- Central banks talk the talk

Central banks use verbal guidance as a tool to prompt financial markets to adjust long before a policy-changing decision is taken and implemented. Forward guidance, as it is referred to, has been used as a tool more often by central banks following the 2008 financial crisis and involves providing information about its future monetary policy intentions based on its assessment of the outlook for price stability. This aims to influence the financial decisions of economic actors by providing a guidepost. The greater the credibility of the central bank, the greater the market response, and the heavier the burden of self-regulation that is carried by the financial markets to moderate the cycle.

One must think about the interplay between financial markets and the yield curve a little more deeply to fully appreciate the power of this tool. It also means that a central bank need not act as tough as it communicates, and therein lies the conundrum for investors. Should they take the central bank at face value, or should they rather focus on how much the underlying bond market has already priced in and achieved in moderating the cycle? The answer is always a bit of both.

- Forward guidance has a pre-emptive impact in the markets and the real economy

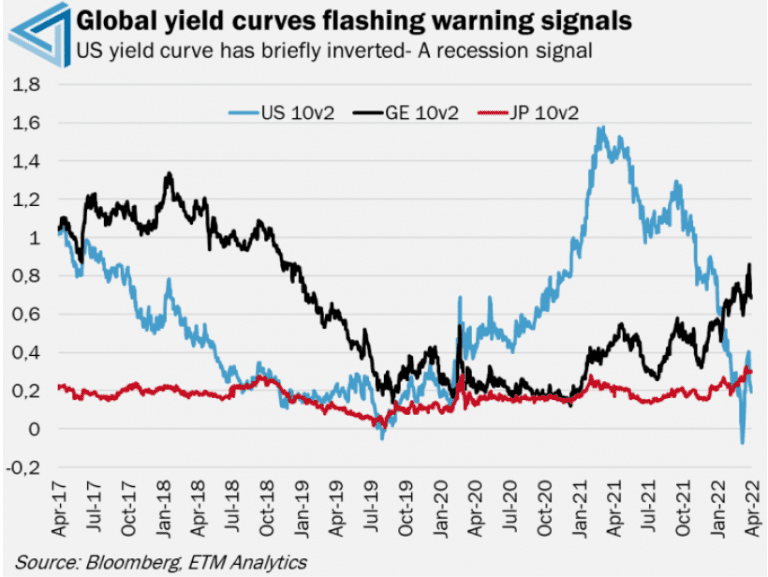

The Fed this year has taken on a notably more hawkish stance towards its monetary policy, with this peaking recently when Chair Powell suggested that more than one 50bp rate hike could be on the cards for this year. The market has responded with the USD surging, while UST yields have climbed to highs not seen since 2019. This rise for UST yields has been more concentrated along the front end of the curve, flattening it out to the extent that the curve inverted over the 10v2 spread briefly at the start of April.

The fact that interest rates over the short-term have risen to near longer-term rates suggests that the market sees heightened near-term economic risks. These risks have come from the expectation that the Fed will hike rates aggressively over the coming months, choking liquidity in the market and effectively tightening financing conditions already without the Fed actually hiking aggressively yet.

This hawkish forward guidance will also send a message to financial officers of companies that interest rates are set to rise, impacting the decision to roll over debt. Higher interest rates in the near term will make rolling over debt less attractive as it will have to be repriced at a higher rate. If options are limited and revenues are weak, debt may need to be rolled over regardless, leading to higher debt servicing costs which will threaten the longer-term profitability and growth prospects of a company.

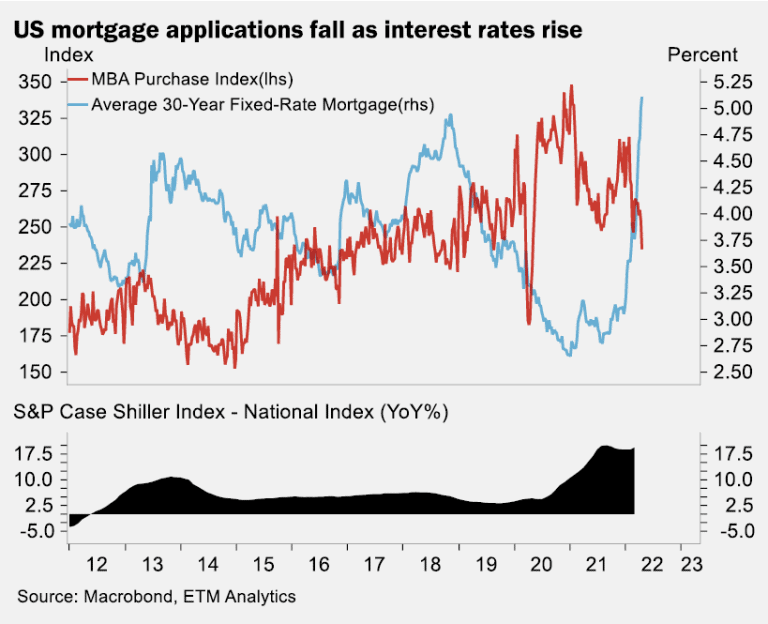

The tightening effect that this hawkish talk has in the real economy can already be felt, with US mortgage rates surging to over 5.00% recently. This compares to levels closer to 3.00% at the start of the year. This more than 200bp increase for 30-year fixed mortgage rates has come while the Fed has hiked, until now, by only 25bp. This perfectly illustrates the power that forward guidance can have, and that the aggressive talk with regard to tightening monetary policy can manifest in the markets as tighter financial conditions without rates actually being hiked so aggressively. These higher mortgage rates have already translated into lower house prices and weaker sales, as reflected in the chart below:

- Bottom-line:

Global central banks have drastically stepped up their aggressive hawkish communication in order to prepare the markets for the tightening of monetary policy. The markets, therefore, have priced in a future of lower liquidity and higher interest rates, effectively doing some of the work of the central banks for them. However, the Fed and its peers will need to follow through with their hawkishness to some degree and hike after this aggressive guidance to ensure their credibility. Otherwise, the market will begin ignore future guidance, limiting its impact and forcing even greater policy moves in the future to achieve the desired policy goal.