In a week that will be dominated by central banks (12 of them!), Andre Botha from TreasuryONE takes a look at what it all means.

There is a collective feeling in the market that the soft landing that has been widely reported might not be possible. This is evident from the central banks’ efforts to slay the inflation monster, which includes raising interest rates while inflation remains out of control, possibly driving economies into recession.

This monster is starting to spread across the developed world, with Japanese CPI printing at 3%, a 30-year high and placing pressure on the Bank of Japan to act.

Recessionary fears have spilled into markets, with emerging markets and other risky assets losing significant ground in the last couple of months. A case in point is the rand, which has lost nearly R3.00 over the space of 4 months. The fact that the US dollar has been the main safety asset that the market has run to also didn’t help the case for the Rand.

US CPI still elevated

Last week we saw US inflation print a little bit higher at 8.3% vs 8.1% expected. This again revived fears that the US Fed could hike rates by 100 basis points at its next meeting. We also saw that emerging market currencies folded like a house of cards once the number was released, and have continued on the back foot heading into this week.

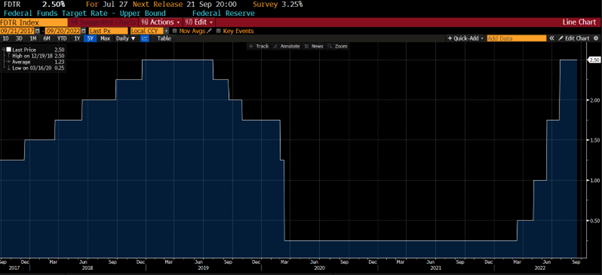

US interest rates over the last 5 years

This week we have a slew of central banks (12 to be exact) who will make interest rate decisions over the span of 24 hours. Although most will not affect the market significantly, the key to watch is the US Fed decision on Wednesday where we expect the FOMC to hike rates by 75 basis points.

It could be a case of “buy the rumour, sell the fact” if the Fed rises by 75 basis points, which could lead to a little relief rally for emerging market currencies. The danger is that should the Fed hike by 100 basis points, it will have a severe knock-on effect on emerging market currencies and we could see the rand testing the R18.00 level.

Attention should be paid to the press conference afterwards, which could give the market some inkling as to the Fed’s thinking going forward.

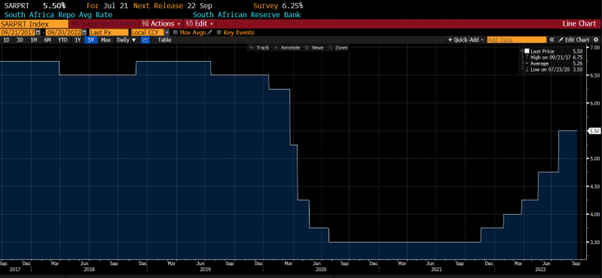

South Africa’s Interest Rate for the past 5 years

On the South African front, we have seen limited fall-out with the announcement of Stage 6 load shedding and the rand has been at the mercy of the US dollar. We expect more of the same, but we do have the MPC of the SARB announcing its interest rate decision on Thursday. We expect the MPC to hike rates by 75 basis points and any deviation from this could send the rand on a volatile run.

This week is fraught with danger and we could see a lot of volatility at the back end of the week. The rand landscape could look very different to at the start of the week.