Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

AB InBev offers a sip of growth (JSE: ANH)

But not so much that you’ll need to take an Uber home

In the third quarter of the 2023 financial year, AB InBev grew revenue by 5%. If you look over the nine-month period, revenue is up 8.3%. This is all coming from pricing increases, as volume growth is down despite the heroics of my dad in trying to prop up the beer story. Total volumes fell by 3.4% in the third quarter and they are down 1.4% over the nine months.

Interestingly, beer volumes fell 4% this quarter and non-beer volumes were up 1.4%.

This isn’t exactly high-growth stuff. To make it works, EBITDA margin contracted by 29 basis points to 34.9% in this quarter. Over nine months, it’s down 31 basis points to 33.6%. This sentence, however, is beyond me:

“Normalized EBITDA figures of 9M22 include an impact of 201 million USD from tax credits in Brazil.”

The “T” in EBITDA stands for Tax. EBITDA is Earnings Before Interest, Taxes, Depreciation and Amortisation. I therefore have no idea why the impact of tax credits would be in normalised EBITDA, but perhaps I’m just not smart enough to understand the intricacies of normalised EBITDA.

Underlying earnings per share is $0.86 vs. $0.84 a year ago. Over nine months, they’ve come in at $2.23 this year vs. $2.16 in the comparable period.

For the full year, EBITDA (whatever that means these days) should be up by between 4% and 8%.

As a fun additional fact, the South African business grew volumes and revenue strongly, so perhaps my dad’s efforts aren’t going to waste. He’s certainly not playing any role in the strong growth in Corona and Stella Artois though. He’s the type of guy who believes that Castle Lite is nonsense.

Only Castle will do.

Astral tells the market just how badly it hurts (JSE: ARL)

The answer: a lot

In case you haven’t been following the markets closely lately, there are three things you need to know about the poultry sector.

Firstly, the margins suck. They have less meat on them than a budget chicken wing.

Secondly, load shedding is a disaster. The only way to make any money at all on chickens is to stick to a strict schedule with raising and slaughtering them. The only schedule that Eskom understands is that one you’ll find on the Eskom-se-you-know-what app.

Thirdly, avian flu has been a huge problem this year. Chickens have been slaughtered left and right and you can’t eat them afterwards, so the financial losses are severe and the meat goes to waste.

Against this backdrop, it should make sense to you that Astral’s profits have collapsed. After reporting HEPS of R27.62 per share in the comparable financial year, the loss in the year ended September is expected to be between -R12.43 and -R15.19 per share.

If the Astral execs are out of ideas for Halloween costumes, they could just go dressed as this trading statement.

The level of gearing on the balance sheet is a focus area, with a debt ratio of 26%. Thankfully, the banking facilities don’t have any covenants.

BHP invests further in the Jansen potash project (JSE: BHG)

This will transform Jansen into one of the world’s largest potash mines

BHP announced that it will invest $4.9 billion in stage 2 of the Jansen potash project. This follows the $5.7 billion investment in stage 1 and the $4.5 billion pre-Jansen stage 1 investment.

Management believes that this will position BHP as one of the leaders in the global potash industry. In case you aren’t familiar with the product, potash is used in fertilisers. The project is in Canada, so the company is investing in a stable jurisdiction.

This is a long-term investment, with stage 1 currently 32% complete and expected to deliver first production in 2026. Stage 2 is expected to take six years but can start now it seems, as first production is expected in 2029.

The expected EBITDA margin of 65% to 70% leads to a forecast internal rate of return of 15% to 18% and an elevated payback period of around six years.

After acquiring Royal Bafokeng, production is obviously much higher at Impala Platinum (JSE: IMP)

Thankfully, the like-for-like results are showing improvement

Impala Platinum released a production report for the quarter ended September 2023. This period is the first time that Royal Bafokeng Platinum (now Impala Bafokeng) is being included in the numbers, so it’s not a surprise that group production looks much higher on a year-on-year basis (up 34% in total 6E production and 25% in refined and saleable production volumes).

Digging deeper, we find that Impala 6E refined production was up 2.7% and IRS 6E refined was up 15.4%. Impala Canada increased production by 8.4%. Of group 6E refined and saleable production of 885,000oz, Impala Bafokeng was 113,000oz.

With PGM prices falling through the floor this year, the share price has tanked 64.5% year-to-date.

Renergen releases its interim results (JSE: REN)

Technical issues are plaguing Phase 1 of the Virginia Gas Project

Renergen has been at the centre of a storm on Twitter / X with Albie Cilliers, an outspoken local investor. Many questions have been asked about the business and although some formal responses have been given on SENS, there are many investors watching this story more closely than ever before.

The six months to August 2023 were affected by a leak in the helium cold box, which isn’t doing Renergen any favours in dispelling the negative views around the quality of the installed equipment. To try and mitigate the pain, Renergen has brought forward some planned maintenance to coincide with the repairs.

Despite the production of LNG that was lower than planned, only 92% of that production was sold to the group’s two local customers. Importantly, an off-take agreement was achieved in this period with Time Link that will see the logistics firm transition their fleet from diesel to dual-fuel.

Phase 1 is clearly suffering from teething problems that need to be addressed as quickly as possible to quell the noise around the share price. Work on Phase 2 continues regardless, with a total planned capex spend of up to $1.2 billion and $750 million of debt already secured from two lenders: the US DFC and Standard Bank.

Two equity raises are anticipated to plug the gap, with the eventual goal of EBITDA of between R5.7 billion and R6.2 billion per annum by FY2027.

Although this is early in Renergen’s journey and I don’t think the current profitability figures are the best explanation of the current market cap, it’s still worth noting that the headline loss per share worsened from 19.31 cents to 29.91 cents in this period.

An interesting rights offer structure at Sable Exploration and Mining (JSE: SXM)

The underwriters want to get as much of the offer as possible

Whenever you see a rights offer, you need to realise that there are various different ways to structure these offers. Although the basic premise is the same (all shareholders can subscribe for more shares), there are various structuring tricks.

In a highly discounted rights offer, the intention is to make it is so painful for shareholders not to follow their rights that they basically have no choice. An underwritten offer essentially guarantees the amount that will be raised, with underwriting fees usually payable to the underwriter. Where there is no underwriter fee, it’s because the underwriter actually wants to get hold of the shares.

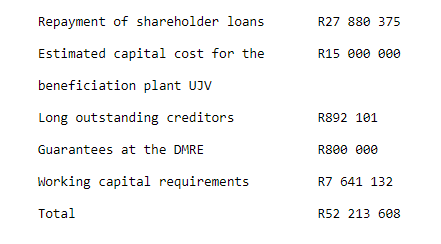

In the Sable Exploration and Mining rights offer for R52.2 million, this is fully co-underwritten (there are two underwriters) and they aren’t accepting a fee. This is because they want to get their hands on the shares, further evidenced by no excess applications being allowed (shareholders asking for more shares than they are entitled to, which reduces the amount going to the underwriters).

Sable’s market cap is under R500k, so this is effectively just a takeover of the vehicle by the underwriters.

Here’s how the funds will be used:

Sasfin just keeps getting worse (JSE: SFN)

Return on equity is lower than you’ll earn on a decent deposit at the bank

If you’ve been paying attention to Ghost Mail recently, you’ll know that I was worried that African Bank had overpaid for the acquisition of business units from Sasfin. The CEO of African Bank, Kennedy Bungane, subsequently joined me on a podcast to explain the rationale in more detail.

Whether or not that acquisition works out for African Bank remains to be seen. I maintain that it was a get out of jail card for Sasfin and the latest results from that bank seem to prove it.

Headline earnings fell by 19.4% for the year ended June, with a massive cost to income ratio of 85.38%. Most other banks are running in the 50% – 60% range. This is why Sasfin’s return on equity is so incredibly poor at 6.8%, which is less than you’ll get on a fixed deposit at the bank!

The company deserves to trade at a large discount to net asset value. The share price recently jumped because African Bank is willing to buy two major business units from Sasfin at a price roughly equal to net asset value, which is far better than the valuation that the market was putting on those assets.

Going forward, Sasfin will consist of only the Wealth, Rental Finance and more focused Banking businesses. The Wealth business is showing a lot of promise, with headline earnings up from R45.5 million to R94.2 million. The same cannot be said for Business and Commercial Banking, which reported a headline loss of R104.3 million (much higher than the R40.3 million loss in the comparable period). Costs and impairments are running away from them. Part of the Rental Finance business is being sold to African Bank, so we will have to wait and see what the remaining part of that business looks like.

On top of all of this, Sasfin also dismissed employees linked to alleged fraud in the foreign exchange business unit going back to 2014.

Before the big jump from the African Bank announcement, Sasfin was trading at roughly R22 and the net asset value per share is R51.22.

Woolworths wags its tail and shareholders approve (JSE: WHL)

This is a Shoprite-esque move to take a stab at a new retail category

Absolute Pets has over 150 stores nationwide. That’s quite the success story, with the business having been established in 2005. It’s currently owned by the management team and Sanlam Private Equity, but not for much longer.

Woolworths is acquiring a 93.45% stake in Absolute Pets and the remaining management shareholding will be acquired over a period of time. This makes Absolute Sense to me, as the average Woolworths shopper has several mouths to feed at home and not all of them are human.

Organic Belgian dog food, anyone?

We don’t know what the pricing of the transaction is, as it falls below the threshold for categorisation under JSE rules. The market liked it regardless, with the share price closing 2% higher.

Personally, I like it too. A lot of progress has been made in fixing the Fashion, Beauty and Home segment. Looking for additional growth areas (preferably not in Australia) sounds sensible. We are seeing very similar behaviour from sector stalwart Shoprite in terms of entering new retail categories.

Little Bites:

- Director dealings:

- You have to read the Truworths (JSE: TRU) director dealings announcement carefully, as CEO Michael Mark has sold another R16.4 million worth of shares. This is linked to shares awarded back in February 2020 and due to expire in May 2025. He exercised the options and sold shares to cover the tax and the strike price on the shares, with the rest of the shares being retained.

- A prescribed officer of ADvTECH (JSE: ADH) has sold shares worth just over R3m.

- Des de Beer has scooped up another R825k worth of shares in Lighthouse Properties (JSE: LTE)

- A prescribed officer of Old Mutual (JSE: OMU) has bought shares worth R298k.

- Finbond (JSE: FGL) announced that the deal to acquire 49% of Trustco Finance Namibia is off the table, at least for the time being.

- Kore Potash (JSE: KP2) has raised $2.5 million through the issuance of new ordinary shares. The Chairman put $750k of the raise into the pot and the rest of the money came from existing large shareholders. As has previously been announced, this funding is necessary in working towards an Engineering, Procurement and Construction (EPC) contract at the Kola Potash Project. The worrying news is that the CEO of the company has resigned to pursue other business interests, which is exactly what you don’t want to see at a critical time like this. The Chairman is stepping is as CEO.

- It’s rather odd that the ex-CFO of AECI (JSE: AFE) and current Managing Director of AECI Mining has stepped down from that role (and the board of AECI) with immediate effect by mutual agreement. The Group CEO will act in that role on an interim basis. After 15 years with the group, that’s a strange and very sudden departure.

- Orion Minerals (JSE: ORN) is in the all-important process of transitioning into an operating copper mining company. The quarter ended June was all about fund raising, so the quarter ended September has been about pushing forward with development activities. The near-term focus is Prieska, with the Okiep Copper Project at a very early stage.

- MC Mining (JSE: MCZ) released its activities report for the quarter ended September. The turnaround activities at Uitkomst seem to be helping, with run-of-mine production up 10% year-on-year. The export marketing agreement expired at the end of June, so high-grade coal has been sold domestically. The concern is that revenue per tonne has fallen by 31% year-on-year in dollars or 24% in rand. The available cash balance of $5.1 million is down from $8.8 million at the end of the last quarter.

- Southern Palladium (JSE: SPD) released a quarterly update that recaps the drilling results and the current cash position of $9.98 million, down from $11.55 million at the end of June. The Total Mineral Resource has increased by 34% since drilling began.

- Sabvest Capital (JSE: SBP) has elected to adopt net asset value per share as its metric for trading statements going forward. Remember, a trading statement needs to be released when the metric differs by more than 20% vs. the comparable period. It makes way more sense for Sabvest to use net asset value per share rather than HEPS, as it is an investment holding company.

- Liberty Two Degrees (JSE: L2D) announced that the clean-out dividend will be in shareholder bank accounts by 13 November and that the listing will be terminated on 14 November as a result of the take-private of the company by Liberty Group (part of Standard Bank).

- aReit Prop (JSE: APO) is still aJoke. The company released a trading statement at 17:30 and then interim results at 17:40, indication that they either don’t understand the JSE rules about trading statements or simply don’t care. It hardly matters, with the share price languishing at R3.20 vs. a net asset value per share of R9.338. Best of all, there is no longer a dividend even though this is a property company. I tried very hard to warn you when the IPO happened that this was a rubbish listing. Sadly, I was proven correct.

- Another company on the JSE that I remain extremely weary of is Labat Africa (JSE: LAB). The listing has now been suspended because results have been delayed. The delay is due to the new auditors performing deep audit work on the claim against SARS (which has somehow been ongoing for over 20 years) and impairment testing around the acquisition of Sweetwaters Aquaponics. I will be very interested to see what the outcome of the audit is.

- Efora Energy (JSE: EEL) has been suspended from trading since October 2020. A whopping three years later, the company is still trying to play catch-up on its financials. Operationally, the company is renting a fuel depot in Gauteng and is looking at opportunities to trade oil and other niche products.

- Rex Trueform (JSE: RTO) and African and Overseas Enterprises Limited (JSE: AOE) have experienced a delay in the release of the reporting suite for the year ended June 2023. It looks to be rectified very soon though, with a planned release date of 3 November.

- The release of the amended business rescue plan by Tongaat Hulett (JSE: TON) has been extended to 24 November. The meeting to decide the future of the company will be held no later than 30 November. The company also released its 2022 financial statements. They are now way out of date, but they do show how profits collapsed in that period.

- PSV Holdings (JSE: PSV) has renewed its cautionary announcement related to a potential recapitalisation that would enable the audits of the 2020 – 2023 years to take place. There has been a LOT of up and down between the potential investor and the business rescue practitioners, including a couple of trips to the high court. I can’t even find a website to link you to.

Fantastic publication. I would like to see comparisons between the performance of different Unit Trusts investments from time to time. I will also not mind ads of different investment options