Combined Motor Holdings (or CMH as everyone calls it) has released financials for the year ended February 2022. With Headline Earnings per Share (HEPS) up 117%, it was a year to remember.

Revenue increased by just over 30% and operating profit jumped by 75.7%, reflecting the joys of operating leverage (fixed costs in the cost structure) and positive JAWS (income growth higher than expense growth).

The operating profit margin has expanded from 4% in FY21 to 5.4% in FY22. A particularly impressive outcome was the jump in return on equity from 19.6% to 37.1%.

Looking at the segments, the core retail motor division (94% of group revenue) increased revenue by 28% and the car hire business recovered sharply with a 92% jump in group revenue. That division only contributes 4% of group revenue. A further 1% is from Financial Services and 1% is in the Corporate Services and Other division, which all accountants know is like that weird drawer in your bedroom where you keep lots of random things.

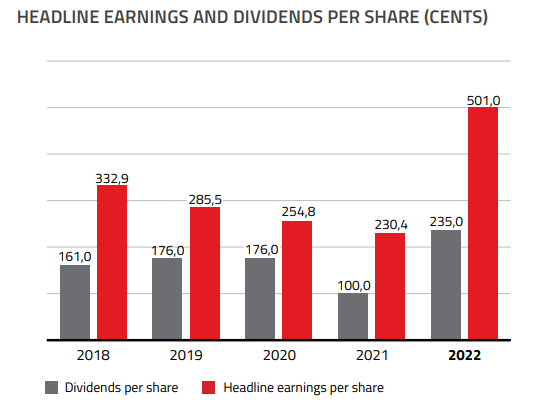

HEPS increased from 230.4 cents to 501 cents and dividends per share increased from 100 cents to 235 cents, reflecting a payout ratio this year of around 47% which is slightly higher than in the prior year.

To put that blockbuster year into perspective, I’ve included the HEPS chart below from the results booklet:

The share price of R28 reflects a trailing Price/Earnings multiple of around 5.6x on these earnings. The multiple is closer to 10x if we use pre-pandemic numbers as a more normalised view on the business.

CMH’s share price is up 12.5% this year and nearly 53% over the past twelve months. The motor trade has been an unlikely winner during a period of tricky supply chains. The difficulty for investors lies in estimating the extent to which these earnings can be maintained.