Congratulations to Mazars on their appointment as the auditors of Fairvest Limited!

Anglo American notes soft demand at De Beers (JSE: AGL)

Again, I can’t help but think that lab-grown diamonds are hurting them

I’ve been sharing my views publicly about lab-grown diamonds this year and how I think they are a very real threat to the De Beers business model. There’s been some robust debate around this point and a number of smart views on both sides of the argument. It is obviously relevant to Anglo American as holding company.

Although the numbers never lie, the problem is that soft demand is being blamed on the prevailing economic conditions without bluntly highlighting lab-grown diamonds. Of course, when times are tough, the cheaper diamond becomes an even more attractive alternative.

In Cycle 7 of 2023, De Beers managed sales of $370 million. That’s miles off cycle 7 last year ($638 million) or cycle 6 of 2023 ($411 million).

This trajectory doesn’t look very shiny to me.

Aspen with the ol’ bait and switch (JSE: APN)

Two announcements on the same day, with very different consequences

You really have to feel sorry for whoever bought Aspen for R195 in morning trade, as the price ended the day at R171. This is what happens when good news is released in the morning, following by tough results in the afternoon.

I’ll start with the good news, which is a distribution agreement with Lilly for products in South Africa and some Sub-Saharan African countries for 10 years, with an automatic renewal for two further periods of 5 years. Aspen will pay $41.5 million for these distribution rights. The Lilly portfolio includes medicines in neuroscience, oncology, diabetes and immunology. There are key pipeline products, as one would expect from a major pharmaceutical house. Lilly’s products generated revenue of R440 million in South Africa in 2022. Remember that Aspen will earn a gross margin on the products (i.e. the R440 million wouldn’t have been the profit to Aspen), so don’t assume that they just locked this in for a bargain price. Still, it’s good news strategically.

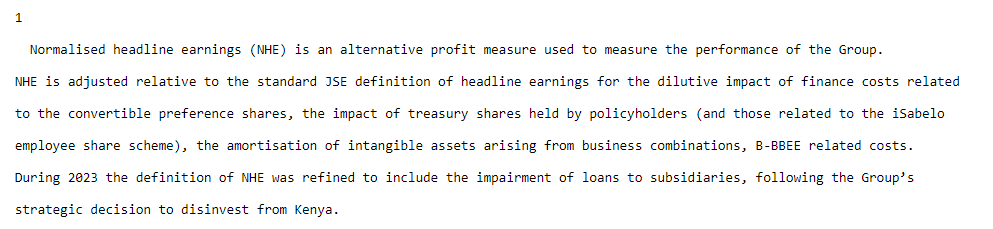

I really don’t understand why the Lilly news was announced separately, as it was included in the results announcement alongside other strategic news anyway. Speaking of those results, revenue for the year ended June increased by 5% but that was nowhere near enough, with HEPS down by 4% and normalised HEPS down by 8%. Despite the drop in HEPS, the dividend was 5% higher.

A major negative in this result was the loss of COVID vaccine manufacturing contribution, which negatively impacted gross margin. Other significant factors included forex swings and higher interest costs.

Aspen called this a solid set of results. The share price response sent a very different message.

The outlook is positive overall, with management focused on filling existing manufacturing capacity. They even go so far as referring to the second half of 2024 as a “significant inflection point” that should “form the foundation for sustainable strong future earnings growth” – let’s hope for the sake of investors that this is the case.

Despite the drop in HEPS and even in the share price on the day of release, Aspen remains 25% up for the calendar year.

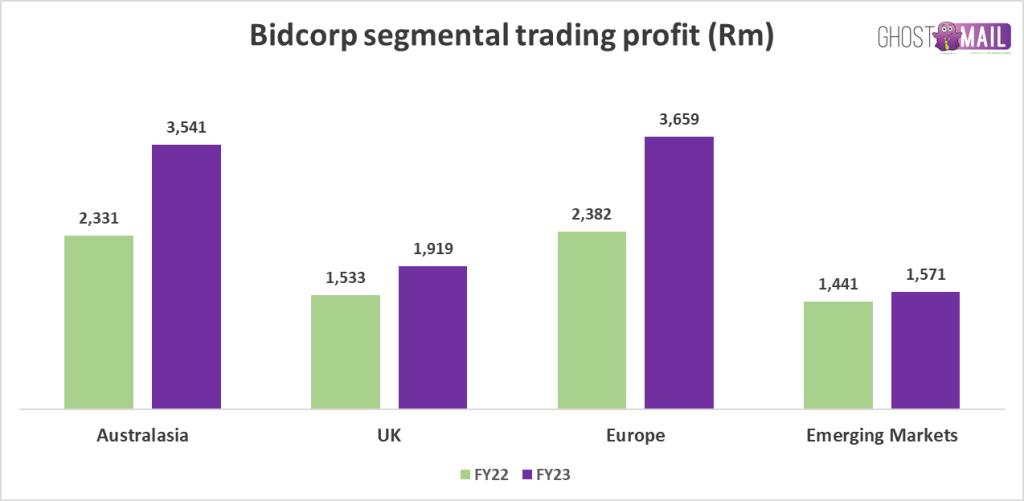

Bidcorp’s numbers look delicious (JSE: BID)

Dividend growth that almost perfectly tracks HEPS growth is great to see

Revenue at Bidcorp has increased by 33.4% in the year ended June, driving trading profit growth of 38.4% and a tasty jump in cash generated by operations of 66%. This is a particularly strong result in terms of cash conversion, adding to what is already a great financial story this year.

HEPS increased by 35.4% and the dividend by 34.3%, so the payout ratio is similar. It’s a big tick in the box to see the cash follow the earnings.

To give you an idea of how quickly this group is growing, there were no fewer than nine bolt-on acquisitions in the year. It’s like a United Nations meeting, with deals everywhere from the UK to Estonia, Spain and even the Czech Republic. Bidcorp is an incredible market consolidator in the food service industry. In many cases, the company doesn’t acquire 100% of the target, leaving behind a piece of equity for the local management team. That’s smart.

This global approach is clearly visible in the note dealing with regional capital expenditure:

Every segment saw a significant jump in trading profit this year, with Europe (up 53.6%) and Australasia (up 51.9%) as the big year-on-year movers. Here’s your chart of the day:

Be careful extrapolating this kind of growth in those regions. There’s definitely a base effect here related to the back-end of the pandemic. Still, these are really strong numbers.

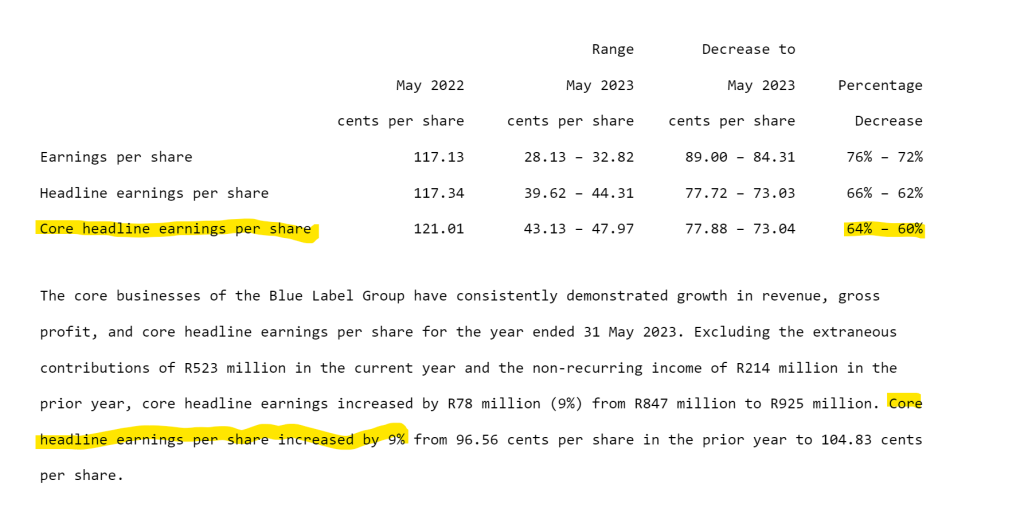

Blue Label Telecoms keeps inspiring 4th year accounting papers (JSE: BLU)

I don’t think you’ll find a more complicated set of numbers anywhere on the local market

It’s bad enough that Blue Label Telecoms has financials that would scare even the most sadistic of 4th year Financial Accounting lecturers. The situation is even worse when the company releases results on such a ridiculously busy day of news.

For the sake of my sanity and yours, I’m not going into details here. I would be surprised if there are more than 10 people in the entire country who fully understand the numbers from start to finish.

Core HEPS has dropped from 121.01 cents to 45.55 cents. Within core HEPS, there are “core businesses” and apparently they did well. There are also “extraneous contributions” to Cell C that are included in Core HEPS, but somehow not in the core businesses. Sigh.

If you exclude the Cell C contributions, core HEPS grew by 9%. The Blue Label management team has a long history of destroying shareholder value in acquisitive adventures, so I wouldn’t just exclude this number as an inconvenience.

The share price has lost 33% this year, probably because nobody actually understands what is going on. Here’s what the long-term chart looks like, in case you’re worried that you are missing out on management’s capital allocation prowess:

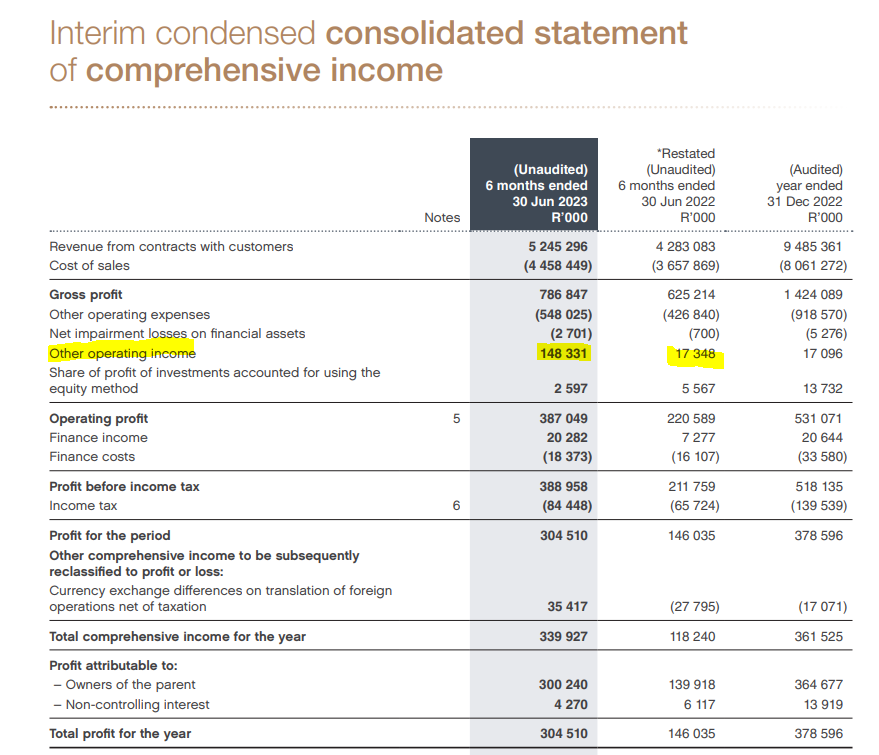

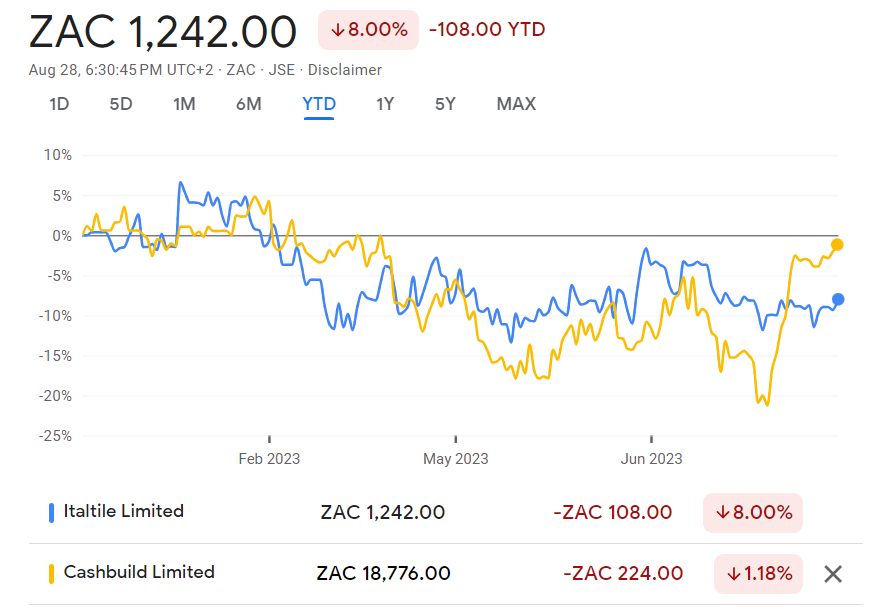

Cashbuild gives full details of the pain (JSE: CSB)

The final dividend has halved

In the current South African environment, you probably wouldn’t wish the Cashbuild business model on your worst enemy. It really is tough out there, with South African consumers nervous to invest in their homes and getting gently obliterated by interest rates when debit orders go off every month. From recent company news, they managed to scrape together enough coins for a trip to Spur and that’s about it.

Revenue down by 4% for the year ended June 2023 doesn’t seem that bad in this environment, with gross profit down by 8% as gross profit margin deteriorated from 26.3% to 25.4%. Sales volumes dropped sharply though, as selling price inflation was 5.4%. This means that if volumes were flat, revenue would’ve been up by roughly that amount. Instead, it was down by 4%.

Speaking of inflation, the pressure on costs is clearly visible with operating expenses up by 5% if you exclude the looting in the prior year and the P&L Hardware goodwill impairment this year. Without those adjustments, operating expenses jumped 20% in this period, absolutely hammering operating profit by 73%.

The best measure is HEPS, which fell by 37% year-on-year. The total dividend for the year is down by 42%. It’s worth highlighting that the final dividend fell by 51%, so things have gotten worse as the year went on.

I don’t even have good news for you on the balance sheet, with stock levels up by 12% despite revenue being lower. In an environment where capital is expensive, this really isn’t good news either.

In the six weeks subsequent to year-end, revenue is down 1% year-on-year. The pain continues.

The share price closed just over 2% lower on a day that was slightly green on the ALSI, so the market wasn’t shocked by this but wasn’t happy either.

Caxton and CTP flags a nice jump in HEPS (JSE: CAT)

A trading statement is the precursor to earnings due to be released by 11 September

The Caxton and CTP trading statement for the year ended June 2023 was light on details but heavy on HEPS growth, so that shouldn’t upset too many shareholders. HEPS is expected to be between 16.6% and 24.8% higher, coming in at between 183 cents and 196 cents.

For reference, the current share price is R10.00 and has been sideways since March, with a year-to-date positive move of over 8%. In other words, that jump all happened in the first couple of months of the year.

Thanks to the gold price, flat production at Harmony was good enough (JSE: HAR)

A 60% jump in HEPS is why the share price is up more than 80% over 12 months

If you manage to time a commodity cycle correctly, it can be very rewarding. If you think that’s easy to do, you are in for a nasty surprise. Predicting gold price moves is harder than guessing what the next political party in South Africa will be.

For the year ended June 2023, Harmony Gold increased revenue by 16% despite a 1% drop in production, which tells you how helpful rand depreciation was. Operating free cash flow more than doubled and the company swung beautifully into a net profit position.

HEPS was up by 60% to R8.00 which puts Harmony on almost exactly a 10x Price/Earnings multiple.

Looking ahead, the guidance for all-in sustaining cost is less than R975,000/kg. Considering it was R889,766/kg in this period, that’s hopefully very conservative guidance. If not, I’m not sure shareholders will be feeling quite so harmonious by this time next year unless the gold price does something exciting.

KAP gets a klap – a big one! (JSE: KAP)

Bye-bye, dividend

There are a number of industrial players on the local market that are doing really well at the moment. KAP isn’t one of them.

The record result last year is a distant memory, with Safripol and Unitrans as the major pressure points. Group revenue increased by 6%, but EBITDA fell by 11% as margins went firmly in the wrong direction. There’s no saving the result from there, with HEPS dropping 43% thanks to the poor result in EBITDA and a 59% increase in net finance costs.

Cash flow from operations dropped by 5%, so this was actually a period of working capital improvement as this is lower than the drop in EBITDA. We have to try look for the rainbows here.

Safripol is the large, ugly elephant in the room. Although revenue increased 2% to R10.3 billion, operating profit plummeted by 45% to R764 million. This is a cyclical business based on polymer prices and the prior year was a record. Still, this result was below expectations because of softer demand. Load shedding impacted local customers who saw a drop in production volumes, with a direct impact on Safripol.

Unitrans is the other ugly part of this story, with revenue up 3% to R10 billion and operating profit down by a nasty 33% to R385 million. The food business was hit by a contract cancellation and the agriculture operations were impacted by rainfall and flooding, with an insurance claim having been registered but no further details given on this. Mining, passenger and petrochemical operations were OK in this environment. There has been significant restructuring activity at Unitrans that will hopefully improve things soon.

PG Bison grew revenue by 10% to R5.35 billion and operating profit by 12% to R933 million. The business won market share after increasing its annual raw board capacity. Demand was impacted by particularly high levels of load shedding in the third quarter.

Restonic increased revenue by just 1% to R1.63 billion, but managed to achieve operating profit up by 17% to R81 million after restructuring its operations. Sales volumes fell 7% in South Africa, returning to pre-pandemic levels. I guess the old beds will do when the home loan repayments have become so expensive for most people.

At Feltex, revenue increased by 27% to R2.3 billion and operating profit was around 6x higher at R211 million. Welcome to the effect of operating leverage in an industrials company, particularly when moving from barely break-even to decent levels. Local automotive assembly volumes increased by 32%, as we recovered from the floods in KZN and the global chip shortage.

Finally, Optix (previously DriveRisk) somehow more than doubled revenue from R242 million to R523 million and yet reported an operating loss of R7 million vs. profit of R22 million. The optics aren’t good at Optix.

The group is focused on reducing debt, as tough conditions are expected to largely continue in the next financial year. Along with the capital projects on the table, this is why the dividend is now a thing of the past.

Lots of revenue at Motus, but what happened to HEPS? (JSE: MTH)

This result requires a lot of digging

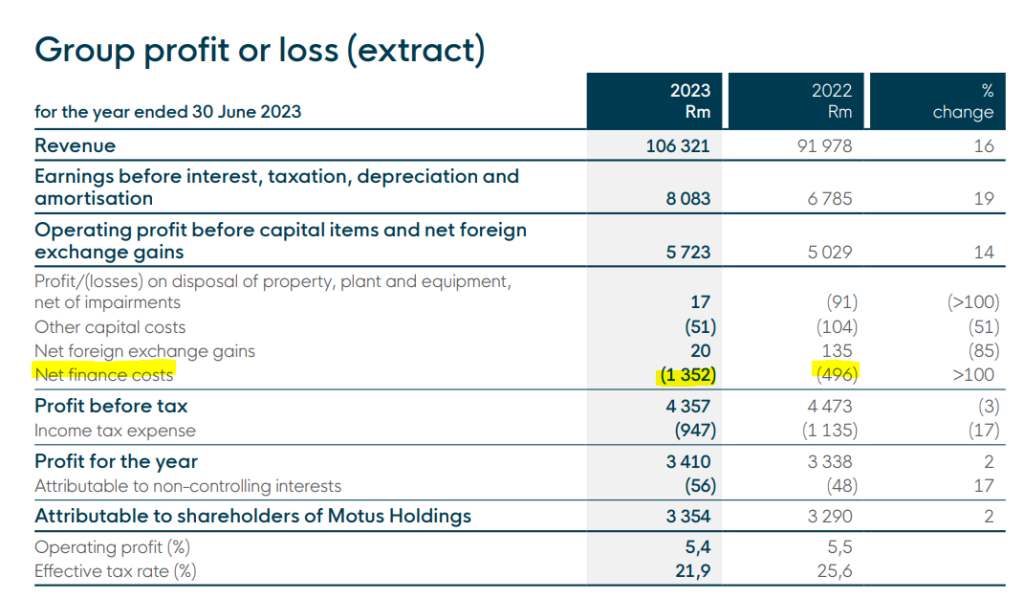

When you are skimming a financial result on SENS, one of the first things to look for is any kind of mismatch between top-line growth and profits. Motus is a perfect example. For the year ended June, revenue increased by 16% and EBITDA by 19%, yet HEPS was only 1% higher at R20.46. The dividend per share is R7.10, which is identical to the previous year.

What happened between EBITDA and HEPS?

Before we get to that, let’s look at revenue. It was up by 52% in Aftermarket Parts (an acquisition is part of that), 14% in Retail and Rental, 9% in Mobility Solutions and 3% in Import and Distribution. The mix is also worth touching on: 13% new vehicle sales, 31% parts sales, 9% pre-owned vehicles and 13% rendering of services.

When you see growth in revenue like this in an asset-heavy business, you need to wonder about what the impact on the balance sheet is. Another clue to what happened to profitability is that the announcement simply talks about net finance costs increasing, without giving the comparable number. That’s like a red flag to a bull, or even a ghost. Sure enough, that’s what happened to profits:

It costs money to fund growth in a business like this, with an outflow of R5.8 billion in net working capital. Net debt to equity jumped from 36% to 77%. In this environment of higher interest rates, this makes the banks very happy, especially when just 7% of funding is at fixed interest rates. Net debt to EBITDA has increased from 0.8x to 1.8x, which is still well below the debt covenant of 3x. With all this additional capital in the system, return on invested capital fell from 17.8% to 14.1%.

In terms of interesting trends, it’s not surprising to read that South Africans are moving from luxury vehicles into more affordable alternatives. Tracking NAAMSA unit sales is one thing, but of course the economic profit pool is based on units multiplied by selling prices. Although unit sales have been ahead of expectations, I question how well the more luxury-focused dealerships out there are doing. Despite this, Motus was happy to acquire three Mercedes Benz passenger dealerships and a commercial dealership in Gauteng in November 2022. Motus achieved 19.8% retail market share in South Africa for the 12 months to June 2023.

The South African operations contributed 61% to revenue and 73% to EBITDA for the year. The rest is contributed by the UK, Australia and South East Asia.

In the UK, economic pressures aren’t really filtering through into the new vehicle market. To give an idea of the relative size, there were over 2.1 million new vehicles sold in the UK in the 12 months to June 2023 vs. 541,000 in South Africa. It’s a much bigger market, with Motus focusing primarily on the van and commercial segments as well as the aftermarket parts business, evidenced by the acquisition of Motor Parts Direct in October 2022. And in Australia, another market in which Motus operates, new vehicle sales were 1.1 million over the same period.

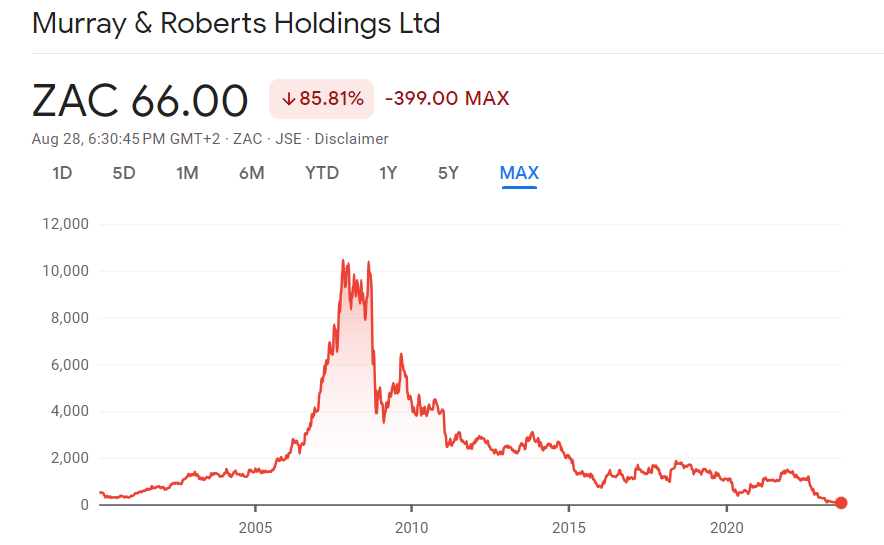

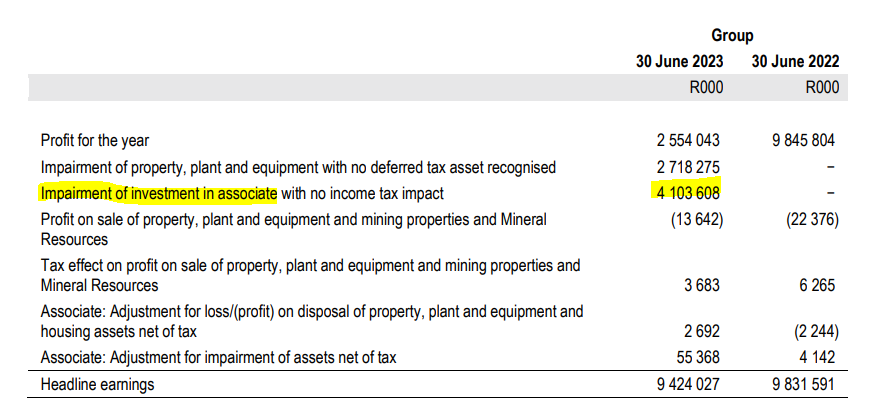

Murray & Roberts is a horror story (JSE: MUR)

I’m not surprised that they released after the market closed

The fact that Murray & Roberts has had a shocking year isn’t a surprise. This doesn’t mean that the share price won’t dive even further when the market opens on Thursday, as these numbers came out after the market close on a ridiculously busy day.

The Clough and RUC Cementation businesses in Australia have been restated as discontinued operations, so this makes the year-on-year result look a lot better than it actually is. I’ll just ignore the comparatives, as the real story is the diluted headline loss per share of -71 cents. This is why the share price has been slaughtered in the past year, now barely keeping head above water at 65 cents.

The net asset value has collapsed from R13 last year to R4 this year.

Obviously, there is no dividend for shareholders.

This is genuinely a game of survival now. Murray & Roberts keeps talking about having a future. That isn’t the same thing as a bright future. Many tears have been shed over the ATON offer of R17 a share back in 2019 that the management team decided wasn’t good enough. The pandemic will always be blamed for the destruction in value since then, but that doesn’t make investors any less angry.

Nampak sells off property and equipment in Nigeria (JSE: NPK)

It doesn’t make a huge dent in group debt, but every bit helps

Nampak has agreed to sell the Nigeria Metals property and various associated equipment to Twinings Ovaltine Nigeria. The effective date of disposal is expected to be in the first half of this financial year. The Nigerian Metals operations had been shut down from 31 July 2023 anyway, so this is actually a pretty good turnaround on getting rid of the assets.

At current exchange rates, this raises around R180 million in cash for Nampak. It will be used to reduce debt.

It certainly helps, but there’s a very long way to go with asset disposals here.

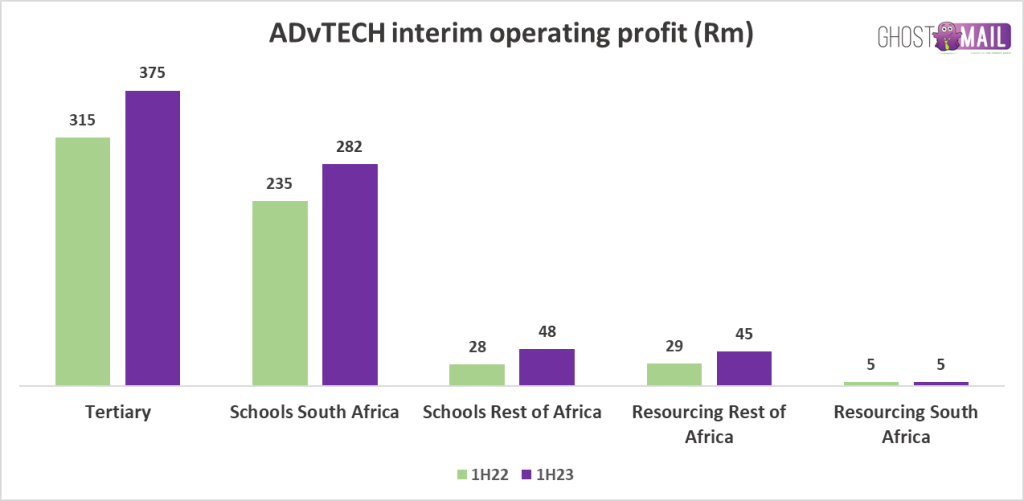

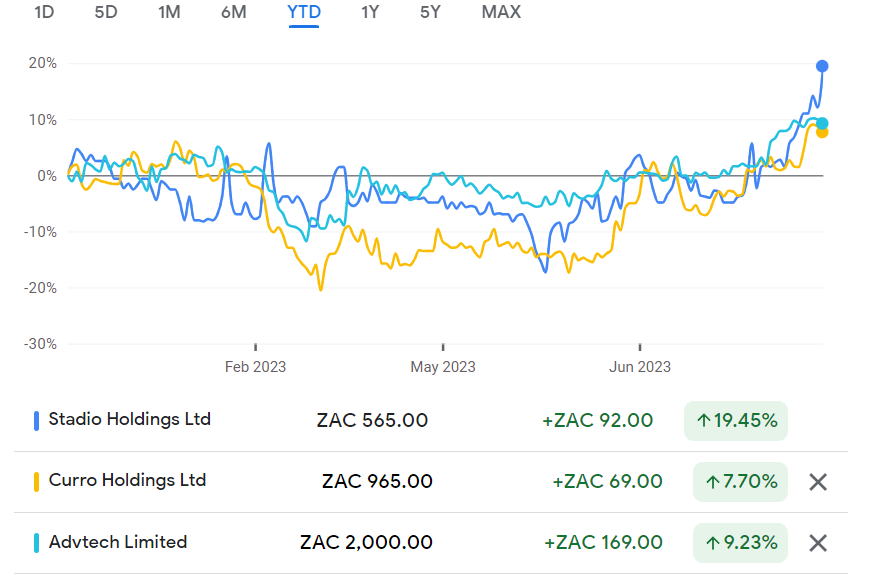

STADIO’s growth is being driven right from the top (JSE: SDO)

An education business needs growth in students, which STADIO is delivering

With growth in Semester 1 student numbers of 9% and an inflationary environment as well, STADIO reported revenue growth of 16% in the six months to June. It’s interesting to note that as at the end of August, student numbers were up 11% year-on-year, so second semester enrolments must be going well.

There was pressure on the loss allowance (related to fee revenue), so EBITDA only increased by 10%. Strategic investment in technology also impacted EBITDA in this period. Core HEPS tells a better story, up by 20% as the group has earned significantly higher investment income on its cash balance.

As was the case last year, no interim dividend has been declared. STADIO only pays a final dividend.

Notably, contact learning student numbers grew 3% after shrinking 4% in the prior year. Nature is healing. STADIO is still predominantly an online business, with a substantial 86% of students being distance learning candidates. This is the core investment thesis, with cash from operating activities of R180.7 million in this period and capex of just R22.2 million on fixed assets.

Keeping Woolworths Food cold is very expensive (JSE: WHL)

Thankfully, the food is organic and so is the growth across the business

When looking at the 52 weeks ended 25 June for Woolworths, you need to know that David Jones has been accounted for as a discontinued operation, bringing to an end one of the most awful deals in South African corporate history. The new management team will be thrilled to close off that legacy nightmare, leaving them to focus on the continuing business.

That business is doing well, with turnover from continuing operations up by 10.6% and HEPS up by 14.8%. The dividend per share has increased by 36.4%, a reflection of growth in the core business and perhaps more certainty with David Jones out of the system.

The greatest irony of all is that including David Jones in this result makes them look better for once, thanks to lockdowns in Australia in the prior year. Total group HEPS increased by 29% vs. 14.8% from continuing operations.

Looking deeper into the remaining business, the Fashion, Beauty and Home (FBH) segment grew turnover by 8.3% on a comparable basis and 8.9% overall. Price movement was 11.6%, which suggests that volumes fell by 3.3%. Online sales only grew by 3.8% and contributed 4.3% of South African sales. Notably, sales growth in the second half was only 6.7%, which is quite a bit slower than the first half. Gross margin improved by 90 basis points to 48.5% and expense growth was 6.8%, so the net effect on adjusted operating profit was a very juicy increase of 21.3%. Management’s strategy in this space is working really well.

Woolworths Food, which I’m convinced has been a major mitigating factor for the emigration trend, grew turnover by 8.5% overall and 6.3% on a comparable basis. Unlike in FBH, the second half was better than the first half. Price movement of 8.3% tells us that volumes fell by 2%. Inflation was 9.9%, so it also tells us that Woolworths Food is being forced to be more competitive on price. If you’re wondering why, it probably has something to do with those turquoise scooters all over our roads. Speaking of online, Woolworths Food grew online by 28.5%, contributing 3.8% of South African sales. Gross margin increased 40 basis points to 24.4% and expenses were up 12.4% because of the impact of load shedding. After all, the ambient temperature of the average Woolworths Food is -493 degrees Celsius and that requires a lot of diesel. With operating margins down, the Food business could only grow adjusted operating profit by 2.9%.

Woolworths Financial Services saw the book increase 14.5%, with the impairment rate up substantially from 4.7% to 7.3%. This is to be expected in this environment.

In Australia and New Zealand, the business of relevance is Country Road Group. Sales grew 12.0% overall and 12.4% in comparable stores, which tells you that net space actually reduced during the year. This hasn’t stopped consumers from returning to stores, with online sales contributing 27.1% to sales vs. 31.6% in the prior year. Importantly, sales growth in the second half slowed severely to 0.6%, so the cadence isn’t promising here. A focus on gross margin management saw that margin increase by 310 basis points to 62.6%. Expenses jumped by 15.9% because of lockdowns in the base. Adjusted operating profit was 25.6% higher.

Based on the slowdown in the second half of the year and the sobering outlook statements, I’m not surprised the share price dropped 1.5% on the day.

Little Bites:

- Director dealings:

- In a shock to precisely nobody, Des de Beer has bought another R764k worth of shares in Lighthouse Properties (JSE: LTE)

- The family trust of a director of Mantengu Mining (JSE: MTU) has sold shares worth R117.5k.

- The company secretary of Exemplar REITail (JSE: EXP) has bought shares worth R100k in an off-market trade.

- There are more sales by directors of Argent Industrial (JSE: ART), though they are very small this time with a total value of under R4k.

- Capitec (JSE: CPI) founder Michiel Le Roux has debt in an associate company called Kalander that is secured with Capitec shares. A collar structure is regularly used in these scenarios. Based on maximum exposure of R449 million, the put price is R1,498.69 and the call price is R2,700.00. The current price is R1,615.97. Kalander intends to cash settle the hedge to the extent necessary, so no sales of shares by Kalander is envisaged.

- Delta Property Fund (JSE: DLT) has very little remaining value, so I guess this is as good a time as any to internalise the management company for a price of just R1,000.

- Sebata Holdings (JSE: SEB) is acquiring a building from Reunert Limited (JSE: RLO) for R32 million. This will help Sebata put all its investee companies under one roof, saving on various leases. The property is in New Germany, KZN.

- If you’re a shareholder in Mahube Infrastructure (JSE: MHB), be aware that there’s a revised AGM notice that includes additional agenda items related to the appointment of a director and chairperson of the company.