Argent has loads of experience in deals and would’ve done their homework here.

They picked up the business on a Price/Earnings multiple of 4.9x, excluding the value of the property held in the group. That’s a sensible valuation, implying an earnings yield of just over 20% in hard currency. Nothing wrong with that!

Aveng has some major corporate activity ahead (JSE: AEG)

The group is considering a split

Before we dive into the major corporate activity that Aveng is considering, let’s deal with the earnings. They are certainly a whole lot better for the year ended June 2024 than the prior year, with a swing from a headline loss of A$77.7 million to headline earnings of A$38 million. On a per share basis, HEPS is A$29.6 cents or R3.64 for this period. When you consider the share price of R10 and the fact that Aveng also has net cash of R2.1 billion on a market cap of R1.3 billion, you can see why value investors are digging deeper here.

I must highlight that the prior year included losses on the Batangas LNG Terminal Project of A$104 million, so just that project explains most of the swing in earnings. Another useful reminder of the challenges of the construction industry is that the cost escalations on certain alliance contracts led to additional revenue at zero margin. There’s nothing quite like working for free, right?

Going forward, Aveng is probably going to look rather different. McConnell Dowell and Moolmans are distinct businesses that have separate strategies. You can probably already guess where this is headed: a split of the group. Moolmans will continue to focus on contract mining businesses in sub-Saharan Africa and McConnell Dowell will pursue its strategy in infrastructure construction across a diverse range of markets.

What could this mean? Aveng indicates that the thinking at the moment is to list McConnell Dowell in Australia and on the JSE, while Moolmans explores “alternative ownership” options with potentially B-BBEE capital. That sounds a lot like Moolmans would move to private ownership.

Investment bankers have been appointed to make this happen.

For value investors, that’s a catalyst for a potential value unlock. Along the way, Aveng benefits from having 80% of planned revenue for 2025 secured, along with a strong cash pile. Those who enjoy more unusual opportunities could well be rewarded with some digging here.

Coronation is paying out most of the tax provision as a dividend (JSE: CML)

With the SARS fight out of the way, they can reward shareholders who were patient

In June, Coronation released the happy news that the tax fight with SARS had gone in Coronation’s favour, with the Constitutional Court delivering its judgment that set aside the Supreme Court of Appeal’s orders. I suspect that many corporates with similar structures breathed a collective sigh of relief.

Coronation had originally provided for R794 million for this matter, which works out to 205 cents per share. The group has decided to declare 153 cents per share as an ordinary dividend, which goes some way towards making up for previously lost dividends that couldn’t be declared while the tax issue was underway.

Hulamin ramped up capex despite earnings dipping (JSE: HLM)

Companies have to carefully manage ongoing investment plans vs. volatile earnings

In capex-heavy operations, like in the resources space, management teams have to continuously invest in sustainable capex in the underlying business, as well as expansionary capex if they hope to remain competitive in years to come. When earnings are heading in the right direction, this is a much easier decision than when things are tough.

Hulamin has released earnings for the six months to June and they reflect a 6% decline in turnover and a 19% drop in normalised EBITDA. Normalised HEPS fell by 38%. Despite this, capital investments were up 114%!

It’s worth comparing capital investments (R302 million) to EBITDA (R343 million), which tells us that most of the profits had to be reinvested back into the business. It’s actually even worse than that, as they generated R604 million in cash before working capital changes and then had to invest R767 million in working capital. In other words, they were cash flow negative before we even consider capex!

The debt to equity ratio of 38.3% is up substantially from 28.1%, as they had to borrow money to cover the cash flow deficit.

The good news is that there is momentum in the business, with this half being considerably better than the second half of 2023. They are therefore hopeful that demand will continue to improve into the second half of the year, which will help with achieving returns from the substantial capital investment.

MTN releases awful numbers and extends the B-BBEE structure (JSE: MTN)

The Nigerian naira is hurting them severely

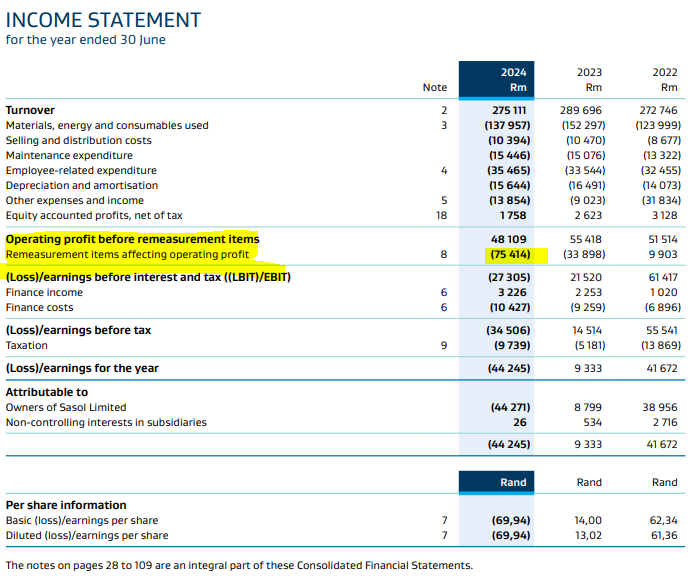

MTN’s numbers for the six months to June 2024 are a tale of two currencies. In reporting currency (rand), they are terrible. In constant currency (i.e. the growth percentages in Africa assuming those currencies didn’t change in value vs. the rand), they look decent. Sadly, reporting currency is what counts.

So, with group service revenue down 20.8% and EBITDA down 41.2%, there isn’t much to smile about. EBITDA margin fell by 11.6 percentage points from 43.6% to 32.0%. As for HEPS, well, MTN is now loss-making. The headline loss per share is -R2.56 vs. HEPS of R2.60 in the comparable period.

The problem is that the South African and Nigerian businesses are similar in size on a consolidated basis, although you would need to take non-controlling interests in Nigeria into account to see the true impact on MTN shareholders. The point is that the Nigerian operation is large enough to single-handedly ruin the group result, with revenue down 52.9% as reported and EBITDA down 68.3%.

There isn’t much to point to as a highlight, with one metric perhaps being that data and fintech volumes were up 35.7% and 18.0% respectively. Although this is where the telecommunication network companies are finding growth, it’s also a treadmill of ever-decreasing data costs and thus lower cellphone bills for users.

The test for me is very simple: what did I pay on my cellphone bill 10 years ago vs. today? And what did their operating costs do over the same period?

Naturally, there’s no interim dividend with numbers like these.

Separately, MTN announced that the Zakhele Futhi B-BBEE scheme would be extended by three years to November 2027. The reality is that the scheme was well on its way to maturing underwater, which means the equity holders would get nothing. To avoid that reputational disaster and all the repercussions of losing B-BBEE status, MTN has little choice but to roll the deal. This doesn’t mean that it will be successful, of course. It just means that there’s a better chance.

To kick the can down the road, MTN needs to ask shareholders to vote in favour of various things, including structuring elements like the option to unwind the scheme along the way if conditions improve. There’s a laundry list of note when it comes to conditions precedent, so there’s no guarantee of what could happen here. A circular will need to be released soon, with the plan for the meeting of shareholders to take place on 14 October.

Earnings halve at Thungela (JSE: TGA)

Single commodity mining houses are a wild ride

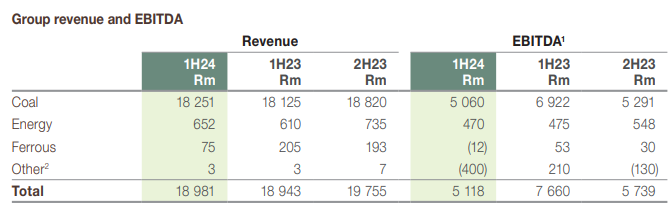

As I often try to remind you, focused mining groups are riskier than larger groups with diversified exposure. This might sound obvious to you, but many investors still get a nasty shock when they see things like HEPS down by 58% at Thungela for the six months ended June.

This is why looking at trailing dividend yields for these businesses could well be the worst valuation metric possible. You should always look at forward yield i.e. what will the next dividend be. To work that out or even estimate it with any degree of certainty, you need to look at commodity prices. Not only have the benchmark coal prices come down, but Thungela has also been dealing with the underperformance at Transnet Freight Rail.

It’s very hard to forecast coal prices, as there are so many supply and demand factors at play. Things like the extent of the cold in the northern hemisphere winter make a difference. As for the rail performance at Transnet, they only expect improved performance from 2025 onwards. Let’s hope that comes to fruition.

With EBITDA margin down substantially from 31% to just 13%, along with a need for ongoing capital expenditure as is usually the case in the mining industry, Thungela is “focusing on controlling the controllables” – and one such controllable is the dividend, which is down 80%. Thankfully, the decrease in the payout ratio is to help make space for more share buybacks, which makes sense when the share price has come off so hard from the peaks seen in 2022.

Little Bites:

- Director dealings:

- The selling of Dis-Chem (JSE: DCP) shares by a prescribed officer continues, this time to the value of R19.4 million.

- An associate of a director of Emira Property Fund (JSE: EMI) sold shares worth R5.4 million.

- There’s more selling at Richemont (JSE: CFR), with an executive member of the board selling shares worth R2.6 million.

- A non-executive director of Glencore (JSE: GLN) bought shares worth over £12k.

- Astoria (JSE: ARA) announced that an associate of directors bought shares in the company worth R273k.

- The non-executive chair of Primary Health Properties (JSE: PHP) reinvested dividends into shares worth £3.3k.

- Tiger Brands (JSE: TBS) announced that the appointment of Tjaart Kruger as CEO has been extended. He was initially appointed on 1 November 2023 for 26 months. This has been extended to December 2028, giving him time to deliver the turnaround and presumably subsequent growth as well, as that’s a solid tenure as CEO. Clearly, he’s impressed the board in his time there thus far.

- Insimbi Industrial Holdings (JSE: ISB) announced that the recently announced deal to basically do the reverse of an asset-for-share acquisition has now met all regulatory requirements and is unconditional.

- Telemasters (JSE: TLM) has renewed the cautionary announcement related to a potential offer to shareholders of Telemasters by a B-BBEE investor. The investor would first acquire the shares of the two largest shareholders in Telemasters and would then trigger a mandatory offer. On top of all this, Telemasters is also looking at a potential acquisition and has issued a non-binding expression of interest to the counterparty. There’s a lot going on at Telemasters and therefore reasons to be cautious!