Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Attacq matches its interim distribution (JSE: ATT)

Growth in cash distributions is what investors want to see

In a trading statement dealing with the year ended June 2023, Attacq flagged an expectation of a final distribution per share of 29 cents. This is the same as the interim distribution, so the full year distribution of 58 cents is 16% higher than the distribution per share in the prior year.

This has been supported by an increase in distributable income per share of between 12.5% and 15.5%.

Detailed results will be out on 28 September.

This announcement came out after the market closed. On a closing price of R8.25, Attacq is on a dividend yield of 7%.

A wobbly at Gemfields? (JSE: GML)

After seemingly endless good news from the company, here’s something to chew on

The good news is that Gemfields believes that the market is “very healthy” based on demand at the commercial and low quality ruby auction over the past couple of days. A commercial quality emeralds auction is also underway and results will be released soon.

The unfortunate news is that the recent emerald production at Kagem hasn’t been to the standard that Gemfields was hoping for. These are naturally occurring gemstones and nature is unpredictable. The company has decided to pull out of a high quality emeralds auction in November 2023, as they would rather not participate than offer a sub-optimal product.

After what feels like a very long string of positive updates, this is a reminder that mining is never easy.

This announcement came out after the market closed, so keep an eye on the share price on Thursday morning.

These conditions aren’t good for Growthpoint (JSE: GRT)

And the outlook for FY24 is particularly worrying

Growthpoint has released results for the year ended June 2023. The distributable income per share and dividend per share are both up by 1.3%, so the payout ratio is consistent. Net asset value per share limped higher by just 0.3%.

A lot of progress has been made in reducing the size of the South African exposure, with 29 properties worth a total of R1.5 billion disposed of in this period. Since 2016, they’ve sold off R11.2 billion of local exposure. Only one property worth R18 million is held for sale as at the end of the period.

The capital-light business Growthpoint Investment Partners has a happier story to tell, with assets under management up by 14.7% and management fees up from R67.2 million to R98.0 million. They raised R750 million from new investors in the healthcare and student accommodation funds.

Offshore dividend income increased by 7.6% in rand terms. The offshore business is 45.8% of group assets and contributed 29.1% to distributable income per share.

With negative valuation movements in Growthpoint Properties Australia as a major contributor to this move, the loan-to-value (LTV) ratio deteriorated from 37.9% to 40.1%. The South African LTV is more conservative than the group LTV, sitting at 32.9% vs. 32.0% in the comparable period.

It’s also worth noting that 77.7% of the South African borrowings carry a fixed rate. The weighted average maturity for local borrowings has increased from 2.9 years to 3.5 years.

The only really sparkling part of the story is the V&A Waterfront, which reported a 21.5% increase in Growthpoint’s share of distributable income. Crown jewel properties are still great assets.

The problem is that conditions in South Africa remain tough, with negative reversions on leases and a decline in renewal success. For South Africa specifically, funds from operations per share (an important industry metric) fell by 4.4% this year.

The outlook for FY24 isn’t great at all, with an expectation for distributable income per share to drop by between 10% and 15%. The group will try and maintain a payout ratio of 82.5%. To help see the group through difficult times, Norbert Sasse has agreed to stay on as CEO until 31 December 2026.

The dividend per share for the year of 130.1 cents and the closing price of R11.40 means that the company is trading on a yield of 11.4%.

Lesaka beats its revenue guidance (JSE: LSK)

Constant currency growth is especially strong

Lesaka is listed on the Nasdaq as well as the JSE and reports in dollars, despite revenue being earned in South Africa. This obviously puts the growth rate under eternal pressure because of rand weakness, perfectly demonstrated by group revenue growth of 9% in dollars vs. 32% in constant currency.

The Connect Group has been included in the result for the full quarter and is outperforming according to Lesaka. The consumer division is also in the midst of a turnaround.

The net loss of $11.6 million this quarter included non-cash charges of $10.6 million, so the group is nearly break-even from a cash profits perspective. Cash generated by operating activities saw a healthy positive swing year-on-year.

The company talks about a “transition from turnaround to growth” and has lots of associated bullish commentary in the announcement. The market clearly liked it, closing 8.7% higher.

Seeing double at Momentum Metropolitan (JSE: MTM)

Financial results and an operating update were released separately

No, I’m not sure why Momentum Metropolitan didn’t release a single announcement that combines the financials for the year ended June and the operating update for the same period. Practically simultaneously on SENS, they released these things separately.

The announcements are extremely detailed and you should work through them if you have a position here. I’ll just touch on the interesting highlights.

Normalised HEPS increased by 19% to historic high levels, driven by operating profit increasing by 31% and the investment return dropping by 35%. Once you read Old Mutual further down in Ghost Bites today, you’ll see that this is at odds with what we have seen at other financial services businesses. This is because Momentum Metropolitan has a sizable venture capital portfolio, which saw valuations come off sharply year-on-year.

One of the businesses that struggled operationally was Momentum Insure, with high claim ratios and premium increases that lagged rising claims inflation. Something interesting that I’ve learnt in the past couple of years is that short-term insurers don’t like an environment of rising inflation, as premiums tend to be adjusted once a year rather than monthly. This even led to an impairment being recognised on Momentum Insure.

Another important point is that although new business margin was unchanged at 0.9%, the value of new business fell by 4% because of lower new business volumes and other factors.

If you’re wondering where the boost to operating profit came from, look no further than Momentum Metropolitan Africa where operating profit jumped from R8 million to R508 million!

Return on equity was 22.3%, down from 22.7% in the prior year.

Finally, the dividend increased by 20% for the year.

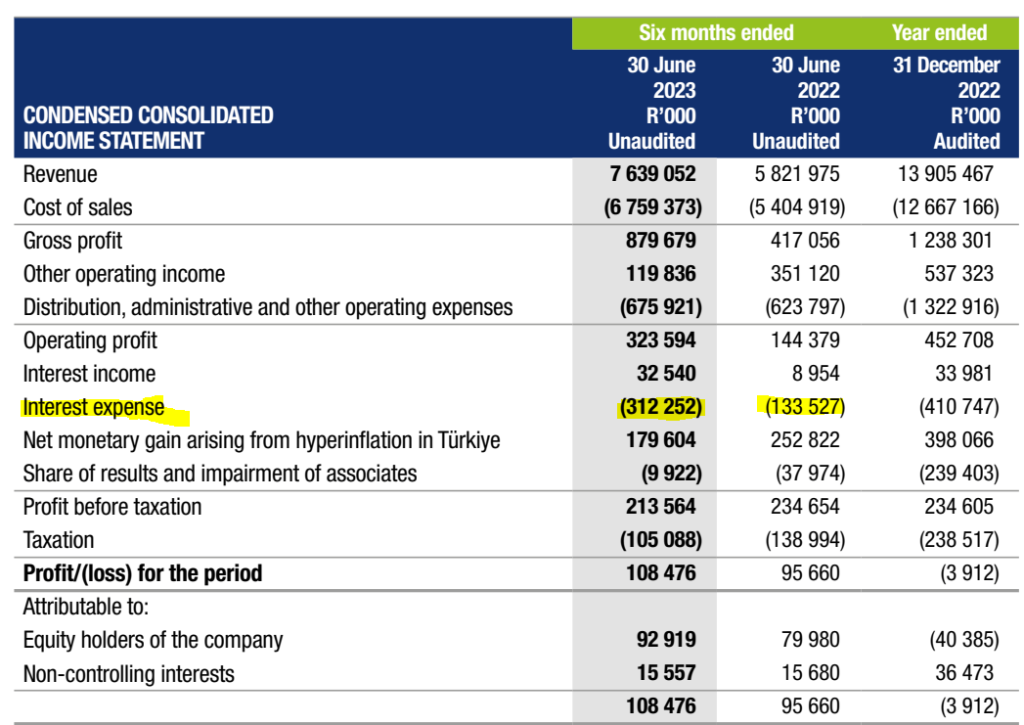

Old Mutual releases complicated earnings (JSE: OMU)

The latest victim of IFRS changes is the insurance sector

The introduction of IFRS 17 is causing significant distortions and complexities in the results of insurance groups. Those results are already pretty specialised and difficult to understand on a good day, so investors in this sector are in for some brain gym this year.

It’s a little bit difficult to know where to look in this Old Mutual announcement dealing with the year ended June 2023. The ranges are also pretty wide, like results from operations that could be anything between 7% lower and 13% higher. In other words, they will probably be pretty flat, with good and bad news within that number.

Adjusted headline earnings per share is expected to be between 11% and 31% higher. This is probably the right metric, as it considers restated numbers on an IFRS 17 basis and also adjusts for earnings in Zimbabwe.

If you remember nothing else, at least remember that although operational performance at Old Mutual doesn’t seem to have shot the lights out, the environment of higher interest rates and a recovery in equity markets means that investment returns on shareholder funds have improved. This is what drove the headline earnings per share performance.

The rand got Pan African out of trouble this year (JSE: PAN)

Production was significantly lower year-on-year

Pan African Resources is listed in London and on the JSE, with an ADR programme in the US as well. To add to the United Nations feel, the company also reports in dollars.

It was the rand that really saved the day, with the rand gold price having a much better year thanks primarily to rand weakness. Gold production fell sharply by 14.8%, so a difficult year in the gold price would’ve been an ugly outcome indeed.

It still wasn’t a happy year though, with HEPS down by 19.5% to US 3.15 cents per share. A dividend of US 0.95592 cents per share has been put forward for approval. It looks like the final dividend is R0.18 per share and the dollar amount will fluctuate, rather than the other way around.

From the current production level of 175,209oz, the company hopes to improve to between 178,000oz and 190,000oz next year. That’s still well down on 205,688oz in FY22.

The other area for improvement is in the high-cost operations Sheba and Consort Mines, which account for 81% of annual production. This is why group level all-in sustaining cost (AISC) is $1,327/oz despite the lower-cost operations running at $1,152/oz. Group level guidance for FY24 is $1,350/oz.

The balance sheet looks fine, so they have a decent platform off which to boost production and hope for the best with the rand gold price.

Putprop inches forwards, on HEPS at least (JSE: PPR)

We will need to wait for full results on this one

In a further trading statement dealing with the year ended June 2023, Putprop has noted that HEPS will be up by between 0% and 10%. But interestingly, earnings per share (EPS) is down by between 77% and 87%.

Results are due on 14th September i.e. the day after this trading statement. They will need to be considered carefully to understand the difference between EPS and HEPS.

Universal Partners reports a drop in NAV per share (JSE: UPL)

It’s not as bad as it looks though, as there was a special dividend

Investment holding companies are judged by net asset value (NAV) per share. When a dividend is paid to shareholders, this reduces the NAV and thus the NAV per share. In assessing performance, it’s important to keep this in mind. Just looking at NAV per share ignores dividends and thus the total return.

After disposing of Dentex Healthcare and proving that not all dentistry-related activities are painful, Universal Partners paid a dividend of 10 pence per share. This means that NAV would’ve been £1.396 per share without the dividend vs. £1.438 at the end of June 2022. That’s a drop of 3% year-on-year, adjusting for the dividend.

If we look into the portfolio, the group has retained £35.2 million worth of exposure to Portman Dental Care, which is the group that merged with Dentex. This makes it a minority shareholder in one of the largest dental care platforms in Europe.

The group also has a stake in Workwell, a payroll solutions and accounting company in the UK that is trading behind budget because of the tough conditions in the UK and Europe. Still, because of the conversion price on debt into equity, the value has been written higher in Universal’s books.

Another company in the portfolio that is battling headwinds is Xcede Group, a recruitment specialist in the IT and sustainable energy space. While you would think that this makes it a gold mine, there’s been a significant slowdown in hiring activity. There’s a new CEO and CFO in the business, so we will see what happens here. Universal had to subscribe for further loan notes to support working capital. The equity investment has been impaired.

SC Lowy is a credit investing and lending business and achieved a positive return in its fund, putting performance ahead of the benchmark. Fundraising is a challenge in this environment but profits are up.

I chuckle a little every time I read about Propelair, a company that claims to have reinvented the toilet. It uses just 1.5 litres of water per flush vs. 9 litres from a traditional toilet. As exciting as that sounds, the business plan also seems to be in the toilet as the company is trading well below where it should be. The company is raising more capital and Universal Partners isn’t participating in that raise, leaving the value at a nominal £1. Yes, one pound.

£2.3 million worth of investment management fees to Argo were accrued during the year. Interestingly, the fees aren’t paid unless there is a realised exit in the portfolio. So this is purely an accounting entry.

Little Bites:

- Director dealings:

- The market doesn’t really understand IFRS, but it does understand a show of faith by directors. We are finally seeing some purchases of shares by the key executives at Blue Label Telecoms (JSE: BLU), with an associate of Mark Levy acquiring CFDs with a value of R3.8 million.

- Capital & Regional (JSE: CRP) announced the results of the scrip dividend election, with shares representing 2.3% of current issued share capital to be issued in lieu of cash dividends.

- For the junior mining enthusiasts, Copper 360 (JSE: CPR) has significantly upgraded its mineral resource and has put out the bullish view that expenditure on the plant currently being built is on schedule for November this year and 8% under budget. Mine development is expected to commence in the final quarter of this year.

- The date for the release of the amended business rescue plan for Tongaat Hulett (JSE: TON) has been extended to no later than 31 October 2023, with an adjournment of the related meetings to no later than 30 November 2023.