This article has been provided by CA&S and does not reflect the views or analysis of The Finance Ghost. As always, you can find that in Ghost Bites. Published with thanks to CA&S for recognising the value of the Ghost Mail investor audience.

Key highlights (FY2024)

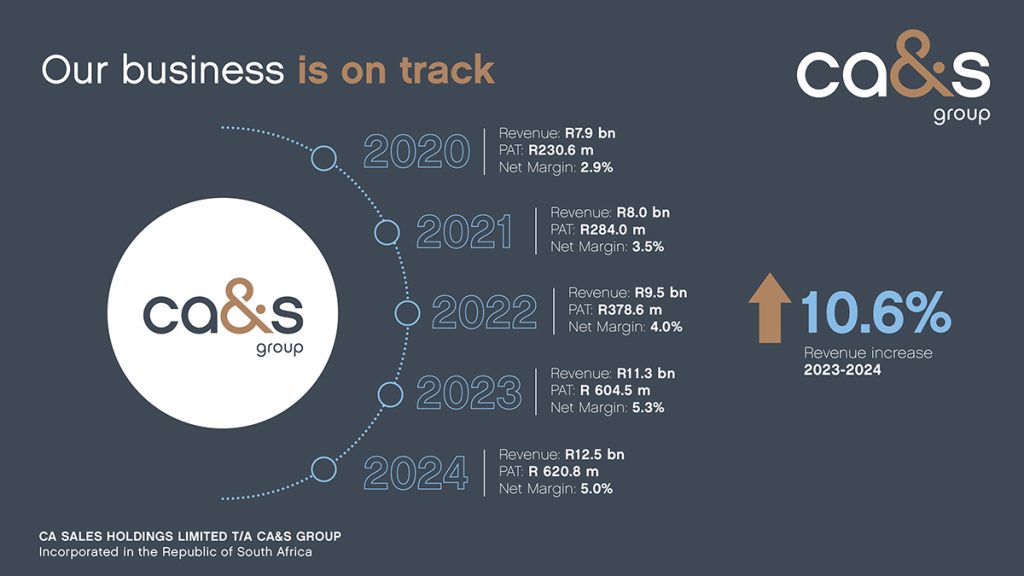

- Revenue increased 10.6%

- Headline earnings rose 25.9%

- Dividend increased 24.9%

CA&S Group (CAS:BSE, CAA:JSE) has reported a strong set of annual results for the financial year ending 31 December 2024, demonstrating the strength of its diversified business model and its continued push into high-growth markets. Revenue rose from R11.32 billion in 2023 to R12.52 billion, with management attributing the growth to expansion into organic growth, geographical expansion and acquisitions. As a result, gross profit increased to R1.92 billion, up from R1.72 billion the previous year.

Headline earnings increased to R585.31 million up 25.9% from last year, with headline earnings per share up from 97.97 cents to 122.71 cents. The Group also reported an increase in total assets to R5.65 billion, driven by warehouse expansion, strategic acquisitions, and investment in associate companies. Operational cash flow remained robust, providing a healthy increase in cash holdings from R1.06 billion to R1.17 billion and further supporting the growth strategy of the group.

While the comparative figures for 2023 were positively impacted by a once-off bargain purchase gain linked to the acquisition of Namibia’s T&C Group, CA&S still delivered a year-on-year increase in operating profit – rising from R747.31 million to R782.57 million. Excluding the non-recurring item, underlying profitability improved meaningfully, with both operating profits increasing by 25.5% and earnings per share by 27.9%, showing solid organic growth.

Commenting on the performance, Group CEO Duncan Lewis said the results were “a testament to our focus on strategic growth, operational efficiency, and market expansion.” He noted that despite a challenging global economic environment, the Group had demonstrated “resilience and agility,” positioning itself well for continued progress across its key markets.

CA&S acquired a 49% stake in Roots Sales (Pty) Ltd, a South African business that specialises in servicing the informal retail sector, an area identified by the Group as a key growth opportunity, and forms part of its channel broadening strategy.

CA&S acquired the remaining share capital in Macmobile, a provider of IT and data-driven market intelligence solutions focused on the formal and informal FMCG retail chains, across Africa.

The group declared a dividend increase of 24.44 cents per share, an increase of 24.9%, in line with its dividend policy.

Looking ahead, CA&S is optimistic about the prospects within southern and East Africa, where GDP growth across most markets is forecast to average 3%. On 17 February 2025, the Group announced a strategic partnership and investment in Tradco Group, a route-to-market operator based in Kenya with a presence across multiple East African countries. The acquisition forms part of the Group’s strategic push into East Africa, aimed at strengthening its regional footprint and deepening its ability to support brand growth for multinational clients.

“We acknowledge the challenges posed by global economic volatility and supply chain disruptions,” Lewis said. “However, with our diversified business model, resilient product portfolio, strong balance sheet and a high-calibre leadership team, we are well positioned to navigate uncertainties and unlock further growth.”

CA&S intends to maintain its disciplined approach to cost management and capital deployment, with Lewis reaffirming the Group’s commitment to “delivering sustainable, long-term value for all stakeholders.”

Interesting. My wife and I are both shareholders, albeit small ones.