Ghost Grad Jordan Theron decided to focus on Citigroup among the US banks who recently released results. Unlike the flashier choices like JPMorgan or Goldman Sachs, Citigroup is a more traditional banking group that makes most of its money the old-fashioned way: by lending to people.

Citigroup has been around since 1812 when it was founded as City Bank of New York. Over 200 years later, this is a major US bank with a large global footprint of around 2,650 branches across 19 countries.

Americans are experts at going big or going home!

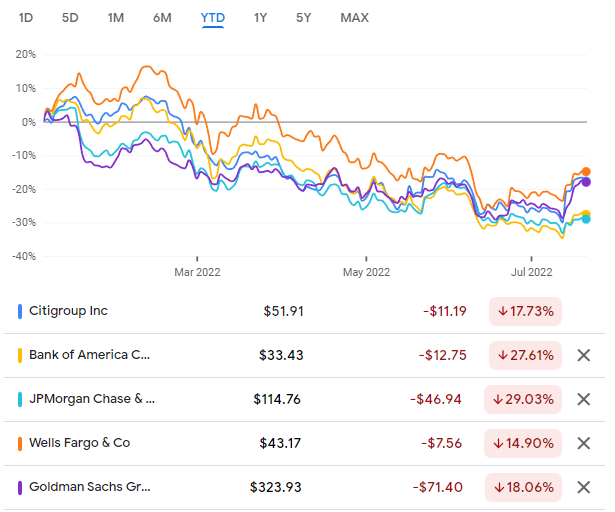

Jane Fraser took the reins at Citigroup in February 2021 and certainly hasn’t taken the top job at an easy time. The US banking sector has been a bloodbath this year, with the more “boring” banks like Citigroup and Wells Fargo proving to be more resilient than the investment banking shops:

This is a direct result of the pain being felt in public markets. Investment banking fees are highly cyclical, driving greater volatility in the earnings of Wall Street giants. It’s important to highlight that Citi also plays in the world of investment banking, so it certainly feels the pinch. The difference is that the group is less dependent on advisory fees than the likes of JPMorgan and especially Goldman Sachs.

Less retail, more institutional

Under Jane Fraser’s stewardship, Citigroup made a significant strategic decision to sell its retail banking operations in 13 countries. This is a clear move towards institutional banking. The bank sold its operations in developed markets (like Australia) and several developing markets (like Thailand). In other cases (like Mexico), only the retail operations were removed and the institutional operations have remained. Citigroup is currently in talks to dispose of its Russian operation, a strategic imperative that has taken on a new and unsavoury flavour this year based on the conflict in Ukraine.

The international focus is thus on centres of wealth like London and Singapore, which in theory creates a more focused and profitable operation. This is a bold move for a new CEO but this is typical of US corporates that tend to make and execute large decisions rather quickly.

Beating the (battered) street

At the time it reported latest quarterly earnings, Citigroup was the only major US bank that beat market expectations. The share price surged 13% on the day despite a fall in profit of 27%, which is another reminder that any investment is a function of price and fundamentals. It’s all about the expected result vs. the actual result.

Group revenue increased 11%, driven mainly by the Institutional Clients Group segment which grew revenue 20% year-on-year. This segment contributes over 58% of total net income. Global Consumer Banking contributes over 40% of total net income and was approximately flat in this quarter.

There are big dark clouds

Like other banks, Citigroup has suspended its share buyback programme to meet the latest capital adequacy requirements being put down by US regulators. These buybacks have been a useful source of shareholder returns in recent years, helping to drive earnings per share even when net earnings have been less impressive. Overall concerns about the economy and the threat of recession are putting banking shares under real pressure.

With US inflation running at over 9%, the cloud of a recession is looming large. This is never good news for banks, as the impact on consumers and businesses inevitably affects their ability to repay loans, driving larger impairments and provisions at banks.

Those provisions can drive sharp declines in profitability. As noted, Citigroup’s earnings fell by 27% in the latest quarter thanks to a major negative swing in provisions. In the comparable period, provisions were released (i.e. had a positive impact on earnings) as the world began to emerge from the pandemic.

Is this a conservative choice?

Of the major US banks, Citigroup is trading at the highest dividend yield (3.9%) which technically makes it the cheapest share among its peers. It is critically important to remember that a trailing dividend yield has limitations when companies are facing a change in economic circumstances. Simply, dividends achieved over the past year may not be achieved over the next year.

This applies to all the banks though, so comparing the relative yield is useful even if the absolute yield can be dangerous.

Currently trading at around $52, there’s still a long way to go in a recovery to pre-pandemic levels of around $80 per share. A recession (mild or otherwise) won’t do that recovery any favours. In the meantime, those looking for relative opportunities within a sector may want to do some deeper digging into the US banking market.

None of the major US banks are truly “conservative” but the risks do vary considerably across the big names. With a focus on traditional banking revenue and institutional clients, Citigroup is arguably a less risky choice than some of its peers. The current valuation also helps with some margin of safety, albeit not enough to get excited about.

For just R99/month or R990/year, you can have access to institutional-quality research that is guaranteed to expand your investment knowledge. Each week, The Finance Ghost and Mohammed Nalla release a detailed report and podcast on a global stock. Visit the Magic Markets website to subscribe.