TreasuryONE’s Andre Botha highlights the volatility in the pound in a week that is almost devoid of data.

As we move through this week of relative calm in the market, it is important to reflect on some of the key themes of the market over the last couple of weeks. Central to the whole market movement currently is the Fed and its reaction to both higher inflation and the fear that inflation puts into the market.

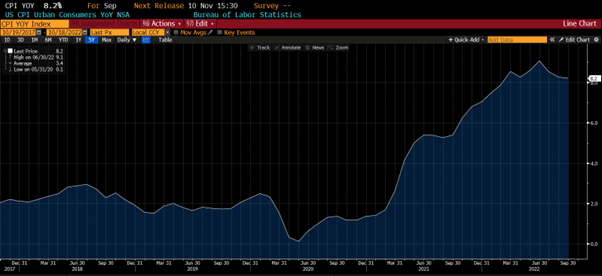

No sharp reversal in inflation

Last week, we saw that inflation in the US printed a little higher than expected at 8.2% vs 8.1%. This caused a little bit of panic in the market with the rand reaching a new high of R18.5700 against the US dollar. The effect of the higher-than-expected inflation number will surely be that the Fed will hike by 75 basis points at its next meeting in November and that the Fed will be quite aggressive going forward. The markets are pricing a 100% chance that the Fed will hike interest rates by 50 basis points.

While the dollar has been the main mover of markets in the past few months, we have seen great volatility in the British pound of late. The volatility stemmed from the tax cut reforms by ex-Chancellor Kwasi Kwarteng a couple of weeks ago. The fallout from the announcement was the pound and UK Government bond yield going into a free fall, with the pound hitting an all-time low against the US dollar.

Mr Kwarteng, who was fired on Friday after just 38 days in the job, paid the price for a giveaway that called into question the government’s economic credibility on financial markets. Mr Kwarteng’s replacement, former foreign and health secretary Jeremy Hunt, has since promised to win back the confidence of the financial markets by fully accounting for the government’s tax and spending plans.

Rollercoaster GBP

What does the above mean for the market in terms of direction for the next week?

As we stated earlier this week, we will have little in the way of data that is coming up. We have seen that emerging market currencies have borne the brunt of the US dollar attack last week and are slowly but surely gaining some ground against the US dollar. The US dollar has been overextended – especially after last week’s CPI print – and with the pound gaining some stability it bodes well for risky assets this week.

However, we need to watch out for any announcement from the Fed or recession talk for the markets to move substantially this week.