JSE-listed property fund Equites has a partnership with Newlands Property Developments LLP in the UK. This partnership has a development pipeline of around GBP1 billion over the next five years, which is gigantic.

The money for these developments needs to come from somewhere. One of the sources of funding is to sell undeveloped land in the UK business if an attractive price can be achieved, thereby unlocking capital for the development of other land.

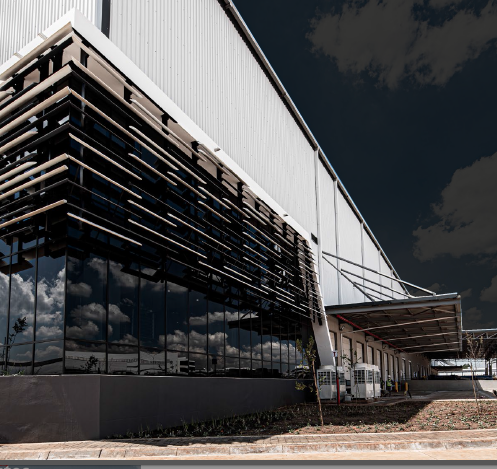

With that in mind, it will hopefully make more sense to you that the partnership has agreed to sell undeveloped land in England to Lidl Great Britain, the famous German retail chain that operates more than 900 stores and 13 regional distribution centres across Britain. The land will be developed into a modern distribution warehouse.

The land is priced at GBP81 million and the Equites partnership has been appointed to implement infrastructure, landscaping and other works on the property with a total value of GBP38 million. In other words, the partnership raises capital from this deal and achieves some development profits along the way.

Equites believes that all conditions will be met by the third quarter of 2022. The various conditions have to be met by 31 December 2022 and may be extended until December 2023 in a worst-case scenario. A deposit equal to 5% of the purchase price has already been paid by the purchaser and the remainder would be paid shortly after the transaction closes.

With respect to the development work, a progress payment of GBP19 million will become due once certain development milestones have been achieved.

This deal achieves post-tax profit attributable to Equites of GBP20.8 million, which will “contribute significantly” to Equites’ growth in net asset value per share in FY21. In addition, the loan-to-value will be reduced by around 250bps.

The Equites share price is up 7% over the past 12 months and down 8.4% year to date.