Spring has sprung and emerging from winter hibernation usually drives most people to do some spring-cleaning around the house. Sometimes, it can be quite awkward to realise you have three of the same thing, an item of clothing in your cupboard that you don’t even recognise, and many sets of socks without a matching pair!

This tends to happen with investments too. You may question your previous decision to buy into a certain investment, or after conducting more research, you find you have exposure to the same asset class but in a different investment vehicle. Even more awkward is finding an unfamiliar investment in your portfolio!

Does It Still Fit?

A good starting point is to understand your portfolio better. Knowing how it should be organised makes cleaning and decluttering a space easier. As an investor, this is achieved by aligning your portfolio holdings with your goals and risk tolerance. Similar to an outfit from your wardrobe that may not fit your style anymore, some of your holdings may have served their purpose already, or you simply wish to make some adjustments to them.

This could be the result of a change in your life circumstances, like a decision to retire sooner than planned, meaning possibly reducing exposure to high-risk positions and preserving your capital. Or, you may be welcoming a little bundle of joy who will probably be in Matric in 2042. Parents most certainly want to consider long-term growth assets for their little one’s future education. Similar to the garments in your wardrobe, investments are not a one-size-fits-all approach. There needs to be an understanding of why a certain allocation to a certain investment product is needed.

The Diversification Effect

Optimum diversification has no exact measure, so it is possible to hold positions that serve the same purpose, which detracts from the very point of diversification. It becomes trickier when you have a mix of shares, Exchange Traded Funds (ETFs) and unit trusts in one portfolio. The balancing act here is to ensure you hold just enough products to optimise diversification, with no overlap.

The advantage of investing in funds like those offered by Satrix, whether through an ETF or a unit trust, is that all of them have minimum disclosure documents (MDDs) which are available online. This allows investors to understand the risk profile of each of the funds they’re invested in, and have sight of the sectors and regional exposures offered by the funds. With all this information, investors can assess the countries or sectors they’re exposed to, through the weightings of each of the products held in their portfolio. This allows investors to spot any market, regional, sector, or asset-type concentration, thereby identifying how much risk their strategy carries to assess whether it matches their investment goals and terms.

Staying the Course, Through a Winter Storm

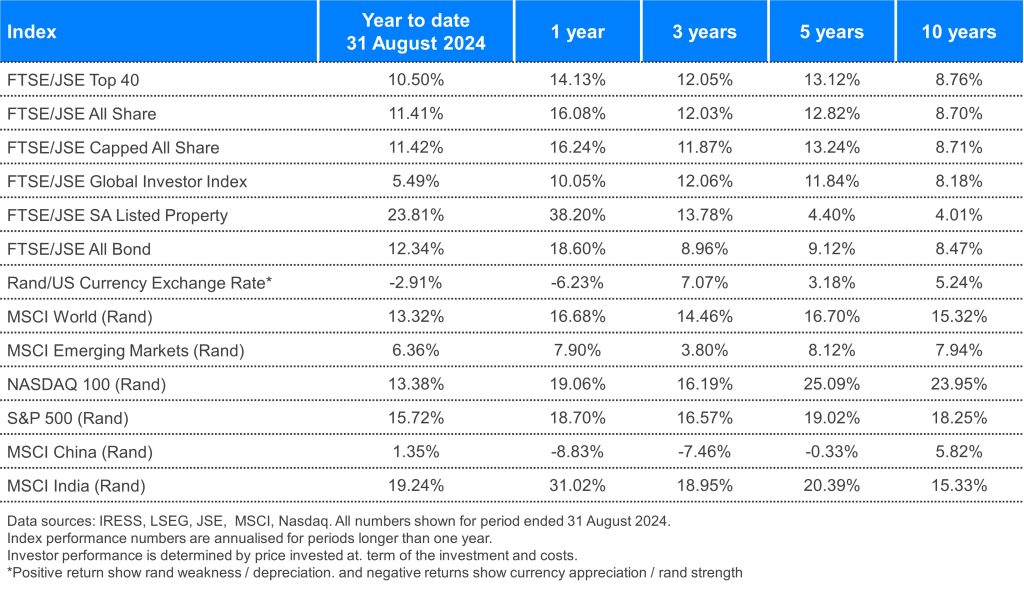

In the first week of August the Nasdaq 100, the S&P 500 and the MSCI World indices all hit their lowest level since May this year. Sentiment remained negative following the continuation of the market fall in July (as featured in our August newsletter). Markets rebounded significantly in the same month, and by the end of August, the Nasdaq 100 Index was up 1.2% in dollar terms, after losing almost 8% in just five working days.

In this period the rand strengthened by 2.4% to the dollar, which would mean some of the offshore investments would have experienced a net loss in rand terms. As a result, during August the Nasdaq 100 and S&P 500 indices declined by 1.3% and 0.1% respectively, with the MSCI World Index up 0.2%, all in rand terms. The MSCI Emerging Markets Index was down 1.3%, as the MSCI China and MSCI India indices were both down 1.4% in that period. The MSCI Euro Index was up 1.4% and the MSCI UK Index was up 0.8%, while the Bloomberg Barclays Global Aggregate Index (Global Bonds) was down 0.1% for the month.

In local markets, the FTSE/JSE Capped SWIX Index returned 1.4% return for the month, largely led by the Listed Property sector as the SAPY was up 8.3% for the month, while Financials was up 5.7% and Industrials up by 4.0%. Resource stocks battled through the month of August, falling 9.7%, while the JSE All Bond Index was up 2.4%.

Judging by the returns of these different asset classes and regions, August continued to carry the July winter storms, with some asset classes recovering well later in the month. August also proved that trying to time the market is not a good idea. Investors should rather stay invested through the sometimes short-lived market volatility to ensure they’re able to participate when markets rebound – which they always do.

This article was first published here>>>

Disclaimer

Satrix Investments (Pty) Ltd is an approved FSP in terms of the Financial Advisory and Intermediary Services Act (FAIS). The information does not constitute advice as contemplated in FAIS. Use or rely on this information at your own risk. Consult your Financial Adviser before making an investment decision.

Satrix Managers (RF) (Pty) Ltd (Satrix) is a registered and approved Manager in Collective Investment Schemes in Securities.

While every effort has been made to ensure the reasonableness and accuracy of the information contained in this document (“the information”), the FSPs, their shareholders, subsidiaries, clients, agents, officers and employees do not make any representations or warranties regarding the accuracy or suitability of the information and shall not be held responsible and disclaim all liability for any loss, liability and damage whatsoever suffered as a result of or which may be attributable, directly or indirectly, to any use of or reliance upon the information.