2023 has seen global capital markets dwindle, with higher borrowing costs and lower valuations leading to more frugal investments. For African countries, market size and liquidity have always been an issue, made even more so by the current challenging global conditions. Activity in these markets is few and far between (SA excluded), so the Latin saying, “fortune favours the brave” indeed applies to these three companies – Airtel Africa, Beltone Financial Holding and Oryx Properties – who defied market conditions, announcing an IPO and listing and capital raises respectively, during H2 2023.

Beltone – one of the fastest-growing investment banks in Egypt – successfully completed the issue and listing of 5 billion shares, raising EGP10 billion (c.US$323 million). The capital raise marked the largest in the history of the Egyptian Stock Exchange, with the second round of the rights issue oversubscribed by 5.49 times. Namibia’s largest property fund, Oryx Properties, raised N$312.85 million ($17,2 million) with unit holders subscribing for a total of 26,947,033 (82.4%) linked units. Airtel Africa, a provider of telecoms and mobile money services, undertook an IPO and listing of its Ugandan subsidiary on the USE. While disappointing – as the offer received only a 54.45% subscription rate – the company listed 4,36 billion shares, attracting some 4,600 investors and raising Shs211 billion (c.$56 million).

The JSE, Africa’s largest stock exchange, comparatively has an active ECM market; however, it is not immune to difficulties. In a move to ease the challenges faced by companies seeking to raise capital in South Africa, a new fintech company, Utshalo has just been launched to address the challenge.

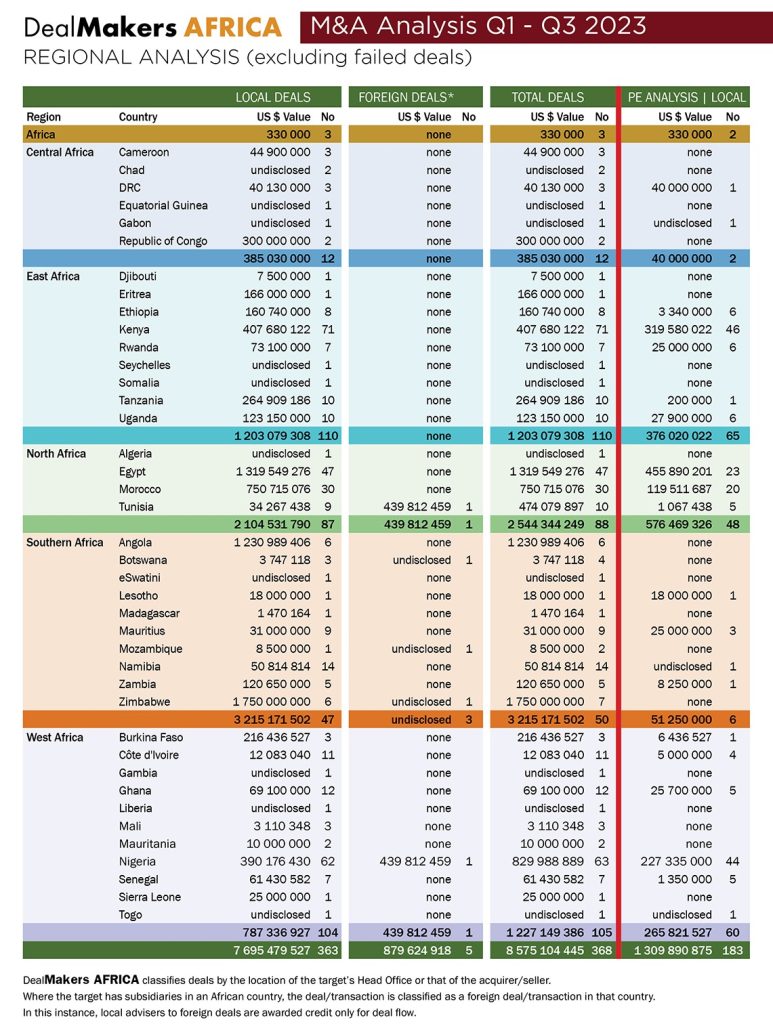

The African M&A environment has faced similar challenges, such as economic and political instability, market fragmentation and limited availability of target companies, currency and exchange rate risks, and infrastructure constraints. The value of deal activity, as captured by DealMakers, for the 2023 year to end-September was 49% down, at $7,9 billion off 363 deals, when compared with 2022’s figure of $15 billion (522 deals) over the same period. Deal activity was highest in East Africa (110 deals), more specifically, Kenya (71 deals), followed by Nigeria (62 deals) and Egypt (47 deals).

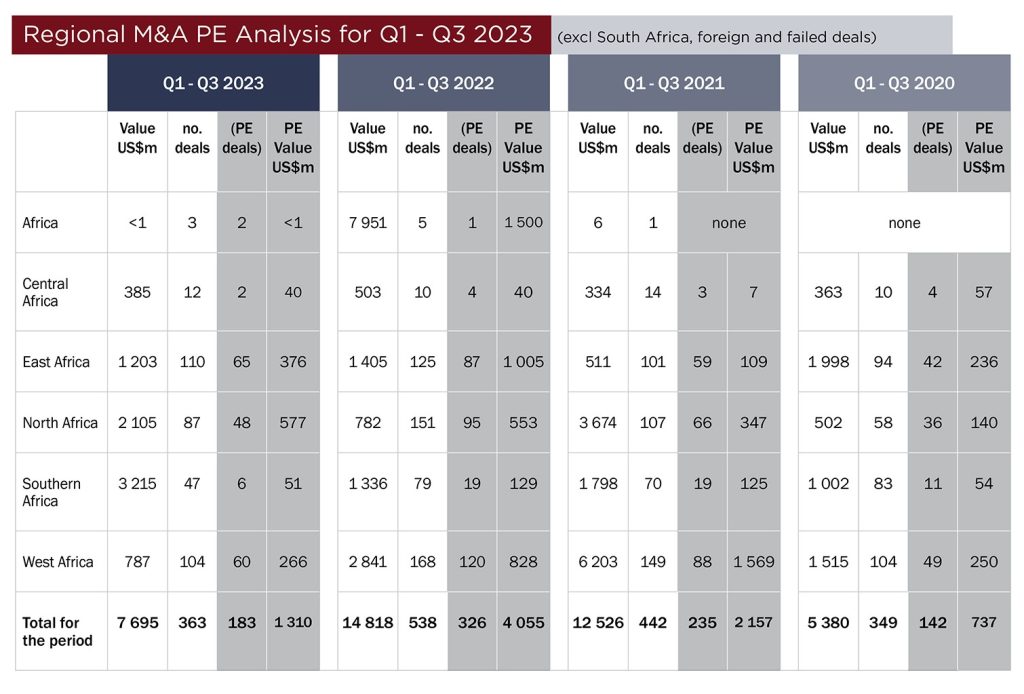

According to the DealMakers’ private equity analysis, in cumulative terms, the value of deals in Africa (excluding South Africa) was $1,3 billion for the year to end-September 2023, a quarter of that recorded in the same period in 2022 ($4,1 billion) and $1 billion down on the value reported in 2021.

Of the top 10 deals for the period, six involved targets in the energy and resources sector. The largest deal by value remains the acquisition by China Natural Resources of Williams Minerals in Zimbabwe, announced in February 2023, with a deal value of $1,75 billion.

On a positive note, the slow growth in sub-Saharan Africa is expected to rebound in 2024 as tough financial conditions ease, inflation continues to come down, and as the global economy rebounds.

The latest magazine can be accessed as a free-to-read publication at www.dealmakersdigital.co.za.

DealMakers AFRICA is Africa’s corporate finance magazine.

www.dealmakersafrica.com