- A basket of goods in 2013 grew by 36% in just 4 years, due to inflation

- The deflationary power of cryptos such as BTC and ETH reflects the financial shift that we are witnessing today

- Blockchain research house Glassnode, shows that BTC holders are in this for the long-term

Unlike rands or any other traditional currency, Bitcoin is designed to have a limited supply, so it can’t be devalued by a government or a central bank distributing or creating too much of it. While over the past few years, the traditional currencies we use have diminished our buying power, while those who opted for digital currencies have seen an increase in theirs.

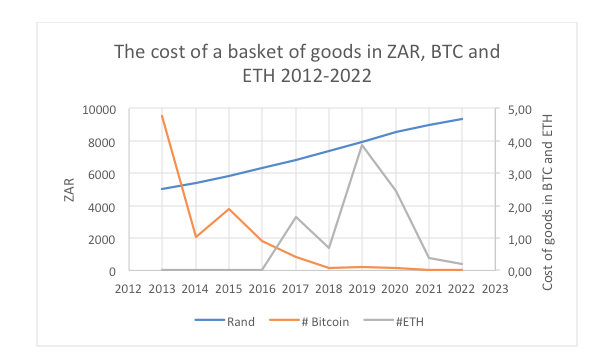

To illustrate this point, we took a basket of goods from a decade ago and escalated the prices by the consumer inflation rate. Assuming that basket of goods cost R5,000 in 2013, by early 2022 it had nearly doubled in price to R9,375.

Using BTC as the currency, that same basket would have cost 4.75 BTC in 2013 and today, it costs 0.01 BTC.

Ethereum, the second-largest crypto as measured by market cap, has been around since 2015 so we have less data to work with. The ETH price was extremely volatile in the first two years of its creation, climbing from about R3,000 in early 2017 to just short of R20,000 in early 2018, before collapsing more than 90% to around R1,200 later that year.

Then Ethereum began its steady but inexorable climb to above R75,000 in late 2021, before giving up some of its gains. In April 2022, it traded at R47,000.

Our R5,000 basket of goods had escalated in ZAR to R6,800 by 2017. If we used Ether as the purchasing currency, it would have cost 1.65 ETH in 2017 and then more than doubled in price to close to 4 ETH in 2019. That same basket of goods today would cost 0.21 ETH.

Source: Jaltech, StatsSA

Bitcoin and Ethereum have entirely different use cases: Bitcoin is regarded as a digital store of value, while Ethereum is challenging financial orthodoxy through the use of blockchain and smart contracts.

Bitcoin has been dismissed time and again by many of the titans of Wall Street, among them Warren Buffet and JP Morgan Chase’s CEO Jamie Dimon, who called it a ‘fraud’ and ‘worthless’, yet the number of corporate investors present at the recent Bitcoin Conference in Miami suggests cryptos are here to stay. There will be some spectacular failures along the way, but virtually all major banks now have at least one or two analysts dedicated to studying and following cryptos. They dedicate their time to identifying the tracking the winners, such as BTC and ETH.

Graphs like the one above can no longer be dismissed by serious analysts. The deflationary power of cryptos such as BTC and ETH reflects the financial shift that we are witnessing where annual interest yields of 20% or more are being earned on decentralised finance (DeFi) platforms, where collateralised loans can be taken out without having to submit so much as a name or email address, where transactions can be settled in seconds rather than days. Where credit committees and bank managers are rendered irrelevant.

The growth in crypto value will never be a smooth line, but crypto enthusiasts are accustomed to this. After peaking above R300,000 in 2017, BTC dropped 84% in price over the following year, before reversing the trend and shooting above R1 million. ETH dropped more than 90% in 2018 before screaming back up more than 2,000%. The peaks and troughs are often extreme, but the same volatility was evident in the early years of Amazon and Apple stock trading. It is already clear that both ETH and BTC are far less volatile today than was the case just a few years ago.

Blockchain research house Glassnode shows that BTC holders are increasingly in this for the long haul. They can now stake their coins – putting them to work on the blockchain for which they earn rewards – and they can borrow against their cryptos to leverage their positions. In other words, the case for owning cryptos is getting more compelling by the month.

Jonty Sacks – Partner at Jaltech

For information about Jaltech’s Cryptocurrency Basket, click here.

Jaltech offers everyday people effortless and convenient access to the cryptocurrency market.

One of Jaltech’s investments is its Cryptocurrency Baskets which is tailored for investors who are looking for an investment option that provides investors with exposure and diversification across protocols, digital currency and blockchain technology.