Marylou Greig

The COVID-19 pandemic has turned many an industry on its head, and none more so than that of dealmaking and private equity. But the disruption caused has resulted in some positive outcomes for investors, with this industry adapting to the new normal surprisingly quickly.

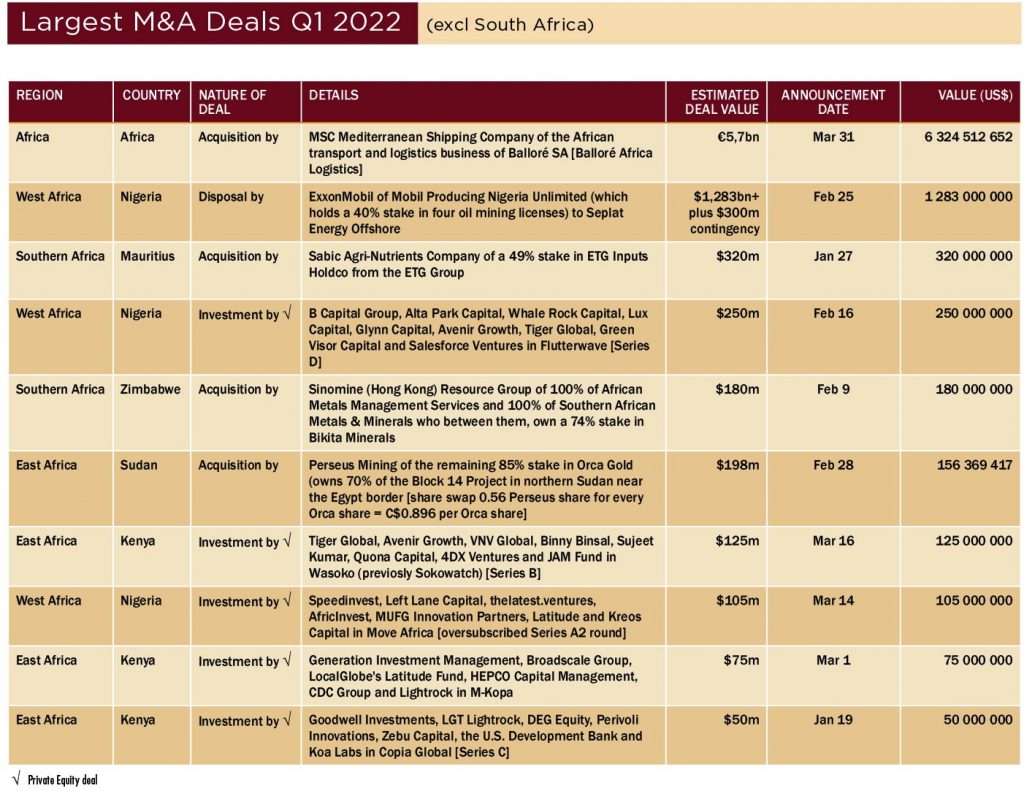

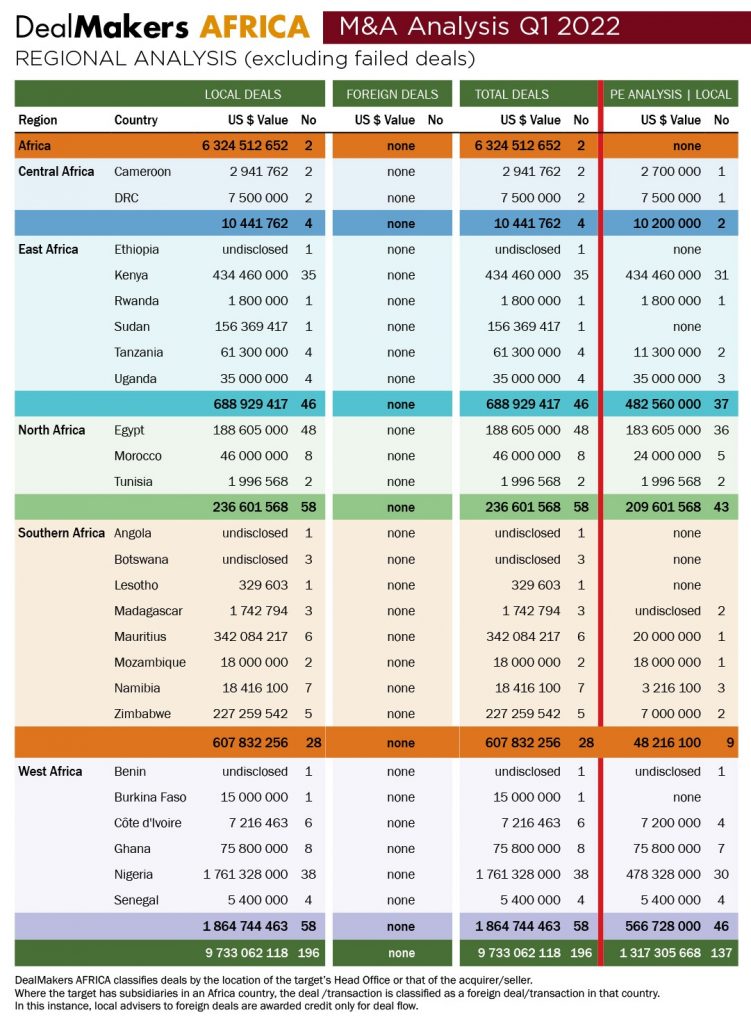

The total value of deals captured by DealMakers AFRICA (excluding South Africa) for Q1 2022 was US$9,7 billion (an increase of almost three-fold that of Q1 2021) off 196 transactions. This jump is attributed to the acquisition by international Swiss shipping line, MSC Mediterranean Shipping of the African transport and logistics business of Balloré SA for US$6,3 billion.

North and West Africa were the two regions with the greatest deal activity (each with 30% of deals recorded), with West Africa receiving the lion’s share of investment at US$1,86 billion. East Africa made a slight recovery, drawing just 23% of total deal volume in Africa (see analysis table below).

While human interaction is a key part of the ability of fund managers to raise capital, online fundraising and parts of due diligence have become workable tools in this digital revolution accelerated by the pandemic. Africa continues to be fertile ground, with attractive investment opportunities for investors in search of yields. The difficulties of the past two years have presented good deal opportunities, especially among companies in need of investment to rebuild and be profitable and has accelerated the adoption of e-commerce.

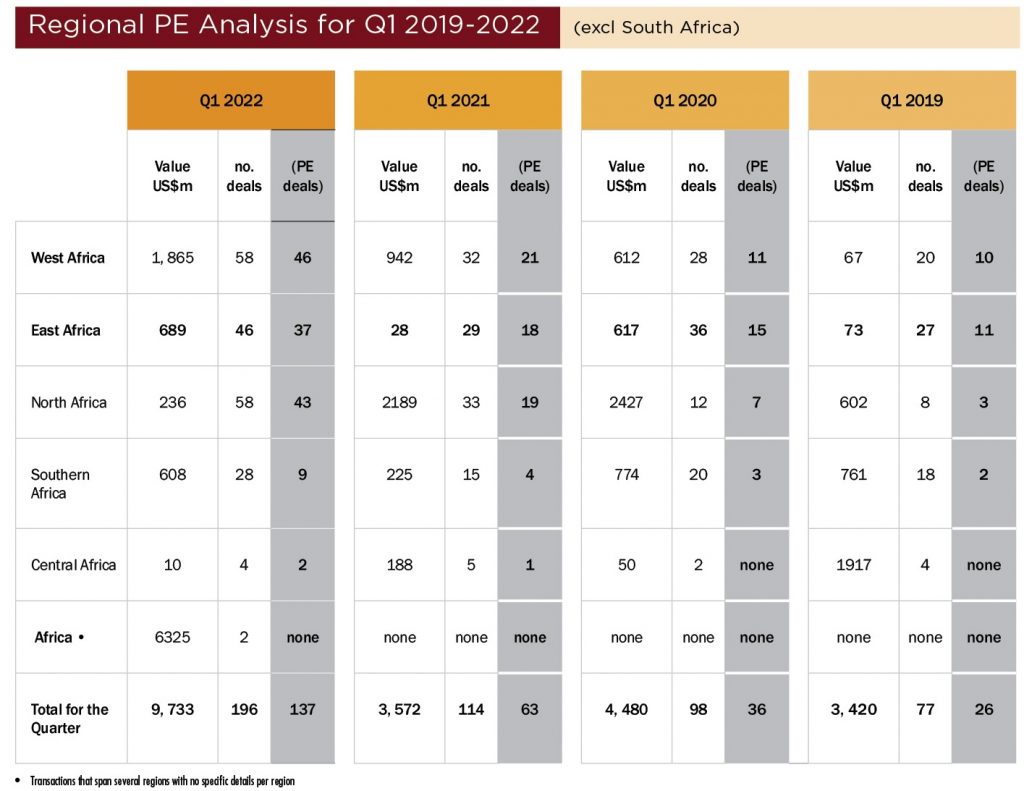

The importance of private equity investment on the continent is clearly reflected in the Q1 2022 numbers with deal activity outstripping previous years (see below). Private equity continues to grow its presence, representing 70% of deal activity on the continent (excluding South Africa) during the first three months of this year. The value attributed to the 137 private equity transactions of US$1,3 billion is not a true reflection of the aggregate investment, as the majority of PE deals are scarce with financial information.

Interestingly, according to the 2022 Preqin Global Private Equity Report, the total size of the global private equity and venture capital asset pool is above US$5 trillion, and is expected to swell to more than $11 trillion within the next four years. However, current global allocation of this asset pool to Africa is well below 1% and falling in real terms.

Looking forward, geopolitical turmoil in Europe (the main trading partners with Africa) and higher oil and energy costs related to the war in the Ukraine will likely cause increased inflation and supply constraints, dragging on growth. However, provided that rising prices don’t flatten demand and send economies into recession, Africa’s M&A activity should continue to perform well.

Data source: DealMakers AFRICA

The latest magazine can be accessed as a free-to-read publication at www.dealmakersdigital.co.za

DealMakers AFRICA is Africa’s corporate finance magazine

www.dealmakersafrica.com